The economic situation is complicated enough with the resumption of payments on student loans, the ongoing UAW strike, and a dysfunctional Congress with the prospect of a government shutdown looming. But the outbreak of war in the Middle East trumps everything else in terms of importance.

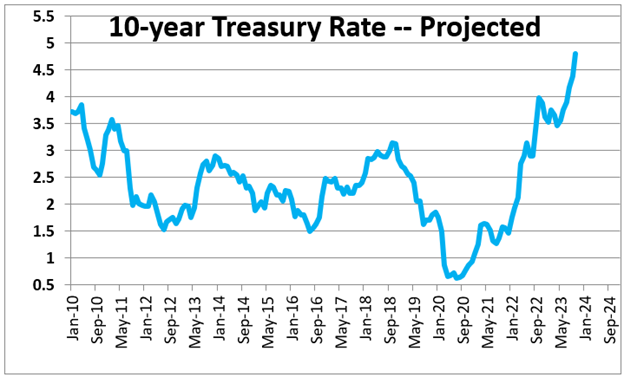

As always, in times of political turmoil investors flee to the safety of the U.S. bond market. That was the case this past week as the yield on the Treasury’s 10-year note declined. But also in times of uncertainty the stock market declines and volatility spikes. But that has decidedly not been the case this time.

As always, in times of political turmoil investors flee to the safety of the U.S. bond market. That was the case this past week as the yield on the Treasury’s 10-year note declined. But also in times of uncertainty the stock market declines and volatility spikes. But that has decidedly not been the case this time.

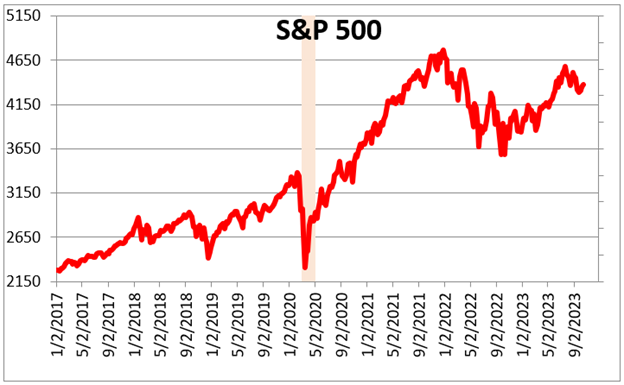

The stock market, in our opinion, is far too complacent about the almost certain spread of war in the Middle East and its potential to disrupt economic activity, not just in the U.S. but around the globe. Oil prices could surge. The flow of shipping through the Persian Gulf could be threatened by Iranian warships. The result could easily be a global recession, a surging inflation rate, or both.

The war has dominated television news, the print media and social media since Oct. 7. An Israeli invasion of Gaza is both certain and imminent. The war could easily spread to Northern Israel and Lebanon which could bring Iran into the picture. It does not take a lot of imagination to envision a much broader, disquieting conflict. Fixed income investors are seeking a safe haven in the form of the U.S. bond market. The yield on the 10-year note declined by 0.2% last week.

The war has dominated television news, the print media and social media since Oct. 7. An Israeli invasion of Gaza is both certain and imminent. The war could easily spread to Northern Israel and Lebanon which could bring Iran into the picture. It does not take a lot of imagination to envision a much broader, disquieting conflict. Fixed income investors are seeking a safe haven in the form of the U.S. bond market. The yield on the 10-year note declined by 0.2% last week.

Stock market behavior is more puzzling. The stock market has been fluctuating in a relatively narrow band for the past several months as investors try to determine whether the Fed funds rate has reached its peak, the economy is going to achieve a soft landing, inflation will continue to retreat, and Congress can overcome its dysfunction and pass a proper budget.

Failure to resolve these spending issues will almost certainly lead to a government shutdown in mid-November. But daily stock market changes in recent months have been triggered by economic issues regarding interest rates, the economy and inflation. There is still no element of fear which, to us, is surprising given the outbreak of war.

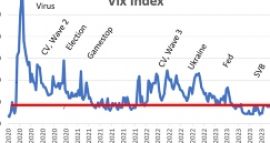

Stock market volatility has been subdued through this entire period. The S&P 500 index is almost exactly where it was prior to the outbreak of war. The VIX index of volatility hovers around 17.5 which is virtually identical to the 18.4 average level in the past 10 years. Business as usual. Nothing out of the ordinary. Why aren’t stock investors more nervous?

Stock market volatility has been subdued through this entire period. The S&P 500 index is almost exactly where it was prior to the outbreak of war. The VIX index of volatility hovers around 17.5 which is virtually identical to the 18.4 average level in the past 10 years. Business as usual. Nothing out of the ordinary. Why aren’t stock investors more nervous?

The spread of the coronavirus caused volatility to spike in the spring of 2020 and several times subsequent to that when cases spread. The outcome of the 2020 election made investors nervous. The outbreak of war in Ukraine in 2021 did the same thing. So why haven’t investors panicked in response to the outbreak of war in the Middle East?

The spread of the coronavirus caused volatility to spike in the spring of 2020 and several times subsequent to that when cases spread. The outcome of the 2020 election made investors nervous. The outbreak of war in Ukraine in 2021 did the same thing. So why haven’t investors panicked in response to the outbreak of war in the Middle East?

It appears that investors have embraced the notion that inflation will continue to shrink, the economy will expand at a moderate pace in the months ahead, and that it is only a matter of time before the Fed begins to lower rates in the second half of 2024. That is a rosy outlook, but is it right?

It does not take much imagination to envision a much more troublesome outcome. An Israeli invasion of Gaza is a certainty. But what happens then? Do militants in Lebanon and Syria join the fight and make it a two-front war? What does Iran do? How about the U.S. and Europe?

A lot of oil is produced by OPEC countries in the Middle East — Saudi Arabia, Iraq, Iran, the UAE and Kuwait. Production could be interrupted. Attacks by Iran on merchant shipping through the Persian Gulf could send oil prices sky high.

The world has just recovered from a bout of inflation triggered by Russia’s invasion of Ukraine. A second spike in oil prices could rekindle a widespread runup in inflation.

The world has just recovered from a bout of inflation triggered by Russia’s invasion of Ukraine. A second spike in oil prices could rekindle a widespread runup in inflation.

The European economy is particularly anemic at the moment with the IMF expecting GDP growth in the E.U. of 0.7% in 2023. That includes an expected 0.5% contraction in GDP for Germany. A surge in oil prices would almost certainly push the entire European economy into recession. GDP growth in the U.S. is expected to soften to 0.7% or so in the first two quarters of next year. A spike in oil prices could push those growth rates into negative territory and trigger a recession in the U.S. as well.

In our opinion, the stock market is being far too complacent about the potential for the Hamas-Israel conflict to widen. With challenges already from a resumption of payments on student debt, a spreading UAW strike, an inability of the Congress to govern, the stock market must now deal with the possibility of a much broader war in the Mideast that could result in a global recession, a spike in inflation, or both.

From 1980 until 2003, when he retired, Stephen Slifer served as chief U.S. economist for Lehman Brothers in New York City, directing the firm’s U.S. economics group along with being responsible for forecasts and analysis of the U.S. economy. He has written two books on using economic indicators to forecast financial moves and previously served as a senior economist at the Board of Governors of the Federal Reserve in Washington, D.C. Slifer can be reached at www.numbernomics.com.