CHANGE: US markets are supersized and dominate global stocks, bonds, and currencies. This makes any changes to their underlying market ‘plumbing’ disproportionately important. On May 28th US stocks move to a quicker T+1 settlement schedule, putting it at odds with Europe. Whilst consultation has opened on a long shot move to 24/7 trading. It’s a test, and potential volume win, for NYSE owner Intercontinental Exchange (ICE (NYSE:)), NASDAQ (NDAQ), and derivatives juggernauts CME Group (NASDAQ:) and CBOE Global Markets (CBOE). The wider US broker dealers & exchanges ETF (IAI.US) is up 21% the past year, in line with the rally.

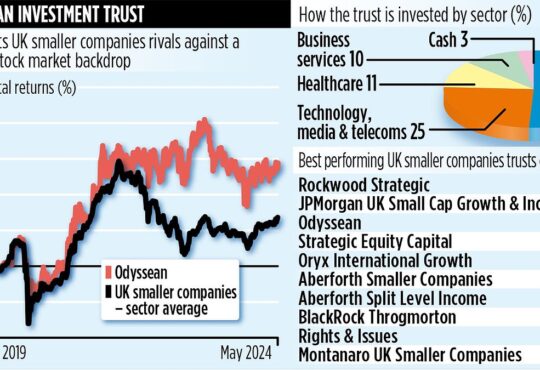

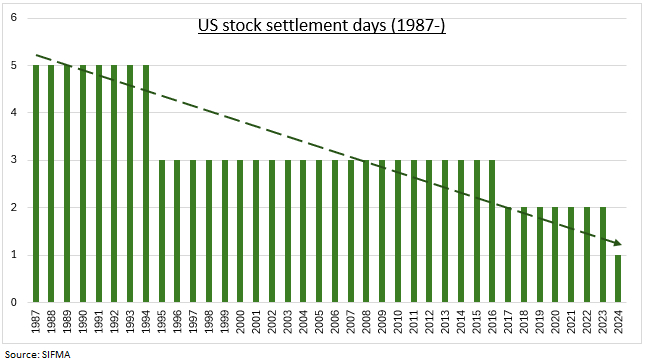

T+1 SETTLEMENT: The world is on a tech-driven march to instantaneous trade settlement. US cash equities settlement will move from a two-day to one-day (T+1) settlement on May 28th. This has been progressively shortened from T+5 over the past forty-five years since the 1987 Black Monday crash (see chart). This will cut the counterparty and margin risks highlighted by the 2021 meme stock boom and should boost market liquidity. But will also put the US out of synch with much the rest of the world that is on T+2 and potentially increase the operational risk of failed trades in short term. Though lagging pace-setters China (T+0) and India (T+1).

24/7 TRADING: Regulators are considering an NYSE application to trade 24/7. Prompted by crypto markets trading 24/7, extended hours stock trading, and others from futures to currencies trading around the clock. This would be the greatest ever change since the move to continuous six-day US stocks trading in 1871. The NYSE moved from working Saturdays to its five-day trading week in 1952 and closed on Wednesdays in 1968 to catch up on paperwork. Trading 24/7 may come with costs and complexity. But could benefit volumes, especially from retail investors that dominate out-of-hours activity. And with welcome tighter regulatory oversight.

remove ads

.