Chancellor Jeremy Hunt: Painful financial measures are pending next Thursday

Pension savers and pensioners fear a raid under cash-raising measures the Government is rumoured to be considering in its latest financial plan.

A more miserly pension tax relief system will make it harder for working people to build a decent retirement pot.

And those who paid towards a state pension all their working life are incensed over the possibility of a second triple lock betrayal.

However, Chancellor Jeremy Hunt will have to come up with some credibly painful measures to prove to international markets he has a grip on the nation’s finances.

Vaguer assurances of probity might have worked in the past, but one of the repercussions of the disastrous mini-Budget in October is that the UK Government must now ‘show’, not just ‘tell’, its creditors that all is in order.

‘Unsurprisingly, speculation is rife as to which taxes might rise, aided by briefings from various “sources” in Westminster,’ says Jason Hollands, managing director of Bestinvest.

‘This kind of kite flying of potential measures has become increasingly common in UK politics and is used to test the likely extent of any backlash.

‘A cynic would note that allowing speculation about a raft of unpopular measures, some of which may not seriously be on the cards, can also help make whatever does transpire on Budget Day appear less harsh than expected so that people breathe a relative sigh of relief.’

We look at what pension announcements might be pending and round up expert views on what the Chancellor could say next Thursday.

Pension tax relief: Tories risk ‘a backlash of biblical proportions’

What is it and what might change? Pensions tax relief allows everyone to save for retirement out of untaxed income. That means you get a bigger sweetener the more you earn.

The rebate is based on people’s income tax rates of 20 per cent, 40 per cent or 45 per cent, which tilts the system in favour of the better-off because they pay more tax.

Rumours about reform usually revolve around the introduction of a flat rate, where higher and additional rate taxpayers receive a reduced level of relief, and basic rate taxpayers either get the same or a bit more than now.

The Government would be stingier in setting a new single rate if it is trying to save money, and afterwards could probably move it up and down pretty much at will.

But overhauling pension tax relief would be a major endeavour rather than a quick cash-raiser, or it would have been done long ago.

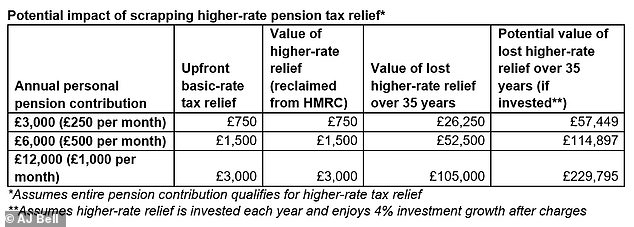

What do pension experts say? ‘The sword of Damocles appears to be constantly dangling over higher-rate pension tax relief, and it has become something of a tradition for rumours to emanate from the Treasury about its imminent demise ahead of Budgets and Autumn Statements,’ says Tom Selby, head of retirement policy at AJ Bell.

Tom Selby: Scrapping higher-rate pension tax relief would hit middle England directly in the pocket

‘This is perhaps inevitable given the total net cost of pension tax and National Insurance relief was estimated at close to £50billion in 2020/21.

‘While successive chancellors have chipped away at pension tax allowances, higher-rate relief has remained untouched, despite estimates scrapping it could deliver an annual saving of around £10billion.’

Selby says there are plenty of reasons why Chancellors have held off so far, and offers the following rundown.

‘Scrapping higher-rate pension tax relief would hit middle England directly in the pocket – a section of society the Conservative Party can ill afford to alienate.

‘Automatic enrolment also remains relatively fragile – particularly given millions are facing a cost-of-living squeeze – and there may be concerns scrapping higher-rate relief could spur a rise in opt-outs.

‘The government would risk standing accused of intergenerational unfairness, given older generations will have had the chance to benefit from higher-rate relief, while younger workers would have the rug pulled from under them.

‘It is also entirely unclear how this would be applied to defined benefit schemes, and in particular the public sector. Whatever the method, the end result would be whacking great tax bills for large numbers of public sector workers.

