Navigating Sector & Industry Strength in the Ever-Changing Landscape

As we stand on the precipice of the final few weeks of the third quarter, a time-honored ritual in the financial world calls for the recalibration of our performance benchmarks. It is a moment when we cast aside the vestiges of the previous year’s data and forge ahead with a new foundation, a crisp starting point for evaluating market dynamics. The shifting sands of time have ushered us to this juncture, where the intricate dance of sectors and industries takes center stage.

In this complex and ever-evolving landscape, it is intriguing to observe that the general contours of market trends have remained relatively unscathed compared to our previous benchmark of Q4 2022. As we delve into the tapestry of sector performance, a few key players emerge, painting a mosaic of risk appetites and economic nuances.

Topping the leaderboard are the vanguards of risk-on sentiment: communications (XLC), technology (XLK), and consumer discretionary (XLY) sectors. These triumvirate sectors, where investors willingly tread the path of risk and volatility, continue to command attention and capital. Their ascendancy is a testament to the enduring allure of innovation and consumer-driven enterprises.

A striking resurgence narrative unfolds as we gaze toward the energy sector (XLE). A mere whisper of its past misfortunes in June, when it languished as the year’s worst-performing sector, has now transformed into a resounding crescendo of recovery. The recent weeks have witnessed a phoenix-like rise, catapulting it to the fourth position in our rankings. It is a testament to the erratic nature of markets, where fortunes can be reversed with remarkable alacrity.

Yet, the procession of inflation-related sectors marches onward. Industrials (XLI) and basic materials (XLB), poised on the heels of the energy sector, underscore the enduring appeal of sectors tethered to the pulse of economic expansion. Like a well-oiled machine, these sectors continue to thrive amid the ebbs and flows of market sentiment.

On the flip side, the roster of risk-off sectors maintains its station in the bottom echelons of our rankings. Utilities (XLU), consumer staples (XLP), and healthcare (XLV) stand as the steadfast guardians of prudence in the stormy sea of market volatility. Their tenacity to weather the storm and remain in the bottom three spots underscores the enduring demand for safety and stability in the portfolios of discerning investors.

Notably, these sectors and the beleaguered real estate (XLRE) sector bear the onus of negative performance year-to-date. In a world where unpredictability reigns supreme, these sectors, while often overlooked in the clamor for riskier assets, serve as the bedrock upon which a diversified portfolio finds its stability.

The only constant in this captivating saga of sectors and industries is change. The ebb and flow of market dynamics, the erratic shifts in sentiment, and the relentless march of time create a mosaic of perpetual transformation. As we embark on the journey into the fourth quarter, armed with new benchmarks and fresh perspectives, the astute investor remains vigilant, ready to navigate the labyrinthine pathways of the financial world with skill and poise.

Japan Surges Ahead of Europe: A Currency Crisis Catalyst? (Sector ETF: VGK/EWJ)

Discerning investors constantly seek alpha-generating opportunities in global finance, where the ebbs and flows of market dynamics paint a canvas of perpetual transformation. Among the myriad variables, one intriguing narrative has emerged – the setup within the Japanese Nikkei. A tale interwoven with the potential repercussions of a currency crisis in the Japanese Yen.

The opening chapters of this year bore witness to a curious phenomenon where foreign stocks outpaced their domestic counterparts, casting a shadow of uncertainty over the Japanese stock market. However, the tides have shifted once more, with the United States resuming its mantle as the harbinger of outperformance in the global arena.

