Britain’s biggest mortgage lender Halifax has become the latest brand to reveal it will increase mortgage rates this week, following a slew of other hikes earlier this week.

Halifax emailed brokers today to say that from Friday, it will be increasing mortgage rates on numerous deals by up to 0.2 percentage points.

It is not the only lender to do so. TSB also said that from Thursday, it would be upping the rates on some of its fixed mortgages by up to 0.75 percentage points.

The pair have followed other major banks that have increased rates this week.

HSBC increased several of its two and five-year fixes, while NatWest also upped rates on selected two and five year deals.

Barclays also increased rates for the second time in a week.

The rate increases have come because of hikes in Swap rates – the interest banks charge to lend to one another.

Swap rates are based on long-term predictions for where the Bank of England interest rate – the interest the Bank charges on its lending to commercial banks – will go in the future.

Until recently, most traders had predicted the Bank of England base rate would go down from its 16-year high of 5.25 per cent in June, but some have now pushed back predictions to August.

It followed inflation figures revealed last week showing it was falling more slowly than expected, to 3.2 per cent in March.

Brokers have also said that some lenders up rates because of high demand.

Nick Mendes of John Charcol brokers explained: “The timing of rate adjustments by any specific lender can vary based on several factors, including whether they managed to secure a significant amount of funding before an increase in Swap rates.

“Lenders in recent days have been quick to adjust there pricing in line with competitors to avoid being an outlier, which would impact on service levels.”

He added that changes in pricing were likely until a cut to the Bank of England base rate was seen, and that more lenders would likely follow with increases this week.

“We’ve seen the majority of the high street lenders adjust and expect the remainder following suit by the end of the week,” he said.

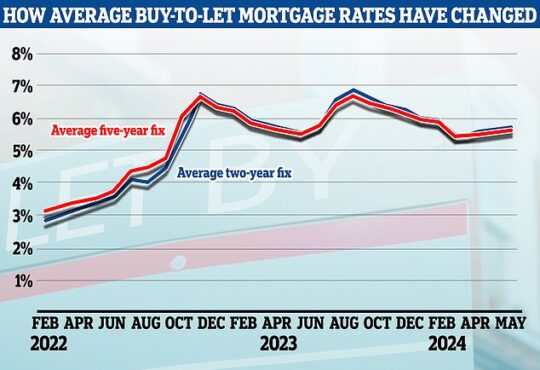

The average two-year fixed mortgage rate is 5.83 per cent, according to Moneyfacts. Meanwhile, the average five-year fixed rate is 5.41 per cent.

Rates got far lower than this at the start of 2024.

On 22 January, the average two-year fixed mortgage rate was 5.59 per cent and the average five-year fixed mortgage rate was 5.22 per cent.