Darren415

After writing a rather long article about QVAL and (systematic) value investing in general, this one examines the next ETF of my peer-group: the iShares Edge MSCI USA Value Factor ETF (BATS:VLUE).

For a more comprehensive overview on systematic value investing, I refer interested readers to the “Value Investing – Idea and Evidence” section of my article on QVAL. To get everyone on the same page, however, here is a brief working definition what I understand as systematic value investing.

The core idea of value investing, introduced by Benjamin Graham and David Dodd in the 1930s, has remained unchanged over the years: stocks that are cheap with respect to fundamentals tend to outperform more expensive stocks in the long run. Within a systematic investment process, value investing usually means buying diversified portfolios of stocks with low fundamental valuation multiples, such as Price/Book, Price/Earnings, or EV/EBITDA. While there are a lot of other details (industry exposures, interactions with the quality factor, or proprietary value signals), the fundamental idea remains unchanged. Value investors want to be long/overweight cheap stocks and short/underweight expensive stocks.

There is ample empirical evidence for a systematic value-premium in virtually all of the world’s equity markets and even within other asset classes. In addition to that, there are plausible theories (both behavioral and risk-based) why value investing worked, should work, and probably continues to do so in the future.

Overall, this makes systematic value (or the “value factor”) a very appealing investment strategy that investors should definitely consider in their portfolios. So let’s see how VLUE implements it.

VLUE’s Implementation of Value

According to its website, VLUE tracks the MSCI USA Enhanced Value Index. However, this was not always the case. From inception in April 2013 until September 2015, the ETF tracked the MSCI USA Value Weighted Index. Given that investors need to evaluate the ETF going forward, I will just examine the currently tracked index in this article. Starting with the most recent factsheet, we find the following description:

The MSCI USA Enhanced Value Index captures large and mid-cap representation across the US equity markets exhibiting overall value style characteristics. The index is designed to represent the performance of securities that exhibit higher value characteristics relative to their peers within the corresponding GICS® sector. The value investment style characteristics for index construction are defined using three variables: Price-to-Book Value, Price-to-Forward Earnings and Enterprise Value-to-Cash flow from Operations.

Source: MSCI USA Enhanced Value Index Factsheet, accessed February 27, 2023. Annotations by the author.

This is already quite comprehensive. Further looking at the methodology book obviously reveals many more technical details, but the underlying idea of the index construction is actually quite simple. MSCI ranks stocks from the parent index (the MSCI USA which is very similar to the S&P 500) by the three valuation ratios and combine those ranks to a composite value score. With a simple formula, they convert those value scores into multipliers and apply them to the respective stocks’ weight in the MSCI USA Index. So if Apple has a weight of 5% in the MSCI USA and scores attractive on value (i.e. it is cheap with respect to fundamentals), it will have a weight >5% in VLUE. Overall, VLUE is therefore a value-weighted large-cap value strategy without too much active risk. MSCI rebalances the index semi-annually. Given that value is a “slower” factor than momentum, this is probably fine. On the other hand, most US companies release quarterly fundamentals such that the ranking is always a bit stale.

Importantly, MSCI also incorporates industry exposures into the value process. VLUE is designed to have a roughly similar industry composition like the parent MSCI USA, so you are not taking active industry bets. Instead, the index/ETF invests in the cheapest stocks within each GICS Sector.

In my opinion, this is a cool feature for two reasons. First, it is a more apple-to-apple comparison. If you rank stocks according to fundamental valuation ratios, you will find that some sectors are generally cheaper than others. This is just rooted in the different underlying businesses and will probably not change in the future. There is always a trade-off. On the one hand, a pure value investor wants to have the cheapest stocks of the universe no matter what industry. On the other hand, I think we all agree that it makes more sense to compare Apple with Microsoft instead of Waste Management. To the best of my knowledge, it became some sort of consensus in the literature that value rankings should be made within sectors/industries and MSCI incorporates that insight.

Second, by investing in the cheapest stocks within each sector, you mitigate unintended and potentially uncompensated sector/industry bets. Without any constraints, a systematic value strategy produces quite pronounced sector tilts and you end up with a portfolio of “cheap” sectors like Utilities. This is not generally wrong and the academic value benchmarks from Kenneth French do not consider industry exposures. However, remember that the core idea of value investing is “cheap beats expensive” not “Utilities beat Information Technology”. To isolate the bet on the value-factor, it is therefore better to diversify across sectors and hold a portfolio of the cheapest stocks within each sector.

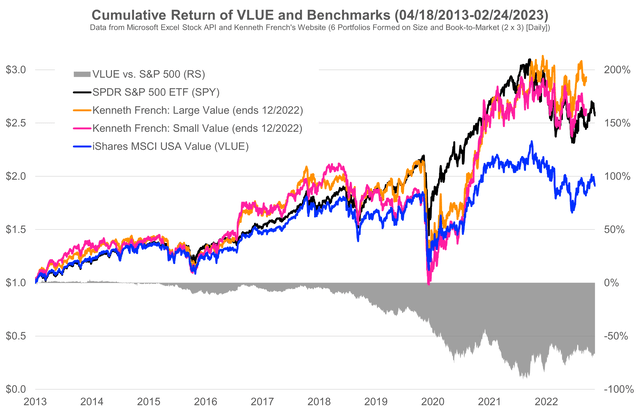

Overall, VLUE is a diversified bet on the value factor among US large caps. While the index manages active risk via industry exposures to the parent index, it still offers true value exposure. For example, the aggregate P/E ratio of the MSCI USA Enhanced Value Index was less than half that of the MSCI USA Index as of January 31, 2023 (10.01 vs. 20.75). The chart below shows the performance of the ETF since inception in April 2013.

