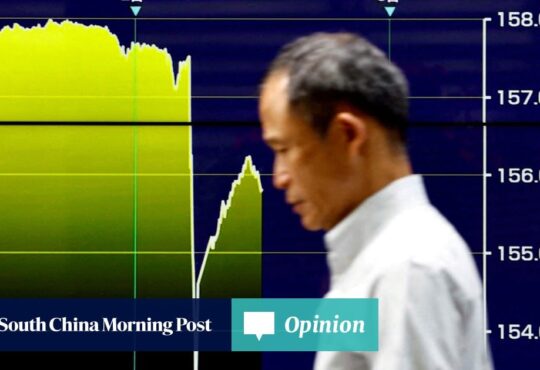

TOKYO – The yen jumped suddenly against the US dollar on April 29, with traders citing yen-buying intervention by the Japanese authorities to boost the currency that is languishing near 34-year lows.

The dollar fell sharply to 155.11 yen, as at 1.07pm Singapore time, from as high as 160.245 earlier in the day. Trade sources said Japanese banks were seen selling dollars for yen.

Against the Singapore dollar, the yen reversed course, jumping to 114.1893 after earlier dropping to 116.943.

Traders had been on edge for any signs of action from Tokyo to prop up a currency that has fallen 11 per cent against the dollar so far in 2024, as even a historic exit from negative rates has failed to lift the currency.

Japan’s Ministry of Finance was not immediately available for comment, with Japan closed for a holiday on April 29.

Bank of Japan governor Kazuo Ueda told a press conference after a meeting last week that monetary policy does not directly target currency rates, although exchange-rate volatility could have a significant economic impact.

Japan intervened in the currency market three times in 2022, selling the dollar to buy yen, first in September and again in October as the yen slid towards a 32-year low of 152 to the dollar.

The yen has been under pressure as US interest rates have climbed and Japan’s have stayed near zero, driving cash out of yen and into dollars to earn so-called “carry”.

The United States, Japan and South Korea agreed earlier in April to “consult closely” on currency markets in a rare warning, and Tokyo has stepped by its rhetoric against excessive yen moves.

The yen has also hit multi-year lows against the euro, Australian dollar and Chinese yuan.

April 26’s forecast-beating reading on the US personal consumption expenditures index came after the Bank of Japan refused to tighten monetary policy further at its meeting last week.

The Fed’s May 1 interest rate decision is the prime focus for markets this week, with investors already anticipating a delay in its rate cuts after a batch of sticky US inflation and as officials including Chair Jerome Powell emphasise even those plans are dependent on data.

Tokyo officials have repeatedly said they are ready to step in if there are wild movements in the exchange rate, citing speculators as a key issue. REUTERS