If you think 2022 has been a trying year for Tesla (TSLA) with the stock down 65%, buckle up. The global EV giant faces different dynamics in the two megamarkets it serves, but in both cases they add up to sizable challenges for Tesla in 2023.

X

The two megamarkets for Tesla are North America and everywhere else. Throughout North America, EV competition remains relatively light. And in the U.S., new EV credits should bolster Tesla demand in 2023.

But it’s a different picture in the rest of the world. China EV subsidies end Dec. 31, and several European countries also are cutting or scrapping subsidies. At the same time, competition is ramping up across Eurasia, especially in China.

These two broad markets do share one thing: A weak economy in the new year will weigh on EV sales worldwide. Tesla’s pricey offerings are particularly vulnerable to a cool-down.

“The brakes are screeching on EV demand,” Morgan Stanley analyst Adam Jonas wrote Dec. 14. “Within autos, we believe the shift in the balance of supply/demand for EVs has the potential to take investors by surprise.”

Will Tesla Cut Prices?

Jonas and several other analysts see Tesla price cuts in the coming year, picking up from outright cuts or other discounts in late 2022.

A drop in Tesla’s global average selling prices to around $50,000 in 2023 from $53,500 in Q3 2022, “does not appear implausible,” Bernstein analyst Toni Sacconaghi recently wrote.

These factors, along with concerns about CEO Elon Musk’s focus since his $44 billion Twitter takeover, have sent Tesla stock plunging as 2022 winds down.

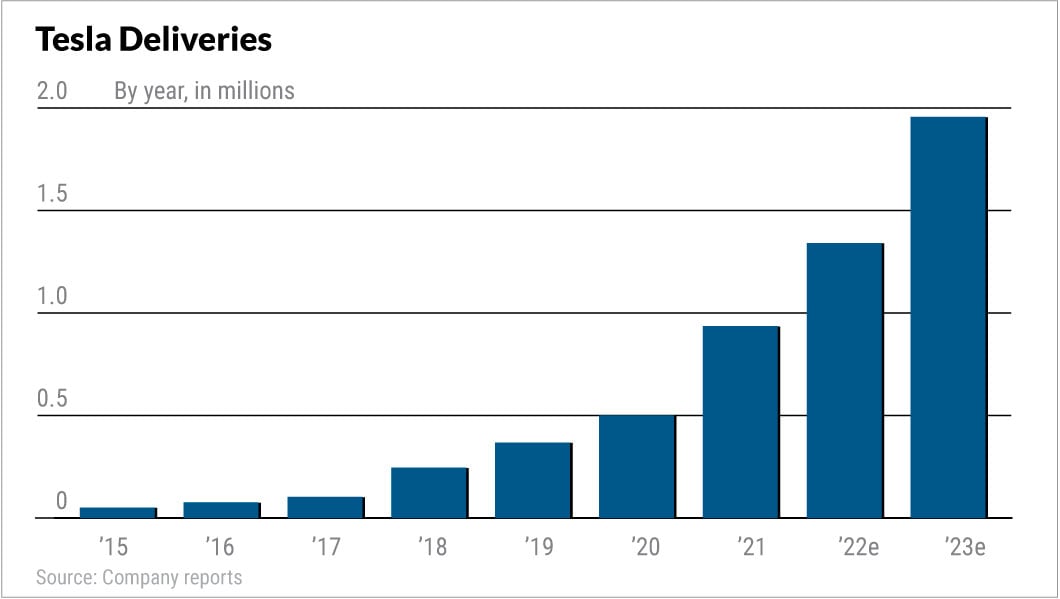

While sales and profits continue to grow at a pace many companies could only dream of, they are slowing. Wall Street forecasts 2022 full-year earnings advancing 80% to $4.07 per share, after surging 202% in 2021. Sales should jump 55% to $83.3 billion, down from a 71% gain in 2021.

Meanwhile in 2023, analysts expect Tesla earnings per share to grow a cooler 40% to $5.66, with sales up 42% to $118.2 billion. That’s a strong pace, but the era of triple-digit growth and idea of unlimited demand that long fueled Tesla stock may be over. Meanwhile, the company faces risks to the downside.

