The bear market in stocks has officially ended and a new bull market has kicked off. Here’s why investors can expect more gains ahead.

-

A new bull market has arrived on Wall Street after the S&P 500 rallied 20% from its October low.

-

The rally ended what turned into the longest bear market since 1948, when stocks fell 25%.

-

A resilient economy and solid corporate earnings could drive further gains in the stock market.

The longest bear market since 1948 is officially over after the S&P 500 closed above 4,292 on Thursday, representing a 20% rally from its October 12 closing low of 3,577.

The threshold was reached on the back of better-than-feared corporate earnings, a resilient economy and job market, and the expectation that the Federal Reserve is about to pause its aggressive cycle of hiking interest rates.

It’s those three same factors that could drive more upside in the stock market going forward, especially as Wall Street analysts start to wake up to the fact that things might not be as bad as some expected at the start of 2023. Expectations of a recession have been pushed out to 2024 and estimates for corporate earnings results being raised.

Softening inflation is also helping the outlook, as a continued drop would give the Fed some breathing room to stop hiking interest rates and potentially pause at its policy meeting next week.

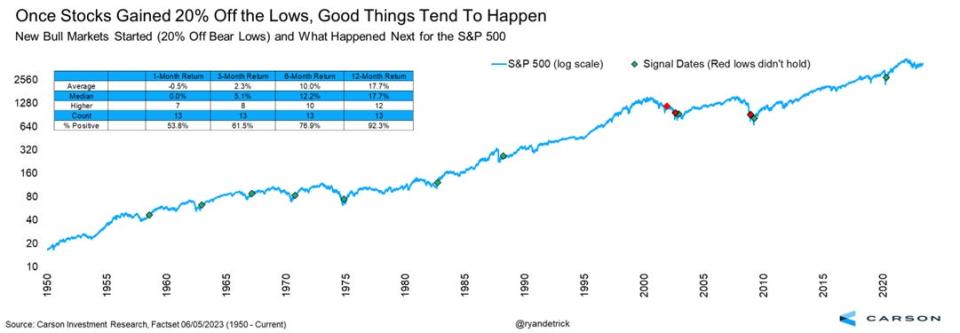

According to Carson Group’s chief market strategist Ryan Detrick, it wouldn’t be out of the ordinary for stocks to continue their rally after cementing a new bull market.

Since 1950, Detrick found there have been 13 times when stocks rallied 20% off their 52-week low, and 12 of those times resulted in higher stock prices 12-months later, resulting in a win ratio of 92% and an average S&P 500 gain of 17.7%. Additionally, in 10 of those 13 times, the lows in stocks were in the rear-view mirror.

“The only times it didn’t work? Twice during the tech bubble implosion and once during the Great Financial Crisis. In other words, some of the truly worst times to be invested in stocks,” Detrick said earlier this week.

And it doesn’t hurt that volatility has been crushed on Wall Street, with the Cboe Volatility Index, known as the VIX, essentially telegraphing that the high-volatility regime of 2022 has transitioned to a low-volatility regime more in line with prior bull markets seen from 2014-2018.

Finally, many investors are not positioned for a bull rally in stocks, and to get ready for a continued rally they’d have to unwind short positions and buy stocks, which could push prices even higher.

According to Ben Emons of NewEdge Wealth, stock market short positions “are at even more dramatic levels than during the Great Financial Crisis” while the the amount of cash in money market funds “has swollen.”

It’s those two factors that represent “dry tinder” for a potential melt up that could extend the current bull market rally, according to Emons.

Read the original article on Business Insider