By Gertrude Chavez-Dreyfuss

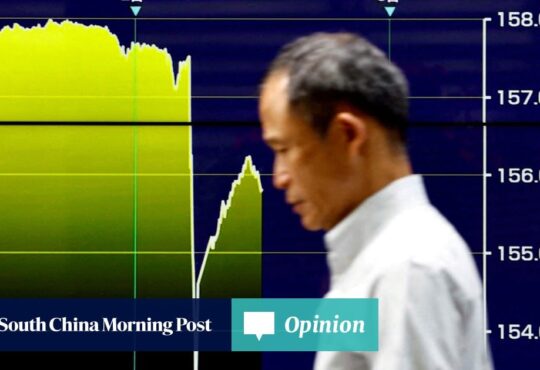

NEW YORK (Reuters) -The yen dropped against the U.S. dollar on Wednesday to its weakest since mid-1990 above the key 155 area, with markets alert to any signs of intervention from Japanese authorities to prop up their currency.

As the yen slid, the greenback edged higher, recovering against most currencies from falls caused by Tuesday’s data showing U.S. business activity slowed this month.

The dollar rose as high as 155.37 yen, its strongest since mid-1990, before falling back in choppy trading, which is a sign of market nervousness around the 155 level. It was last at 155.26, up roughly 0.3% .

The yen’s weakness against the dollar has ignited the market’s anxiety surrounding currency intervention. Japanese Finance Minister Shunichi Suzuki and other policymakers have said they are watching currency moves closely and will respond as needed.

Senior ruling party official Takao Ochi told Reuters that a decline in the currency towards 160 could trigger intervention. Ochi said if the yen slides further toward 160 or 170 to the dollar, “that may be deemed excessive and could prompt policymakers to consider some action.”

Market participants, however, have taken Japanese comments on the yen with a grain of salt.

“The move in dollar/yen has been in line with what’s happening with the broad dollar re-assessment,” said Jayati Bharadwaj, global FX strategist, at TD Securities in New York. “It’s not being driven by BOJ (Bank of Japan) speculation, which it was at one point last year, but a broad dollar move backed by fundamentals.”

She added that if the BOJ were to intervene on behalf of the Ministry of Finance, it’s not going to target a “round number.”

“I don’t think there’s specific number that the BOJ is keeping in mind. It would have to be the magnitude of the move,” she added.

The BOJ is set to start its two-day policy meeting on Thursday and is widely expected to leave policy settings and bond purchase amounts unchanged, having raised interest rates for the first time since 2007 just last month.

BOJ Governor Kazuo Ueda has said the central bank may raise interest rates again if the yen’s decline significantly pushes up inflation.

The fall in the yen comes after a string of strong U.S. inflation data pushed the dollar to five-month highs and reinforced expectations that the Federal Reserve is unlikely to be in a rush to cut interest rates this year.

The dollar index, which measures the currency’s value against six major peers led by the euro, was last up 0.2% at 105.84. Earlier, the index hit 105.59, a roughly two-week low, after Tuesday’s surprisingly robust European activity data and cooling U.S. business growth.

The greenback pared gains on Wednesday after data showed new orders for key U.S.-manufactured capital goods increased moderately in March and data for the prior month was revised lower. The report suggested that business spending on equipment likely remained weak in the first quarter.

The euro was little changed at $1.0697, following Tuesday’s rally following data showing business activity in the euro zone expanded at its fastest pace in nearly a year.

Sterling, meanwhile, was up 0.1% at $1.2460, continuing gains from Tuesday on data showing British businesses recorded their fastest growth in activity in nearly a year. The pound was also boosted by comments on Tuesday from Bank of England chief economist Huw Pill who said interest rate cuts remained some way off.

Friday sees the release of the Fed’s favored inflation measure, the personal consumption expenditures (PCE) price index. Markets currently price in a 70% chance of a first U.S. rate cut by September, according to the CME’s FedWatch tool.

In other currencies, the Australian dollar rose 0.1% to US$0.6497, after hitting as high as US$0.6530 for the first time since April 12, as it rallied on the back of hotter-than-expected consumer price data. That led markets to abandon hopes for any rate cuts from the Reserve Bank of Australia in the near term.

(Reporting by Gertrude Chavez-Dreyfuss; Additional reporting by Samuel Indyk in London and Kevin Buckland in Tokyo; Editing by Kim Coghill, Mark Potter, Sharon Singleton, Christina Fincher and Andrea Ricci)