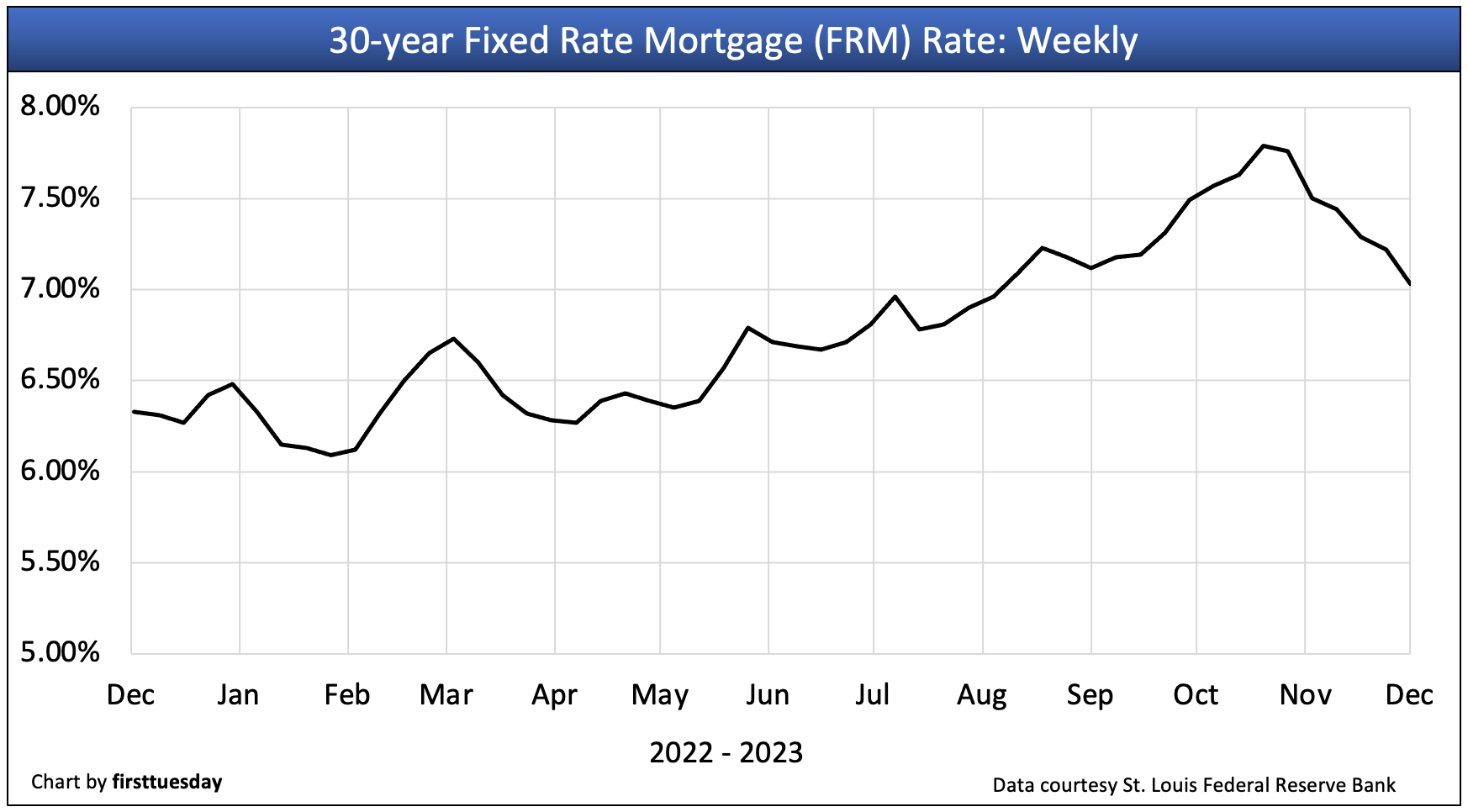

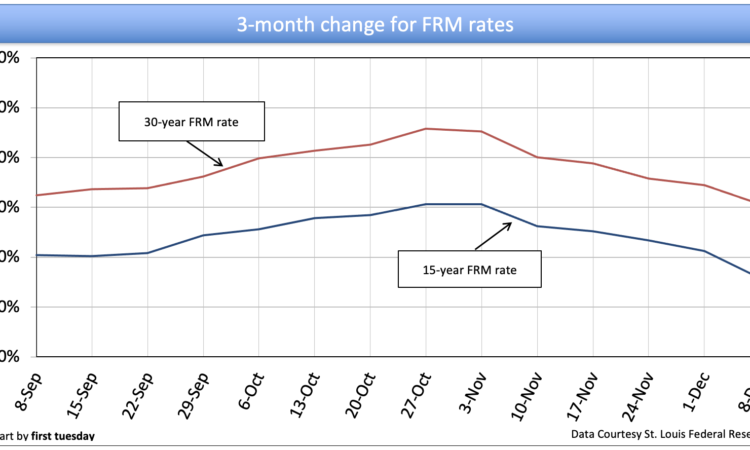

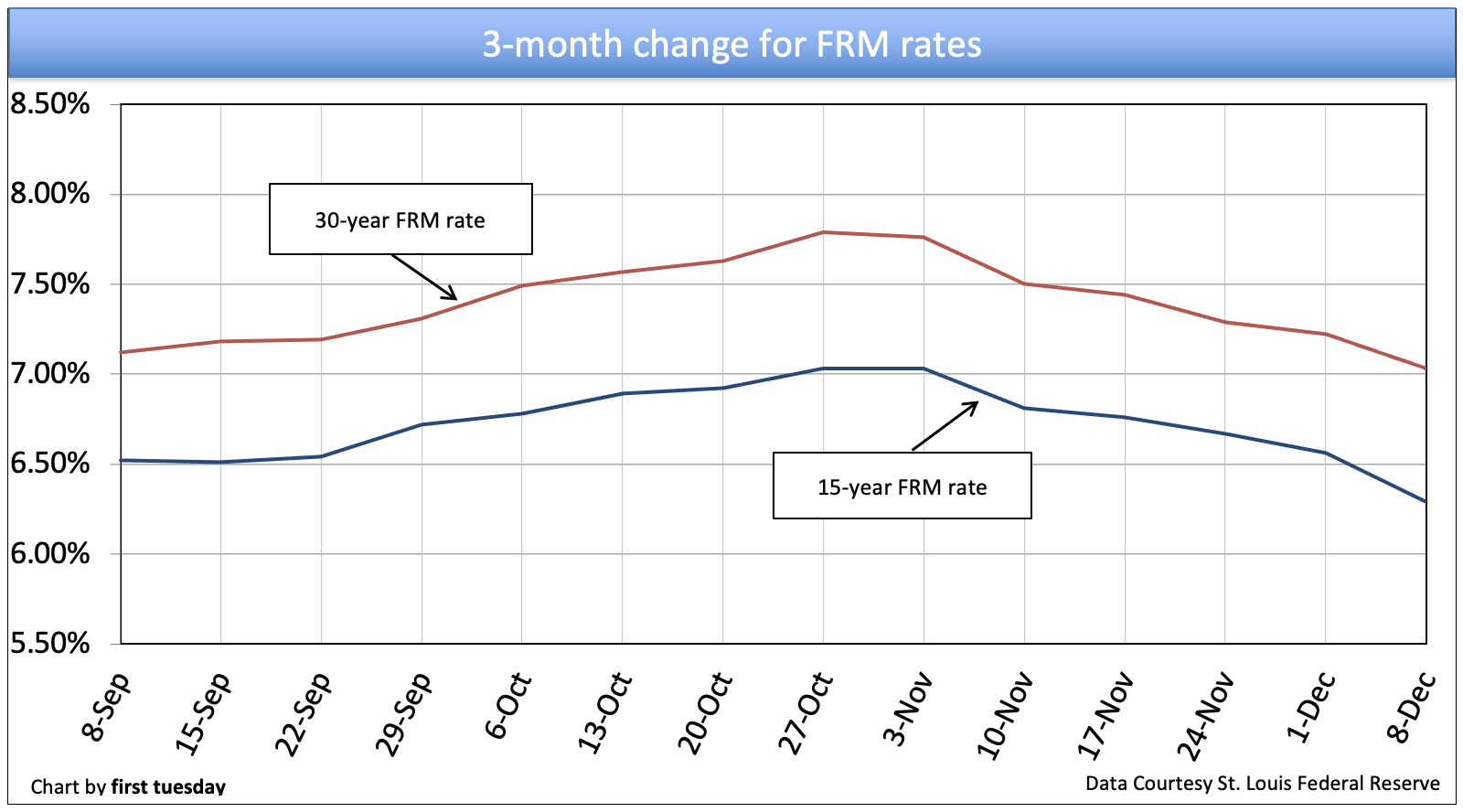

The rate on an average 30-year fixed rate mortgage (FRM) continues to slide, at 7.03% in the week ending December 8, 2023. The average 15-year FRM rate also decreased, to 6.29%.

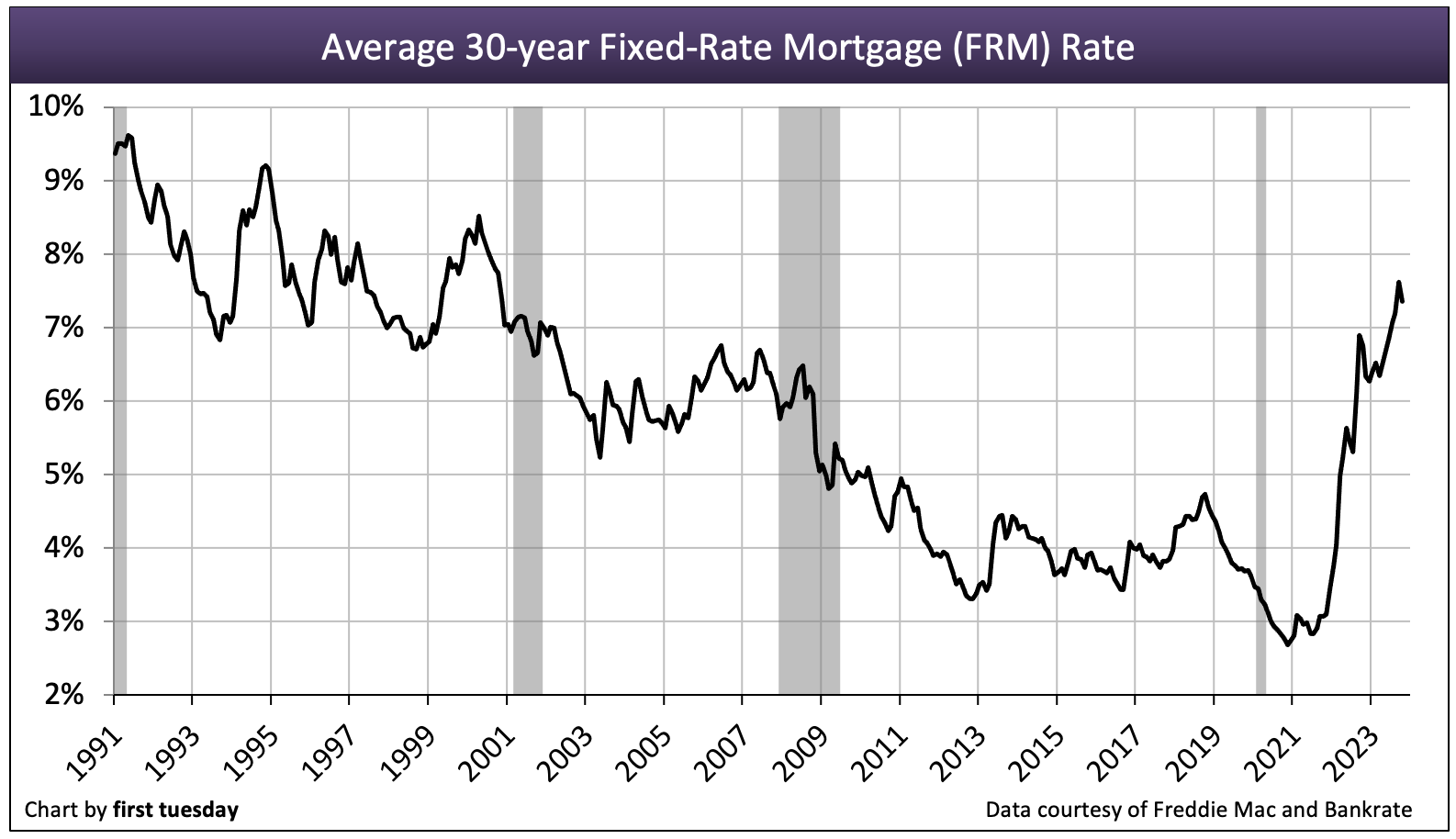

Watch for FRM rates to work their way lower as the Fed demonstrates inflation (and job growth) are under control. Expect the FRM rate to dip through 2025 followed by a long-term upward trend, which, in 2013, introduced a half-cycle of some 30 years of rising rates for all types of borrowing.

Primarily, property sellers suffer from higher FRM rates, since current asking prices are not supported by the amounts buyers can borrow to fund a purchase. Thus, an increase in the FRM rate forces sellers to drop prices or exit the market.

Buyers dependent on purchase-money mortgage funding either reduce their standard of living and acquire a home in a lower price tier, or, more likely as is taking place, simply wait out the drop in asking prices until pricing matches their reduced purchasing power.

As buyers increasingly sense the economic situation heading into 2024 does not create safe economic conditions for an over-priced purchase financed at a high interest rate, more buyers are heading for the sidelines. However, buyers (the patient ones and their agents), will soon discover their situation improving as for-sale inventories grow, forcing sellers to cut prices to unload property they no longer want.

Video updated November 2023

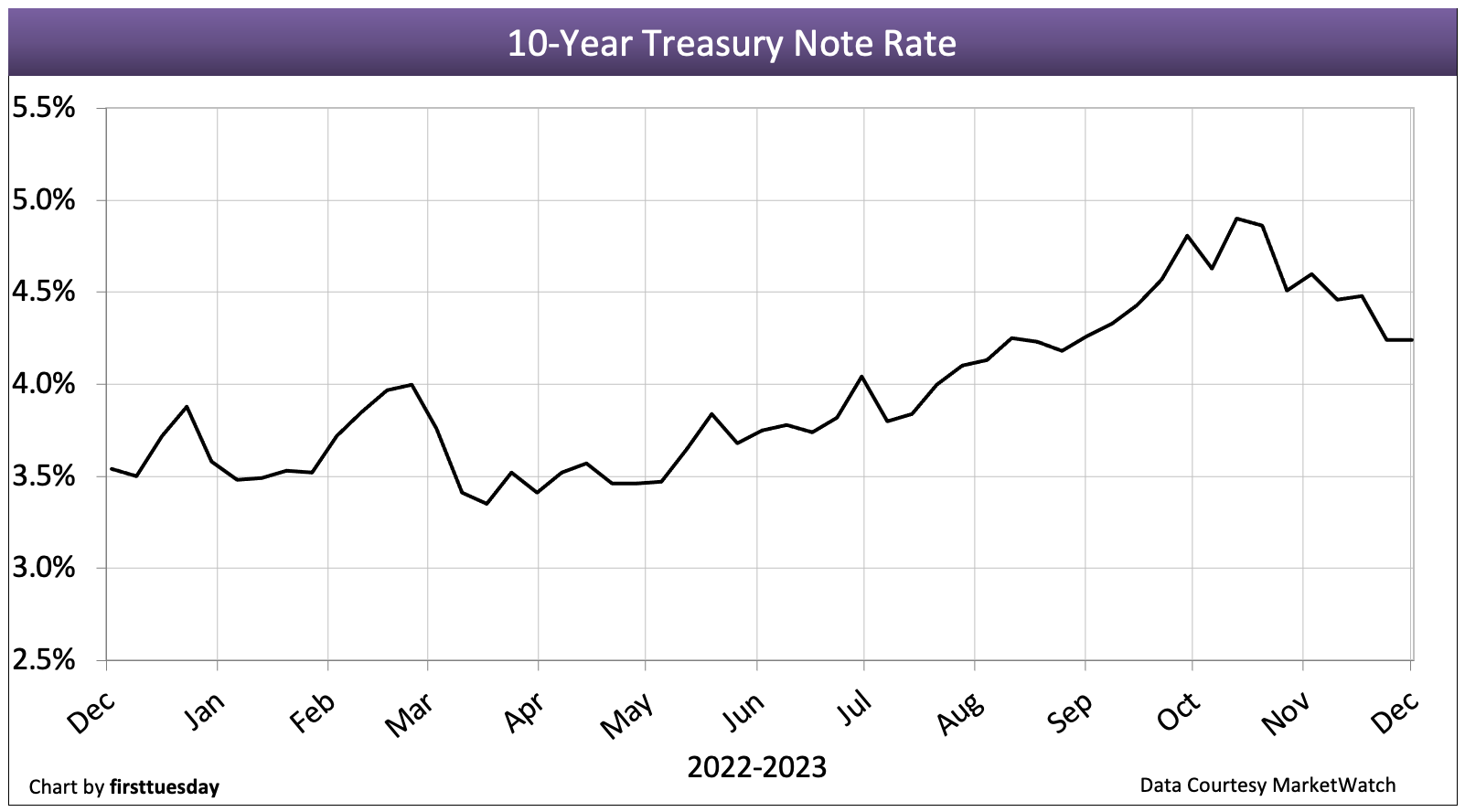

