Stock Market LIVE: Indices turn flat; Bajaj twin shine; Eicher, SBI Life lag

An increase in US jobless claims signalled some cooling in the economy. With central banks hiking interest rates to fight inflation, worries about global recession keep investors on their toes. Spiking cases of COVID-19 in China amidst easing pandemic-curbing restrictions has not helped the sentiment.

Noon Update: Indices pare morning gains and are trading flat now with PSU Bank and Metal shining, while other Bank indices, FMCG and Pharma struggling

View Full Image

Cipla EU to invest EUR15 mn in Ethris

Pharmaceutical firm Cipla on Friday announced that its wholly-owned UK subsidiary — Cipla EU — has signed definitive agreements for equity investment of EUR15 million in Ethris GmbH for the development of messenger RNA (mRNA)-based therapies.

German firm Ethris is a global leader in delivering mRNAs directly to the respiratory system including administration by inhalation.

According to a company statement shared with exchanges, the investment will facilitate a long-term strategic partnership between Cipla and Ethris for the development of messenger RNA (mRNA)-based therapies and fast-track Cipla’s participation in the mRNA space, enabling it to provide access to latest solutions developed by Ethris for the developing countries. (ANI)

Small-cap stocks mulling stock split raises ₹700 crore via NCD

IRB Infrastructures Ltd is one of those listed companies that will be in focus after ushering in 2023. The small-cap company has informed Indian bourses that its board of directors are going to consider and discuss a stock split in its upcoming board meeting scheduled on 4th January 2022. However, ahead of this board meeting, the real estate company has raised ₹700 crore from non-convertible debentures (NCD). The NCD has been issued on a private placement basis to eligible investors. (Read More)

Healthcare index is among the few indices that have shed in today’s session

View Full Image

Govt introduces National Geospatial Policy to promote startups, advanced tech

After liberalising the use of geospatial data under the draft geospatial data policy in February last year, the Ministry of Science and Technology on Wednesday notified the National Geospatial Policy, 2022.

Besides developing geospatial infrastructures, skills and knowledge, standards, and businesses, among others, the policy aims to develop high-resolution topographical survey and mapping, and a high-accuracy digital elevation model for the entire country by 2030. (Read More)

₹50 baking stock gives 50% return in YTD. Experts see 100% return in 2023

Banking stocks have delivered a stellar return to their shareholders in 2022. As the year 2022 is about to end and the whole world is set to usher in the new year 2023, stock market investors are busy scanning banking stocks that may given them stellar return or may be double their money in 2023. For such stock market investors, stock market experts have recommended Punjab National Bank (PNB) shares. They believe that banking stock may go up to ₹120 in 2023 as banking business and model is expected to remain intact in 2023 on a hawkish interest rate regime. (Read More)

CRISIL upgrades Inox Wind’s ratings on long-term, short-term bank facilities

Inox Wind on Friday said that CRISIL has upgraded its ratings on the long-term and short-term bank facilities and has revised its outlook from stable to positive.

CRISIL has upgraded its ratings from Crisil BBB to Crisil BBB (long-term rating), Crisil A3 to Crisil A2 (short-term ratings) and the outlook has been revised from stable to positive in relation to ratings of its banking facilities, Inox Wind Ltd said in a statement.

The rationale for upgrading Inox Wind’s outlook reflects CRISIL’s expectation of an improvement in business risk profile to be driven by higher revenue and cash accrual from the execution of auction-based orders and steps taken by the promoters during fiscal 2023 to reduce debt which has led to improvement in the financial profile, it stated.

Wind business has successfully raised ₹740 crore through an initial public offering and offer-for-sale of Inox Green Energy Services Ltd, it stated. (PTI)

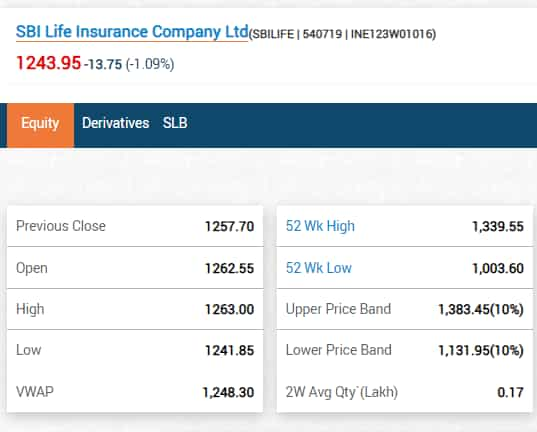

SBI Life puts a drag on the market as it sheds a per cent in today’s trading

View Full Image

Bikaji Foods shares hit upper circuit for 5th straight session, stock up 25% in 5 days

Shares of Bikaji Foods International surged to hit upper circuit for the fifth straight session on Friday by rising up to ₹446 apiece on the BSE in early deals. The stock has gained more than 25% in the past trading five sessions. Bikaji Foods shares made their market debut in November and have gained about 36% since listing.

Earlier this month, the company announced the acquisition of Hanuman Agrofood Private Limited. Its board on December 6 authorized officials to take necessary steps for availing the exercise of ‘right of conversion’ of 28,13,050 Compulsorily Convertible Cumulative Preference Shares into 28,13,050 equity shares held by the Company in its name in Hanuman Agrofood Private Limited. (Read More)

Rupee gains 16 paise to 82.71 against US dollar in early trade

The rupee appreciated 16 paise to 82.71 against the US dollar in early trade on Friday, tracking a firm trend in domestic equities.

Forex traders said sustained foreign fund outflows weighed on investor sentiments and restricted the appreciation bias.

At the interbank foreign exchange, the domestic unit opened at 82.77 against the dollar, then gained further ground to touch 82.71, registering a rise of 16 paise over its previous close.

On Thursday, the rupee consolidated in a narrow range and settled 7 paise lower at 82.87 against the US dollar.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.13 per cent to 103.97. (PTI)

Elin Electronics shares fall on market debut

Shares of Elin Electronics made their flat market debut on Friday with the stock listing at ₹244 apiece on the NSE, a discount of more than a per cent as compared to its IPO issue price of ₹247 per share. On the BSE, Elin Electronics shares started trading at ₹243 a piece.

The Initial Public Offer (IPO) of electronics manufacturing services company Elin Electronics was subscribed 3.09 times on the last day of subscription that was open from Tuesday, December 20 till Thursday, December 22, 2022. The public issue received bids for 4,39,67,400 shares against 1,42,09,386 shares on offer. (Read More)

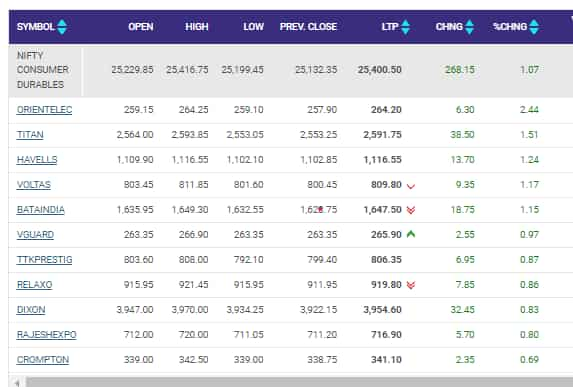

Consumer Durable index shines as it gains a per cent with all stocks in green

View Full Image

SVS Ventures IPO opens today. Price, other details about SME issue

The initial public offering (IPO) of SVS Ventures Limited has opened for subscription for investors and the public issue will remain open for bidding till 4th January 2023. The public offer is proposed for listing on SME SME exchange and the company aims to raise 11.24 crore from this issue via the fresh issue route. The issue has been offered at a fixed price of ₹20 per equity share and a bidder will be able to apply in lots where one lot of the public issue comprises 6000 company shares.

