Twinbeech Capital LP acquired a new stake in Skechers U.S.A., Inc. (NYSE:SKX – Get Rating) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 285,725 shares of the textile maker’s stock, valued at approximately $9,063,000. Twinbeech Capital LP owned about 0.18% of Skechers U.S.A. at the end of the most recent reporting period.

Twinbeech Capital LP acquired a new stake in Skechers U.S.A., Inc. (NYSE:SKX – Get Rating) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 285,725 shares of the textile maker’s stock, valued at approximately $9,063,000. Twinbeech Capital LP owned about 0.18% of Skechers U.S.A. at the end of the most recent reporting period.

→ Is Taiwan a Chinese Red Herring? The Real Threat to the U.S. (From Investing Trends)

Several other large investors have also made changes to their positions in SKX. Samlyn Capital LLC purchased a new stake in shares of Skechers U.S.A. in the 2nd quarter valued at $27,160,000. Dimensional Fund Advisors LP increased its holdings in Skechers U.S.A. by 19.4% in the third quarter. Dimensional Fund Advisors LP now owns 2,949,350 shares of the textile maker’s stock valued at $93,568,000 after buying an additional 478,224 shares in the last quarter. Bank of Montreal Can increased its holdings in Skechers U.S.A. by 2,598.2% in the third quarter. Bank of Montreal Can now owns 404,725 shares of the textile maker’s stock valued at $13,919,000 after buying an additional 389,725 shares in the last quarter. Point72 Asset Management L.P. purchased a new position in Skechers U.S.A. in the third quarter valued at $11,338,000. Finally, Landscape Capital Management L.L.C. purchased a new position in Skechers U.S.A. in the third quarter valued at $10,420,000. 93.29% of the stock is owned by hedge funds and other institutional investors.

Skechers U.S.A. Stock Down 0.4 %

Shares of NYSE SKX opened at $44.34 on Thursday. Skechers U.S.A., Inc. has a 12-month low of $31.28 and a 12-month high of $49.56. The stock has a market cap of $6.88 billion, a PE ratio of 18.63 and a beta of 1.32. The company has a current ratio of 2.26, a quick ratio of 1.13 and a debt-to-equity ratio of 0.06. The company has a 50-day moving average of $45.34 and a 200 day moving average of $40.41.

Skechers U.S.A. (NYSE:SKX – Get Rating) last announced its quarterly earnings data on Thursday, February 2nd. The textile maker reported $0.48 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.38 by $0.10. Skechers U.S.A. had a net margin of 5.01% and a return on equity of 9.94%. The company had revenue of $1.88 billion during the quarter, compared to analysts’ expectations of $1.77 billion. During the same quarter in the prior year, the company earned $0.43 EPS. Skechers U.S.A.’s revenue was up 13.5% compared to the same quarter last year. As a group, sell-side analysts predict that Skechers U.S.A., Inc. will post 2.95 EPS for the current fiscal year.

Analyst Ratings Changes

A number of research analysts have weighed in on SKX shares. Cowen cut their price objective on shares of Skechers U.S.A. from $65.00 to $62.00 and set an “outperform” rating for the company in a report on Friday, February 3rd. Argus raised shares of Skechers U.S.A. from a “hold” rating to a “buy” rating and set a $50.00 price objective for the company in a report on Friday, January 6th. UBS Group lifted their price objective on shares of Skechers U.S.A. from $63.00 to $69.00 in a report on Friday, February 3rd. Piper Sandler initiated coverage on shares of Skechers U.S.A. in a research note on Wednesday, December 28th. They set a “neutral” rating and a $42.00 target price for the company. Finally, Raymond James boosted their target price on shares of Skechers U.S.A. from $48.00 to $55.00 and gave the stock an “outperform” rating in a research note on Wednesday, February 1st. Three analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of “Moderate Buy” and a consensus price target of $53.83.

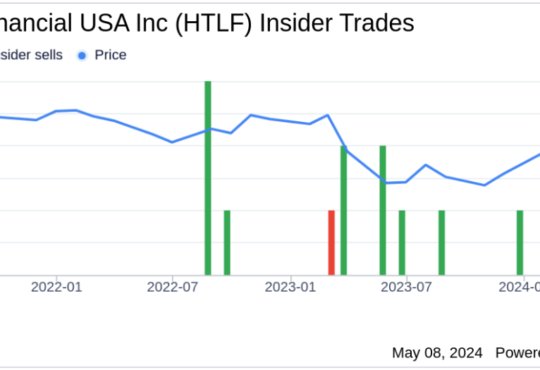

Insider Activity at Skechers U.S.A.

In related news, EVP Mark A. Nason sold 1,093 shares of the company’s stock in a transaction dated Monday, March 6th. The shares were sold at an average price of $45.12, for a total transaction of $49,316.16. Following the completion of the sale, the executive vice president now owns 18,903 shares of the company’s stock, valued at approximately $852,903.36. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. In other Skechers U.S.A. news, President Michael Greenberg sold 10,503 shares of the business’s stock in a transaction dated Tuesday, January 3rd. The shares were sold at an average price of $42.29, for a total value of $444,171.87. Following the transaction, the president now directly owns 427,080 shares in the company, valued at approximately $18,061,213.20. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Mark A. Nason sold 1,093 shares of the business’s stock in a transaction dated Monday, March 6th. The shares were sold at an average price of $45.12, for a total transaction of $49,316.16. Following the completion of the transaction, the executive vice president now owns 18,903 shares in the company, valued at $852,903.36. The disclosure for this sale can be found here. In the last quarter, insiders sold 97,211 shares of company stock valued at $4,348,160. Corporate insiders own 24.44% of the company’s stock.

Skechers U.S.A. Profile

Skechers U.SA, Inc engages in designing, development, and marketing of lifestyle footwear for men, women, and children of all ages. It operates through the Wholesale and Direct-to-Consumer segment. The Wholesale segment includes department stores, family shoe stores, specialty running, and sporting goods retailers.

Further Reading

Want to see what other hedge funds are holding SKX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Skechers U.S.A., Inc. (NYSE:SKX – Get Rating).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you consider Skechers U.S.A., you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Skechers U.S.A. wasn’t on the list.

While Skechers U.S.A. currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.