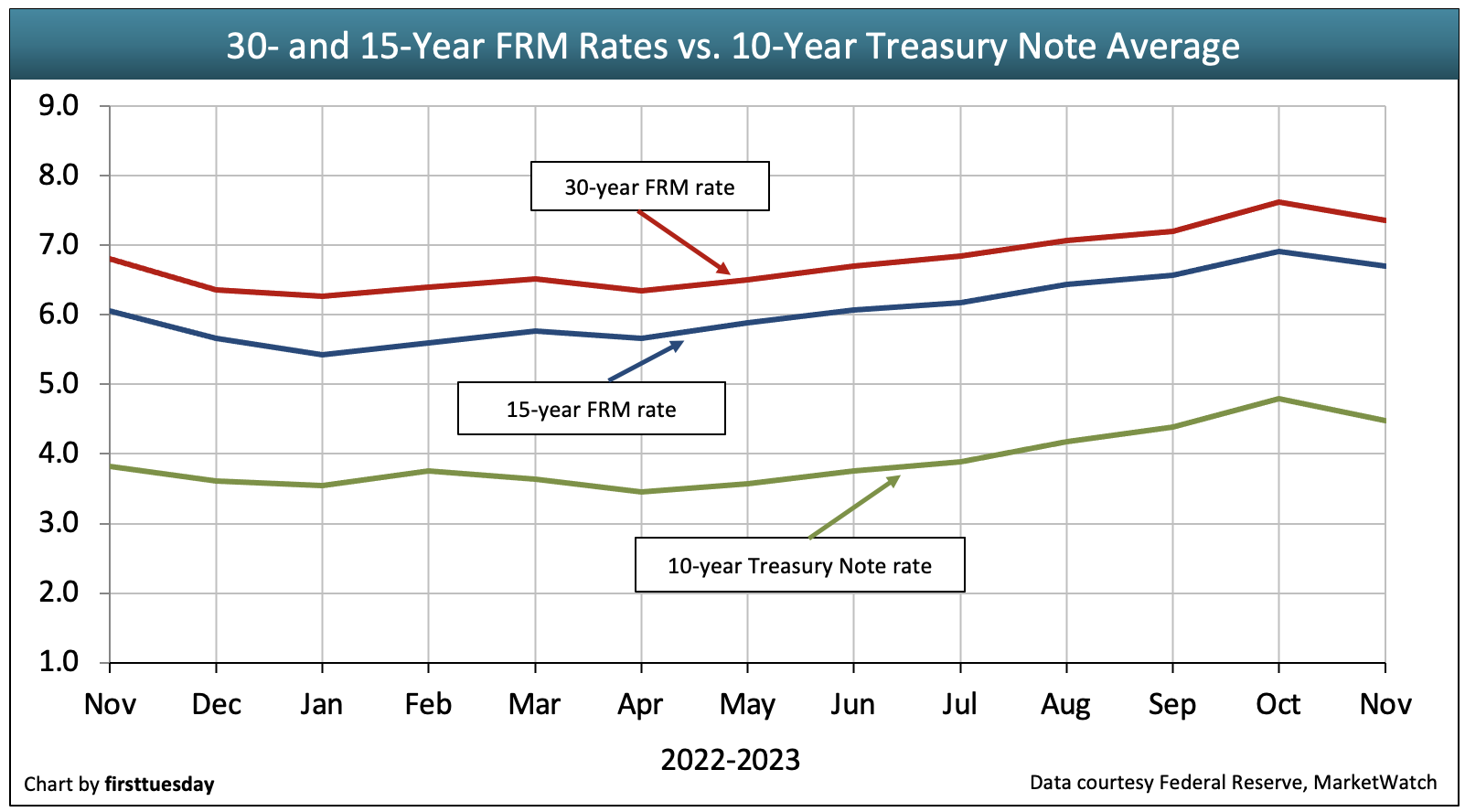

Fundamentally, the setting of FRM rates is tied to the treasury bond market, as are capitalization (cap) rates. The 30-year FRM rate moves in tandem with the 10-year Treasury Note rate. Historically, the risk premium spread between the 10-yr T-Note rate and the 30-yr FRM rate is 1.5%. The spread is far greater for cap rates.

However, on December 8, 2023, the 10-yr T-Note rate is 4.24%. Thus, the spread between the 10-year T-Note and 30-year FRM rate is a high 2.79%, nearly twice the historical risk premium spread of 1.5%. Today’s generous spread indicates lenders continue to pad their risk premiums in anticipation of future rate increases — and foreclosures due to defaults.