Tesla Stock: Global EV Giant

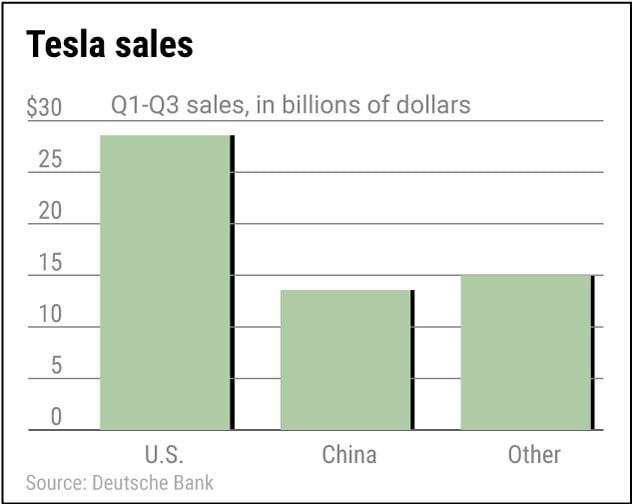

Tesla has major sales in North America, Europe and China. It has notable business in Korea, Japan, Australia and some other Asian markets. The company builds its cars at plants in Fremont, Calif.; Austin, Texas; Shanghai; and Berlin.

Tesla remains the world’s largest maker of fully electric battery EVs, with a commanding BEV lead in North America. But China EV giant BYD (BYDDF), already far above Tesla in BEV and plug-in hybrid (PHEV) sales combined, will likely overtake its U.S. rival in global BEV deliveries in 2023.

For now, Tesla remains the most profitable EV maker, due to its high vehicle prices.

“While we see 2023 as a challenging year for the EV market categorically, we believe Tesla’s gap to competition can widen,” Morgan Stanley’s Jonas has said.

Tesla 2023 U.S. Market

Tesla remains the dominant EV maker at home. Through the first nine months in 2022, 65% of the 525,000 registered EVs in the U.S. were Tesla vehicles, according to data released in November by S&P Global Mobility.

The original Fremont plant is bursting at the tent seams. Fremont makes the Model 3 and Model Y, as well as the luxury Model S sedan and Model X SUV.

The Fremont factory can produce up to 550,000 Model 3 and Model Y vehicles a year, according to Tesla. It also has capacity to build up to 100,000 Model S and Model X vehicles.

The newer Austin site has a planned capacity of 250,000 vehicles. Tesla Austin is currently ramping up Model Y output, which should help profit margins as the plant nears capacity.

Austin is set to make the Cybertruck when that vehicle comes online, perhaps in mid- to late 2023. But the oft-delayed truck isn’t likely to be a volume contributor next year.

Tesla is also finalizing plans to build an auto assembly plant in northeastern Mexico, Bloomberg reported this month.

What’s Tesla Competition In U.S.?

Tesla’s U.S. prowess is unquestioned. Currently, General Motors is producing the GM Bolt and Bolt EUV in decent numbers. But in price and features, these are sub-Tesla EVs. So is the Volkswagen ID.4, now produced in Tennessee.

The Ford Mustang Mach-E, Hyundai Ioniq 5 and Kia EV6 are intriguing crossover rivals to the Model Y, but overall volumes are still fairly light.

Ford Mach-E production is set to ramp up in 2023, while the moderately priced Fisker Ocean SUV will enter the market. By late 2023, General Motors aims to have several EVs with its new Ultium batteries on the market.

Ford is also looking to expand production of the all electric F-150 Lightning to an annual run rate of 150,000 units by fall 2023. Through the end of November, the company sold 13,258 F-150 Lightning units. Multiple price hikes have pushed the entry-level Lightning price to nearly $56,000, up 40% vs. the original $39,974. That reflects the Lightning’s popularity, but also its scarcity and high costs for batteries.

The bottom line is that volume EV production, especially of head-to-head rivals to Tesla vehicles, may not come until 2024 or later.

But overall competition to win over American car buyers will heat up. Total U.S. auto production should pick up in 2023 as chip shortages and other supply chain woes fade. Prices of used cars, including Tesla EVs, are coming down.

Tesla U.S. EV Credits

Still, expectations are high that Tesla sales will rise significantly in the U.S. next year.

