Stock Market LIVE: Sensex sheds 400 pts, Nifty around 17k; Wipro tanks; HCL up

US wholesale inflation rose 0.4% last month — more than expected. Meanwhile, in India, retail inflation rose to a five-month high of 7.41% in September mainly due to costlier food items. Inflation data hint that central banks have little incentive to slow down the pace of interest rate hikes.

Adani Transmission rating withdrawn at company request, S&P Says

S&P Global Ratings withdrew its rating for Adani Tranmission Ltd, ending an assessment of barely investment grade at the company’s request.

The withdrawal of the BBB- rating follows a restructuring at the company, part of the conglomerate of Gautam Adani, Asia’s richest man. The revamp didn’t weaken the protection for bondholders, S&P said.

The shift comes just a few weeks after a report by CreditSights, which called the group “deeply overleveraged.” The research firm later revised its label, though stuck to its main conclusion that the conglomerate, which owns India’s largest private-sector port and airport operator, has too much debt.

In a rebuttal to CreditSights, Adani Group termed the leverage ratios of its companies “healthy.”

A spokesman for Adani Group didn’t immediately comment when contacted by Bloomberg on Thursday to find out about the reasons for the withdrawal request. (Bloomberg)

Axis Securities earnings preview on Consumer Durables: Festive season to support growth amidst moderate recovery

The demand for Cables & Wires has been healthy across residential, industrial, and infrastructure segments. This coupled with an uptick in exports is expected to drive volume growth moving forward. Meanwhile, the pricing is expected to remain moderate given softening of commodity prices, especially copper. For ACs and Coolers, Q2 is a seasonally weak quarter, thus growth is expected to remain moderate. In the other Electric Consumer Durables, the demand for mid-premium and premium products continues to grow while demand for entry[1]level products remained subdued. The demand for lighting, water heaters, and fans, too, stood subdued during the quarter.

We would watch out for management commentaries on a) Channel inventory in the system given the softening of RM prices; b) the Impact of Rupee depreciation on margins; c) Market share gains vs. unorganized players (for Polycab India and Sheela Foam); d) Updates on production under the PLI schemes (for Dixon Technologies and Amber Enterprises). We would also closely monitor commentary on international subsidiaries and their performance (especially Symphony and Sheela Foam) as well as export opportunities going forward.

TOP PLAYS

Positive: Polycab India, Dixon Technologies

Negative: Symphony Ltd

India sees rise in Covid infections; active cases increase to 26,509

India reported a single-day rise of 2,786 new COVID-19 cases, taking the country’s tally of infections to 4,46,21,319, according to Union Health Ministry data updated on Thursday. This rise comes a day after the country reported 2,139 cases on 12 October.

The active cases in the country has increased to 26,509 from the earlier 26,292, it said. Active cases now comprise 0.06 per cent of the total infections, while the national COVID-19 recovery rate has increased to 98.76 per cent, the ministry said. (Read More)

TSMC Q3 profit jumps 80%, beats market expectations

Taiwanese chipmaker TSMC posted an 80% surge in third-quarter net profit on Thursday, Reuters calculations showed, buoyed by strong sales of its advanced chips despite a slowdown in the global chip industry because of economic headwinds.

Taiwan Semiconductor Manufacturing Co Ltd (TSMC) , the world’s largest contract chipmaker and a major Apple Inc supplier, saw net profit for the July-September period rise to T$280.9 billion ($8.81 billion) from T$156.3 billion a year earlier. (Reuters)

Rupee trades in narrow range against US dollar in opening trade

The rupee was trading in a narrow range against the US dollar in opening trade on Thursday, tracking a muted trend in domestic equities amid weak domestic macroeconomic data.

At the interbank foreign exchange, the rupee witnessed range-bound trading in early deals. It opened at 82.30 against the US dollar, then rose to 82.29, registering a gain of 4 paise over the last close.

It was moving in a tight range of 82.25 to 82.34 in the morning trade.

