Triasima Portfolio Management inc. Has $5.91 Million Stock Position in Murphy USA Inc. (NYSE:MUSA)

Triasima Portfolio Management inc. lifted its holdings in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) by 47.9% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 21,152 shares of the specialty retailer’s stock after purchasing an additional 6,852 shares during the quarter. Triasima Portfolio Management inc. owned approximately 0.09% of Murphy USA worth $5,912,000 as of its most recent SEC filing.

Triasima Portfolio Management inc. lifted its holdings in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) by 47.9% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 21,152 shares of the specialty retailer’s stock after purchasing an additional 6,852 shares during the quarter. Triasima Portfolio Management inc. owned approximately 0.09% of Murphy USA worth $5,912,000 as of its most recent SEC filing.

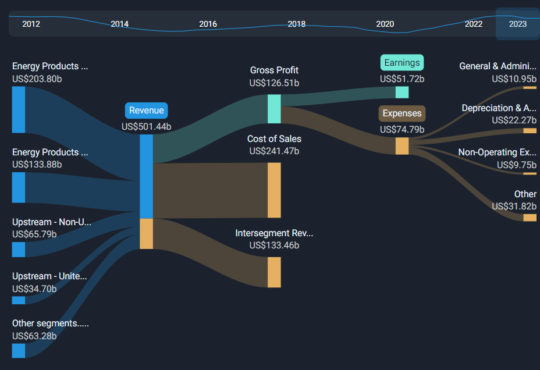

Several other hedge funds also recently modified their holdings of MUSA. ExodusPoint Capital Management LP acquired a new position in shares of Murphy USA during the 3rd quarter worth $28,635,000. BlackRock Inc. grew its stake in Murphy USA by 3.1% in the 3rd quarter. BlackRock Inc. now owns 2,650,681 shares of the specialty retailer’s stock valued at $728,697,000 after buying an additional 80,089 shares during the last quarter. Marshall Wace LLP grew its stake in Murphy USA by 251.2% in the 3rd quarter. Marshall Wace LLP now owns 89,379 shares of the specialty retailer’s stock valued at $24,571,000 after buying an additional 63,932 shares during the last quarter. Goldman Sachs Group Inc. grew its stake in Murphy USA by 20.6% in the 2nd quarter. Goldman Sachs Group Inc. now owns 332,877 shares of the specialty retailer’s stock valued at $77,518,000 after buying an additional 56,905 shares during the last quarter. Finally, Allianz Asset Management GmbH grew its stake in Murphy USA by 115.3% in the 3rd quarter. Allianz Asset Management GmbH now owns 89,131 shares of the specialty retailer’s stock valued at $24,502,000 after buying an additional 47,731 shares during the last quarter. Institutional investors and hedge funds own 85.30% of the company’s stock.

Murphy USA Price Performance

MUSA traded up $4.44 during midday trading on Friday, hitting $282.00. The company had a trading volume of 94,961 shares, compared to its average volume of 289,605. The company has a debt-to-equity ratio of 2.50, a quick ratio of 0.53 and a current ratio of 0.92. The company has a market capitalization of $6.14 billion, a PE ratio of 10.35 and a beta of 0.80. Murphy USA Inc. has a twelve month low of $217.39 and a twelve month high of $323.00. The firm’s 50-day simple moving average is $262.94 and its 200-day simple moving average is $274.24.

Murphy USA (NYSE:MUSA – Get Rating) last issued its quarterly earnings results on Tuesday, May 2nd. The specialty retailer reported $4.80 EPS for the quarter, topping the consensus estimate of $4.18 by $0.62. Murphy USA had a net margin of 2.68% and a return on equity of 86.87%. The company had revenue of $5.08 billion during the quarter, compared to analysts’ expectations of $4.95 billion. During the same quarter in the previous year, the company earned $6.08 EPS. Murphy USA’s revenue was down .8% on a year-over-year basis. Equities research analysts predict that Murphy USA Inc. will post 18.8 EPS for the current fiscal year.

Murphy USA Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, June 1st. Investors of record on Monday, May 15th will be issued a dividend of $0.38 per share. The ex-dividend date of this dividend is Friday, May 12th. This represents a $1.52 dividend on an annualized basis and a yield of 0.54%. This is a boost from Murphy USA’s previous quarterly dividend of $0.37. Murphy USA’s payout ratio is currently 5.52%.

Analyst Upgrades and Downgrades

MUSA has been the topic of several research analyst reports. Wells Fargo & Company raised their price target on shares of Murphy USA from $325.00 to $330.00 in a research report on Thursday, May 4th. StockNews.com upgraded shares of Murphy USA from a “hold” rating to a “buy” rating in a research report on Friday. Finally, Raymond James reduced their price objective on shares of Murphy USA from $335.00 to $305.00 and set an “outperform” rating for the company in a report on Friday, February 3rd. One analyst has rated the stock with a sell rating, one has issued a hold rating and four have issued a buy rating to the company’s stock. According to MarketBeat, the company has an average rating of “Moderate Buy” and a consensus target price of $315.60.

Insider Activity at Murphy USA

In other Murphy USA news, Director Jeanne Linder Phillips sold 550 shares of Murphy USA stock in a transaction that occurred on Wednesday, May 10th. The shares were sold at an average price of $283.97, for a total value of $156,183.50. Following the transaction, the director now owns 2,874 shares of the company’s stock, valued at $816,129.78. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 9.47% of the company’s stock.

About Murphy USA

Murphy USA, Inc engages in marketing motor fuel products and convenience merchandise through retail stores, namely Murphy USA and Murphy Express. It collaborates with Walmart to offer customers discounted and free items based on purchases of qualifying fuel and merchandise. The company was founded in 1996 and is headquartered in El Dorado, AR.

Featured Stories

Want to see what other hedge funds are holding MUSA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Murphy USA Inc. (NYSE:MUSA – Get Rating).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Murphy USA, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Murphy USA wasn’t on the list.

While Murphy USA currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.