A new European Central Bank (ECB) analysis reveals that the corporate loan portfolios of 90% of Euro-area banks are significantly misaligned with EU climate goals. The report examines loans to six sectors chosen because of their exposure to a decarbonising world: power, automotive, oil & gas, steel, coal and cement. Everything from new decarbonisation rules through to changing consumer behaviour is altering the risk profile of loans, which banks are failing to account for. Put simply, they’re lending to corporates that aren’t planning for new decarbonisation costs and may soon struggle to afford the loans. This is exposing banks to climate transition risks, making them less competitive against peers and more prone to defaults on loans. Also, when a bank’s corporate lending portfolio doesn’t align with their own stated climate commitments it could expose them to litigation risks. Nicholas Dodd, George Harris and Sarah LaMonaca at RMI look at the report and its implications. They end by pointing to the tools that are available to banks to properly forecast change, improve their planning, identify new opportunities, and better align their portfolios.

A new European Central Bank (ECB) analysis reveals that the corporate loan portfolios of 90% of Euro-area banks are significantly misaligned with EU climate goals. The report examines loans to six sectors chosen because of their exposure to a decarbonising world: power, automotive, oil & gas, steel, coal and cement. Everything from new decarbonisation rules through to changing consumer behaviour is altering the risk profile of loans, which banks are failing to account for. Put simply, they’re lending to corporates that aren’t planning for new decarbonisation costs and may soon struggle to afford the loans. This is exposing banks to climate transition risks, making them less competitive against peers and more prone to defaults on loans. Also, when a bank’s corporate lending portfolio doesn’t align with their own stated climate commitments it could expose them to litigation risks. Nicholas Dodd, George Harris and Sarah LaMonaca at RMI look at the report and its implications. They end by pointing to the tools that are available to banks to properly forecast change, improve their planning, identify new opportunities, and better align their portfolios.

In a landmark report published earlier this month, the European Central Bank (ECB) analysed how the portfolios of 95 Euro-area banks (who together provide 75 percent of Euro-area lending) align with global climate goals.

The report uses RMI’s open-source Paris Agreement Capital Transition Assessment (PACTA) approach to assess how exposed Euro-area banking institutions may be to climate transition risk, and which underlying sectors need the most attention to decarbonise. The findings offer critical insights on the underlying transition risk factors in the EU — and how forward-looking, capex-based metrics can be used to help evaluate and plan to mitigate them.

Most banks’ lending portfolios do not match stated climate goals

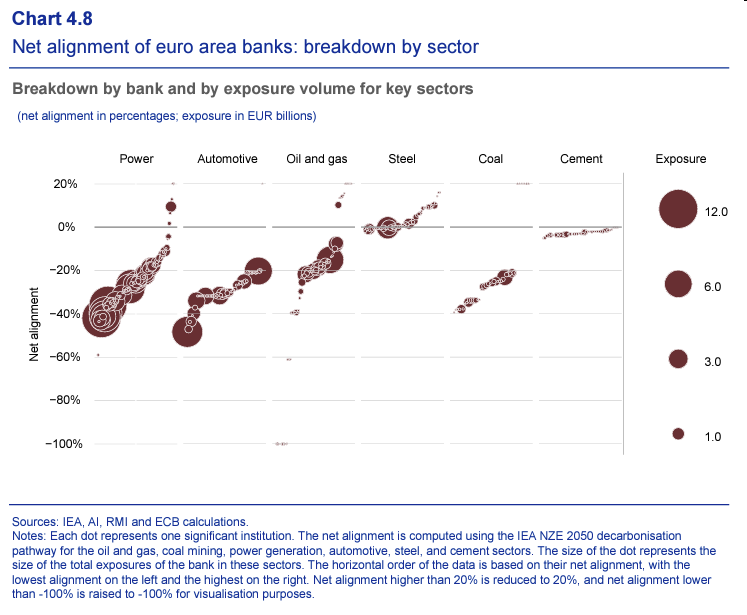

The ECB’s analysis of 95 Euro-area banks found that approximately 90 percent are misaligned with the goals of the Paris Agreement. Misalignment with climate pledges can expose financial institutions to significant risk as policy and market conditions increasingly reflect climate realities. For example, when carbon-intensive borrowers face carbon pricing, regulatory restrictions, or shifting consumer preferences, they can become less competitive against peers and more prone to default on loans.

The ECB report also shows that 70 percent of Euro-area banks’ stated climate commitments did not add up to the alignment of their corporate lending portfolio. The ECB suggests that this gap between performance and commitments could expose companies and financial institutions to litigation risks.