On Wednesday, the rupee fell by 12 paise to close at 82.33 against the US dollar. (PTI)

Reliance Securities recommendations on Wipro and HCL – BUY

Mitul Shah, Head of Research at Reliance Securities outlook on:

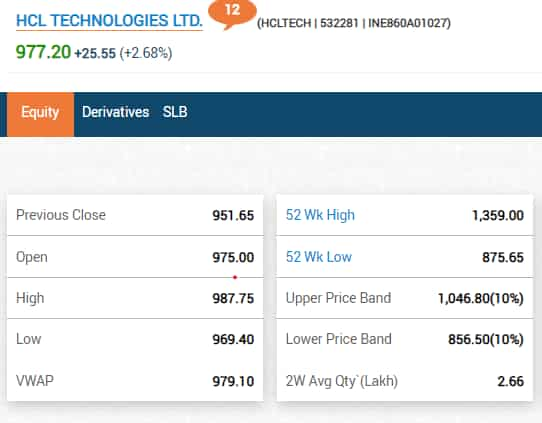

HCL Technologies: We believe that HCLT’s revenue growth momentum would continue going forward on the back of strong deal wins and all-around growth in IT space. Moreover, recent deal ramp up by large manufacturing client from Europe provides healthy cushion against any slowdown from the region. We estimate FY23E/FY24E EBIT margin of 18.3/19%. We expect HCLT to report a significant revenue growth, with 11% revenue CAGR over FY22-FY24E, driven by consistent transformation deal wins, an increasing focus on ER&D services and rising share of Mode 2 business. At CMP, HCLT trades at 17.3x/15x on FY23E/FY24E EPS. We believe that post 30% correction from peak, HCLT’s valuation is comfortable and gives decent potential upside, considering strong earnings growth. We upgrade HCLT to BUY from HOLD with the revised target price of Rs1,080 (vs. earlier Rs1,000), valuing the stock at an unrevised P/E multiple of 17x FY24E earnings.

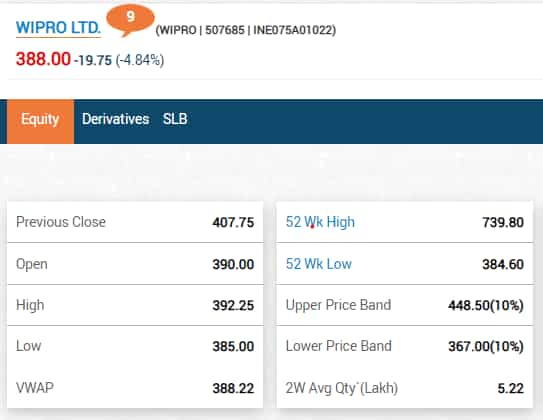

Wipro: We believe that IT Services would not remain immune to worsening global macros in terms of rising inflation, economic slowdown, currency headwinds and likely cut on spending. Therefore, we expect moderate revenue growth and margin pressure in FY24E. We cut our revenue/EPS estimates by 3%/5% for FY24E. However, WPRO’s deal wins remain stronger than peers and its revenue growth trajectory would remain in leader quadrant. We expect WPRO’s revenue to clock 10% (including acquisitions) CAGR over FY22-FY24E vs. 4% CAGR over FY18-FY21, driven by the recent large deal wins and focused efforts on prioritized sectors/geographies. In view of strong deal wins and attractive valuation, we retain our BUY recommendation with a revised target price of Rs455.

Gold rates today fall for fourth day in a row. Check latest prices

Gold prices remained weak today with MCX futures edging lower to ₹50,891 per 10 gram as the precious metal declined for the fourth straight day. Silver futures were flat at ₹57,335 per kg. Domestic gold rates have dropped over ₹1,000 in past four days. International gold prices were steady at $1,670.20 per ounce as traders remained cautious stance ahead of a key US inflation data scheduled later today. A stronger reading would be negative for gold, say analysts. Spot silver fell 0.6% to $18.95 per ounce. (Read More)

