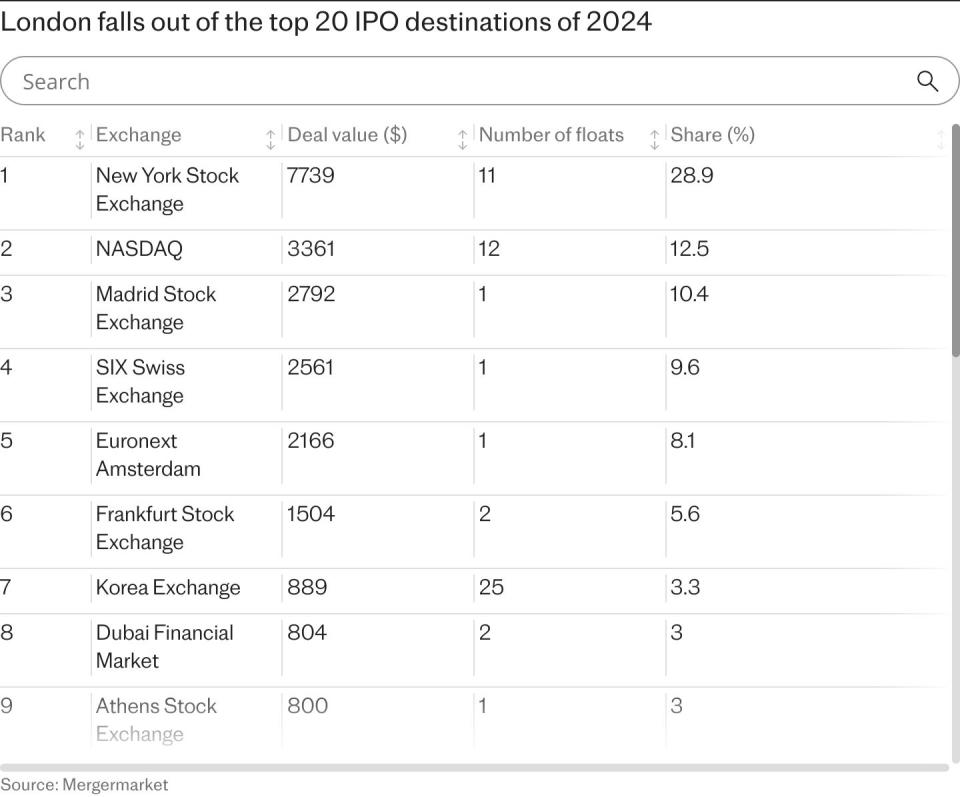

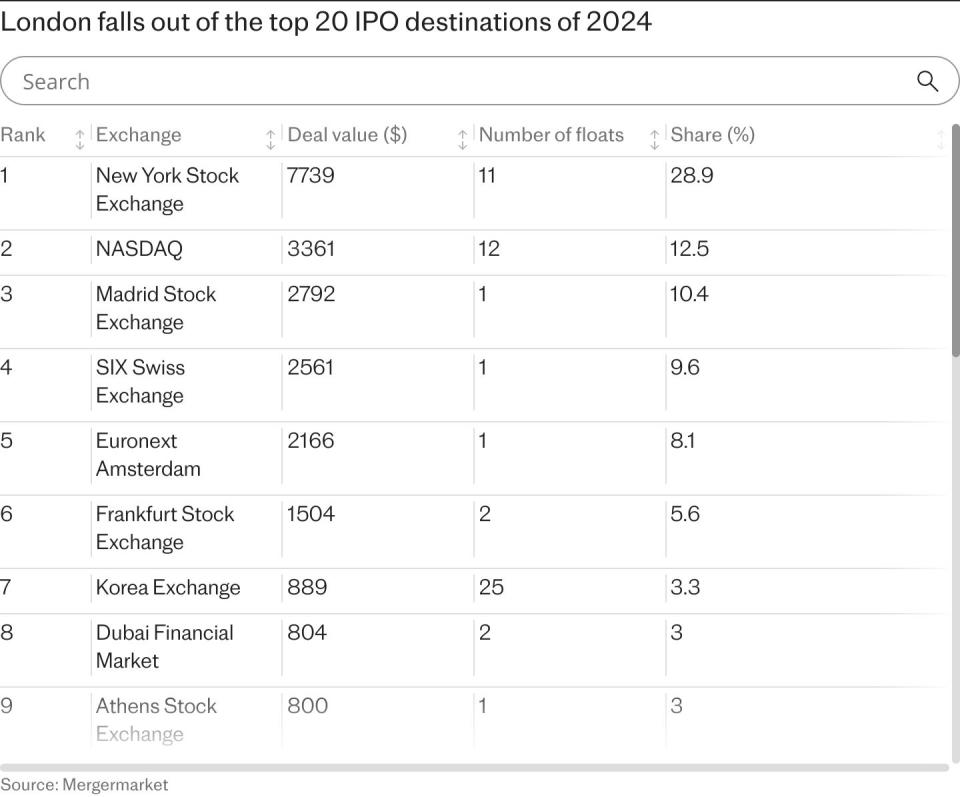

The London Stock Exchange (LSE) has raised only as much money in initial public offerings (IPOs) so far this year as Kazakhstan as it drops in global rankings.

London’s main market is in joint-21st position for money raised by new floats in the first four months of the year, according to analysis by Mergermarket. There has been only one IPO, raising just £95m ($119m), which was Air Astana’s joint float between London and Kazakhstan.

The single float means that London’s centuries-old stock exchange has raised only as much as the 30-year-old exchanges in Kazakhstan’s Astana and Almaty – a country which is the world’s 54th-largest economy.

It is behind other much smaller exchanges, including Istanbul, which has raised £486m, Athens at £638m, and Oslo, which has had one float raising £111m.

In total, approximately 370 IPOs have raised $32.3bn in the first four months of the year.

The London market has been hit with a string of companies opting to list abroad in places such as New York.

Mining giant Glencore last year chose to spin off and list its coal business in New York rather than London, while its secondary listings went to Toronto and Johannesburg.

Last month, fears were raised that FTSE giant Shell was contemplating a move, with a senior executive saying “all options” were under consideration – although it has since played down the suggestion.

Initial Public Offerings (IPOs) are when a company makes its shares available for the first time to the public, allowing a firm to raise capital. But London has long been struggling to attract floats.

Last year, in a difficult year for the British market, London had eight floats raising a total of £728m, just above Tokyo, which raised just £688m from 21 floats. It was the worst year for IPOs in London since the financial crisis.

