A look at the day ahead in U.S. and global markets from Mike Dolan

A fresh burst of chipmaker excitement around artificial intelligence and some punchy U.S. jobs data have reinvigorated Wall St and Tokyo, even as Chinese markets resume their slide and a surprising UK retail plunge showed trouble elsewhere.

Taiwanese chipmaker TSMC, the world’s biggest semiconductor maker and major Apple supplier, set an otherwise unremarkable earnings season alight on Thursday by projecting more than 20% growth in 2024 revenue on booming demand for high-end chips used in AI.

The buzz sent the chipmaking sector surging around the world over the past 24 hours, with TSMC’s Taipei-listed shares jumping 6.5% on Friday.

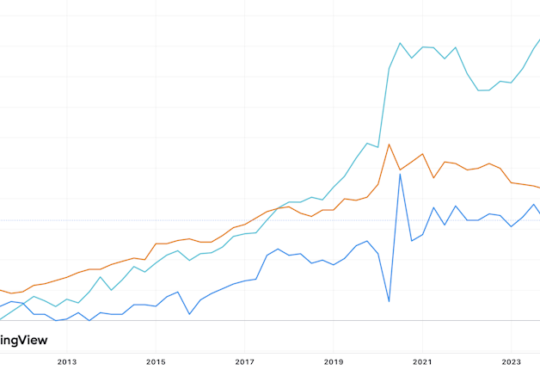

Tokyo’s Nikkei, one of the darlings of 2024 so far and up 7.5% in the year to date, jumped back 1.4% toward Wednesday’s 34-year high – aided by the chip rally and soft core inflation readings that leave the Bank of Japan in no rush to tighten its easy money policy.

Bank of America said fund data showed the largest inflow in 12 weeks into Japanese stocks this week.

Wall St stocks had already picked up the baton and run with it on Thursday, coming back within 1% of its record high set two years ago. The Nasdaq 100 jumped 1.5%.

Futures look set to extend those gains on Friday, with regional U.S. banks topping the earnings season diary.

There was also some relief that Congress once again averted a government shutdown by today’s funding deadline, even though it’s merely kicked issues six weeks down the line.

The U.S. House of Representatives on Thursday approved a stopgap bill to fund the federal government through early March, sending it to President Joe Biden for final approval.

But any balm for the Treasury market was challenged by another sign the U.S. labour market remains red hot – with weekly jobless sliding to a 16-month low and again questioning the sort of aggressive Federal Reserve easing path still priced into markets. Futures are still more than 50% priced for a first rate cut in March.

On the flipside, the Philadelphia Fed’s latest business survey for January showed a sharp drop in sentiment, activity and prices paid. And the housing starts readout was more mixed.

Existing home sales top the list on Friday, with an eye on the University of Michigan’s latest household survey for this month.

The upshot in bond markets is that 10-year Treasury yields nudged up to another one-month high – although the short end of the curve was more restrained and traders kept a close eye on this year’s 2-10 year yield curve disinversion. The dollar slipped back further from recent highs, and recoiled from its highest level since November against the yen.

Markets continue to monitor elevated container shipping prices amid Red Sea disruptions for any sign they may spur more general price rises and complicate the disinflation picture for central banks.

But disrupted trade routes are acting as a hit on economic activity too, not least in China – where the economy was already under considerable pressure from a property bust and foreign capital flight.

Despite all the renewed market optimism elsewhere on Friday, renewed stocks losses in Shanghai and Hong Kong showed China continues to be an outlier.

Brokerage Citic Securities has suspended short selling for some clients in mainland markets amid a deepening rout in the nation’s stocks, Bloomberg reported.

But China has also instructed heavily indebted local governments to delay or halt some state-funded infrastructure projects, according to Reuters sources, as Beijing struggles to contain debt risks even as it tries to stimulate the economy.

And in a wild ride for UK government bond traders this week, Britain reported an unexpectedly large slide in retail sales for December – dragging down the whole retail picture for the year and painting a confusing picture for Bank of England watchers after the early week’s inflation surprise.

Sterling and gilt yields fell back.

Key diary items that may provide direction to U.S. markets later on Friday:

* U.S. Corporate earnings: State Street, Huntington Bancshares, Travelers, Comerica, Fifth Third, Regions Financial, Schlumberger

* U.S. Dec existing home sales, University of Michigan’s Jan consumer survey, Nov TIC data on overseas Treasuries holdings

* San Francisco Federal Reserve President Mary Daly, Fed Vice Chair for Supervision Michael Barr speak

* World Economic Forum in Davos, final day – IMF Managing Director Kristalina Georgieva, ECB President Christine Lagarde and German Finance Minister Christian Lindner among speakers

* U.S. Treasury auctions 10-year inflation-protected securities, 4-week bills

(By Mike Dolan, editing by Nick Macfie [email protected])