Analysis of lending to six climate-critical sectors

The analysis identifies that transition risk exposure mainly stems from the delayed phase-down plans for fossil fuel technologies in the automotive and power sectors combined with the slow planned build-out of renewable capacity. Build-out of electric vehicle production offers a bright spot for alignment.

The ECB analysis used PACTA to assess the climate alignment and associated transition risks for six key sectors, including fossil fuel production and sectors whose end use of fossil fuels together accounts for around 70 percent of CO2 emissions: power generation, automotive, steel, and cement. Transition risks arising from climate misalignment in these sectors may come from plans to build out climate solutions too slowly, and/or from phasing down high-carbon technologies too slowly.

The analysis showed that more than 50 percent of misalignment is caused by a slow drop in production from carbon-intensive technologies including gas and coal-fired power, as well as internal combustion engine (ICE) vehicles. Replacement renewable power capacity is also lagging behind what Paris-aligned scenarios prescribe.

The report does share some good news: electric vehicle production is projected to increase as Euro-area banks’ borrowers plan a significant uptick in electric vehicle production in line with climate targets.

Exhibit 1: Screenshot from ECB report showing the extent of banks’ misaligned exposure to the power, automotive, and oil and gas sectors. These sectors drive the majority of the net misalignment of the portfolios analysed, with the steel and cement sectors showing better alignment.

Three ways banks need to plan for transition and mitigate risks…

While the results of the report are sobering, banks do have access to open-source tools to measure the alignment of their portfolios and navigate the risks of climate transition. In particular, the report underscores how alignment approaches such as PACTA can help banks meet a range of upcoming Euro-area requirements focused on climate transition.

1] Euro-area banks must disclose their climate alignment

As the ECB report demonstrates, forward-looking metrics such as the ones offered by the PACTA approach are an effective tool in measuring the climate alignment of a portfolio and understanding its implications from a transition risk perspective. Banks can utilise the PACTA approach and RMI’s free open-source software tool to gain the same alignment insight on their own portfolios and counterparties.

Furthermore, in its report, the ECB points out how disclosure using alignment metrics is now required under the European Banking Authority’s latest Pillar 3 requirements that come into force from June 2024.

2] Euro-area banks can manage their climate risk and get ahead of regulation by developing transition plans

Beyond understanding exposure to transition risks, banks can use forward-looking metrics such as those offered by PACTA to plan for the transition to the low-carbon economy. Transition plans are quickly emerging as an area of best practice for financial and non-financial actors to adopt. They are anticipated to become mandatory EBA requirements in the Euro area by next year. PACTA’s use of asset-based and forward-looking production values can help banks in developing their transition plans by showing the forward-looking trajectory of key climate change solutions and technologies required for the transition.

Moreover, PACTA’s company-level analytics can help inform a bank about the credibility of their counterparties’ transition plans and its use of multiple climate scenarios can help banks develop their own transition planning by exploring the driving forces and risks associated with sector transitions.

3] Euro-area banks can find opportunities in the climate transition and capitalise on them through transition finance

The climate transition holds not only risks but also tremendous investment opportunities. According to the European Commission, annual investments will need to increase by around €520 billion in the coming decade to deliver on the European Green Deal. Transition finance will be a key tool through which banks can support their clients with the products and services to make the transition and hence capitalise on the financial opportunity it presents.

Once again, the PACTA tool can help to identify clients who may benefit from transition finance and form the basis for engagements with misaligned companies, with transition finance products providing a means to help align their operations with climate goals. As an ECB Executive Board member noted, “it is vital that [these] banks do more work with their counterparties to ensure the companies they finance do not prevent them from living up to their net-zero commitment.”

In conclusion, an analysis of lending to six climate-critical sectors finds there is a significant misalignment between Euro-area corporate loan portfolios and climate goals. This is driven by the misalignment of the real economy companies, exposing banks to climate transition risks. Forward-looking capex-based methodologies and tools, such as PACTA can support banks in taking steps towards aligning their portfolios through mitigating transition risks and capitalising on alignment opportunities in the real economy. In doing so, they can contribute to global climate goals, as well as mitigate climate change-driven financial risks.

Learn more about PACTA and portfolio alignment:

Banks, investors, or supervisory institutions wanting to learn more about the PACTA open-source software tools can visit the PACTA website and keep up to date with the latest via the LinkedIn page.

Contact us at: [email protected], [email protected], [email protected].

***

Nicholas Dodd is a Climate Finance and Energy Transition Expert at RMI

George Harris is a Senior Associate at RMI

Sarah LaMonaca is a Principal, Climate-Aligned Finance, at RMI

This article was first published on RMI.org, and has been reprinted with permission