USING a regular credit card when shopping or withdrawing cash abroad can be extremely costly.

But several major banks don’t charge fees on overseas transactions or cash withdrawals on certain cards.

Regular credit cards often have hefty charges for spending abroad such as non-sterling transaction fees of around 3%.

They typically charge fees on cash withdrawals and spending too.

However, many travel credit cards are designed to make it cheaper to spend money when you are overseas.

Similar to a standard credit card, a travel credit card will give you a limit that you can spend based on your credit report and income details that you provided during the application.

You can use the card for your holiday spending and often avoid transaction charges, with only the exchange rate to pay.

It works like a normal credit card so as long as you clear the balance each month there will be no interest to pay.

If you miss a payment or only pay the minimum amount then a hefty annual percentage rate of up to 40% could be charged and it could affect your credit rating.

Credit card holders who always clear their balance in full at the end of every month should consider a travel-orientated card.

But while some providers offer fee-free cash withdrawals – we’d always recommend using a travel debit card for this instead.

Most credit card providers always charge interest on cash withdrawals, even if you repay your bill in full each month.

We’ve listed all the providers offering the best credit cards to use abroad.

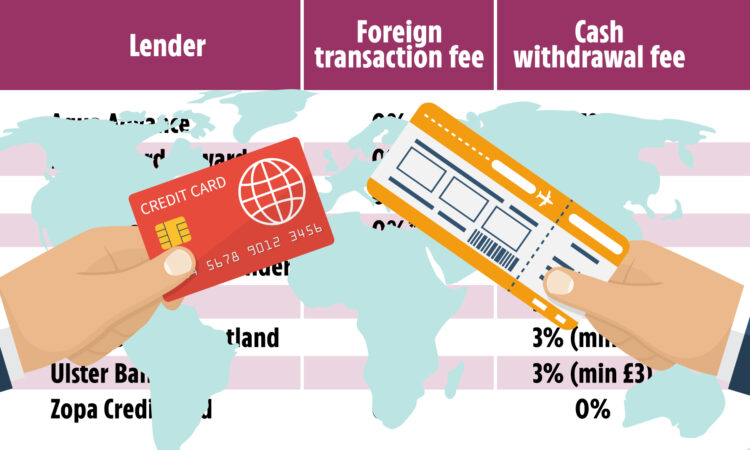

Cards offering fee-free spending and cash withdrawals

Four major lenders allow certain credit card customers to use their cards abroad without facing any extra fees.

Barclaycard, Halifax, Metro Bank and Zopa all offer travel-friendly credit cards.

But be aware that some cards may charge you a non-sterling transaction fee in certain locations.

Barclaycard

Barclaycard’s Reward credit card comes with no annual fee and offers the average customer an interest rate of 25.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

The credit card also comes without a cash withdrawal fee, which could be beneficial in emergencies.

Halifax

The Halifax Clarity credit card comes with no annual fee and offers the average customer an interest rate of 22.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

The credit card also comes without a cash withdrawal fee.

Metro Bank

The Metro Bank credit card comes with no annual fee and offers the average customer an interest rate of 14.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

However, this only applies to overseas spending within the European Union.

If you plan to spend outside this zone, you’ll be charged a 2.99% non-sterling transaction fee.

The credit card also comes without a cash withdrawal fee.

Zopa

The Metro Bank credit card comes with no annual fee and offers the average customer an interest rate of 34.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

The credit card also comes without a cash withdrawal fee.

Cards offering fee-free spending only

Aqua

The Aqua Advance credit card comes with no annual fee and offers the average customer an interest rate of 34.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

However, you’ll be charged a 5% fee for every cash withdrawal made outside of the UK.

You’ll also be charged interest to the tune of 44.9% on any cash withdrawals – and it doesn’t make a difference if you pay off your monthly statement in full.

Nationwide

The Nationwide All Rounder credit card comes with no annual fee and offers the average customer an interest rate of 19.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

However, you’ll be charged a 2.5% (minimum £3) fee for every cash withdrawal made outside of the UK.

NatWest

The NatWest credit card comes with no annual fee and offers the average customer an interest rate of 12.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

However, you’ll be charged a 2.5% (minimum £3) fee for every cash withdrawal made outside of the UK.

You’ll also be charged interest to the tune of 26.9% on any cash withdrawals – and it doesn’t make a difference if you pay off your monthly statement in full.

Royal Bank of Scotland

The Royal Bank of Scotland credit card comes with no annual fee and offers the average customer an interest rate of 12.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

However, you’ll be charged a 2.5% (minimum £3) fee for every cash withdrawal made outside of the UK.

You’ll also be charged interest to the tune of 26.9% on any cash withdrawals – and it doesn’t make a difference if you pay off your monthly statement in full.

Ulster Bank

The Ulster Bank credit card comes with no annual fee and offers the average customer an interest rate of 12.9% representative APR.

Those wishing to use the card for spending abroad won’t be charged a non-sterling transaction fee.

However, you’ll be charged a 2.5% (minimum £3) fee for every cash withdrawal made outside of the UK.

You’ll also be charged interest to the tune of 26.9% on any cash withdrawals – and it doesn’t make a difference if you pay off your monthly statement in full.

How to find the best credit card?

Before you start, make the most of eligibility checkers and soft searches (soft, because they don’t leave a ‘hard’ trace on your credit file) to see which products your application is most likely to be successful for.

Be aware that the “representative APR” interest rate is only offered to 51% of successful applicants and you may be offered a rate above this based on your own personal financial circumstances.

Getting your hands on that useful piece of plastic then means filling out an application form on the provider’s website.

Your application will usually go through an automated process first so make sure you fill out the form carefully and honestly. Even a tiny mistake, like the spelling of a name or address, could mean a refusal.

Depending on how complicated your application, circumstances or the credit card conditions are, you may get a decision almost instantly while other applications can take much longer.

Your card should arrive a week or two after a successful application but if you’re refused you may not find out for several working days.