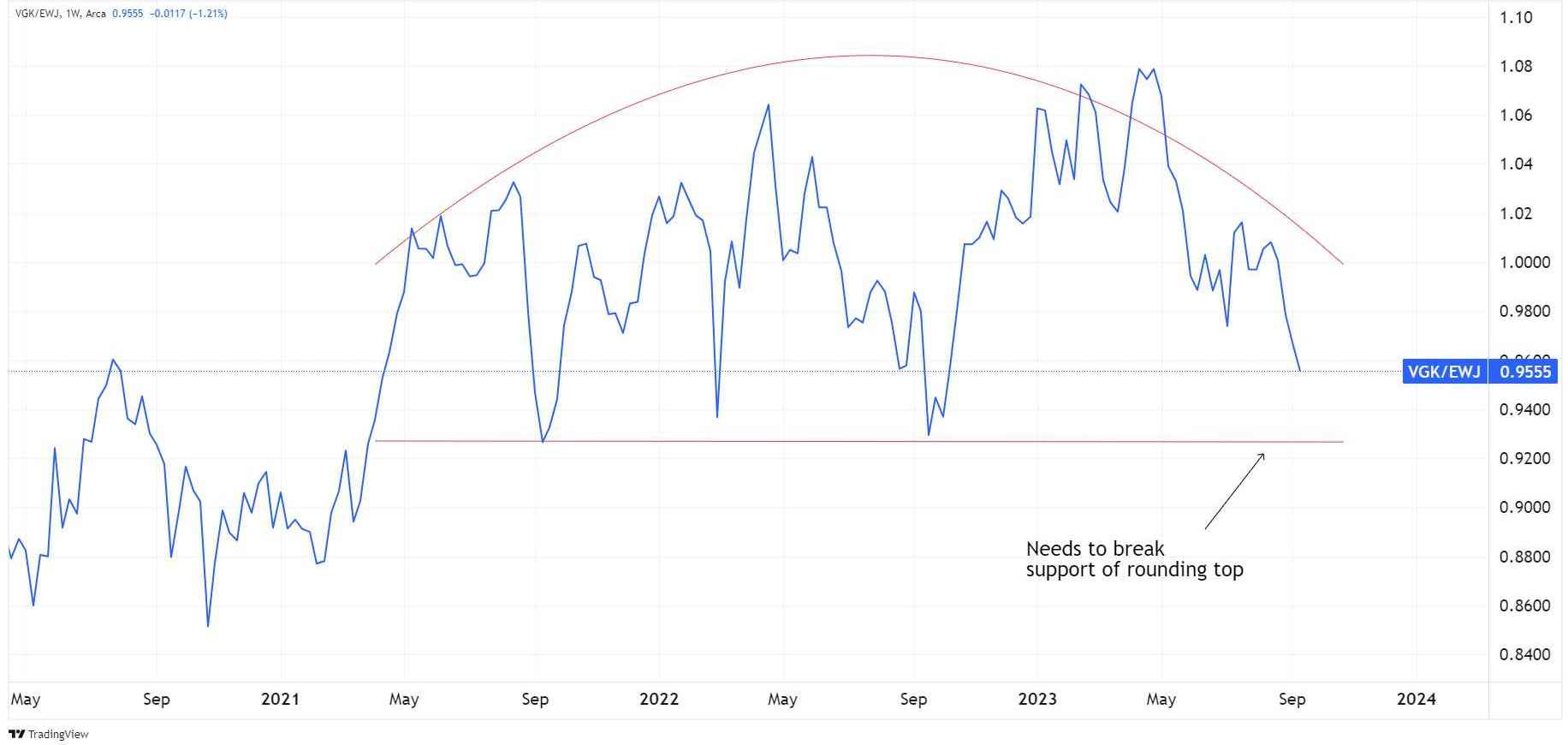

Amidst this ever-changing panorama, our focus this week turns to the ratio that has underpinned a compelling contest between European stocks (VGK) and Japanese stocks (EWJ) since the dawning of 2021. The battle was waged fiercely, akin to a relentless chess match where no clear victor emerged. The ratio chart, marked by its intricate undulations, bore testimony to the lack of a discernible trend and, by extension, a dominant outperformer.

Yet, a tantalizing prospect on the horizon bears the markings of a potential inflection point. A discerning eye may discern the emergence of a rounding top formation within this ratio chart. Per the annals of technical analysis, a rounding top is a pattern often associated with impending reversals. In the annals of financial history, it has proven to be a harbinger of profound shifts in market dynamics.

Should the ratio succumb to the inexorable gravitational pull of this rounding top formation and break below its support, it could portend the commencement of a new epoch. In this period, Japanese equities ascend the throne of outperformance over their European counterparts.

This potential transformation, wrought from the intricate dance of market forces, is not to be taken lightly. It invites us to ponder the complex interplay of factors where currency dynamics, economic fundamentals, and investor sentiment converge. As a linchpin in this narrative, the Japanese Yen can act as a catalyst, either perpetuating or quelling the rising tide of Japanese equities.

Investors would be wise to maintain a vigilant posture as we stand at the precipice of this prospective shift in market dynamics. The financial world remains a realm of perpetual perplexity, where opportunities arise from the most unexpected corners. The ratio between European and Japanese stocks is one thread in the intricate tapestry of global finance, where the weave of fortunes is as elusive as it is captivating. In such times, the astute investor is well-served by a steady hand, a discerning eye, and a penchant for navigating the labyrinthine pathways of market trends with grace and understanding.