It was also a miserable 2023 for European markets, but there are some signs of life. Shares in the European private equity firm CVC jumped as much as 25pc after debuting in Amsterdam last month.

There is also some hope on the London horizon. From Boots to e-bank Starling and buy-now-pay-later giant Klarna, there are large companies that are looking at the British capital for their IPO.

Other fintechs, including Zilch and Zopa, are also considering potential floats, although many are waiting for the flow of IPOs to pick up first. There are also concerns about the uncertainty caused by an upcoming general election.

Analysts Peel Hunt, who offer an “IPO Speedometer”, say the signs for the second half of 2024 are “more positive”, and expect a “broader re-opening” in the first six months of next year.

Lindsay James, investment strategist at Quilter, said the trend of companies leaving the UK market for the US or through acquisitions was “worrying”.

“While the exit of some notable firms and the decline in new floats is certainly a setback, it is the cumulative impact of multiple companies departing that would signal a more substantial threat to London’s financial standing.

“The UK index faces distinct challenges, including a scarcity of large growth companies, an under-representation of technology stocks, and the diminished role of UK defined benefit pension funds in ownership. Additionally, stringent regulations may deter companies from listing, presenting a hurdle that needs addressing,” she said.

The London Stock Exchange Group (LSEG), which was formed in 2007, made more than £7bn in profit in 2023, but just 3pc came from the exchange.

An LSEG spokesman said: “LSEG is a leading global financial markets infrastructure provider offering services across the entire trade lifecycle. London Stock Exchange is an important part of the Group and it is wrong to suggest otherwise.

“All entities across the Group benefit from our diversified business model and strong balance sheet, enabling investment in growth and transformation.”