Tesla should get a boost in 2023 from new EV tax credits of up to $7,500 per vehicle from the Inflation Reduction Act (IRA). Income and vehicle price caps, however, could limit Tesla vehicle and buyer eligibility.

The EV credits limit eligible sedans to prices of $55,000 or less, with pickup trucks and SUVs capped at $80,000.

Tesla will likely make “permanent (price) cuts in the U.S. to qualify for IRA rebates,” Bernstein’s Sacconaghi wrote.

The EV credits only apply to vehicles assembled in North America. That excludes imports such as the Ioniq 5 and EV6.

With EV credits looming, many would-be Tesla owners have delayed purchases or taking delivery until 2023. Tesla on Dec. 21 began offering a $7,500 credit on Model 3 and Model Y deliveries in the U.S. before the year-end. That’s up from $3,750 at the start of the month. The EV giant also is offering free Supercharger miles as another incentive.

Rest Of The World

Elsewhere, Tesla faces other challenges. China, Europe and other markets outside North America have many differences, but for Tesla, they’re one big pot for two production hubs.

Elsewhere, Tesla faces other challenges. China, Europe and other markets outside North America have many differences, but for Tesla, they’re one big pot for two production hubs.

Shanghai, already the biggest Tesla factory, got a big capacity expansion in Q3. The newer Berlin-area plant, meanwhile, has been picking up production. Shanghai makes the Model 3 and Y, while Berlin only produces the Model Y for now.

While China is a huge Tesla market for local sales, Shanghai is also the EV giant’s export hub. Tesla ships some Model Y and many Model 3 vehicles from China to Europe, as well as to markets such as Japan, South Korea, Australia and New Zealand.

As the Berlin plant ramps up, that will help boost profit margins, as in Austin. However, that benefit could be offset if Berlin’s higher output spurs production cuts in Shanghai — or price cuts in the Eurasian megamarket.

Why doesn’t Tesla ship cars to the U.S. from overseas plants? Tesla exports from Shanghai to the U.S. would not be profitable due to a 27.5% tariff on Chinese-made autos. Theoretically, Berlin could export Model Y vehicles to the U.S. But any foreign-made Tesla EVs would not be eligible for the new U.S. tax credits.

Tesla China Demand

So what’s the demand forecast? Tesla is famously coy about geographic sales details. But global demand is clearly one of the question marks for 2023.

Shanghai’s big capacity expansion quickly raised questions about whether demand could keep up. That’s been a major factor behind Tesla stock’s poor performance late in 2022.

China backlogs and wait times have essentially been at zero since September.

China’s economy is struggling. After “zero-Covid” stifled the economy for much of 2022, a massive wave of infections as policies quickly ease could roil economic activity to start the new year.

Tesla is also facing competition in China from rivals BYD (BYDDF), Li Auto (LI) and Nio (NIO), which are seeing sales surge as they roll out new model lines. Vehicles including the BYD Seal, Nio ET5 and other EVs are taking on the popular Tesla Model 3.

The higher-margin Model Y faces relatively less competition in China, but that could change in 2023. BYD, Nio, Li Auto, XPeng (XPEV), Zeekr and others are looking to move into Tesla’s affordable luxury space. Meanwhile, the Tesla Model 3 and Y are starting to age.

Tesla already cut Model 3 and Model Y prices in China on Oct. 24 by as much as 9%, followed by sizable year-end incentives.

Even with China EV subsidies of 11,088 yuan ($1,593) set to end Dec. 31, the EV giant’s local China sales have faded in December. That raises the prospect of a tough year ahead for Tesla there.

Tesla Europe Demand

In Europe, the dynamics seem more favorable, at least on the surface. Tesla deliveries in Europe are tracking for a record in the fourth quarter. The company is ending 2022 as the No. 2 seller of all-electric vehicles in the region, behind only Volkswagen.

But wait times have shrunk amid other signs that Q4’s stepped-up deliveries are drawing down Tesla’s European backlogs. To drive year-end sales, Tesla is offering sizable discounts in the U.K. and free Supercharger miles in Europe.

“In addition to general economic weakness in Europe,” Bernstein’s Sacconaghi wrote, “Tesla’s lead times on its cars in Europe have been shortening, pointing to slowing demand and erosion of backlog, though not as pronounced as in the U.S. and China.”

Permanent Tesla price cuts in Europe are likely, he says.