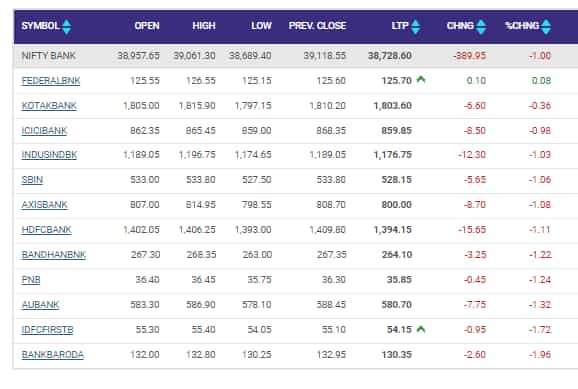

Bank index remain under pressure, almost all stocks in red

View Full Image

HCL Tech gains in today’s session after it announced its quarterly result

HCL Tech reported a 7.1% rise in its net profit for the quarter-ended September, at ₹3,489 crore versus ₹3,259 crore year-on-year. The IT major has also revised its revenue and Ebit guidance for FY23, at a time when the street is cautious on the IT sector’s medium-term outlook as companies may look to cut tech spends in case of a recession.

View Full Image

Oil prices jittery as market wary of demand risks

Oil prices struggled to find their footing in Asian trade on Thursday after easing in the previous session on the back of a weakening global demand outlook.

Brent crude futures dropped 7 cents, or 0.1%, to $92.38 a barrel by 0310 GMT. U.S. West Texas Intermediate crude was down 21 cents at $87.06 a barrel, or 0.2%.

Both OPEC and the U.S. Energy Department have cut their demand outlooks, while a flare-up in COVID-19 cases in China has sparked fresh demand concerns for the world’s top crude importing-country.

“This week has placed growth risks back into the spotlight for oil prices, as the initial enthusiasm over OPEC+ production cuts has proved to be short-lived and gains are seen fading off,” said Jun Rong Yeap, market strategist at IG. (Reuters)

Ashika Stock Broking on today’s market: Index most likely to hold the key support of 16700 in the near term

Tirthankar Das, technical & derivative analyst, retail, Ashika Stock Broking Ltd: On the technical front, Nifty formed a strong bullish candle yesterday following the long bearish candle the other day indicating presence of strong demand zone around the crucial support level of 16950-16970. Going ahead, it can be expected that the index to consolidate in the broader range of 17500-16700 amid stock specific action for a few sessions while for the Index to end its prolonged correction, it needs to provide a decisive close above 17350. Presently a trader needs to show patience and need to avoid trading aggressively in the market as the risk of a bare minimum correction of 38.2% of the entire rally from 15,183 to 18,096 comes around 16990 followed by 50% correction at 16650 remains. However amidst all the pessimism it can be expected that index is most likely to hold the key support of 16700 in the near term as it is confluence of 52 weeks EMA and the 50% retracement of June-August rally (15185-18070) at 16650. During the day index is likely to open on a subdued note tracking muted global cues. Post initial decline, one can expect the Nifty to hold the crucial 200dma at 16900-16950 however, formation of lower high- lower low signifies corrective bias. Hence, until and unless Index provides a decisive close above 17350, it would be a sell-on-rise market.

Infosys stock in focus as IT major to consider share buyback today

Infosys shares will be one of the stocks in focus today as the board of directors of the IT major is going to consider the buyback of shares today. Infosys had informed Indian stock market exchanges in this regard. The It major informed that the company board would consider the buyback of shares in its board meeting scheduled on 13th October 2022. (Read More)

Cryptocurrency prices today: Bitcoin, ether gain marginally. Check latest rates

Cryptocurrency prices today rose marginally with the world’s largest and most popular digital token Bitcoin trading almost flat with a positive bias at $19,088. The global crypto market cap today was below the $1 trillion mark, even as it was almost flat in the last 24 hours at $955 billion, as per CoinGecko. (Read More)

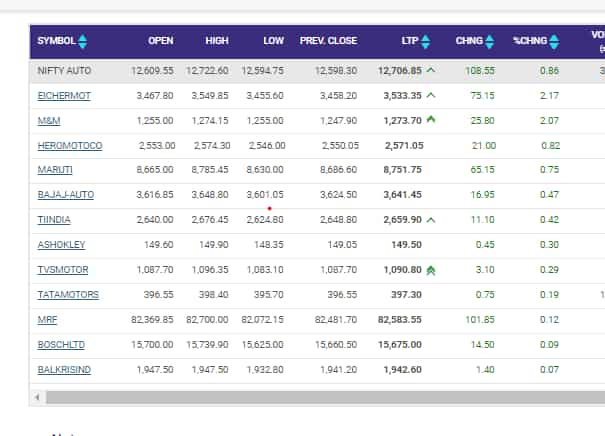

Auto Index shines, gains almost 1% in early trading

View Full Image

Corporate revenue to rise by 15 pc in July-Sept, profit likely to fall: Crisil Research

Revenues of Indian companies are expected to rise by 15 per cent in the second quarter and their profitability dip by 3 per cent, according to Crisil Market Intelligence & Analytics.