The promoter of the company Shashikant Vedprakash Sharma holds a 90.49 per cent stake in the company which will go down to 66.66% in the post-issue phase. (Read More)

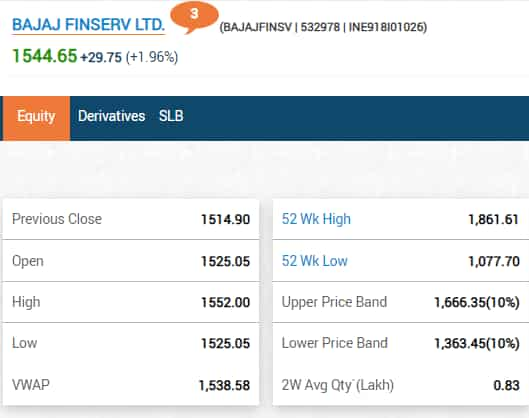

Bajaj Finserv along with Bajaj Finance among biggest gainers in early trading, jumps around 2%

View Full Image

BOJ Seeks to Fend Off Bond Bears With Third Day of Debt Buying

The Bank of Japan announced a third day of unscheduled bond purchases as it fights back against speculation it’s moving toward ending its super-accommodative monetary policy.

The BOJ offered to buy unlimited amounts of two-year notes at a yield of 0.04%, and five-year debt at 0.24%. It also offered to purchase a total ¥700 billion ($5.3 billion) of one-to-10 year bonds, and ¥300 billion of 10-to-25 year debt. That’s in addition to a daily operation to buy unlimited quantities of 10-year securities and futures-linked securities at 0.5%.

The BOJ’s struggle to contain rising local yields may have a global consequence as investors in the nation own $2.4 trillion of foreign debt. Higher local yields may spur Japanese investors to bring home more funds, exacerbating upward pressures on bonds around the world. (Bloomberg)

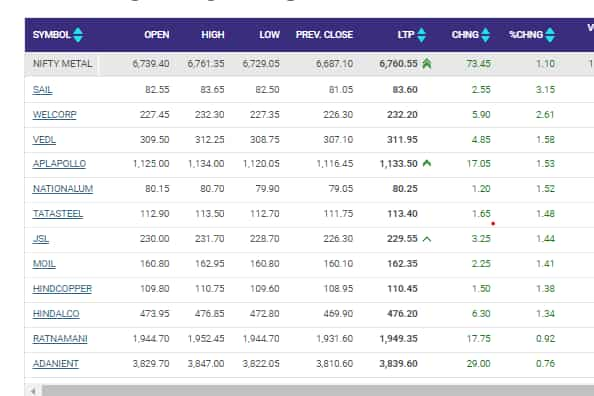

Metal index starts strong in today’s session with a gain of 1%; all stocks in green

View Full Image

Oil set to close higher in 2022, a turbulent year marked by tight supplies

Oil prices edged up on Friday and were on track to post a second straight annual gain, albeit a meagre one, in a year marked by tight supplies due to the Ukraine conflict, a strong dollar and weak demand from the world’s top crude importer China.

Brent crude futures climbed 44 cents, or 0.5%, to $83.90 a barrel by 0138 GMT after settling 1.2% down in the previous session.

U.S. West Intermediate crude was at $78.88 a barrel, up 48 cents, or 0.6%, after closing 0.7% lower on Thursday. (Reuters)

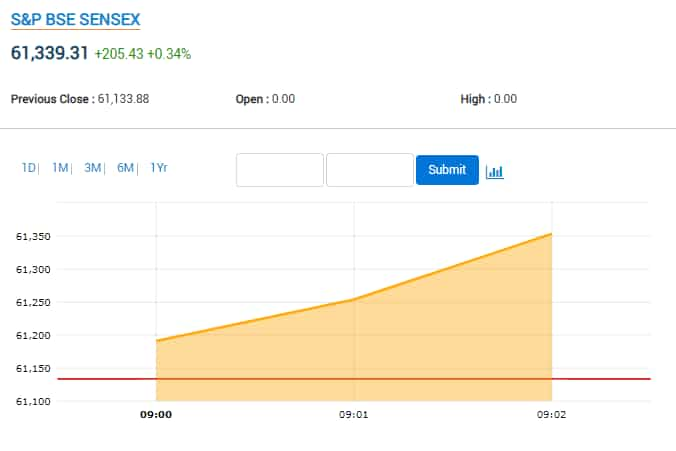

Indices open in green as Sensex gains 100 pts and Nifty 30 pts

View Full Image

Reliance Securities Stock in Focus for Today: Hero MotoCorp

STOCK IN FOCUS

Hero MotoCorp (CMP 2,722): In view of the likely rural revival, focus on the premium segment, HMCL’s market leadership position to capitalize on the demand recovery and attractive valuation, we have BUY rating on HMCL with a 1-Year Target Price of ₹3,000.

