“Thanks to this,” European Commission President Ursula von der Leyen said at the time, there will be “a ban on almost 90 percent of all Russian oil imports” entering the EU, later adding the measures would “reduce Russia’s revenues significantly.”

However, the plan had some glaring workarounds that have undermined its effectiveness. In addition to the carve-out allowing EU countries to still buy Russian crude refined outside the bloc, a further exemption was given to EU member Bulgaria, which was temporarily allowed to export limited Russian-origin fuels under strict conditions.

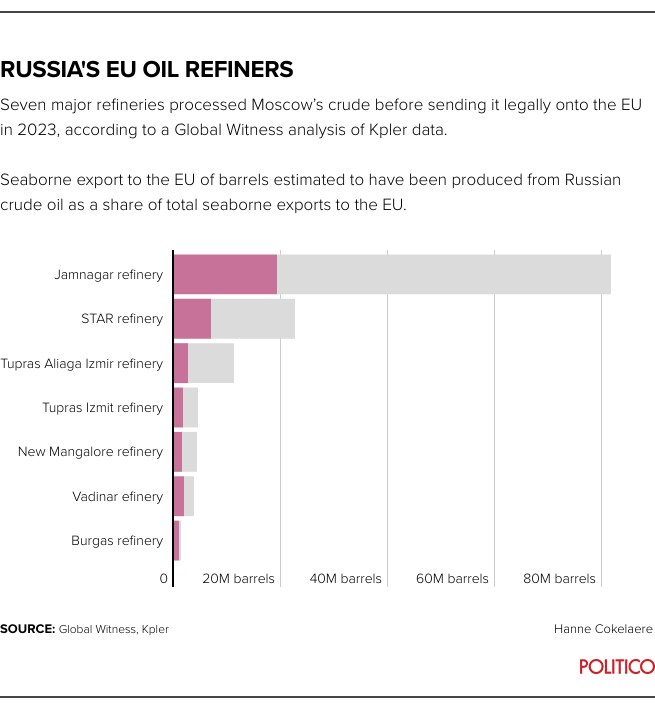

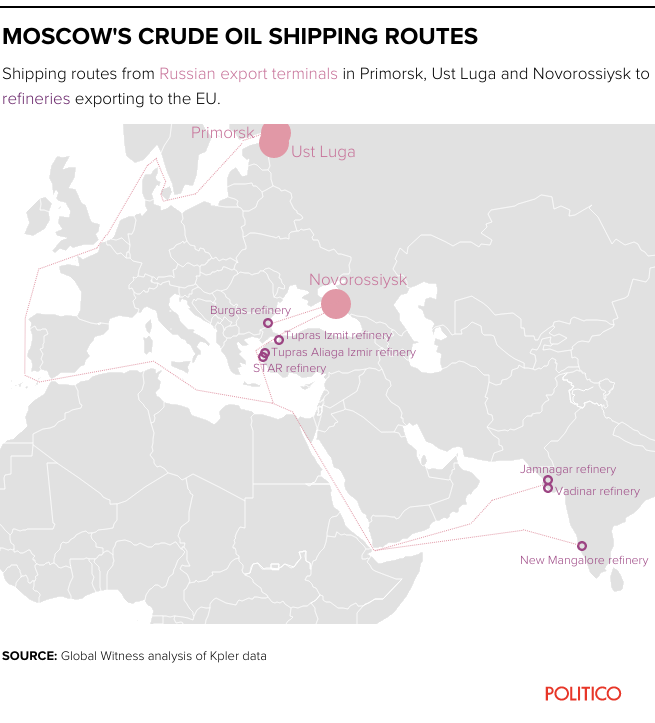

In all, that meant seven refineries processing Moscow’s crude in India, Turkey and Bulgaria continued exporting refined fuels to the EU. Indian facilities supplied the most fuel to the bloc, accounting for two-thirds of the supply.

Those processed fuels were then sold legally, including via Western oil firms and commodity traders, and later arrived at EU ports, according to the report. All refineries involved in the process were also in compliance with current EU sanctions laws. None of the facilities’ owners responded to a request for comment.

|

|

Global Witness estimated that the fuel exports from these refineries to the EU last year generated between €870 million and €1.3 billion for the Kremlin based on the average tax levied on crude exports leaving Russia combined with the amount of unprocessed crude Moscow sent to each refinery.

“Every penny spent on Russian oil helps pay for the Kremlin’s war of aggression on Ukraine,” said Christopher Lambin, a senior analyst at the NGO who authored the report, adding that “the EU should move to close the refining loophole.”