Video updated July 2023

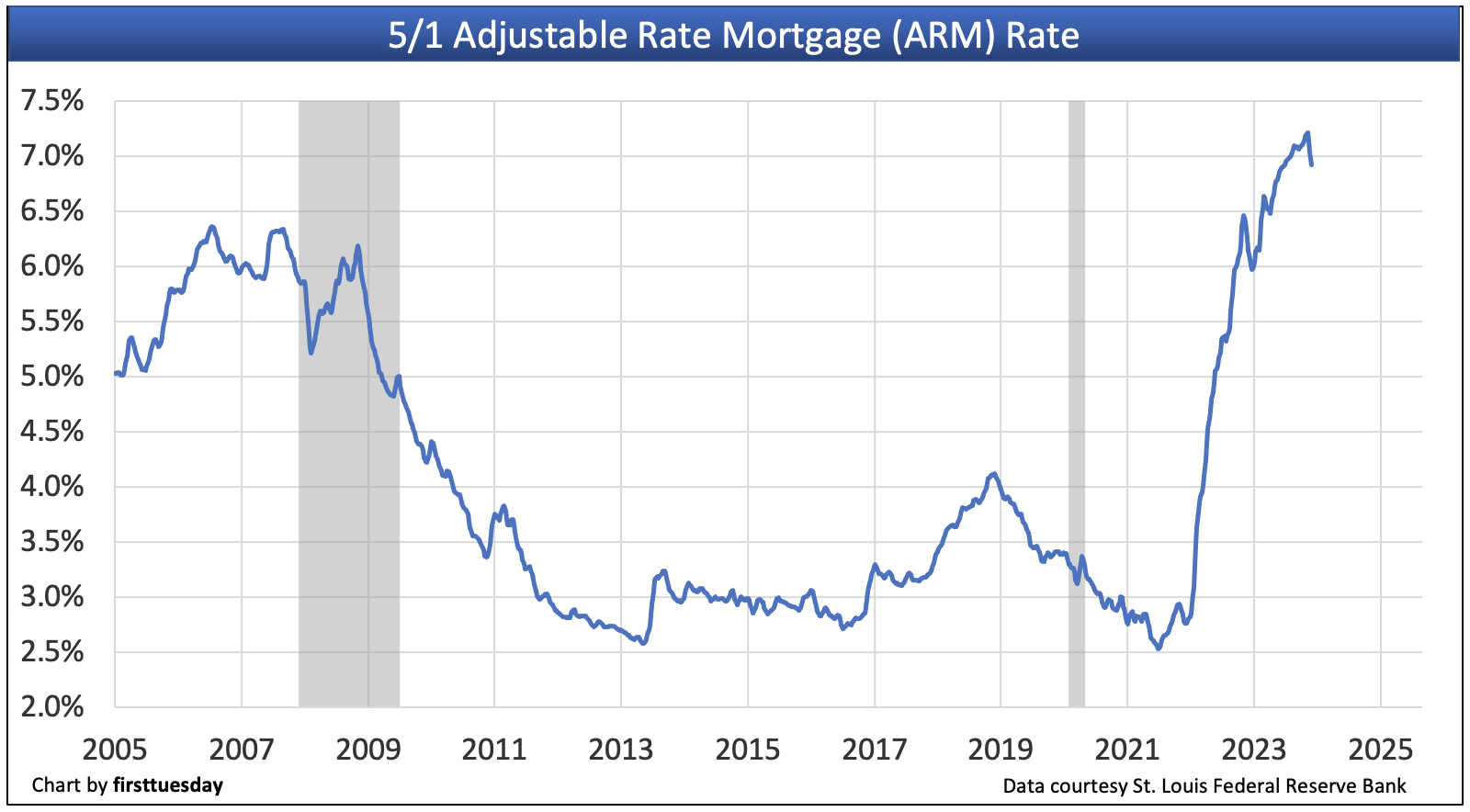

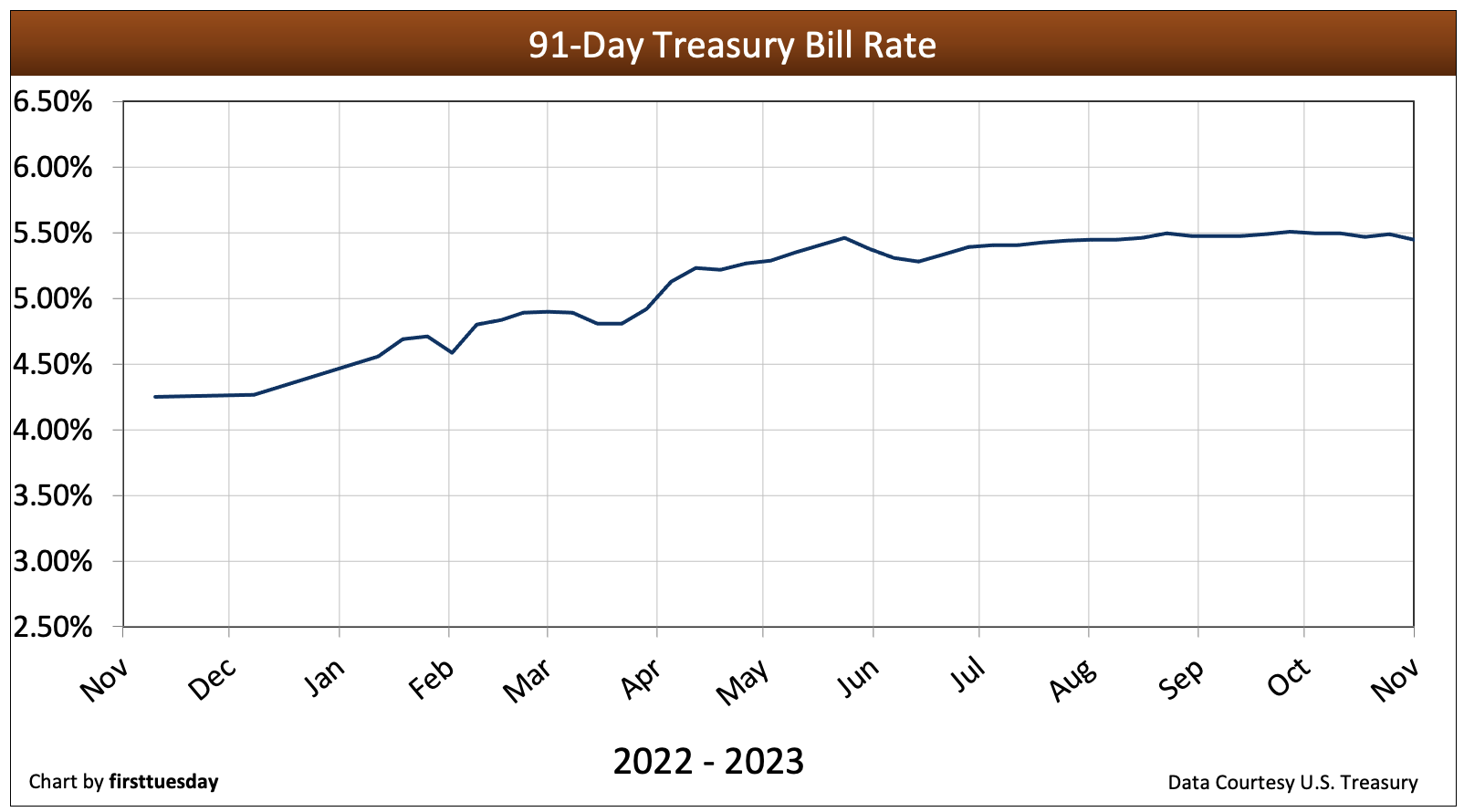

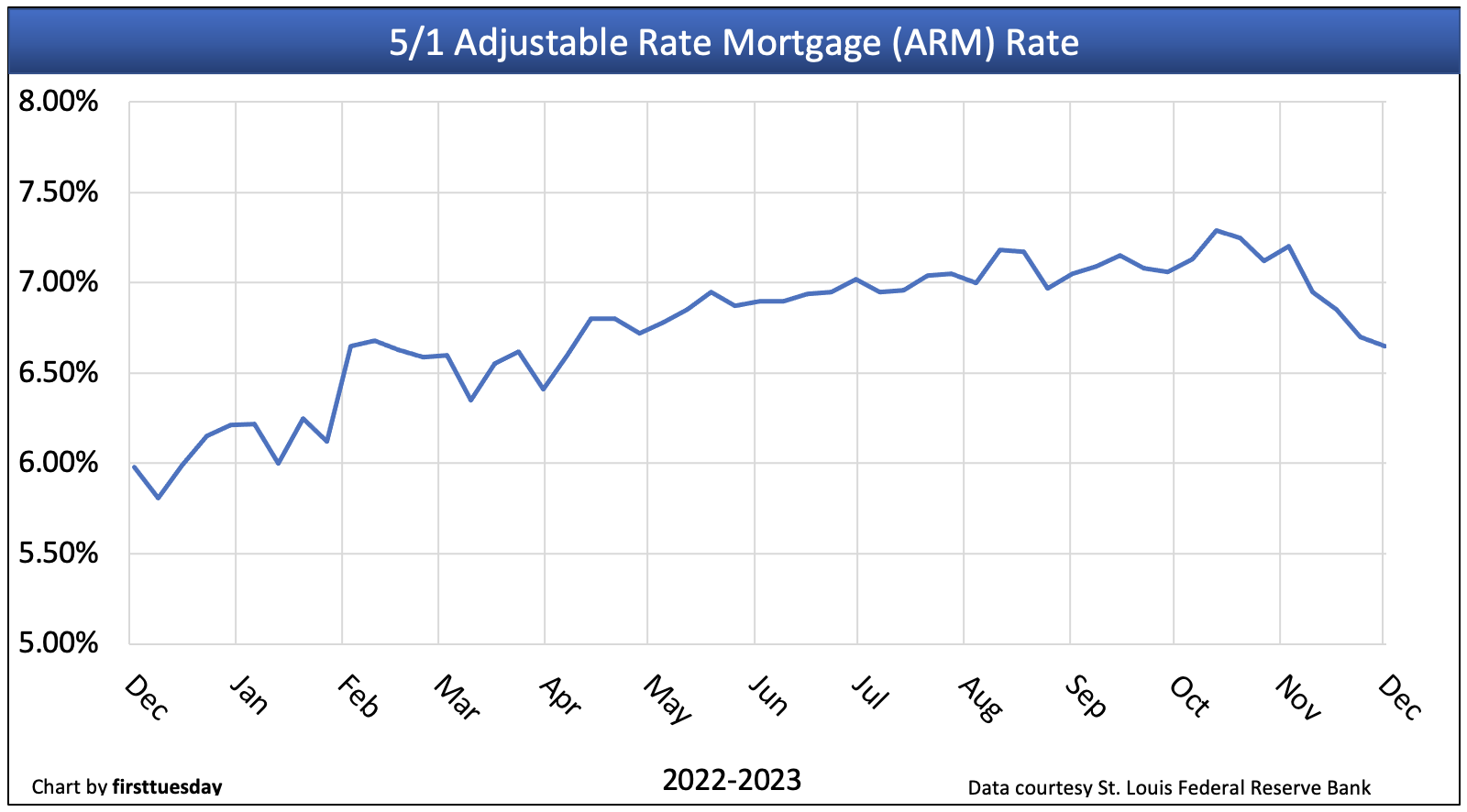

The average monthly rate on adjustable rate mortgages (ARMs) is also falling back in December 2023, presently averaging 6.65%. The interest rate on the ARM is higher than the 15-year FRM and just slightly lower than the 30-year FRM rate — with the limited savings not worth the significant dangers inherent in ARMs. Thus, a riskier ARM is useless to buyers seeking to increase their borrowing capacity.

This inversion in FRM and ARM rates has completely eliminated the appeal of ARMs except in mortgaged-financed high-tier housing and commercial property. Thus, the support for low- and mid-tier home prices ARMs provided before the inversion is now unavailable.

Updated December 8, 2023. Original copy released March 2012.

Click the link to go directly to a chart, or browse the charts by scrolling below.

1. 30-year fixed rate mortgage (FRM) rate, weekly — Chart update 12/08/23

2. 30-year FRM rate, monthly — Chart update 12/08/23

3. 15-year FRM rate — Chart update 12/08/23

4. 5/1 adjustable rate mortgage (ARM) rate, monthly — Chart update 12/01/23

5. 10-year Treasury note rate — Chart update 12/08/23

6. Combined FRM and 10-year Treasury note rates — Chart update 12/01/23

7. 91-day Treasury bill rate — Chart update 11/10/23

8. 3-month Treasury bill — Chart update 12/08/23

9. 6-month Treasury bill — Chart update 12/08/23

10. Treasury Securities average yield (CMT) — Chart update 11/10/23

11. 12-month Treasury average — Chart update 12/08/23

12. Secured Overnight Financing Rate (SOFR) — Chart update 11/17/23

13. Applicable federal rates — Chart update 11/17/23