Fed officials largely sanguine about rise in US bond yields

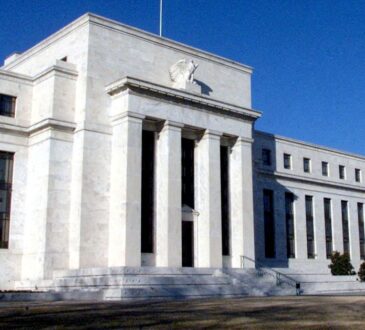

San Francisco Federal Reserve Bank President Mary Daly poses at the bank’s headquarters in San Francisco, California, U.S., July 16, 2019. REUTERS/Ann Saphir/File Photo Acquire Licensing RightsOct 5 (Reuters) - Federal Reserve officials on Thursday indicated little concern that the recent rise in U.S. Treasury yields could imperil a "soft landing" for the economy, and said it could actually help the central bank in its fight against inflation.The Fed held its benchmark overnight interest rate steady in the 5.25%-5.50% range last month, but signaled that one more quarter-percentage-point hike would...