The stock market’s mantra in 2023 might be `just follow the dollar’

Computer glitches notwithstanding, stocks on Tuesday are once again following the mantra of what’s good for the U.S. dollar is bad for equity prices.

The dollar is stronger and stocks are weaker, as per the recent trend. That was a point made in a report Monday by Morgan Stanley strategist Mike Wilson, noting “Many are pointing to a weaker dollar and China’s reopening as positive drivers.”

The idea there is that the “weaker dollar does provide some incremental relief on the earnings front,” (although Wilson says it’s limited.)

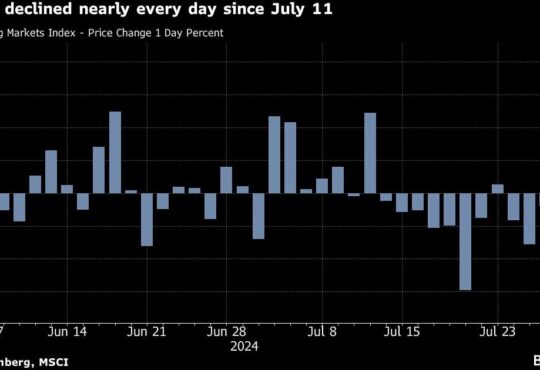

The trend in the dollar has been weaker so far in 2023, and the trend in stocks stronger. The Dollar Index (DXY) has fallen 10 days and risen on five, while the S&P 500 advanced on eight days and fell on 7.

Bearing in mind that the currency market has no fixed opening or closing time, nonetheless, on 10 of those 15 trading days (67%), stocks and the dollar were inversely correlated: when the dollar rallied, stocks sank and vice versa.

— Scott Schnipper

Dozens of NYSE-listed stocks briefly halted

Dozens of stocks listed on the New York Stock Exchange were halted Tuesday due to a technical issue.

The stocks showed significantly large moves as the market opened and lead to brief volatility halts.

Some of the impacted stocks included Verizon, AT&T, Nike and McDonald’s. many stocks resumed trading shortly after.

— Jesse Pound, Samantha Subin

Semi ETF on pace for best start to the year since 2001

The VanEck Semiconductor ETF is on track for its best start to the year since 2001, when it surged 20.43%.

Since the start of January, the SMH has risen more than 17%, driven by more than 20% gains from Nvidia, ASML, Taiwan Semiconductor Manufacturing, Micron and more.

The ETF is also headed for its best month since November, when it jumped 20.35%.

— Samantha Subin

Stocks open lower Tuesday

Stocks opened lower Tuesday as the major averages struggled to build on back-to-back gains.

The Dow Jones Industrial Average fell 166 points, or 0.5%. The S&P 500 slipped 0.6%, and Nasdaq Composite dropped 0.4%.

— Samantha Subin

Gold hits highest level since April

Gold futures hit a high of $1,943.8 Tuesday, the highest level since April. The precious metal rose amid expectations for a less-aggressive interest rate hike path from the Federal Reserve.

Gold miners have had a strong start of the year with the VanEck Gold Miners ETF up 13% year to date, led by Dundee Precious Metals, Equinox, Coeur Mining, which are all up more than 20% this month.

— Yun Li, Gina Francolla

Stocks making the biggest premarket moves

Here are some of the companies making the largest premarket moves:

Verizon — Verizon shares slipped 1.51% after the company posted mixed results for the 2022 fourth quarter. While earnings met analyst predictions, forward earnings fell short of a Refinitiv consensus estimate. .

Bed Bath & Beyond — The meme stock gained 5.78%, building on its dramatic start to the year, even as the retailer warns of a potential bankruptcy. Year to date, Bed Bath & Beyond shares are up 17.1%.

Lockheed Martin — Lockheed Martin shares gained 1.52% after the company posted latest quarterly results. The defense company’s revenue came in at $18.99 billion, topping a Refinitiv forecast of $18.27 billion. Lockheed’s earnings per share also topped expectations.

For more big movers, check out our full list here.

— Hakyung Kim

Lyft gains 4% following KeyBanc upgrade

Lyft advanced more than 4% before the bell on the back of an upgrade from KeyBanc.

Analyst Justin Patterson upgraded Lyft to overweight from sector weight, noting the stock should be helped by cost-cutting measures and stabilizing demand. He also set a price target of $24, which would reflect a 55.7% upside from where the stock ended Monday’s session.

CNBC Pro subscribers can click here to read more about why Patterson anticipates the stock could rally.

Verizon falls on earnings outlook

Verizon shares fell more than 2% before the bell even after it met analysts expectations for the recent quarter.

The telecom giant shared a disappointing full-year adjusted earnings outlook, saying it expects EPS to come in between $4.55 and 4.85 excluding items. FactSet estimates called for EPS of $4.96.

Verizon also reported 41,000 net additions within its wireless retail postpaid business.

— Samantha Subin

3M falls on guidance cut, earnings miss

Shares of 3M declined more than 5% before the bell after the company shared disappointing guidance for the full year and posted an earnings miss.