Intraday Picks

ASHOKLEY (PREVIOUS CLOSE: 144) BUY

For today’s trade, long position can be initiated in the range of ₹141-

143 for the target of Rs.149 with a strict stop loss of ₹140.

DELTACORP (PREVIOUS CLOSE: 208) BUY

For today’s trade, long position can be initiated in the range of ₹204-

206 for the target of Rs.212 with a strict stop loss of ₹202.

LTIM (PREVIOUS CLOSE: 4420) BUY

For today’s trade, long position can be initiated in the range of Rs

4360-4385 for the target of Rs.4460 with a strict stop loss of ₹4340.

Sensex preopens in green as it gains 200 points; Elin Electronics to debut at the bourses today

View Full Image

Decision to re-introduce Covid testing for international passengers ‘disappointing, a step backwards’: IATA

International Air Transport Association (IATA) has said that India’s decision to re-introduce coronavirus testing for international passengers is ‘disappointing and a step backwards’ as the current situation is different from when the pandemic started around three years ago. IATA is a grouping of nearly 290 airlines, including various Indian carriers.

Philip Goh who is IATA’s Regional Vice President for Asia Pacific, in a statement told PTI, “India’s decision to reintroduce Covid-19 testing is disappointing and a step backwards. We are in a different situation from when Covid-19 started about three years ago. Medical treatments are available. Vaccination levels are high. Governments need to respond based on science and facts.” (Read More)

Dish TV appoints Lalit Behari Singhal as independent director

Direct-to-Home operator Dish TV on Thursday said it has appointed former bureaucrat Lalit Behari Singhal as an independent director to its board.

The company’s board, at its meeting held on Thursday, “considered and appointed Lalit Behari Singhal, as an Independent Director of the company with effect from December 29, 2022, for a term of 5 consecutive years”, Dish TV said in a regulatory filing.

Earlier this month, Dish TV announced the appointment of three new independent directors to the company’s board, which was the first major appointment after the departure of its former promoter-backed chairman Jawahar Lal Goel.

Dish TV’s largest shareholder Yes Bank Ltd (YBL) and the promoter family led by its chairman Jawahar Lal Goel were engaged in a legal battle over board representation in the company. (PTI)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today

As mentioned above, Vaishali Parekh of Prabhudas Lilladher has recommended 2 stocks to buy today, here we list out full details in regard to those two shares:

1] GMR Infra: Buy at ₹39.40, target ₹44, stop loss ₹38; and

2] Pidilite Industries: Buy at ₹2601, target ₹2720, stop loss ₹2565. (Read More)

Geojit Financial Services on today’s market: Q3 results starting from Jan 12th will be the next trigger for markets

Dr V K Vijayakumar, chief investment strategist at Geojit Financial Services: The most significant feature of 2022 is the outperformance of the Indian market. In a year in which S&P 500 is down by 20% and most markets are down between 10 to 20 %, Nifty is up by 4.8%. This outperformance is the result of mainly two factors: One, India’s superior economic growth; two, domestic investors support the market by buying every dip caused by FII selling. These two factors are expected to continue in 2023 too. Dollar index dipping below 104 is a positive for the market. This trend is likely to sustain forcing FIIs to turn buyers in India in 2023. Q3 results starting from Jan 12th will be the next trigger for markets. Capital goods, financials and construction-related segments are likely to post good results.

Cryptocurrency prices today: Bitcoin, ether, dogecoin, Shiba Inu gain marginally

In cryptocurrencies, Bitcoin price today rose with the world’s largest and most popular digital token trading almost flat with a positive bias at $16,607. The global cryptocurrency market cap today remained below the $1 trillion mark, as it was flat in the last 24 hours to $828 billion, as per the data by CoinGecko.

