Treasury officials are exploring the idea of setting up a sovereign wealth fund in what could deliver a boost to households and markets ahead of the General Election, The Mail on Sunday understands.

A well-placed City source said officials have been seeking input from financial sector experts to see how such a scheme might work.

Foreign sovereign wealth funds are best known in the UK for buying up luxury property and investing in everything from the London Stock Exchange Group to Harrods and Heathrow Airport.

One idea being put forward for a homegrown fund is to pool nationally-owned assets along the lines of Singapore’s Temasek sovereign wealth fund.

These could include some of those held by UK Government Investments, which owns shares in 24 companies ranging from Network Rail and the Royal Mint to engineering firm Sheffield Forgemasters and a 39 per cent stake in lender NatWest.

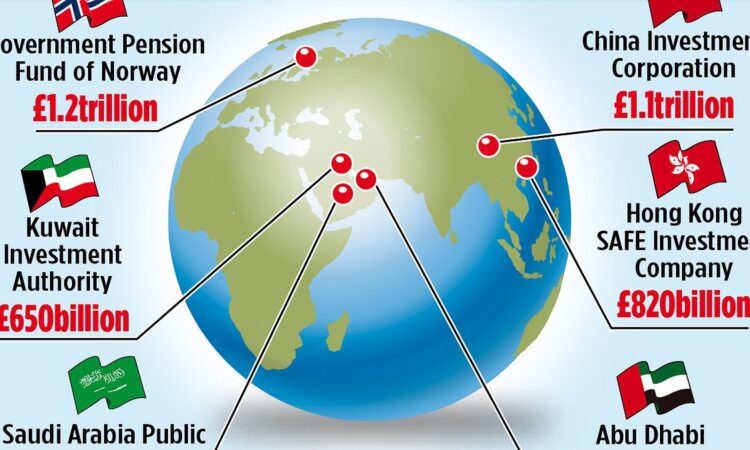

UKGI manages assets of more than £1 trillion – which generate about £30 billion of income – some of which could be distributed to taxpayers or used to improve public services. Experts say any UK state investment fund would need to be on a huge scale to compete with the foreign titans.

Even the fragmented Local Government Pension Scheme, which looks after the nest eggs of six million council workers and has total assets of £360 billion, if combined would not be one of the top dozen global sovereign wealth funds (see table).

But the idea of a domestic wealth fund is gaining traction across the political divide, with Labour recently proposing a national wealth fund to boost investment in infrastructure and green projects – but it would be funded by borrowing.

Sovereign wealth funds are typically paid for by surplus revenues – such as Norway’s, which reinvests its vast North Sea oil wealth. It is now the biggest sovereign wealth fund in the world with assets of £1.2 trillion. The pot helps to shield the Norwegian economy from ups and downs in energy prices, acts as a financial reserve and is a long-term savings plan for both current and future generations.

Britain did not opt for such a scheme when its North Sea oil boom began in the 1970s. Instead, successive governments used the proceeds from oil and gas fields to keep public borrowing down rather than to build a fighting fund to tackle long-term problems such as our ageing population.

But even that approach has failed to curb the national debt, which has ballooned to £2.6 trillion – almost as much as the UK’s entire annual economic output.

The sovereign wealth fund plan, which is at an early stage, could build on separate Treasury aims to create a vehicle to boost pension funds’ investment in high-growth companies.

Related Articles

HOW THIS IS MONEY CAN HELP

The Mail on Sunday understands that the Treasury is not actively considering the idea for now, but it has not been ruled out. A source with knowledge of the matter was struck by the fact officials were willing to consider the idea after decades of Treasury orthodoxy which in the past would have seen it dismissed out of hand.

But Tory MP John Penrose described a UK sovereign wealth fund as a ‘game-changingly big idea’. He said: ‘It would help us deal with three of the biggest problems Britain is facing. We don’t save and invest enough compared to pretty much all of our rivals.

‘Our ageing population is a demographic time bomb which will blow the welfare state apart if we don’t reinforce it quickly.

‘And we’re far better at inventing new ideas than turning them into world-beating businesses which create jobs and wealth in the UK.’

A number of overseas sovereign wealth funds have invested heavily in property and infrastructure in the UK in recent years. They include gas-rich Qatar which owns stakes in Barclays, Sainsbury’s and British Airways. Russ Mould, investment director at AJ Bell, said it was easy to see why the idea was on the Chancellor’s agenda.

He said: ‘It presumably ties in with his desire to reinvigorate the flagging UK stock market, promote ownership of UK equities and provide a stable base of shareholders – and perhaps access to pools of capital – for companies that are of strategic importance.’

A Treasury spokesman said: ‘As the Chancellor set out this year, we are looking at ways the Government can facilitate investment. This would build on the skills and expertise of the British Business Bank, which has helped mobilise £15 billion of capital into over 20,000 companies.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.