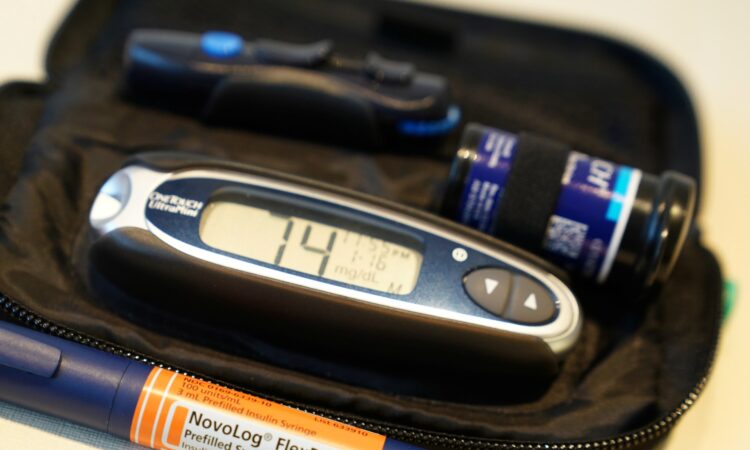

Skye Murphy, who is 22 years old, has lived with type 1 diabetes since she was 14. In the past month, she learned that there would be a 30-to-60-day delay in receiving her medication Humalog, an insulin drug made by Eli Lilly.

While announcing a shortage in March, Eli Lilly said several key insulin medications would be out of stock for several weeks, which, as reported by CNN, was because of a “brief delay in manufacturing”. The company has since scrubbed details on the shortage from the news release.

More than 38.4 million people in the United States have diabetes and rely on insulin for their survival. In context, that is more than the population of Tokyo, one of the world’s most populous cities.

Indianapolis-based Eli Lilly is one of three pharmaceutical companies that control the global insulin market. It competes with France’s Sanofi and Denmark’s Novo Nordisk. But Novo Nordisk and Eli Lilly are of particular note. The two companies control 75 percent of the global market – and both have insulin shortages impacting people who rely on the medication.

That includes Murphy. She is down to her last vial and is having to ration her dosages just in case she can’t find a refill. She spent nearly a day calling pharmacies all over the Chicago metro area where she lives to find a dose, but has yet to locate one.

“I’ve been on this certain insulin for eight years now. If I don’t get my medication, I could have hypoglycaemia, low blood sugar or high blood sugar or some other serious adverse reaction,” Murphy told Al Jazeera.

She says her insurance provider suggested she use generics in the meantime, but that worries her because it took years for her to find the right combination of medications that works for her.

Generic medications are not foolproof. The US Food and Drug Administration (FDA) allows for an up to 20 percent variation in the active ingredients from the original formula. That’s a risk that Murphy is wary of taking.

Price caps, reduced offerings

Novo Nordisk holds 54.8 percent of the global market, and one of its recent moves – slashing product offerings – is only fuelling a bigger shortage.

In November, the Danish pharmaceutical giant announced it would phase out its long-lasting insulin injection Levemir. The drug will be fully discontinued by the end of 2024. At the time, the company said that because of the move, there would be supply-chain shortages starting this past year.

Levemir is now on the list of drug shortages.

But if the company controls most of the global insulin market, why slowly and quietly reduce offerings?

Over the last year, the White House touted its plan to cap insulin costs for consumers at $35. US President Joe Biden showcased the efforts in his recent State of the Union Address. Thanks to cooperation with several pharmaceutical giants including Eli Lilly, Sanofi and Novo Nordisk, prices tumbled.

Prices dropped by 70 percent for Eli Lilly, 75 percent for Novo Nordisk, and 78 percent for Sanofi.

But even as the price cap kicked in, a new study from Yale University published in the Journal of the American Medical Association (JAMA) showed that pharmaceutical giants have been charging significantly more than it costs to produce the drug.

The study found that insulin pens – consumer-friendly self-administration devices that contain preset doses and typically hold around 3ml of the medicine – could be sold at a range between $50 and $111 annually.

This has been a problem across the pharmaceutical industry prior to the Biden administration’s move to cap insulin prices. Eli Lilly, for instance, charged as much as $274.70 for a single vial of Humalog U-100 10mL – one of its most popular medications.

Despite Novo Nordisk’s vocal move to back the Biden administration’s plan to cap prices, it has quietly reduced its portfolio of insulin medications.

Novo Nordisk’s 2023 annual report showed insulin sales dropped by 6 percent.

Lucrative alternatives

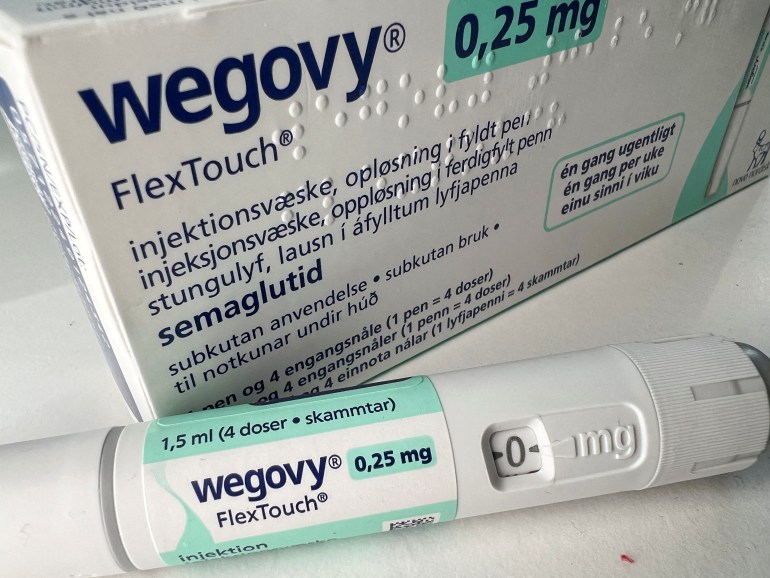

Novo Nordisk is now focusing on another set of medications called GLP-1 receptors, which regulate the gut hormone that affects hunger. The market for these is more lucrative. GLP-1 receptors are also intended for diabetes, but are now used more widely as a weight-loss medication – semaglutide, more commonly known as Wegovy or Ozempic.

Other pharmaceutical companies are also trying to make gains on Novo Nordisk’s GLP-1 receptors, including Eli Lilly, which, too, has an insulin shortage even as it is ramping up production of Zepbound and Mounjaro, Novo’s GLP-1 competitors.

On Tuesday, Eli Lilly revised up its yearly revenue forecast by $2bn and said it expects to bring in $42.4bn to $43.6bn by year-end. That is thanks to increased demand for its alternatives to Ozempic and Wegovy. As per a Reuters News Agency report, on average, doctors prescribed Zepbound a combined 63,000 times each week so far this year.

Despite Eli Lilly’s gains, Novo Nordisk still has a stronghold on the market. The same report points out that doctors write a combined 110,000 Wegovy prescriptions on average every week.

“Companies still have an incentive to set the price where the market will bear it [for these weight-loss drugs], whereas for a more competitive, saturated market like insulin, the margins may be way smaller,” Krutika Amin, associate director of the programme on the Affordable Care Act at the Kaiser Family Foundation, told Al Jazeera.

But while Novo Nordisk and Eli Lilly duke it out on the corporate level, it still leaves Americans like Murphy in the crosshairs.

In the case of GLP-1 receptors, despite Novo Nordisk’s efforts to ramp up drug production, the market is only getting more strained.

Wegovy, in particular, has been in the spotlight in recent weeks. That’s because Medicare, a government health insurance programme for people age 65 or older, may now cover the blockbuster weight-loss drug, giving seniors insurance coverage for it.

The medications Wegovy and Ozempic surged in popularity in recent years as its active ingredient semaglutide has shown to cause significant weight loss.

So far, unless a patient had diabetes already, semaglutide was accessible only if you were willing to shell out the cash. A month’s supply of Ozempic injections can cost as much as $936, and $1,349 for Wegovy, according to analysis from the Kaiser Family Foundation.

Supply shortages, ‘outrageous’ prices

The situation is only getting tighter as several semaglutide injections are in active shortage and have been since March 2022. In part, that was driven by the surge in demand – 300 percent between 2020 and 2022. That’s compounded after Novo Nordisk announced it halted a contract with a manufacturer that filled Wegovy syringes after the manufacturer failed an inspection by the FDA in December 2021.

Because of the surging demand, Novo Nordisk still has been unable to catch up. That’s on top of the other supply-chain strains hitting the pharmaceutical industry and broadly ranging from Adderall to Tylenol. India and China supply 61 percent of the active ingredients used in medications. COVID-19 fuelled the supply-chain shortages, which have only continued as major geopolitical and humanitarian crises – notably the Russia-Ukraine conflict and Gaza’s more recent Israel-Hamas war – have slowed trade.

