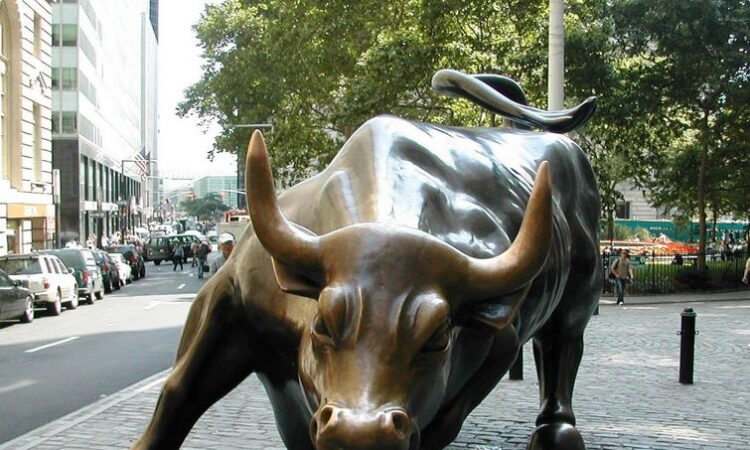

The new bull market in stocks has begun as history shows the bear narrative is coming apart, Fundstrat says

-

The new bull market in stocks has begun, according to Fundstrat’s Tom Lee.

-

Lee pointed to waning volatility stemming from SVB and other bullish market signals.

-

He’s made the case for the S&P 500 to rally at least 20% this year, with a 4% gain coming in April.

A new bull market in stocks has taken off, and history shows the bear narrative is falling apart, according to Fundstrat’s head of research Tom Lee.

In a note on Friday, Lee pointed to the strong gains the S&P 500 in recent months, with the benchmark stock index up 5.5% over the past quarter. Stocks were up a similar amount the previous period, surging 7% in the last quarter of 2022.

That’s a strong signal that equities have entered a new bull market, Lee said, as stocks have historically never been in a secular bear market after two straight quarters of gains. He predicted the rally would continue to run throughout April, taking the S&P 500 higher by 4%. Previously, he forecasted the S&P 500 would gain at least 20% in total this year.

“Two consecutive quarters of gains validate the start of a new bull market. This only solidifies out view that 10/12/22 was the bear market low and we are 6 months into a bull market,” Lee said in a note on Friday.

The winning quarter for the stock market comes despite a month of turmoil in March, with early-year gains nearly erased by the collapse of Silicon Valley Bank and the fear of a blooming financial crisis.

But volatility stemming from SVB has ebbed as banks begin to regain their footing, Lee said, which suggests the turmoil isn’t going to balloon into a full-blown crisis.

The bank’s collapse has also ramped up pressure on the Federal Reserve to pull back on rate hikes, another bullish development for stocks. Central bankers hiked interest rates aggressively last year to control inflation, a move that experts warned could push the economy into recession and sent stocks 20% lower in 2022.

A pause or cut by the Fed could fuel more stock gains, and a potential rally could be supported by a handful of bullish market indicators. Lee previously noted that stocks were flashing a bullish trifecta of signals in January, which historically indicate a year of strong gains ahead.

Lee has been bullish on stocks for months, keeping up calls for a big rally even in the face of the S&P 500’s brutal 20% decline in 2022. His view of a strong year for stocks runs contrary to other market commentators, who have warned of an impending recession and a looming plunge coming for equities.

Read the original article on Business Insider