A combination of factors such as moderate price hikes and steadily rising volumes is expected to lift corporate revenue by 15 per cent on-year to ₹10.2 lakh crore in the second quarter (July-September) of this fiscal, the Crisil report said. Profitability, however, is seen declining 300 basis points due to elevated commodity prices. On a sequential basis, corporate revenue is likely to decline by 3 per cent.

The analysis by Crisil Research was done on the basis of 300 companies which excluded those in the financial services, and oil and gas sectors. (ANI)

Wipro tanks 5% in early trading after a disappointing quarterly result

Wipro Ltd reported 12.9% year-on-year growth in revenue in constant currency terms in the September quarter on Wednesday, while operational metrics declined. Its Q2 net profit dropped 9.6% to ₹2,649 crore from ₹2,930 crore in the year-ago.

View Full Image

Car-sharing platform Zoomcar to go public

Zoomcar Inc., an India-based car-sharing platform, has reached an agreement to go public via a merger with blank-check firm Innovative International Acquisition Corp., according to people familiar with the matter.

The company, whose headquarters are in Bangalore, operates in more than 50 cities in India, Indonesia, Vietnam and Egypt. (Read More)

Indices flat with a tilt towards the red at open. Wipro sheds 4% and HCL gains 2% after they their quarterly report

View Full Image

India will have a difficult task as G-20 chair, says IMF chief economist

India, which will hold the G-20 presidency next year, will have a difficult task as the group’s chair to bring countries together on some of the key challenges being faced by the world, Pierre-Olivier Gourinchas, the chief economist of the IMF, said on Wednesday.

“One of the challenges for the G-20 right now, as we’ve seen, is of course how to deal with geo-economic fragmentation. And geo-economy fragmentation is just reflecting the fact that we’ve seen enormous tensions following the Russian invasion of Ukraine,” Gourinchas told PTI in an interview. (PTI)

Union govt to give oil marketing companies ₹22,000 crore in LPG compensation

The Union cabinet on Wednesday approved a one-time payment of ₹22,000 crore to oil marketing companies (OMCs) to compensate them for their losses in selling cooking gas below cost. The grant will be distributed among Indian Oil Corp. Ltd (IOCL), Bharat Petroleum Corp. Ltd (BPCL) and Hindustan Petroleum Corp. Ltd (HPCL).

IOCL, BPCL and HPCL have suffered the worst quarterly losses in years as they absorbed record global crude prices. (Read More)

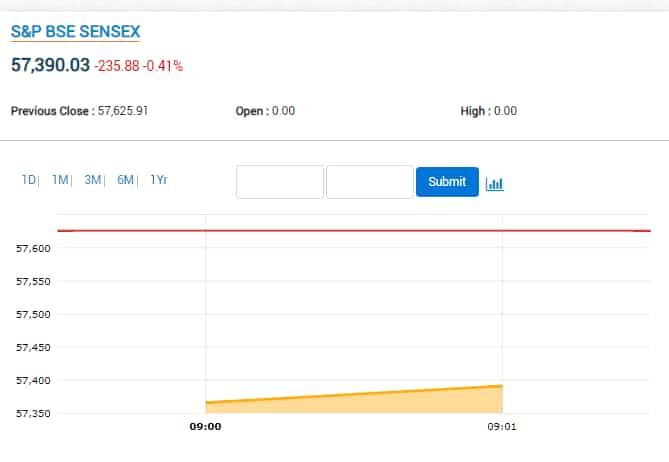

Sensex in red at the preopen session; Wipro, HCL, Adani Wilmar stocks are in focus today

View Full Image

INDIA BONDS-Bond yields may open higher as jump in inflation subdues sentiment

Indian government bond yields are expected to rise on Thursday, as the nation’s retail inflation print rose to its highest level in five months, which is expected to influence central bank’s interest rate trajectory.