Own illustration of data from Kenneth French’s website and market data. (Tuck School of Business and Microsoft Excel Stock API)

As all other value products, VLUE had a difficult period over the last years and massively underperformed the overall US market since inception (see my first value-article for more details).

What is more striking though, is the fact that VLUE also massively lags Kenneth French’s Large Cap Value portfolio since the sharp value recovery in late 2020. It is also quite remarkable that VLUE continued to underperform in 2021 and 2022 which were actually strong years for the value factor. Without having specific holding data, I suspect that the industry-neutrality to the parent index worked in reverse here. Although other sectors were cheaper and outperforming in 2021 and 2022 (Energy and Healthcare, for example), VLUE still held a large fraction of Technology stocks simply because the US market consists of those. But again, this is just a potential explanation and not thoroughly researched.

Overall, and especially over 2021/2022 and with respect to the academic value portfolio of Kenneth French, the historical performance of VLUE was somewhat disappointing. In my opinion, this is unfortunate because the underlying value process actually incorporates many aspects that are considered best-practice in the academic and practitioner literature (multiple value signals, apple-to-apple comparisons within sectors, no active sector bets). But this is sometimes the reality in stock markets we have to live with. A “good” process sometimes yields worse results than a naive one and you look stupid after the fact… Note that this doesn’t mean MSCI’s value process is perfect. In the end, the ETF is a smart beta product and specialized quant managers like AQR or Robeco certainly do many things different and maybe better. For a fully published smart-beta value ETF though, I believe the process is actually quite good – despite improvable performance.

VLUE and Value-Peers

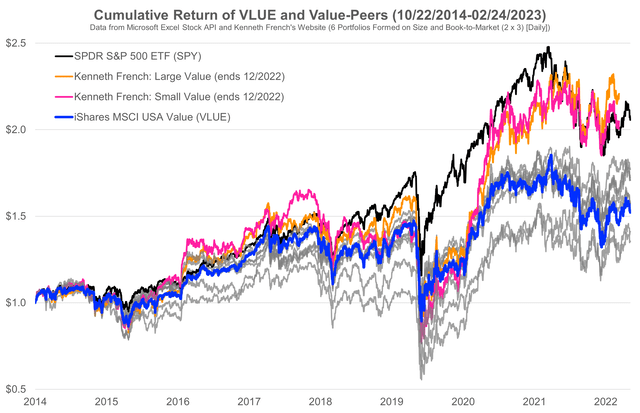

In addition to the full history of VLUE and its benchmarks, the following chart shows the ETF versus my (admittedly somewhat arbitrary) peer-group of other value ETFs for the longest common period since October 2014. The peer-group consists of IWN, VTV, VBR, IVE, IWD, QVAL, DFFVX, and IUSV. The goal is to give you a broad overview where VLUE stands against its competitors. Therefore, I haven’t included the names of the other funds for brevity.

Own illustration of data from Kenneth French’s website and market data. Value-peers are QVAL, VTV, VBR, IVE, IWD, IWN, DFFVX, and IUSV. (Tuck School of Business and Microsoft Excel Stock API)

With respect to VLUE, I would say the performance with respect to the value-peers is somewhere between “improvable” and “okay”. There are worse funds like QVAL and DFFVX, and there are some better ones which, however, didn’t beat VLUE by a wide margin. Also note that some of the peers only invest in small caps which is not directly comparable to VLUE.

What still strikes me is the very strong performance of the two value portfolios from Kenneth French’s website. These are simple value-weighted portfolios that are based on just one value signal (Price/Book) but still massively outperformed all investable products. Some of this is probably due to their unconstrained and rather theoretical nature (no position limits, no management fees, etc.). But to me it is still surprising how difficult it seems to beat this academic value benchmark.

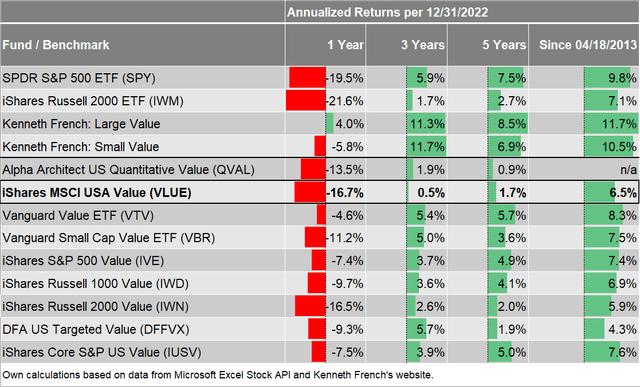

The table below shows the same performance data numerically and also includes some sub-sample periods. Looking at those other periods again reveals some performance problems for VLUE. While performing in-line with the peer-group since inception, the ETF was among the worst of the peers over the last 1, 3, and 5 years.

Data from Tuck School of Business and Microsoft Excel Stock API

Conclusion

So what to me make out of this article? On one hand, we have a value-process that doesn’t seems too bad and certainly better than others. At the same time, the process did not materialize in “good” or at least above-average performance. In particular, VLUE couldn’t fully participate in the strong value recovery since late 2020 and when compared to the simple academic Large Cap Value portfolio from Kenneth French, it just doesn’t look too good.

Despite those performance issues, however, I believe the process makes sense and is better and closer to the empirical research on the value factor than those of QVAL and IWN, for example (see the articles on my profile). In my opinion, VLUE is an efficient, cheap, and transparent instrument to systematic value exposure among US large caps without running into unintended sector bets and without taking too much active risk. This is not the right product for unconstrained “deep-value” investors who really want to have the cheapest of the cheapest no matter what sector. But for what the VLUE intends to do, I think MSCI found a good balance between “simple smart-beta value” and “state-of-the-art value from the literature”. I therefore assign a “Buy” rating.