In recent weeks, Novo Nordisk has come under increased scrutiny over the sky-high price tag of its weight-loss drugs. The same Yale University study that points out the markup on insulin costs also shows a similar issue with the Danish pharmaceutical giant’s semaglutide medications. The study concluded that the drug costs an estimated $0.89 to $4.73 to make.

In response to the study, Vermont’s US Senator Bernie Sanders slammed Novo Nordisk, the pharmaceutical giant behind the drug, saying it is “outrageous”.

Sanders’s remarks came as the FDA expanded its approval for Wegovy. The medication has also been shown to reduce the risk of cardiovascular events like a heart attack or stroke in overweight patients with a history of cardiovascular disease by 20 percent, according to a recent study published in the New England Journal of Medicine.

While Medicare’s expanded coverage will open the doors for more people to get access to the medication, there are still large swaths of the population reliant on the drug who do not have access, including those with heightened A1C and insulin resistance.

Medicare still does not cover the drug solely for weight loss use, but rather for some of the health consequences often associated with obesity. In July 2023, a bipartisan group of US senators proposed legislation to change that, but it has since stalled in committee.

Medicare’s new coverage options widen the market for Novo Nordisk and its blockbuster weight-loss drugs.

“The supply has not increased. It’s going to basically worsen the shortage, or it’s going to worsen the gap between the demand and the supply. That could be the consequence of all this,” Bruce Y Lee, professor of health policy and management at the CUNY Graduate School of Public Health, told Al Jazeera.

Medicare’s possible coverage will inherently lower costs for the thousands of diabetics who need the drug and expand access. But because supply is already strained and demand is high, the move will only fuel the ongoing shortage. It will also further limit access for both diabetics and nondiabetics alike.

“Pharmaceutical companies will set up the production lines that want to support the demand over the next two years, and then they’ll set up production lines. Now, if the demand is greater, much greater than the supply, many times the response is that the pharmaceutical company will simply raise the price … because they’ll have a greater profit margin per unit. But that doesn’t solve the problem,” Lee added.

In addition to the ongoing shortage, private insurance rarely covers the drug unless a patient has diabetes. While there is a strong correlation between obesity and diabetes, it is far from the only health condition that is either associated with or causes obesity – as is the case with hyperthyroidism and certain medications such as selective serotonin reuptake inhibitors (SSRIs), a class of drugs used to treat anxiety and depression.

Heaviest burden

While access is an issue for all, the heaviest burden is on communities of colour. The cost overwhelmingly impacts the socioeconomically disadvantaged – mostly non-white communities. Obesity rates are highest amongst the Black community. Almost 57 percent of Black women, in particular, are overweight, according to the National Institutes of Health.

As for the impact on those with diabetes – rates among American Indian/Alaska Natives (AIAN) over the age of 18 are almost double what they are for white Americans. While diabetes is on the decline among AIAN people, 25 percent of them live below the poverty line compared with 8.6 percent of the white community.

Even if Wegovy is covered by private insurance for diabetics, as of 2022, more than 19 percent of the AIAN population is uninsured – the highest of any demographic in the US.

Despite the consistent supply-chain challenges, Novo Nordisk’s financial health is only getting stronger.

Last year, Novo Nordisk became Europe’s most valuable company – beating LVMH – the parent company of high-end luxury brands like clothing brand Louis Vuitton and champagne Dom Perignon – for the title. In March, it became the 12th most valuable brand in the world.

The Danish pharmaceutical giant’s market capitalisation is more than $440bn now. Its chief executive took home 13 percent more in 2023 than he did the year prior.

The market is only slated to get bigger for weight-loss drugs like Ozempic and Wegovy. JP Morgan Healthcare expects the weight loss drug market could be worth a staggering $100bn by the end of the decade.

For its part, Novo Nordisk is trying to take this challenge on. The company also made a recent investment of $16.5bn to buy three manufacturing facilities.

Neither Novo Nordisk nor Eli Lilly responded to Al Jazeera’s requests for comment.

Though the long-term investments could help patients in the long run, that doesn’t help people like Murphy, who need the medication today.

“People are dependent on their medication just to get through the day sometimes,” Murphy said. “I shouldn’t be in a position to have to ration my medication, but that’s the reality I’m living in right now.”