|

| This week’s gainers and losers |

|

Gainers: Is Polestar automotive, the Swedish electric vehicle manufacturer, benefiting from Tesla’s recent rebound? Despite the recall of 66 vehicles in the United States, the stock gained 11.3% over the week.

After a difficult period on the stock market, Madrigal pharmaceuticals is riding on the success of its Phase 3 study of its drug for NASH, a liver disease, and has secured financing. The group is also attracting interest from potential buyers. +8.4%

It’s been a good season for toy maker Mattel, which is benefiting from a strong product line and strong sales of its Hot Wheels brand. Investors are also betting on the release of the Barbie movie in 2023, which should provide strong returns. +6.4% First Quantum Minerals (+5%): The mining company says that its Cobre Panama mine is operating normally and that it has resumed talks with the government of Panama to resolve a dispute over the long-term future of the mine.

Chinese authorities granted licenses to 128 new video games this week, pushing up the shares of Tencent and other publishers. +4.1% for the Chinese giant. Losers:

Moderna (-10%): A tough week for the American laboratory, which suffered intense profit taking after a rebound of nearly 70% since October.

Nio (-9%): Nio has revised downwards its vehicle delivery forecasts for the fourth quarter, a bad momentum that brings the Chinese group’s prices to its lowest levels of the year.

AMC Entertainment (-8.5%): The movie theater company plans to raise $110 million in a preferred stock offering to reduce its debt at the highest interest rates.

Erie Indemnity Company (-9.8%): The insurance company is giving up ground this week after announcing management changes. Julie Pelkowski was named CFO and Sean Dugan was named Vice President.

Chipmakers are under pressure. Demand for electronic gadgets is sagging, chip inventories are swelling and pushing manufacturers to cut production, costs and labor. Nvidia is down 5.5%.

|

|

| Commodities |

|

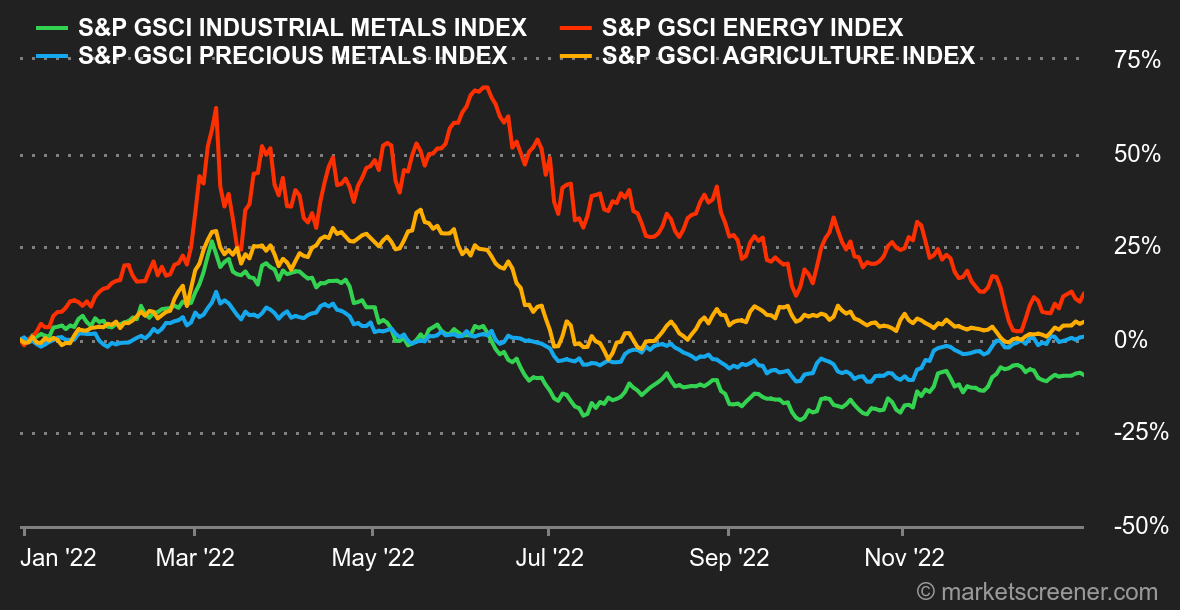

Energy: Oil prices end the year on a stable note. Russia will prohibit from February 1 the sale of its oil to foreign countries that use the cap on the price of Russian black gold, set in early December at $60 per barrel by the European Union. In fact, the EU has already anticipated a reduction of its dependence on Russian oil, so the impact of this decision is not significant and the market knows it. In terms of prices, North Sea Brent is trading around USD 83.50 while US WTI is trading at USD 78.40 per barrel. Due to the exceptionally mild temperatures in Europe, the price of natural gas has fallen back to 81 EUR/MWh for the European reference.

