Coinbase wants potential customers in Europe to give it a warm reception as crypto winter chills trading activity in its home market. But expanding into Europe may not be enough to reverse the company’s fortunes.

On Tuesday morning, the publicly traded U.S. crypto exchange slashed another 20% of its workforce, shuttering most of its Japanese operations. It also cut 18% of its employees last summer to refocus its priorities as it fought bear market headwinds.

Coinbase wasn’t always struggling, however.

At the end of 2021, Coinbase was flying high on crypto’s mainstream moment. Investors who had never bought a bond or invested in the stock market flocked to the crypto exchange to trade buzzy tokens like dogecoin, bitcoin and ether.

The deluge of customers helped the company rack up record revenue and profits in 2021. The platform’s monthly active users grew by 300%. Coinbase’s revenue soared to $7.8 billion that year.

But a major stablecoin crash roiled crypto markets in May, plunging the price of bitcoin to a new two-year low and prompting investors to withdraw their funds from centralized crypto exchanges like Coinbase — a drop that grew steeper in the wake of competitor FTX’s implosion in November.

Traders’ exodus from the market has presented a major existential threat to Coinbase, which collects roughly 90% of its revenue from trading fees. Without a steady stream of new users, the company may not survive.

Its saving grace, the company hopes, lies in Europe, where the European Union is preparing to pass the Markets in Crypto Assets (MiCA) Regulation, a common framework intended to regulate crypto trading across the European bloc’s 27 member states. There, Coinbase hopes to find new traders in Europe to sustain its largely user-dependent revenue model.

Coinbase began expanding into markets in Italy, Spain, France, The Netherlands and, outside the EU, Switzerland last year ahead of MiCA’s likely passing and implementation. Coinbase hopes a stricter regulatory environment in Europe will give it an advantage over its privately held competitors and facilitate its plan to capture greater market share.

“It’s almost like an existential priority for us to make sure that we are able to realize our mission by accelerating our expansion efforts,” Nana Murugesan, vice president of international and business development at Coinbase, told Bloomberg in September.

Murugesan is steering the company’s foray into Europe, assisted by five regional directors who are overseeing operations in each new market.

Coinbase will likely confront stumbling blocks in its bid to capture greater market share across the EU, however.

That’s because the regulatory shift Coinbase is banking on may not impose strict enough guidelines to curb competing exchanges’ activities in the region. Coinbase faces major competition from rivals including Binance and Crypto.com, which have leveraged their competitive fees and specialized trading services to establish strong footholds in Europe. As Coinbase contends with declining revenue and a plummeting share price, the company may have to muster the resources to build out its fledgling derivatives trading service, which poses greater regulatory risks than other forms of trading, and spearhead other initiatives that will woo European customers.

The success of Coinbase’s current revenue model lives or dies by the exchange’s ability to charge a steady stream of new traders high fees to process crypto transactions. But it’s those traders who are among the first to exit the market during a protracted market downturn, says Lisa Ellis, a senior equity analyst at MoffettNathanson LLC.

“When prices are low and you’re in a crypto winter, a lot of those [beginner] retail investors kind of go into hibernation,” said Ellis.

Coinbase’s revenue for 2022 is expected to drop by roughly $3.2 billion, or 59% from the year prior, according to analysts surveyed by FactSet. The company expects revenue in 2023 to decline year over year and losses of as much as $500 million before interest, taxes, amortization and depreciation.

