Stocks were little changed Wednesday as traders looked to the end of a losing year and prepared for 2023.

The Dow Jones Industrial Average added 43 points, or 0.1%. The S&P 500 added 0.1% and the Nasdaq Composite hovered above the flat line.

Investors will look for insights into the state of the economy in manufacturing data from the Richmond Federal Reserve and pending home sales coming Wednesday morning. Market participants will be looking for numbers that can signal the economy is cooling, which they hope could indicate to the Fed that interest rate hikes can continue slowing.

Tuesday kicked off the start of a holiday-shortened trading week. The Dow rose 37.63 points, or 0.11%, to close at 33,241.56. The S&P 500 fell 0.40%.

The Nasdaq Composite shed nearly 1.4%, driven down by an 11% drop in Tesla stock after The Wall Street Journal reported that the electric vehicle maker would continue a weeklong production pause at a Shanghai facility. Tuesday marked the seventh straight day of losses for the stock.

It comes at the end of a tumultuous year for the electric-vehicle maker as owner Elon Musk executed a chaotic purchase of Twitter. Tesla’s share value is down 69% this year.

“A year ago, Musk was a hero and there was panic buying to the upside,” said Eric Jackson, founder of EMJ Capital, on “Closing Bell: Overtime.” “Right now … it’s panic selling.”

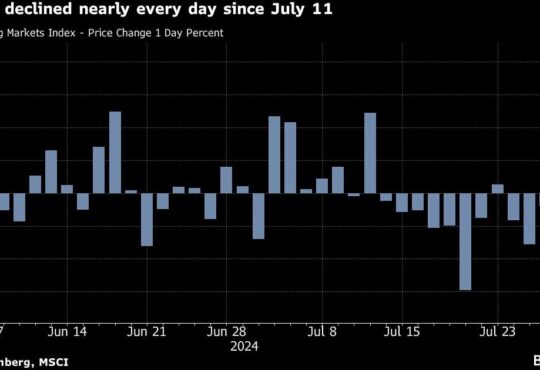

With three trading days left in 2022, the stock market is on track for its worst year since 2008. The Nasdaq has performed the worst of the three indexes, losing 33.8% this year as investors rotated out of growth stocks amid rising recession fears. The Dow and S&P 500 are on track to lose 8.5% and 19.7%, respectively.