Washington, DC(CNN) The United States could default on its debt in less than two weeks, and cities with a large military presence risk an economic firestorm if lawmakers don’t act.

A default would mean the government won’t be able to meet all of its financial obligations, which include salaries paid to federal workers and payments to Social Security recipients. About a sixth of government spending goes toward national defense, a quarter of which is to pay military personnel, according to the Congressional Budget Office.

If the United States can’t pay its national defense bills, cities with large military bases face a potentially massive fallout, encompassing missed payments, rising debt and a significant pullback in spending that would cut into local businesses’ bottom lines.

“A default on the federal debt would be an economic disaster in many ways, but it will especially hit cities with high government employment, so military communities around the country are especially vulnerable,” John Mayo, professor of economics, business and public policy at Georgetown University, told CNN.

“These are middle-class families that have a high paycheck-to-paycheck living ratio. They don’t have a lot of extra income, don’t have a lot of savings and if the payments to those families are delayed, they’ll have to make really horrible choices.”

It remains unclear what payments the Treasury Department would prioritize or how it would service the government’s debts once it runs out of cash.

Workers on government payrolls, such as military personnel, likely wouldn’t get laid off if a default drags on, according to an analysis from the Brookings Institution, but their payments would probably be delayed. That could further damage local economies grappling with financial market turbulence that could unfold even ahead of a possible default.

At the end of March, there were at least 1.7 million Americans employed by the Defense Department in all states, including civilians, according to government data.

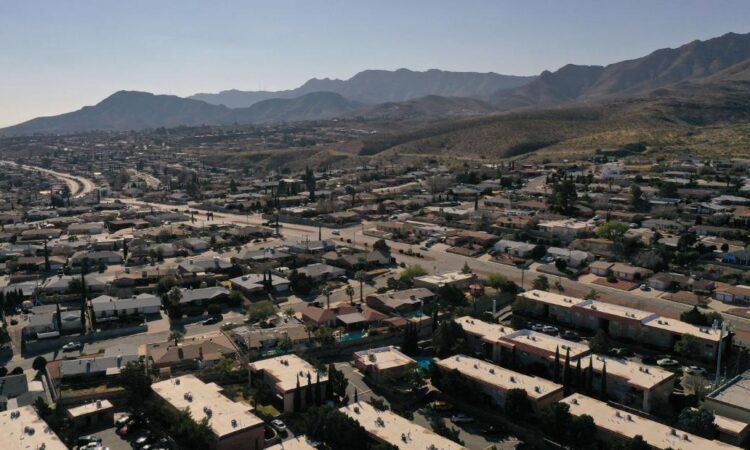

Delayed payments could have massive impacts for US cities with large military bases such as San Diego, San Antonio and El Paso, Texas — and even more for small cities that don’t have diversified economies and rely heavily on the military’s presence to drive activity.

Federal workers could get stuck pulling from their savings accounts or relying on credit to make everyday purchases, Mayo said. They could also make “drastic spending cuts” on discretionary purchases, such as dining out or watching films, hurting local businesses. If that goes on long enough, those businesses could lay people off or even go bust.

San Antonio is home to one of the largest joint bases operated by the Defense Department, consisting of four military installations: Fort Sam Houston, Camp Bullis, Randolph Air Force Base and Lackland Air Force Base.

Even though the region has a diversified economy, that won’t be enough to shield households from significant damage if payments to federal workers are delayed, according to Thomas Tunstall, an economist at the University of Texas at San Antonio.

In the far-west Texas city of El Paso, Fort Bliss and William Beaumont Army Medical Center pay more than $3.5 billion in wages and salaries to their military and civilian employees, according to Thomas Fullerton, an economist at the University of Texas at El Paso.

“Business cash flows will be disrupted by the paycheck delays as well as any employee layoffs or furloughs on the base, at the medical center, or by companies that subcontract at either facility,” Fullerton told CNN in an emailed statement. He added that “the impacts will be especially severe for low wage and income households.”

San Diego is another major city with a heavy military presence. It houses one of the largest naval bases in the country — and a robust tourism scene. The metropolitan area had more than 193,000 employees in leisure and hospitality last year, according to data from the Bureau of Labor Statistics.

If payments to all workers on government payrolls are delayed, they could first cut back on leisure spending, so tourism businesses would be in big trouble, according to Jeffrey Clemens, an economist at the University of California, San Diego.

“The local economy would be impacted primarily through any effects of late wages and salary payments on the consumption of restaurants, entertainment, purchases of electronics and other consumer goods by those households,” Clemens said. “If the federal government goes into default and there’s to some extent a seizing up of economic activity everywhere, I would certainly expect people’s summer vacation plans to be impacted and places like San Diego that have an important tourism sector will be adversely affected by that.”

President Joe Biden and House Speaker Kevin McCarthy struck an optimistic tone earlier this week that negotiations would result in a successful raising of the debt ceiling as soon as this weekend, but those negotiations hit a snag on Friday, putting talks on pause for the moment.