Working Capital Advisors UK Ltd. purchased a new position in Funko, Inc. (NASDAQ:FNKO – Free Report) in the first quarter, according to its most recent disclosure with the SEC. The institutional investor purchased 229,161 shares of the company’s stock, valued at approximately $2,161,000. Funko accounts for 3.1% of Working Capital Advisors UK Ltd.’s portfolio, making the stock its 3rd largest holding. Working Capital Advisors UK Ltd. owned 0.45% of Funko as of its most recent filing with the SEC.

Working Capital Advisors UK Ltd. purchased a new position in Funko, Inc. (NASDAQ:FNKO – Free Report) in the first quarter, according to its most recent disclosure with the SEC. The institutional investor purchased 229,161 shares of the company’s stock, valued at approximately $2,161,000. Funko accounts for 3.1% of Working Capital Advisors UK Ltd.’s portfolio, making the stock its 3rd largest holding. Working Capital Advisors UK Ltd. owned 0.45% of Funko as of its most recent filing with the SEC.

Several other institutional investors and hedge funds have also made changes to their positions in the stock. Price T Rowe Associates Inc. MD raised its position in Funko by 2.9% in the second quarter. Price T Rowe Associates Inc. MD now owns 21,338 shares of the company’s stock worth $476,000 after acquiring an additional 604 shares in the last quarter. BNP Paribas Arbitrage SA grew its stake in shares of Funko by 11.6% in the 1st quarter. BNP Paribas Arbitrage SA now owns 8,185 shares of the company’s stock worth $141,000 after purchasing an additional 850 shares during the last quarter. Deutsche Bank AG raised its holdings in shares of Funko by 8.1% in the 4th quarter. Deutsche Bank AG now owns 15,209 shares of the company’s stock worth $166,000 after purchasing an additional 1,136 shares in the last quarter. Legal & General Group Plc lifted its stake in Funko by 9.5% during the fourth quarter. Legal & General Group Plc now owns 13,377 shares of the company’s stock valued at $146,000 after purchasing an additional 1,156 shares during the last quarter. Finally, American International Group Inc. boosted its holdings in Funko by 11.7% during the second quarter. American International Group Inc. now owns 14,900 shares of the company’s stock worth $333,000 after buying an additional 1,556 shares in the last quarter. 89.88% of the stock is currently owned by institutional investors.

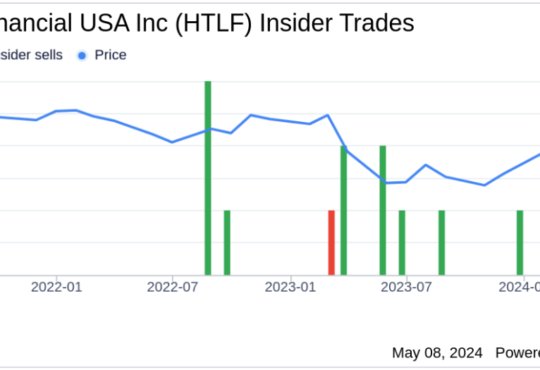

Insider Buying and Selling at Funko

In other news, President Andrew Mark Perlmutter sold 142,012 shares of the company’s stock in a transaction dated Tuesday, August 1st. The stock was sold at an average price of $8.04, for a total transaction of $1,141,776.48. Following the completion of the sale, the president now owns 313,676 shares in the company, valued at approximately $2,521,955.04. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. In other news, CFO Steve Nave bought 55,500 shares of the company’s stock in a transaction that occurred on Thursday, August 17th. The shares were purchased at an average price of $5.45 per share, for a total transaction of $302,475.00. Following the acquisition, the chief financial officer now directly owns 55,500 shares of the company’s stock, valued at approximately $302,475. The purchase was disclosed in a filing with the SEC, which is available at this hyperlink. Also, President Andrew Mark Perlmutter sold 142,012 shares of the business’s stock in a transaction on Tuesday, August 1st. The stock was sold at an average price of $8.04, for a total transaction of $1,141,776.48. Following the transaction, the president now directly owns 313,676 shares of the company’s stock, valued at approximately $2,521,955.04. The disclosure for this sale can be found here. Insiders have purchased a total of 615,176 shares of company stock worth $3,622,388 over the last three months. Corporate insiders own 11.48% of the company’s stock.

Funko Stock Down 0.1 %

Funko stock traded down $0.01 during trading hours on Friday, hitting $7.10. The company had a trading volume of 846,520 shares, compared to its average volume of 904,635. Funko, Inc. has a fifty-two week low of $5.27 and a fifty-two week high of $25.24. The company has a debt-to-equity ratio of 0.54, a current ratio of 0.99 and a quick ratio of 0.53. The firm has a market capitalization of $367.78 million, a P/E ratio of -2.08 and a beta of 1.39. The firm’s fifty day moving average is $7.51 and its 200-day moving average is $9.39.

Funko (NASDAQ:FNKO – Get Free Report) last announced its quarterly earnings results on Thursday, August 3rd. The company reported ($0.53) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.44) by ($0.09). The firm had revenue of $240.03 million for the quarter, compared to analyst estimates of $253.15 million. Funko had a negative net margin of 13.52% and a negative return on equity of 18.61%. On average, research analysts forecast that Funko, Inc. will post -1.13 earnings per share for the current year.

Analyst Ratings Changes

Several research firms have issued reports on FNKO. Stifel Nicolaus dropped their price target on Funko from $9.00 to $8.00 in a report on Monday, August 7th. JPMorgan Chase & Co. decreased their price target on Funko from $9.50 to $8.00 and set a “neutral” rating for the company in a research report on Monday, August 7th. TheStreet cut Funko from a “c-” rating to a “d+” rating in a research note on Friday, August 11th. Bank of America reduced their price objective on shares of Funko from $13.00 to $10.50 in a research note on Monday, August 7th. Finally, DA Davidson reissued a “buy” rating and issued a $9.50 target price (down from $20.00) on shares of Funko in a research report on Friday, August 4th. One equities research analyst has rated the stock with a sell rating, six have assigned a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of “Hold” and a consensus target price of $9.81.

Get Our Latest Analysis on Funko

Funko Company Profile

Funko, Inc, a pop culture consumer products company, designs, sources, and distributes licensed pop culture products in the United States, Europe, and internationally. The company provides media and entertainment content, including movies, television (TV) shows, video games, music, and sports; fashion accessories, including handbags, backpacks, wallets, clothing, and other accessories; and figures, apparel, board games, accessories, plush products, homewares, vinyl records and art prints, posters, and digital non-fungible tokens, as well as creates soundtracks, toys, books, games, and other collectibles.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you consider Funko, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Funko wasn’t on the list.

While Funko currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

Do you expect the global demand for energy to shrink?! If not, it’s time to take a look at how energy stocks can play a part in your portfolio.