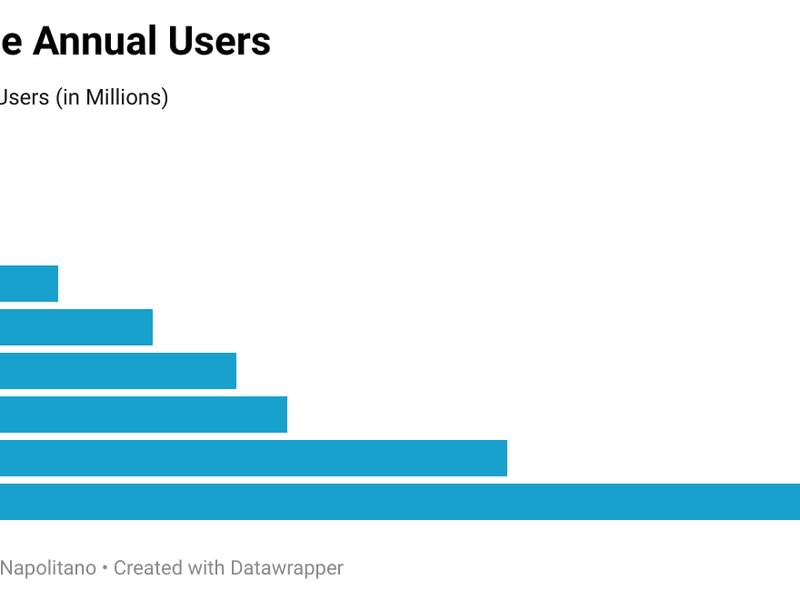

Coinbase’s sliding revenue and earnings have sagged as the company’s user base dwindles. During the third quarter of 2022, Coinbase reported 8.5 million monthly active users, down from 9.2 million in the first quarter. Perhaps more important, those who remain on the platform are trading less.

“Since the onset of the crypto winter earlier this year, trading volumes have been shifting offshore to Europe in a material way,” said Ellis.

Monthly trading volumes declined more than 50% from January to September 2022 in the U.S. compared to just 18% across the global monthly crypto spot market during the same time period, according to a letter Coinbase shared with its shareholders late last fall.

Those higher trading volumes abroad, along with the sheer size and population of the European Union, enticed Coinbase to make a play for European markets, says Daniel Seifert, vice president and regional managing director of Coinbase’s EMEA [Europe, Middle East and Africa] division.

“One thing that’s important to realize is that with eight billion people on this planet, only about 300 million are in the United States,” Seifert told CoinDesk. “We want to make sure that we’re winning in EMEA, because we think that it has a lighthouse character globally.”

The EU’s tentative approval of MiCA regulations also makes the region ripe for Coinbase to plant its roots across the EU, said Seifert. The regulations, if given the final go-ahead by lawmakers in February, should go into effect in early 2024.

“As publicly listed companies we already have and have had for a very long time, a very, very high level of transparency,” said Seifert. “Having independent auditors who regularly, every quarter, look at our financial statements, our accounts … is probably one of the strongest things in terms of [securing regulatory] approval that you can have.”

Rivals and regulations

But the road ahead is not without challenges, and Coinbase isn’t the only exchange revving up to increase its market share across the EU.

Binance and Crypto.com, Europe’s two largest exchanges by daily trading volumes, are already serving users in Coinbase’s target markets, where they have sometimes operated without licenses.

Now, both exchanges are working to secure regulatory licenses, or at least tentative approvals, in those markets and beyond. This week, Binance received the green light from Swedish regulators, clinching its seventh regulatory approval in the EU.

However, publicly owned Coinbase may come out on top in European markets when the privately run Binance, Crypto.com and others battle to quash media scrutiny of their opaque corporate structures and financials and their reputations for flouting regulations in years past, said Ellis.

“The fact that [Coinbase] operates within the boundary of regulations all the time is a major thing that differentiates Coinbase from its competitors, [and] that should help them bubble up to the top,” said Ellis.

That’s especially true in the wake of November’s FTX collapse, which increased regulatory scrutiny of cryptocurrency exchanges and increased traders’ anxieties about the assets that back those exchanges.

But it remains uncertain whether Coinbase’s friendlier relationship with regulators is enough to sway European customers to park their assets on the company’s platform. Binance charges a trading fee of 0.10% for most transactions, while Coinbase charges a flat fee, ranging from 99 cents to $2.99 for transactions up to $200, and a percentage-based fee of up to 3.99% for transactions above $200.

Those higher fees may discourage new customers from migrating to the exchange as high inflation continues to take a big bite out of Europeans’ paychecks.