The industrial conglomerate beats Wall Street’s revenue estimates for the recent quarter, although earnings fell short of expectations. The company reported earnings of $2.28 a share on revenues of $8.08 billion. Analysts had expected earnings of $2.36 a share on revenues of $8.04 billion, according to Refinitiv.

For 2023, 3M said it anticipates a 2% to 6% decline in sales and and earnings of $8.50 to $9.00 a share.

3M also said it’s cutting 2,500 global manufacturing jobs.

3M shares fall on guidance cut

GE shares rise on better-than-expected earnings

General Electric traded more than 2% higher in the premarket after the industrial giant posted quarterly results that beat analyst expectations.

GE earned $1.24 per share on revenue of $21.79 billion for the previous quarter. Analysts expected earnings of $1.13 per share on revenue of $21.59 billion, according to Refinitiv.

“2022 marked the beginning of a new era for GE. We successfully launched GE HealthCare, delivered strong financial performance, made significant operational progress, and continued our steadfast commitment to our customers. Thanks to the high-quality work of our team, GE ended the year with solid revenue growth and margin expansion,” CEO Larry Culp said in a statement.

— Fred Imbert

AMD falls after Bernstein downgrade

AMD shares slipped more than 2% after Bernstein downgraded the semiconductor manufacturer to market perform from outperform. The firm cited worsening personal computer market trends for the downgrade.

“It must be said that the PC environment has grown considerably worse since then,” Bernstein said in a note to client. “And our belief that AMD would prove relatively more immune to channel degradation proved unfortunately incorrect, and in recent months we have been growing more wary of potential PC dynamics.”

— Alex Harring

European markets flat as investors digest key PMIs

European markets were mixed on Tuesday with investors digesting the latest flash purchasing managers’ index data from the euro zone in January.

The pan-European Stoxx 600 index hovered fractionally above the flatline in early trade, with retail stocks adding 0.7% while oil and gas stocks fell 0.6%.

The S&P Global euro zone composite PMI came in at 50.2 in January, up from 49.3 in December and ahead of a consensus forecast of 49.8.

CNBC Pro: Goldman Sachs Asset Management singles out a corner of the U.S. market with ‘great opportunities’

A Goldman Sachs Asset Management strategist has named a segment of the market that could be poised for a comeback this year.

James Ashley, head of international market strategy at Goldman Sachs Asset Management, also pointed toward research that showed these types of companies tend to outperform when inflation is high but falling.

CNBC Pro subscribers can read more here.

— Ganesh Rao

Zions shares fall after earnings

Shares of Zions Bancorp fell more than 2% despite the regional bank beating earnings estimates for the fourth quarter. Zions reported $1.84 in earnings per share, above the $1.65 expected by analysts, according to StreetAccount. Net interest income also beat estimates.

Noninterest income was lower than expected, however, and deposits fell 13% year over year to $71.7 billion.

Shares of Zion gained 2.27% in regular trading on Monday before its earnings were released.

—Jesse Pound

Stocks need to notch this key level to potentially be considered rallying, Dawson says

Stocks rose on Monday, but aren’t quite high enough to be considered a true market rally, according to Cameron Dawson of NewEdge Wealth.

“We have to get through the most critical level of 4,100,” Dawson said on CNBC’s “Closing Bell: Overtime” on Monday. That’s because 4,100 is the S&P 500’s 65-day high.

The S&P 500 never hit the key moving level in 2022 because it was in a downtrend, Dawson said. If stocks break through this level, it may indicate that the rally has potential to move into a new bull market cycle.

Technicals and positioning can only get stocks so far, she added, before a fundamental shift is needed to really give stocks forward momentum.

“We’d need to see a change in fundamentals to really think this rally will continue,” she said.

She cautioned that stocks upside will likely stay capped until the Federal Reserve fully pivots and stimulates the U.S. economy again.

“It’s unlikely we can go back to pre-pandemic multiples without help from the Fed,” she said.

If stocks are able to rally and break the 65-day high, it would also likely lower the probability of the S&P 500 retesting its October lows, Dawson said.

—Carmen Reinicke

Stock futures open little changed

Futures opened little changed on Monday evening after solid gains for stocks during regular trading hours. There were no large cap earnings reports after the bell to spark major moves in the futures market.

— Jesse Pound

Nasdaq, chip stocks led the way on Monday

Stocks enjoyed a broad rally on Monday. Here’s a look at some of the key numbers from the trading session.

- The Dow gained 254 points, or 0.76%, to close at 33,629.56.

- The S&P 500 gained 47 points, or 1.19%, to close at 4,019.81.

- The Nasdaq Composite gained 224 points, or 2.01%, to close at 11,364.41.

- Nvidia had the largest impact on the Nasdaq, adding 36 points.

- The VanEck Semiconductor ETF (SMH) rose 4.72% for its best day since Nov. 30.

— Jesse Pound, Christopher Hayes