Metals: Base metals were little changed this week, ending a difficult year. The evolution of copper price bears witness to this, as the so-called barometer of the world economy has lost nearly 13% this year. The reasons for this debacle? The economic health of China, which is struggling to restart its economy and boost its industrial production. Nickel is the only commodity that has performed spectacularly well, rising 36% to USD 30,000 per ton. Agricultural products: As far as soft commodities are concerned, wheat and corn continue to rise in Chicago at 775 and 680 cents per bushel respectively. |

|

| Macroeconomics |

|

Atmosphere: It is not particularly relaxed. The contraction of real estate sales in the United States initially caused concern among investors before the latest employment data in the United States reassured them. Some observers see this as a sign that the US economy is slowing down, which would obviously be good for investors, who are extremely wary of central banks being hawkish for too long.

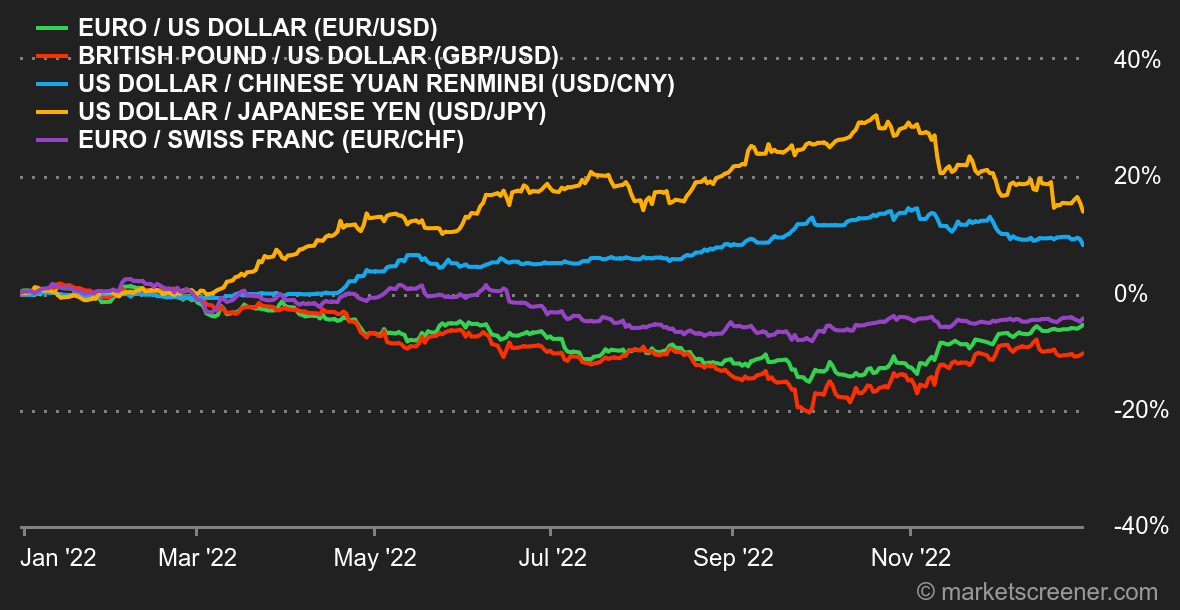

Currency: No major movement apart from the collapse of the ruble against the US dollar. The Russian currency is approaching the USD 70 mark, affected by fears about the impact of an oil embargo and a cap on hydrocarbon prices. Rates: Bond yields froze this week. The U.S. 10-year stabilized at 3.85%, as did the German Bund and the French OAT at 2.51% and 3.05% respectively. The yield curve remains inverted with the US 5-year peaking at 3.97%. In short, nothing new on the horizon, investors are still betting on a recession and have difficulty agreeing on the rate peak envisaged by the Fed. Crypto-currencies: Unsurprisingly, this week has been relatively quiet in the digital asset market with bitcoin hovering around the $16,500 mark, down 2.20% since Monday, at the time of writing. For the first time in its short history, bitcoin is expected to post four quarterly closes in the red in 2022, unless a miracle happens in the next 24 hours. The cryptocurrency market leader will have shed 62% of its valuation by 2022, falling from $46,000 at the start of the year to $16,500. Meanwhile, the total valuation of all digital assets has fallen from $2.2 trillion to $750 billion, down 66% this year. Calendar: It’s going to get busy next week, with manufacturing PMIs in Europe (Monday) and the US (Tuesday). On Wednesday, the ISM Manufacturing PMI, the JOLTS job openings survey and the Fed minutes. On Thursday, the ADP report on U.S. employment will set the pace for the session, along with weekly unemployment benefit registrations. Finally, Friday will be busy with inflation in Europe, non-farm payrolls in the United States and the ISM services report. |

|

|

| Things to read this week | ||||||

|

| *The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

MarketScreener.com 2022