Tesla’s Changing Market Dynamic

EV subsidies also are changing throughout Europe. Germany plans to reduce EV subsidies as of Jan. 1, with subsidies for EVs priced at 40,000 euros ($42,620) or above falling to 3,000 euros ($3,196) from 5,000 euros. Norway is ending subsidies. Sweden has just ended subsidies, and U.K. subsidies are winding down.

France is increasing EV subsidies for lower-income buyers, but trimming subsidies for other buyers.

Tesla already introduced a less-expensive Model Y SR in Europe at the end of August.

Piper Sandler’s Alex Potter said Tesla could feasibly run out of European buyers in the $50,000-plus price range “just as localized production begins ramping in Europe, thereby reducing demand for exports” from Shanghai.

“The problem is, with a shaky macro and ongoing COVID disruptions, it’s possible that Tesla may become a victim of its own success,” Potter wrote Dec. 8.

Other Tesla EV Markets

Other key markets for Tesla include Japan, South Korea, Australia, New Zealand and Israel. These markets are doing relatively well, but they represent just a fraction of Tesla’s sales in China, Europe and North America.

In the third quarter, U.S. sales made up 48% of Tesla’s total revenue, according to the company’s SEC filings. China accounted for about 24% of Q3 revenue. The rest of the world, including Europe, made up another 28%.

In 2021, U.S. sales were 44% of Tesla’s total revenue, according to FactSet. China was second with 25% of Tesla’s total revenue coming from the country. Europe sales made up around 7% of 2021 revenues.

Tesla will enter the Thai auto market in 2023, offering a test case for middle-income markets in Southeast Asia and Latin America.

Tesla Earnings And Deliveries

Fourth-quarter Tesla deliveries should reach 431,000, according to the analyst consensus. That would mean roughly 1.34 million for the full year, up 43% from 2021. Analysts are also projecting Tesla deliveries will swell 46% to 1.96 million vehicles in 2023, according to FactSet.

Even with headwinds and macroeconomic challenges, Tesla Q4 deliveries should easily surpass Q3’s record of 343,830 EVs. That was up 42% vs. a year earlier but missed analysts’ estimates.

If demand were red-hot, Tesla deliveries could have easily topped 450,000 in Q4 given its production capacity and existing inventory. Instead, Tesla sales are expected to lag those levels considerably, with hefty discounts needed in its main markets.

Analysts expect Tesla earnings per share to grow 53% to $1.30 in Q4. Revenue should swell 51% to $26.6 billion, roughly in line with the past three quarters.

But the forecasts for next year call for slower earnings and sales growth ahead.

Analysts are betting on robust Tesla profits and deliveries, but the “unlimited demand” bull thesis has taken a blow.

Tesla Stock

Even in a bad year for the overall market and growth companies, the TSLA stock sell-off stands out.

Tesla stock has lost more than a third of its value just in December, plunging to a two-year low. Tesla shares have plunged 70% from the November 2021 peak, with most of that coming since late September amid demand concerns and Musk’s Twitter purchase.

Musk has sold $39 billion worth of Tesla stock since shares peaked in November 2021, including yet another batch of sales in mid-December. Big, longtime Tesla stock investors are increasingly critical of Musk, calling on the historically quiescent board of directors to take action or even pick a new CEO.

On Dec. 22, Musk pledged not to sell any more Tesla stock through at least 2023.

Tesla stock has had big sell-offs and long stretches of not advancing. TSLA stock may need months of time to repair, if not longer.

Tesla stock has a Composite Rating of 35 out of 99. It has a 6 Relative Strength Rating, an exclusive IBD Stock Checkup gauge for share price movement relative to all other stocks, putting it in the bottom 6%. The EPS Rating is 75.

However, despite the near-term risks and challenges facing Tesla in 2023, analysts generally remain optimistic about the EV giant.

“We continue to believe that Tesla is well-positioned for long-term top and bottom-line growth, given its leading position in the EV market,” Goldman Sachs analyst Mark Delaney wrote earlier this month.

Please follow Kit Norton on Twitter @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Top Funds Buy Into No. 1 Industry Leader Near Breakout With 364% Growth

Get An Edge In The Stock Market With IBD Digital

Tesla On Track For Worst Year Ever