On the other hand, Ether, the coin linked to the ethereum blockchain and the second largest cryptocurrency, was up about a per cent at $1,198. Meanwhile, Dogecoin price today was trading at $0.07 whereas Shiba Inu gained more than 2% at $0.000008. (Read More)

Stocks to Watch: Elin Electronics, RIL, Eicher, Cipla, Tata Power, Dish TV, Transformers & Rectifiers India, IRB Infrastructure, Aster DM Healthcare, Satin Creditcare Network

Elin Electronics: Elin Electronics IPO listing date has been fixed for today, December 30, 2022. As per the information available on BSE website, “Effective from Friday, December 30, 2022, the equity shares of Elin Electronics Limited shall be listed and admitted to dealings on the Exchange in the list of ‘B’ group of securities.” Elin Electronics shares will become available for trade on BSE and NSE in a special pre-opening session on Friday morning deals. (Read More)

Rupee drops 7 paise to 82.87 against US dollar

The rupee consolidated in a narrow range and settled 7 paise lower at 82.87 against the US dollar on Thursday despite softening crude oil prices and a weak greenback overseas.

At the interbank forex market, the local unit opened weak at 82.77 against the greenback and witnessed an intra-day high of 82.77 and a low of 82.87.

It finally ended at 82.87 against the American currency, registering a fall of 7 paise over its previous close of 82.80.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, declined 0.19 per cent to 104.26. (PTI)

IRB Infrastructure Developers’ SPV raises ₹700 crore

IRB Infrastructure Developers on Thursday said its special purpose vehicle — Udaipur Tollway Limited — has raised ₹700 crore through issuance of redeemable non-convertible debentures on a private placement basis.

According to a statement, the Special Purpose Vehicle (SPV) will use proceeds to refinance the existing project debts.

“The NCD (Non-Convertible Debenture) proceeds from refinancing would be utilised for part takeout financing of the existing project loans obtained and provide a significant saving of over ₹100 million annually at a revised interest cost of nearly 8.9 per cent,” it said in a statement.

Earlier in the quarter, it had re-financed its two SPVs under the private InvIT arm (through private placement of listed NCDs), viz Solapur Yedeshi Tollway Limited and Yedeshi Aurangabad Tollway Limited, it added. (PTI)

Sah Polymers IPO opens today: Should you subscribe? GMP, key details to know

The initial public offering (IPO) of polymer manufacturer Sah Polymers will open for subscription on Friday, December 30, 2022, and conclude on January 4, 2023. The company has fixed a price band of ₹61 to Rs65 per share for its issue.

As per market observers, Sah Polymers shares are commanding a premium of ₹6 in the grey market today. The company’s shares are expected to list on leading stock exchanges BSE and NSE on Thursday, January 12, 2023. (Read More)

India’s current account deficit widens in July-September quarter: RBI data

India’s current account balance recorded a deficit of USD 36.4 billion (4.4 per cent of GDP) in Q2 of 2022-23 (July-September), up from USD 18.2 billion (2.2 per cent of GDP)1 in Q1 (April-June), RBI’s balance of payments (BoP) data showed on Thursday.

The deficit was USD 9.7 billion (1.3 per cent of GDP) a year ago in the July-September quarter.

A current account deficit is when the total value of imports a country make exceeds the total value of exports.

“Underlying the current account deficit in Q2:2022-23 was the widening of the merchandise trade deficit to USD 83.5 billion from USD 63.0 billion in Q1:2022-23 and an increase in net outgo under investment income,” the RBI said. (PTI)

China’s Economic Activity Rebounds in Cities Where Covid Peaked

Economic activity is rebounding in several Chinese cities where Covid infections likely already peaked, although many parts of the country are still grappling with soaring cases and mobility is still far below levels reached a few months ago.

The number of passengers using subways in Beijing, Chongqing, Chengdu and Wuhan rose about 40% to 100% in the week through Wednesday, a sign that residents in those areas are returning to work, shopping and restaurants once again. A measure of traffic congestion in those cities increased about 150% to 240% over the period.