The benchmark Indian 10-year government bond yield is seen in a 7.42%-7.47% band, a trader with a private bank said. The yield ended at 7.4348% on Wednesday.

“Though inflation was expected to rise as compared to previous month, a higher number raises concerns on how soon it could fall below the upper tolerance range of the Reserve Bank of India (RBI),” the trader said.

India’s annual retail inflation accelerated to a five-month high of 7.41% in September, as food prices surged, beating Reuters forecast of 7.3%. (Reuters)

Reliance Securities Stock in Focus: Supreme Industries

STOCK IN FOCUS

Supreme Industries (CMP 2,022)

We have our BUY rating on the stock with a Target Price of Rs2,265.

Intraday Picks

M&MFIN (PREVIOUS CLOSE: 207) BUY

For today’s trade, long position can be initiated in the range of Rs202- 200 for the target of Rs212 with a strict stop loss of Rs196.

ADANIPORTS (PREVIOUS CLOSE: 804) BUY

For today’s trade, long position can be initiated in the range of Rs799- 793 for the target of Rs834 with a strict stop loss of Rs782.

AUBANK (PREVIOUS CLOSE: 588) BUY

For today’s trade, long position can be initiated in the range of Rs585- 581 for the target of Rs604 with a strict stop loss of Rs572.

Budget will aim to sustain growth and check inflation: Nirmala Sitharaman

Union finance minister Nirmala Sitharaman on Tuesday said the Indian economy may grow around 7% in FY23, adding that the next Union budget will have to be “carefully structured” to sustain growth and contain inflation.

The statement follows a downward revision in growth by the International Monetary Fund to 6.8% in its latest World Economic Outlook report on Monday from 7.4% estimated earlier.

“So, it will have to again be a very carefully structured budget, in which growth momentum will have to be sustained,” the minister said at a fireside chat organized by the Brookings Institution in Washington DC. (Read More)

Stocks to Watch: Wipro, HCL, Adani Wilmar, Reliance Power, SAIL, Gretex Corporate Services, Dish TV, BHEL, PVR, Inox Leisure, Sterling and Wilson

Infosys, Mindtree, Angel One, Cyient and Anand Rathi Wealth will be in focus as they declare their September quarter earnings today. (Read More)

LIC sells over 2 pc stake in Power Grid for ₹3,079cr in 5 months

LIC has sold over 2 per cent of its holding in Power Grid Corporation over the past five months for ₹3,079.43 crore, the insurer said on Wednesday.

There is a decrease of 2.003 per cent in holding during the period from May 18, 2022 to October 11, 2022.

As per regulatory requirement by Sebi, listed companies have to disclose about change in shareholding of 2 per cent and above.

“Corporation’s shareholding in Power Grid Corporation has diluted from 36,99,02,170 to 23,01,82,028 equity shares decreasing its shareholding from 5.303 per cent to 3.3 per cent of the paid-up capital of the said company,” LIC said in a regulatory filing. (PTI)

India’s energy future is looking green, says report

India’s renewables sector is booming, with the country projected to add 35 to 40 gigawatts of renewable energy annually until 2030, enough to power up to 30 million more homes each year, a report said Thursday.

The Institute for Energy Economics and Financial Analysis estimated that India, the third largest energy-consuming country in the world, will reach 405 gigawatts of renewable energy capacity by 2030. It’s expected to surpass the government’s target of producing 50% of its electricity from non-fossil fuel sources by the end of the decade. (Read More)

Adani Wilmar expects Q2 revenue growth in low single digit amid fall in edible oil rates

Edible oil major Adani Wilmar on Wednesday said the company’s overall revenue in the July-September quarter will annually grow by low single-digit amid a fall in rates of edible oils.

Adani Wilmar markets its edible oils and other food items under the Fortune brand.

In a regulatory filing, the company shared a preliminary update on the standalone performance during the quarter ended September.

“Multiple macro challenges continued to impact the business in the quarter gone by owing to domestic and global cues, continued geo-political standoff, rising interest rates, slow uptick in the rural demand and delayed withdrawal of monsoon in major parts of India,” it said. (PTI)

Veranda Learning arm to acquire JK Shah Classes for ₹337.82 crore

Veranda Learning Solutions Limited has announced that it has signed a definitive agreement for the acquisition of equity shares of J. K. Shah Education Pvt Ltd through its wholly owned subsidiary, Veranda XL Learning Solutions Pvt Ltd.

