The UK’s cryptoasset financial promotion regime came into force from 8 October 2023. From 8 January 2024, those firms that were granted an extension by the Financial Conduct Authority (FCA) to implement certain “back end” rules will need to be fully compliant. This article provides an overview of the regime and rules.

How can cryptoassets be marketed into the UK legally?

A crypto financial promotion can only be made to UK persons if the promotion is communicated in one of the following ways:

- (for unauthorised persons) approved by an authorised person

- by (or on behalf of) a cryptoasset business registered under the Money Laundering Regulations

A breach of the financial promotion requirement is a criminal offence punishable by up to two years’ imprisonment, the imposition of a fine, or both. It is also likely to give rise to reputational damage and opens up the possibility that the consumer may be entitled to recover any monies paid.

What rules apply if I make a crypto promotion?

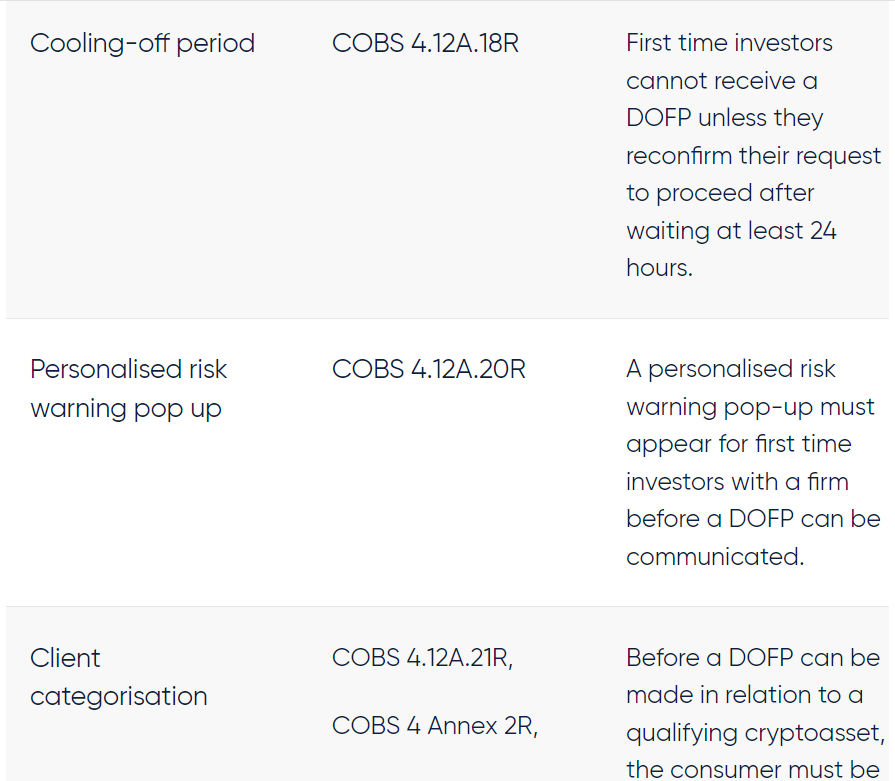

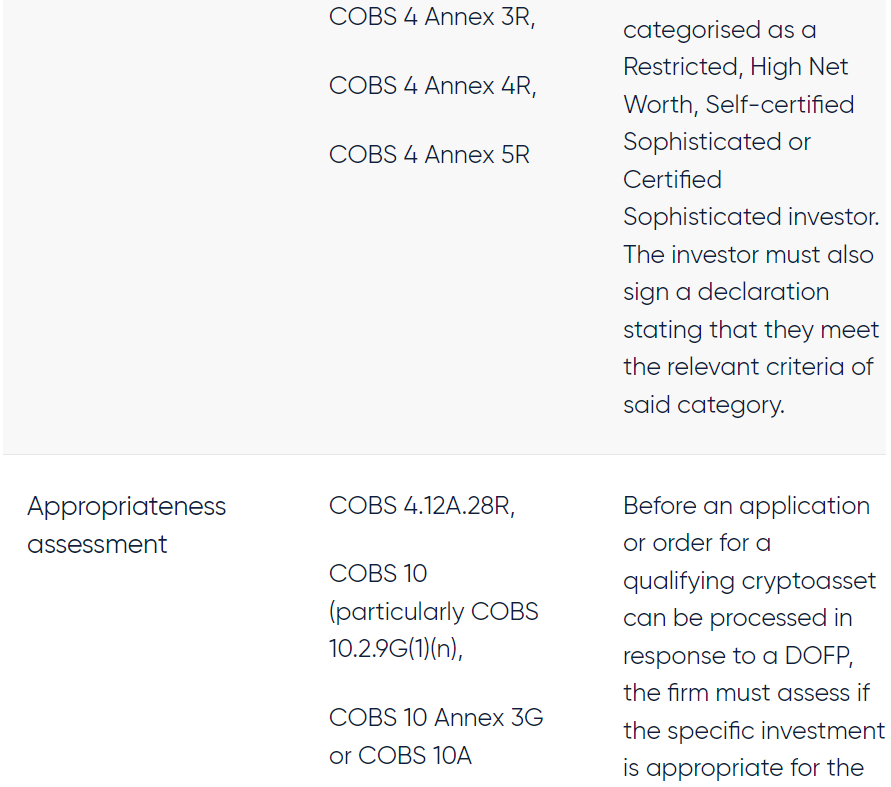

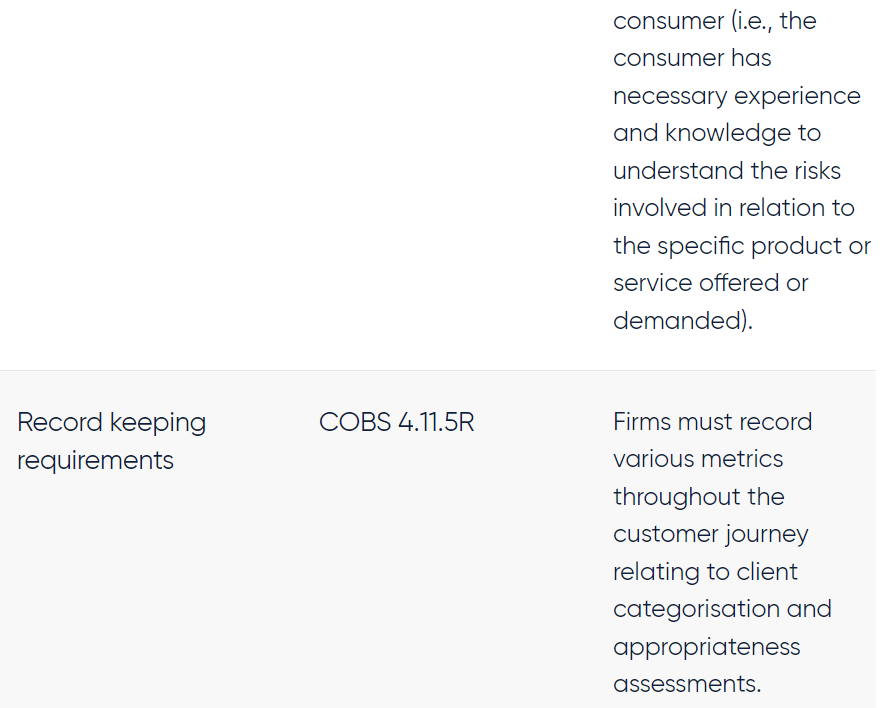

See an overview of the rules in the table below. Note, additional requirements apply to crypto promotions that are a Direct Offer Financial Promotion (DOFP) as opposed to a standard financial promotion.

Non-compliance

The FCA proactively supervises and monitors firms’ compliance with the rules, including regularly updating warnings lists of non-compliant businesses, and restricting businesses from approving crypto promotions (eg, rebuildingsociety.com Ltd). Where a contravention has taken place, the FCA will expect prompt remedial action. Failure to take such action may result in FCA enforcement action.

Key sources

In addition to relevant FCA Rules particularly in the Principles for Businesses and COBS, other materials you should consider include PS23/6: Financial promotion rules for cryptoassets, FG23/3: Finalised non-handbook guidance on Cryptoasset Financial Promotions, GC23/2 Financial promotions on social media, Chapter 8 of the FCA’s perimeter guidance, and other FCA publications on the new regime (eg, common issues with crypto marketing, feedback on good and poor practice).