The mobility figures back up comments from the Chinese Center for Disease Control and Prevention on Thursday that infections have peaked in places like Beijing, Tianjin and Chengdu. The situation remains serious in Shanghai, Chongqing, Anhui, Hubei and Hunan, it said. (Bloomberg)

For OTT content producers, the gravy train has stopped

After an initial rush of bullish spending as they looked to consolidate their presence in India, video streaming platforms are slowing investments in the country. In 2022, spending dipped by 50% as parent companies of foreign platforms reeled from the global downturn with subscriber addition in India remaining tepid. Along with issues of copyright infringement, advertising spending slowed, thanks to global inflation that left crypto and tech brands struggling with funds. (Read More)

Elin Electronics IPO listing date today. Experts predict ‘flat’ debut of shares

Elin Electronics IPO listing date has been fixed on 30th December 2022. As per the information available on BSE website, “Effective from Friday, December 30, 2022, the equity shares of Elin Electronics Limited shall be listed and admitted to dealings on the Exchange in the list of ‘B’ group of securities.” Elin Electronics shares will become available for trade on BSE and NSE in a special pre-opening session on Friday morning deals.

According to stock market experts, Elin Electronics IPO was attractively priced compared to its peers but the company is operating in a highly competitive market. Majority of Elin Electronics’ revenue is derived from a limited number of customers. But, due to shattered primary market sentiments, the public issue received lacklustre response from investors and hence, stock market experts believe that Elin Electronics share price may have a ‘subdued ‘ or ‘flat’ debut today in secondary markets. (Read More)

Eicher Motors announces strategic investment in Spain’s Stark Future

Eicher Motors on Thursday announced a strategic investment in Spain’s Stark Future SL to develop electric motorcycles and for technology sharing, technical licensing, and manufacturing.

The company’s Board of Directors has approved an investment of Euro 50 million for a close to 10.35 per cent equity stake in Stark Future. With this investment, Eicher Motors Ltd. will have a seat on Stark Future’s Board, and will explore further opportunities to collaborate in the space of electric mobility, said the company. (Read More)

Reliance Retail arm acquires 51% stake in Lotus Chocolate for ₹74 cr

Reliance Retail Ventures Ltd’s subsidiary on Thursday said that it has acquired a 51% controlling stake in Lotus Chocolate Company. The FMCG arm, Reliance Consumer Products Limited, is the wholly owned subsidiary of Reliance Retail Ventures Limited has acquired Lotus Chocolate company from Prakash P Pai, Ananth P Pai and other members of the current promoter and promoter group of the company for ₹74 crore.

It has also announced an open offer to the public shareholders of Lotus for 26 per cent. (Read More)

Covid surge in China can create havoc across the globe: Report

While the world is still recovering from the losses of livelihoods, damages to businesses and national economies, and healthcare disruptions, the new, deadly variant of coronavirus from China can create havoc across the globe if its spread is not checked in time, reported The HK Post. What is going on in China at present has stoked fears about the repetition of the horrific Covid-19 outbreak that killed millions of people across the globe.

And like what Beijing did in 2019, this time too Chinese authorities are hiding information about the coronavirus infections from their own people and the world outside. (Read More)

Radiant Cash Management IPO allotment date today. How to check status online

The announcement of share allocation for the initial public offering (IPO) of Radiant Cash Management Services Ltd can be finalised any time today. As per the tentative schedule of the public issue worth ₹387.94 crore, the Radiant Cash Management IPO allotment date is most likely on 30th December 2022. Those, who have applied for the public issue can check Radiant Cash Management IPO allotment status online by logging in at the BSE website — bseindia.com or at the website of the official registrar of the IPO. Link Intime Private Limited has been appointed as the official registrar of this public issue and its official website is linkintime.co.in. (Read More)

US, European stock markets jump on Thursday on US labour data

Wall Street and European stocks rose Thursday as an increase in US jobless claims signalled some cooling in the economy, bringing optimism about the direction of interest rate hikes.

The US Federal Reserve and other central banks have hiked rates in efforts to rein in runaway inflation, but investors fear the aggressive stance could spark a recession as higher borrowing costs slow economic activity.

Data on Thursday showed initial US jobless claims for the week ending December 24 rose more than expected to 225,000, indicating that the labour market could be cooling.

Central bank policymakers have been particularly concerned about the jobs market, where demand for workers has exceeded supply, with wages picking up quickly.

The Paris CAC 40 index and the Frankfurt DAX closed around one per cent higher while London’s FTSE 100 gained 0.2%.

Wall Street closed higher as well after two gloomy days, with the tech-heavy Nasdaq bouncing by 2.6%.

But traders said volumes remained thin in the final trading week of the year. (AFP)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!