‘Pensions are already creating a significant squeeze on the NHS, and landing doctors with another tax bill to cancel out their higher-rate pension tax relief would risk a backlash of biblical proportions.’

Source: AJ Bell

Jason Hollands of Bestinvest, says: ‘A move against pensions tax relief – or the annual contribution limit – would certainly raise significant taxes but reduce the attractions of pension saving for millions of Britons in the process.

‘There would be some political cover as the opposition parties have previously called for a similar overhaul, making it hard for them to oppose such a measure.

‘However, it would carry considerable political risk among core Tory voters and meddling with pension allowances could also reignite problems with senior medical professionals who enjoy generous NHS pensions.’

Alice Guy, personal finance expert at Interactive Investor, says: ‘Reducing pension tax relief would disproportionately affect private sector workers, most of whom don’t have a guaranteed defined workplace pension. They rely on pension tax relief to help them build up enough wealth for a comfortable retirement.’

She explains: ‘Many European countries have a much more generous state pension system where final payments are based on almost 50 per cent of average wages.

‘In contrast the UK state pension is a two-tier system with a small flat state pension, supplemented by workplace and private pensions which are boosted by tax relief.

Jason Hollands: A move against pensions tax relief would reduce the attractions of pension saving for millions of Britons

“If the state pension triple lock is scrapped or pension tax relief is reduced, then there is a risk that the UK state pension system could become one of the worst in Europe.’

Annual and lifetime allowances: Changes could trigger row with well-paid public sector workers like doctors

What is it and what might change? The annual allowance is is £40,000, which is the standard amount you can put in your pension every year and qualify for tax relief – including your own and your employer’s contributions, and the tax relief itself.

The rules are more complicated for higher earners, whose annual allowance is ‘tapered’ down to either £10,000 or £4,000.

The lifetime allowance is how much you can save into a pension and get tax relief in total, and is currently £1,073,100.

To save money, the Government currently intends to freeze the lifetime allowance at the same level until 2025/26, but it is reportedly considering holding it there even longer.

It might also tinker with the annual allowance, although it has fairly recently put in a fix to resolve a dispute with doctors, who were taking a disproportionate hit due to working patterns and overtime.

NHS staff shortages might cause the Government to hesitate before riling up the medical professional over this issue again.

What do pension experts say? ‘It is entirely possible the Treasury chose to raise the possibility of a dramatic and hugely controversial scrapping of higher-rate tax relief in order to soften the blow of pension tax tweaks elsewhere,’ says Tom Selby of AJ Bell.

‘One option could be to reduce the annual allowance. Such a move would be less seismic than ditching higher-rate relief but would not be without problems or controversy. Once again, the big sticking point will likely relate to defined benefit schemes – and specifically the NHS scheme.

‘The British Medical Association has previously warned the spike in inflation we have seen this year could lead to NHS practitioners being hit with pension tax charges running into tens of thousands of pounds – and that is assuming the annual allowance remains at £40,000.

‘If the annual allowance is cut, there will clearly be a risk of more early retirements, placing further strain on the NHS.’

Savings blow: ‘Reducing pension tax relief would disproportionately affect private sector workers, most of whom don’t have a guaranteed defined workplace pension,’ says one expert

Selby says perhaps the most likely option is to extend the freeze in the lifetime allowance which Rishi Sunak announced when still Chancellor in spring 2021.

Inflation means the saving to the Exchequer will have risen as well, and by prolonging the freeze the Treasury ‘may be able to pocket a few quid’, he points out.

But Selby notes: ‘It will also drag increasing swathes of middle Britain – again including public sector pension members – into the orbit of the lifetime limit.’

Alice Guy of Interactive Investor says: ‘Freezing the lifetime allowance at £1,073,100 would make it more difficult for pension savers to achieve a comfortable retirement.

‘Inflation since 2006, when the cap was introduced, means that £1,500,000 (the lifetime allowance in 2006) would now be worth £2,322,583 in today’s money.

‘That means the lifetime allowance has more than halved in real terms since it was introduced in 2006.