The said transaction will be completed in two phases, with the first phase seeing the payment of 76% of the outstanding capital together for ₹337.82 crore. The entire transaction will be funded through a combination of Debt and Equity, Veranda Learning Solutions Limited said in a regulatory filing. (Read More)

Wipro rolls out 5-year salary plans for campus recruits

India’s fourth largest IT services company Wipro has rolled out a five-year plan for freshers detailing their salary structure, including annual increments and bonuses to ensure the new hires know what to expect. It is also trying to identify moonlighters, crosschecking provident fund details of employees and engaging with startups to weed them out.

“We communicated a very clear five-year plan from career and compensation perspective. In the communication in offer letters we said how their salary will progress over the next five years. There is a lot of surety given to them on what is going to happen including the deferred bonus over and above the hikes that will take place,” Saurabh Govil, chief human resources officer, Wipro, said in an interview. (Read More)

Rupee falls 12 paise to close at 82.33 against US dollar on fund outflows

The rupee fell by 12 paise to close at 82.33 against the US dollar on Wednesday due to sustained foreign fund outflows and a stronger dollar in the overseas markets.

Besides, risk aversion sentiment among investors ahead of the release of US Fed minutes and inflation data weighed on the local unit.

At the interbank foreign exchange market, the local currency opened lower at 82.32 and later fell further to 82.3750 against the American currency. It recovered some ground to close at 82.33, registering a decline of 12 paise over its previous close. (PTI)

Electronics Mart IPO: Share allotment soon. How to check application status

Announcement of share allotment for the public issue worth ₹500 crore may come any time soon. Those who have applied for the public offer are advised to check Electronics Mart IPO allotment status online by logging in at the BSE website or at the website of its official registrar. The official registrar of the IPO is KFin Technologies Limited.

For convenience, a bidder can login at direct BSE link — bseindia.com/investors/appli_check.aspx or direct KFintech link — kprism.kfintech.com/ipostatus and check their Electronics Mart IPO allotment status online. (Read More)

Infosys Q2 preview: Margins likely to improve, PAT may witness double-digit growth YoY

Infosys will be in focus on Thursday ahead of its Q2 results. The company will also announce a buyback plan and interim dividend for FY23 tomorrow. Infosys peers TCS, Wipro, and HCL Tech have already presented their earnings and it has been a broadly mixed bag. In Q2FY23, Infosys is likely to continue its revenue growth momentum while margins are expected to improve as wage hike shocks are behind now. However, Infosys’ attrition rate is expected to shoot further up. Growth guidance along with commentary on large deals among key monitorable. (Read More)

Retail inflation moves to 5-month high of 7.41% in Sep on costlier food items

Retail inflation rose to a five-month high of 7.41% in September mainly due to costlier food items, reason enough for the Reserve Bank to continue with its rate hike cycles it has resorted to since May 2022.

Inflation in the food basket rose to 8.60 per cent in September from 7.62 per cent in August.

It is for the ninth month in a row that retail inflation has remained above the Reserve Bank of India’s upper tolerance level of 6 per cent.

Official data released by National Statistical Office (NSO) on Wednesday showed that the retail inflation based on Consumer Price Index (CPI) was at 7.41% in September as against 7% in August.

In the year-ago month, it was at a comfortable level of 4.35%. (PTI)

Wall Street ends volatile day lower after Fed minutes, PPI

U.S. stocks ended a choppy session slightly lower on Wednesday after minutes from the last Federal Reserve meeting showed policymakers agreed they needed to maintain a more restrictive policy stance.

The September meeting minutes also showed many Fed officials stressed the cost of not doing enough to bring down inflation.

Recent market weakness has been tied in part to increasing fears among investors that aggressive rate hikes by the Fed could tip the world’s largest economy into a recession.

The Dow Jones Industrial Average fell 28.34 points, or 0.1%, to 29,210.85, the S&P 500 lost 11.81 points, or 0.33%, to 3,577.03 and the Nasdaq Composite dropped 9.09 points, or 0.09%, to 10,417.10. (Reuters)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!