Inflation across the GCC has been significantly lower than in most advanced and emerging market economies amid repeated interest rate increases, while its members’ economies remain on a growth trajectory, said economists and analysts at the Abu Dhabi Economic Summit.

“GCC economies, especially Saudi Arabia and the UAE, are in a ‘sweet spot’ with solid underlying economic growth, relatively low inflationary pressures, strong public finances and external accounts supported by high oil prices,” said Simon Williams, chief economist at HSBC for Central and Eastern Europe, Middle East and Africa.

Globally, inflation has continued rising due to steep increases in the prices of food and other commodities driven by the Ukraine conflict which began a year ago.

However, inflation in the GCC has been significantly lower than in most advanced and emerging countries. Inflation reached an estimated 3.6 per cent on average in 2022, according to the International Monetary Fund.

“Repeated interest rate increases by GCC central banks in tandem with the US Federal Reserve rate hikes will continue to keep the inflationary pressures at bay across the GCC,” said Martin Tricaud, group head of investment banking at First Abu Dhabi Bank.

The impact of higher interest rates on gross domestic product growth in the GCC has been limited “as most GCC governments implemented fiscal reforms and structural reforms to support economic growth”, he said.

GDP growth for the GCC is expected to have more than doubled to 6.5 per cent in 2022, the IMF said.

Gulf economies are performing well due to the “relentless” pursuit of reforms and not just because of high oil and gas prices, IMF managing director Kristalina Georgieva said last month.

“There is this impression that the only reason the Gulf countries are doing well is high oil and gas prices — this is not true,” Ms Georgieva said at the World Government Summit in Dubai.

“They have been opening up more space for private investments and for jobs being generated by competitive businesses.”

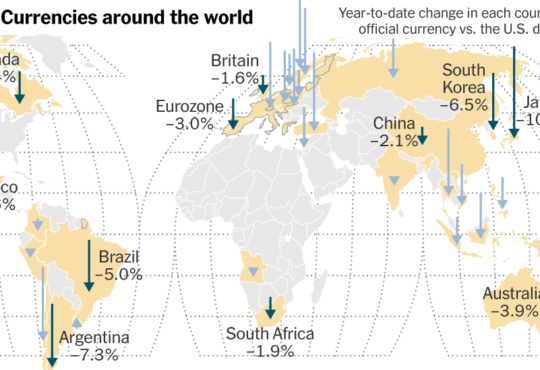

Central banks around the world have increased their benchmark policy rates to curb inflation.

The Fed has been aggressively raising rates with more increases expected as it aims to bring inflation down from 40-year highs last year to its target range of 2 per cent.

Earlier this month, the Fed raised interest rates by 25 basis points. The move marked the eighth increase in a process that began in March 2022.

It also indicated that more increases were on the way this year.

The headline US Consumer Price Index slowed to 6.4 per cent annually in January, from 6.5 per cent the previous month, marking the smallest annual increase since October 2021, according to the Bureau of Labour Statistics.

“Going by the US economic data such as consumer prices and labour market trends, it is too early to say if the Fed is going to pause the rate hikes immediately. However, the trends suggest inflation plateauing in the second half of the year”, Mr Tricaud said.

The IMF expects global inflation to decline to 6.6 per cent in 2023 from 8.8 per cent last year. It is expected to fall further to 4.3 per cent next year.

According to the IMF, inflation in the Middle East and North Africa region is expected to surpass 10 per cent for the fourth consecutive year in 2023 on higher food prices and currency depreciations.

In the GCC, economists expect inflation to remain in the lower single digits this year as the six-member bloc will also benefit from guaranteed exchange rate stability.

All Gulf currencies, with the exception of the Kuwaiti dinar, are pegged to the dollar. Kuwait’s currency is pegged to a basket of currencies.

“GCC countries have maintained their currency pegs based on their strong fiscal and current account positions supporting exceptionally high levels of forex assets held by sovereign wealth funds and public institutions”, said Carla Slim, executive director at Standard Chartered.

“While anti-inflationary monetary policy has kept inflationary pressures at bay, the exchange rate stability too has played a big role in keeping prices under check,” she said.

Updated: February 28, 2023, 2:32 PM