Sarah Coles: For those who are reliant on the state pension or any other benefits, not keeping the triple lock this year would be a terrible blow

‘A private pension pot of £1,073,100 would give someone a pension income of around £32,193 per year if they withdraw 3 per cent per year from their pension. It’s a relatively modest amount and is only around the current average salary in the UK.’

Sean McCann, chartered financial Planner at NFU Mutual, says slashing the annual allowance from £40,000 to £30,000 or even £20,000 would save huge sums.

‘However, the population is not saving enough for retirement so Jeremy Hunt will need to tread carefully.’

Inherited pensions: Likely to provoke ‘death tax’ accusations

What is it and what might change? Beneficiaries of pension pots invested in income drawdown plans either pay no tax if the owner dies before age 75, or their normal income tax rate if they are 75 or over.

This relatively generous system introduced with pension freedom in 2015 could be targeted, but risks disrupting the inheritance plans of many people using drawdown plans with an eye to passing on pension wealth to the next generation.

What do pension experts say? ‘The Treasury could introduce a tax charge on death to raise extra revenue from retirees hoping to pass money on to loved ones tax efficiently,’ says Tom Selby of AJ Bell.

However, he warns this would come with significant challenges, saying: ‘Being able to pass on funds tax-efficiently on death will have been one of the primary motivations for contributing to a pension for some people.

‘Slapping a new tax on that money would therefore leave many feeling like the Chancellor has pulled the rug from under their inheritance plans.

‘It would risk being deeply unpopular, with predictable headlines of “pensions death tax” likely to follow. Given the proximity of the general election, this might be enough to put Hunt and Sunak off going down this road.’

Inheritance planning: Beneficiaries of pension pots invested in income drawdown plans either pay no tax if the owner dies before age 75, or their normal income tax rate if they are 75 or over

State pension triple lock: Pensioners are fearful of a second betrayal of manifesto promise

What is it and what might change? The triple lock pledge means the state pension should increase every year by the highest of price inflation, average earnings growth or 2.5 per cent.

This year, the inflation rate is 10.1 per cent, which should prompt a hike in the full rate state pension to £203.85 a week or £10,600 a year.

There is speculation that the Government will renege on its triple lock manifesto promise for a second year running, a move that would cause a furore among pensioners.

Instead of using the inflation figure which was lower last time, it could uprate the state pension in line with the earnings growth figure because that is the cheaper option this year.

If the total pay growth, including bonuses, figure of 5.5 per cent is deployed then pensioners on the full rate would receive around £195.35 a week or £10,160 a year, and those on the basic rate would get £149.65 a week or around £7,780 a year.

What do pension experts say? The debate as to whether the triple lock will be uprated with inflation continues to rage, and for anyone who receives a state pension it is a major concern that this might not happen, according to Sarah Coles of Hargreaves Lansdown.

‘For those who are utterly reliant on the state pension or any other benefits, it would be a terrible blow.’

Jason Hollands of Bestinvest says: ‘Apart from the fiscal burden, the lock is seen as inter-generationally unfair in some quarters.

‘Opposing views point to the comparatively stingy level of state-funded retirement income in the UK compared to peer nations.

‘It seems unlikely that the Tories, lagging Labour by a huge gap in the polls, will target a measure that would leave them facing accusations of betrayal from core voters.

State pension: There is much speculation that the Government will renege on its triple lock manifesto promise for a second year running

‘However, a hard-pressed Chancellor could argue the 10.1 per cent inflation in September is also an anomaly, and water down the lock again for a year while pledging to reinstate it the following year, before an election.’

Selby says: ‘While former prime minister Liz Truss committed to the triple lock during her final Prime Minister’s Questions appearance, the current PM and Chancellor have been unwilling to do so.

‘This is perhaps understandable given an inflation-linked increase could cost in the region of £5 billion more than an earnings-linked rise.

‘However, failing to honour the triple-lock for a second consecutive year would be a huge risk given where the Conservative Party finds itself in the polls.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.