Binance also operates a derivatives trading business, a service Coinbase does not offer in Europe, which could put Coinbase at a disadvantage. Derivatives trading now accounts for more than 60% of all crypto trading transactions, according to data provider CryptoCompare, which could continue to grow during the market downturn.

Still, the EU’s new crypto regulations may allow regulators to crack down on crypto derivatives trading in Europe, leveling the playing field for Coinbase. MiCA gives individual national regulators the power to forbid crypto products they deem risky and there is some evidence major countries would seek to deploy it against retail use of derivatives.

“Derivatives based on crypto-assets are one key area where such inconsistency can occur [under MiCA],” wrote the International Association for Trusted Blockchain Applications (INATBA), a non-profit advocacy group for blockchain technologies, in a note to European regulators last year. “In cases where a derivative product references underlying assets which are settled in crypto-assets rather than in fiat currency, it is unclear whether the instrument would be a financial instrument or a crypto-asset across all EU member states.”

Coinbase also trails its competitors in terms of its advertisement spending in the region, meaning it will have to spend more to catch up with its rivals and capture market share. In 2021, Crypto.com spent roughly $2.5 million on advertising in the U.K., while Coinbase spent just 5% of that, according to market intelligence company Sensor Tower. Coinbase declined to disclose how much it would spend on advertising for its latest Europe push, but regulations on crypto advertising make it difficult to plan advertising campaigns in some European markets like the U.K., which is not part of the EU.

Still, some traders doubt Coinbase will be able to allocate the necessary resources to support its European expansion as crypto winter takes a big bite out of the company’s profit margins, says Chris Brendler, a senior equity analyst at D.A. Davidson Companies.

“There are a lot of folks with this view that crypto [trading] volumes are crashing, and [those volumes] are 90% of Coinbase’s revenue, and they’ve got this massive expense base,” said Brendler. “There’s worries about not only the company’s earnings, but its financial health too.”

Coinbase stock plunged roughly 86% in 2022, compared to a 19% drop in the S&P 500 during the same period. The stock now trades at $43, up from its all-time low of $31.55 last week. Coinbase reported a per-share loss of $2.43 in the third quarter of 2022, signaling the company is down after a profitable first year as a public company in 2021.

Success with stablecoins

But although things look uncertain on Wall Street, there is one bright spot for the exchange. Coinbase’s partnership with stablecoin issuer Circle may allow the exchange to bolster its revenue amid a sagging market. Investors’ interest in stablecoins, which are pegged one-to-one to the U.S. dollar or another asset and designed to maintain a relatively stable price, has soared thanks to falling cryptocurrency prices and increased market volatility in recent months.

Coinbase’s stablecoin offering will enable the company to accrue more revenue through the net interest income yielded by the short-term Treasurys that back the Circle-issued USD coin, which may help the exchange raise the necessary capital to put some funds behind its Europe push.

At the same time,Coinbase is pushing for global adoption of USDC by removing barriers to entry, such as waiving fiat-to-USDC conversion fees.

In Italy, as in other parts of Europe, the partnership may be particularly profitable.

Marco Gallazi, a crypto trader from Italy who runs the crypto investing blog “Mind the Chart,” says Europeans prefer stablecoins pegged to the U.S. dollar over those pegged to the euro, so Coinbase’s zero-fee USDC incentive is likely to attract some Italians to the platform.

“We do not use the euro as a base currency but prefer pegged stablecoins at the value of the dollar, ” Gallazi told CoinDesk. “You have less liquidity in euros and it is more complex to determine the movements.”

European crypto investors have mostly shied away from euro-denominated stablecoins, which account for only 0.2% of trading volumes, according to a European Central Bank report.

A provision in the current version of MiCA, however, could impose limits on the issuance of USD-backed stablecoins, crimping Coinbase’s opportunity to capitalize on its Circle partnership and zero-fee stablecoin incentive.

But, Coinbase is prepared to deal with any last-minute amendments to the regulatory framework and will adjust its strategy accordingly, said Seifert.

“[Our teams] are going through the [draft legislation] that we have at the moment and are parsing all of that and kind of going literally line by line and seeing what kind of changes we would have to make [to be in compliance],” said Seifert.