Which stocks are leading the market’s year-end rally? Previously down-trodden sectors stage a comeback in November – but investors warn rebound could be short-lived

Previously struggling sectors of the stock market are now rebounding to help drive a year-end rally.

The stock market gained steam in early November as investors gained confidence the Federal Reserve was likely done with its historic series of interest rate hikes this year – and picked up again in the middle of the month following news the annual rate of inflation had slowed.

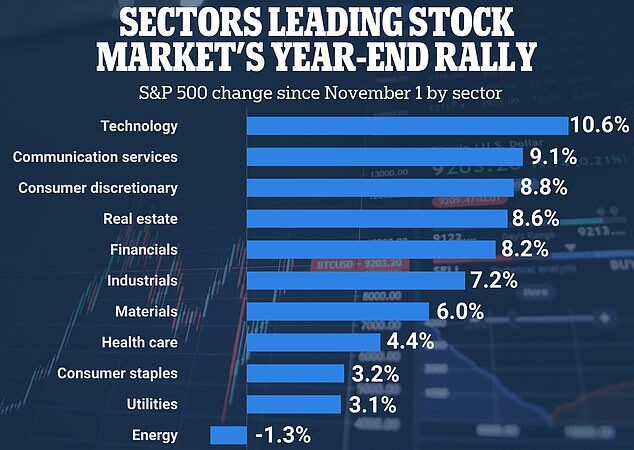

Overall the S&P 500 was up by around 7.7 percent from the beginning of the month through to when markets closed on Wednesday ahead of the Thanksgiving holiday.

The S&P 500 index tracks the stock performance of 500 of the largest companies in the US – and is categorised into 11 industry sectors.

Its recent growth has been driven most notably by the technology sector, which considers the value of shares in Apple, Microsoft, Nvidia and IBM, among many others. Technology stocks have benefited in part thanks to investor enthusiasm around artificial intelligence.

The stock market’s recent growth was driven most notably by the technology sector, which was up 10.6 percent from November 1 through to Thanksgiving

On November 1 the Federal Reserve indicated its historic series of benchmark interest rate rises may finally be over. Pictured is Fed Chair Jerome Powell

But other sectors which had previously been impaired by inflated interest rates and fears of a looming recession are now on the rise.

The communications sector – which includes companies like Comcast and AT&T – has seen the second biggest gain after the tech sector. It is up 9.1 percent from November 1.

The discretionary consumer sector, which includes companies such as Starbucks, AMC and BestBuy, was up 8.8 percent from the beginning of the month.

The S&P 500’s industrials and materials segments grew 7.2 and 6 percent over the month respectively.

Health care, consumer staples and utilities were up 4.4, 3.2 and 3.1 percent respectively – below the overall growth of the S&P 500 index.

The only sector to have shrunk since the beginning of the month was energy, which was down 1.2 percent. Some of the largest companies in that index include Shell and Exxon.

In the beginning of November, the Federal Reserve indicated its historic series of benchmark interest rate rises may finally be over.

That signalled to many investors that US economic growth may be on the horizon, as the cost of borrowing may finally be on its way down.

Then the markets were given another significant boost after consumer inflation figures on November 14 revealed the annual rate of inflation had slowed to 3.2 percent in October – edging closer to the Fed’s 2 percent target.

The S&P 500 was up by around 7.7 percent from November 1 through to when markets closed on November 22 ahead of the Thanksgiving holiday

A trader is seen working on the floor at the New York Stock Exchange on November 16

While the November rally is generally good news, some investors have cautioned that 2024 may not be all roses – and stock market advances might be short-lived.

One market ‘prophet’ last week predicted stocks could fall by as much as 30 percent next year, and investors were spooked by the emergence of the dreaded ‘death cross’ technical pattern on the Dow Jones Industrial Average index earlier this month.

The presidential race next year is a concern because it could be a source of more market instability, experts claim.

‘As we get into 2024, with a general election that’s going to be extremely contested, I think we’re going to see more risks there,’ Max Gokhman, head of investment strategy at Franklin Templeton, told Reuters.

Peter van Dooijeweert, a hedging specialist for hedge fund Man Group, offered the agency a similarly sober outlook.

‘I don’t think that the market is going to dodge a very aggressive Fed tightening cycle and then continued quantitative tightening environment without a little bit of damage coming sometime next year,’ he said.

He also commented on potential overexcitement around AI.

‘The market might be too optimistic about how much of the AI boom is really going to contribute to the bottom line of earnings of the Magnificent Seven,’ he added, referring to the tech industries seven big stocks – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla.