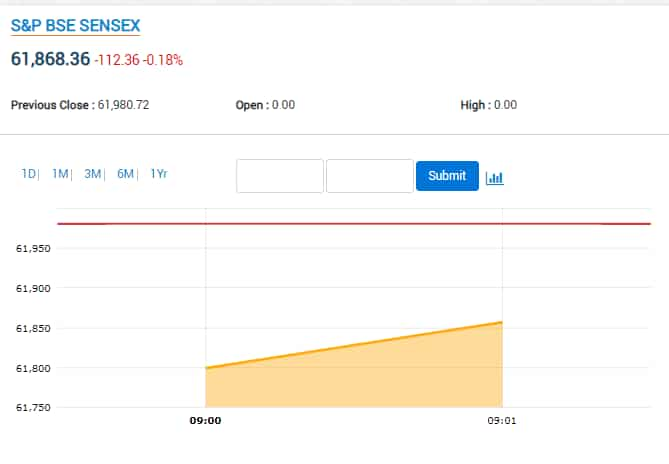

Stock Market LIVE: Indices turn flat; Apollo Hosp, Titan drag; Tata Consu shines

The Bank Nifty logged a lifetime high for the second consecutive session and the BSE Sensex hit a record closing high on Wednesday. However, negative outlooks and softer demands heading into the holiday season in the US will compel investors to remain pessimistic.

Geojit Financial reccomendation on Escorts Kobuta – Q2FY23 Result Update – SELL

Geojit says SELL with Target Price of ₹1783 for Escorts Kobuta: Cconsidering the margin pressure and lower volume for H2, we downgrade our estimate and recommend Sell rating at CMP.

Meta appoints Sandhya Devanathan as its new India head

Meta today announced the appointment of Sandhya Devanathan as the Vice President of Meta India. Devanathan will focus on bringing the organization’s business and revenue priorities together to serve its partners and clients, while continuing to support the longterm growth of Meta’s business and commitment to India. She will transition to her new role on January 1, 2023 and will report to Dan Neary, Vice President, Meta APAC and will be a part of the APAC leadership team. She will move back to India to lead the India org and strategy. (Read More)

ABFRL to bring French luxury store Galeries Lafayette to India

Aditya Birla Fashion and Retail Limited (ABFRL) on Thursday announced that it has entered into a strategic partnership with French luxury department store chain Galeries Lafayette to open stores and a dedicated e-commerce platform in India.

The 90,000 square feet flagship store in Mumbai is expected to be operational by 2024, ABFRL said in a statement on Thursday. (Read More)

IRFC shares rally to hit record high; trade above IPO issue price

Shares of Indian Railway Finance Corporation Ltd (IRFC) rallied more than 8% to hit a record high of ₹28.7 apiece on the BSE in Monday’s afternoon deals, with the stock trading above its initial public offering (IPO) issue price of ₹26.

The public issue of IRFC was open for subscription last year from 18-20 January, 2021 with a price band of ₹25- ₹26. The company’s shares made their market debut on January 29, 2021. IRFC shares are up about 23% in 2022 so far. (Read More)

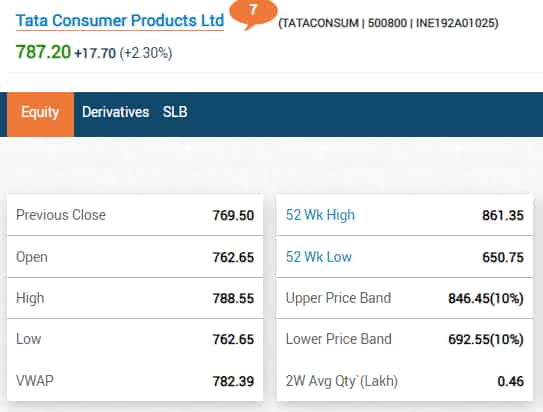

Tata Consumer shines as it gains 2% in today’s trading

View Full Image

Angel One appoints Prateek Mehta as its Chief Business Officer

Fintech company Angel One Limited (formerly known as Angel Broking Limited) appointed Prateek Mehta as its Chief Business Officer. In his new role, he will be chalking out growth strategies and business plans for the company to achieve its vision, the company said in its statement.

COP27 Draft Leaves Out Pledge to Phase Down All Fossil Fuels

Countries negotiating at the climate summit in Egypt are on track to reject calls for phasing down the use of all fossil fuels, snuffing efforts by India and key developed nations to target oil and gas as well as coal in an overarching deal at COP27.

The Egyptian presidency published the first draft of its so-called “cover decision” and largely kept last year’s pledge made at Glasgow to “accelerate measures towards the phase down of unabated coal power” and phase out fossil fuel subsidies. It also stuck with a commitment to keep global warming to 1.5 degrees Celsius. It highlighted that countries are currently falling well short on meeting the climate finance needs of developing countries. (Bloomberg)

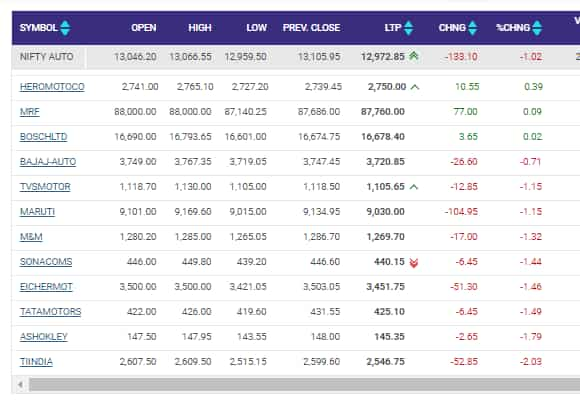

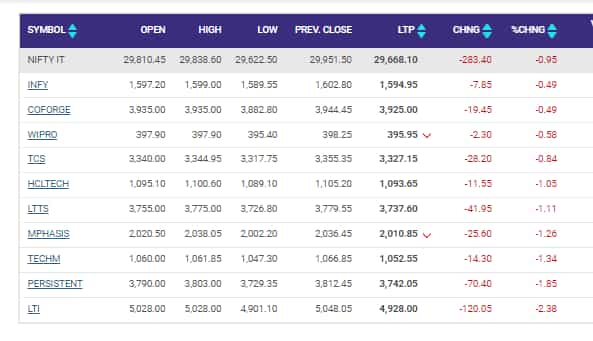

Auto index under pressure, sheds 1% with most stocks in red

View Full Image

Why Nykaa shares are down nearly 20% in 4 days

Shares of FSN E-Commerce Ventures Ltd., owner of beauty e-retailer Nykaa, has been under pressure since lock-up ended last week. Nykaa shares fell 4% to ₹171 at day’s low, extending the four-day losses to about 20%. According to NSE data, LIGHTHOUSE INDIA FUND III LIMITED sold 96,89,240 shares on 10th November at average price of ₹171 per share. Among other major sellers, SEGANTII INDIA MAURITIUS sold 33,73,243 shares at average price of ₹199 on 15th November.

Stocks often fall after lock-ups expire, as investor selling puts downward pressure on shares. Food-delivery company Zomato Ltd. had plunged to a record low in July when a lock-up on its shares expired. Since Nykaa’s bumper market debut in November last year, its shares have tumbled to drop below their IPO price. (Read More)

Inox Green Energy IPO: Latest GMP ahead of share allotment

The initial public offering (IPO) of Inox Green Energy Services, a subsidiary of Inox Wind, received 1.55 times subscription on the last day of offer on Tuesday, November 15, 2022. The issue received bids for 10.37 crore shares against 6.67 crore shares on offer.

As per market observers, Inox Green Energy shares’ GMP have slipped to a discount of ₹2 in the grey market today. The shares of the company are expected to list on the stock exchanges BSE and NSE next week on Wednesday, November 23, 2022. (Read More)

Breakfast index surges in UK: How much more Britons are paying for bread and milk

Higher-than-expected inflation is taking a toll on UK consumers’ grocery shopping, spelling food poverty for many families.

Bloomberg’s monthly Breakfast Index shows that the cost of basic ingredients that go into an English “fry-up” have all increased significantly from a year ago, with milk jumping by 51% and butter up 31%. It’s yet another measure of how thousands of families can’t avoid paying ever-higher prices for the foods they regularly put on the table.

“Supermarkets have been forced to pass on input cost price increases to already hard-pressed customers,” said Lisa Hooker, industry leader for consumer markets at PricewaterhouseCoopers LLP. “Worryingly, there have been particularly large increases in the price of food staples such as bread.” (Read More)

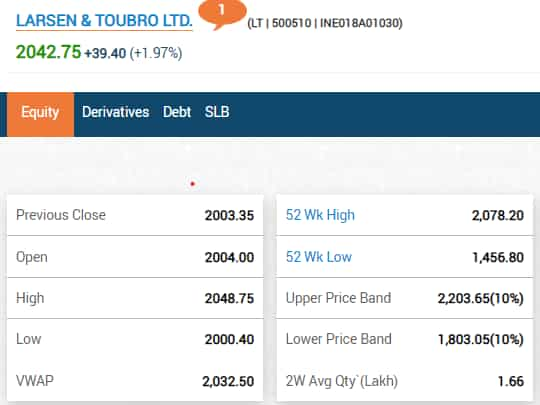

Noon Update: Indices marginally in red on Thursday noon with Sensex shedding around 150 points and Nifty 50 points

Apollo Hospitals, Titan and Hindalco drag the market, while L&T shines.

View Full Image

LinkedIn CEO Sees Growth Outside US, With India Leading

LinkedIn Chief Executive Officer Ryan Roslansky is gearing up for growth for the social-networking site in markets such as India, even as it prepares for economic headwinds more broadly by pausing hiring.

India has become LinkedIn’s fastest-growing market as more companies and advertisers come online, with sales in the country rising at a 50% year-on-year clip, Roslansky told Bloomberg TV on Thursday on the sidelines of the Bloomberg New Economy Forum in Singapore. “What’s going to happen in the next 10 years in India is being written right now,” he said.

The business networking service owned by Microsoft Corp. is looking abroad for new growth opportunities as the worsening economic climate weighs on its US home market. He said LinkedIn has paused hiring to prepare for tougher conditions. (Bloomberg)

Goldman Sachs buys stake in Bikaji Foods. Shares surge on Day 2 of listing

Global investment agency Goldman Sachs Fund has bought stake in newly listed Indian company Bikaji Foods International Ltd. As per the information available on NSE website, Goldman Sachs Fund has bought 17,45,354 Bikaji Foods shares paying ₹324.50 apiece. This means, Goldman Sachs Fund has invested ₹56,63,67,373 in this newly listed stock. The global investment agency bought these shares through a bulk deal executed on 16th November 2022 i.e. on Bikaji Foods share listing date. (Read More)

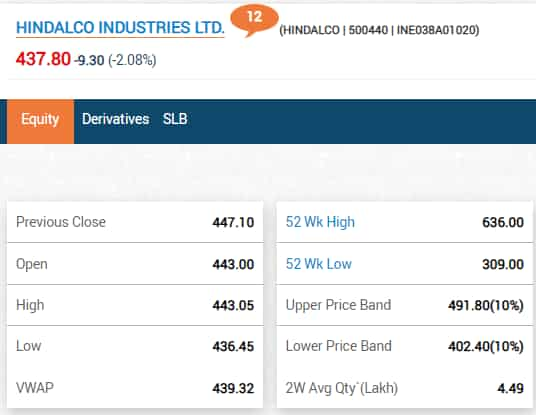

Hindalco among biggest droppers today; sheds 2%

View Full Image

Prabhudas Lilladher recommendations on Aarti Industries, Bharat Electronics, Aurobindo Pharma, and ABB India

Aarti Industries (ARTO IN): Rating: ACCUMULATE | CMP: Rs706 | TP: Rs775

Q2FY23 Result Update – Muted demand suppresses profitability

Bharat Electronics (BHE IN): Rating: BUY | CMP: Rs107 | TP: Rs125

Event Update – Signed various MoU in Defense segment

Aurobindo Pharma (ARBP IN): Rating: ACCUMULATE | CMP: Rs492 | TP: Rs550

Q2FY23 Result Update – Challenges persist

ABB India (ABB IN): Rating: ACCUMULATE | CMP: Rs3,028 | TP: Rs3,291

Q3CY22 Result Update – Outlook continues to remain strong

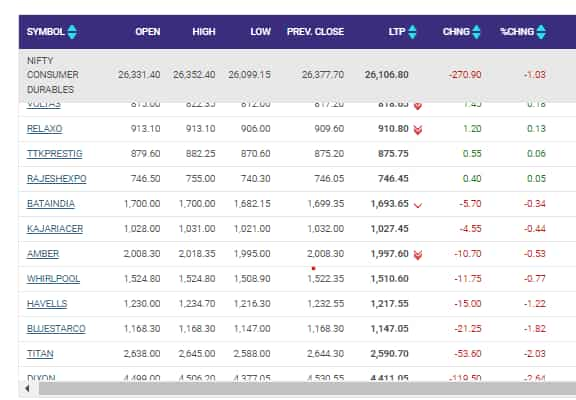

Consumer Durable index sheds; drops 1% with most stocks in red

View Full Image

INDIA BONDS-Bond yields tad lower tracking decline in U.S. yields, oil prices

Indian government bond yields were marginally lower in the early session on Thursday, tracking a dip in U.S. yields and oil prices that aided investor sentiment.

The benchmark Indian 10-year government bond yield was at 7.2519% as of 0500 GMT, after closing slightly higher at 7.2736% on Wednesday. The yield had declined for seven sessions till Nov. 15, dropping by an aggregate of 22 basis points (bps).

The benchmark yield fell below the 7.25%-mark for a brief period in early trade but is expected to trade in the range of 7.25%-7.27% through the day, with the major focus on tomorrow’s debt sale, a trader with a private bank said. (Reuters)

Medanta shares surge on Day 2, now up 35% from IPO price

After a decent listing on Wednesday, Global Health’s share price continues to give upside movement after day one of the listing. Medanta’s share price today opened upside and went on to climb to a new high of ₹455.70 apiece on NSE, within a few minutes of the stock market opening bell, logging around a 10 per cent rise in intraday trade session on Thursday. (Read More)

Ashika Stock Broking views on today’s market: Nifty is on the path to challenge the all-time high of 18600 in coming sessions

Tirthankar Das, Technical & Derivative Analyst, Retail, Ashika Stock Broking Ltd: On the technical front, Nifty formed an indecisive candle resembling closer to a Doji kind of pattern on the daily charts, indicating uncertainty about the future trend in the market. Though the sequence of higher high formation remains unabated without any signs of price exhaustion or topping out situation and chances remain high of price consolidation after a sharp rally of almost 1700 points in last one month. Nifty since the past few days of trading session has led the Index to breach past the falling trend line which confirms that the primary trend is up and is well placed to accelerate the upward momentum hereon, aptly supported by global cues and multi-sector participation in our domestic market. India VIX, which gauges market volatility, has also recorded five months’ range breakdown and is trading below 16, indicating low-risk perception among market participants, followed by sequential lower high-low formation in USINR to favour inflows in Indian equities. Now the elevated support level for the market now stands at 17950 followed by 17500 as it happens to be the 50 days EMA and the breakout point from the 12 months falling trend line. The momentum indicator RSI (relative strength index) is presently at 68 slightly closer to overbought situation which further reinstates of an upcoming consolidation in the market, however present setup signifies that Nifty is on the path to challenge the all-time high of 18600 in coming sessions followed by 18900 in near term. During the day, Nifty is likely to open on a negative note amid negative global cues though the positive momentum in the Index is likely to withstand thus lower levels of 18300-18340 need to be utilized for initiating long position for an upside target of 18600.

Blackstone to buy majority stake in R Systems, delisting offer at ₹246 per share

US investment fund Blackstone Inc said on Thursday that it would buy a 52% stake in Indian IT services company R Systems International for $359 million ( ₹2,904 crore). Shares of R Systems rallied more than 15% to ₹281 apiece on the BSE in early trading session.

Private equity funds managed by Blackstone have signed definitive agreements with Satinder Singh Rekhi and other current promoters to purchase a majority stake in R Systems International Limited. (Read More)

L&T stock shines in today’s trading, gains 2%

View Full Image

India, GCC group to launch free trade pact negotiations on Nov 24

India and the Gulf Cooperation Council (GCC) are expected to launch negotiations for a free trade agreement on November 24 with an aim to boost economic ties between the two regions, an official said.

GCC is a union of six countries in the Gulf region — Saudi Arabia, UAE, Qatar, Kuwait, Oman and Bahrain.

“The FTA will be launched on November 24. GCC officials will be here to launch the talks,” the official said.

India has already implemented a free trade pact with the UAE in May this year.

Commerce and industry minister Piyush Goyal had, on November 16, said that India will be launching a new free trade agreement (FTA) next week. (PTI)

Bangalore airport IPO could be coming next year

Fairfax India Holdings Ltd. is considering an initial public offering for Bangalore International Airport Ltd. that could value the asset at about 300 billion rupees ($3.7 billion), according to people familiar with the matter.

The Indian arm of Canadian investment group Fairfax Financial Holdings Ltd. is working with an adviser on the potential listing that could take place as soon as next year, the people said. Fairfax India holds a majority stake in the owner of Kempegowda International Airport, Bengaluru, located in the southern Indian city also known as Bangalore. (Read More)

Rupee falls 37 paise to 81.63 against US dollar in early trade

The rupee depreciated 37 paise to 81.63 against the US dollar in early trade on Thursday, tracking the strength of the American currency in the overseas market and a muted trend in domestic equities.

Forex traders said the American currency strengthened after strong US retail sales data pointed to resilient consumption despite a slowing economy, adding room for tighter policy by the US Federal Reserve.

At the interbank foreign exchange, the domestic unit opened at 81.62 against the dollar, then lost ground to quote at 81.63, registering a loss of 37 paise over its previous close.

On Wednesday, the rupee depreciated by 35 paise to close at 81.26 against the US dollar. (PTI)

Tata Group stocks under pressure with three stocks among top laggards

View Full Image

Small-cap stock that surged 100% in one year hits 52-week high after Q2 results

Shares of small-cap company Apollo Micro Systems Ltd hit a 52-week high on Wednesday after the announcement of Q2FY23 results. On Wednesday’s session, Apollo Micro Systems’ share price opened upside and went on to climb to its fresh 52-week high of ₹250 apiece on NSE. This small-cap stock with a market cap of ₹486 crore has doubled shareholders’ money in the last one year as it rallied from around ₹116 to ₹234 apiece levels in this time. (Read More)

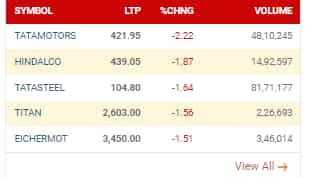

IT index sheds 1% with all stocks trading in red in today’s session

View Full Image

Paytm share price tumbles nearly 10% as Softbank seeks to cut stake

Shares of One 97 Communications Ltd (Paytm) tumbled about 10% to ₹541 apiece on the BSE in Thursday’s opening deals as a unit of Japan’s SoftBank Group Corp offered to cut its stake in the company. About 29.5 million shares, equivalent of 4.5% of the company’s equity capital, were traded in a single block on the NSE, according to data compiled by Bloomberg.

The trade pulled down shares of Paytm to their biggest plunge since July 29. Reports on Wednesday suggested that Japan’s SoftBank will sell a third of its stake in One97 Communications Ltd, the owner of the Paytm payments app, through a $200 million block deal. (Read More)

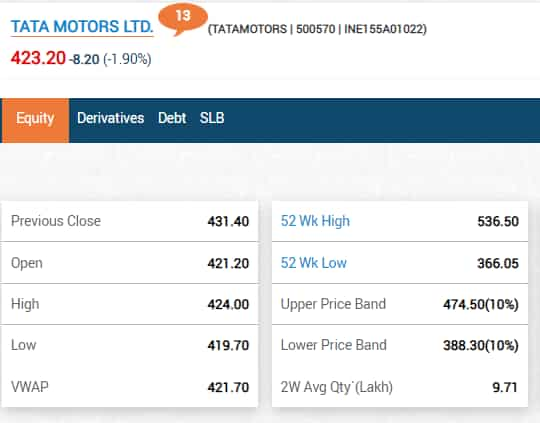

Tata Motors sheds 2% in early trading

Tata Motors said in a BSE filing on Wednesday, “We wish to inform you that Mr Thierry Bolloré, Non-Executive Non-Independent Director of Tata Motors Limited (the Company) has tendered his resignation w.e.f. December 31 2022.”

View Full Image

Geojit Financial Services on today’s market: The mid- and small-cap indices are likely to remain weak.

Dr V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services: “The fact that Sensex and Nifty are at record closing highs tells us that the Buy on Dips strategy has worked well in this market. Therefore, this strategy can be expected to work, going forward, too. High quality stocks in banking, IT, telecom and capital goods form the backbone of this large-cap driven rally. Dips in this segment are likely to get bought. India is the only large market that crossed previous record highs. This will stand the market in good stead. Even though the mother market US has turned a bit weak, the sustained fall in US bond yields is a positive for emerging markets like India. The mid- and small-cap indices are likely to remain weak.”

Indices open marginally in the red zone with Sensex shedding around 100 points and Nifty 40 points.

View Full Image

Oil falls as geopolitical tensions ease, China COVID concerns return

Oil prices fell for a second day in early Asian trade on Thursday as concerns over geopolitical tensions eased and rising numbers of COVID-19 cases in China added to demand worries in the world’s largest crude importer.

Brent crude futures dropped by 62 cents, or 0.7%, to $92.24 a barrel by 0110 GMT. U.S. West Texas Intermediate (WTI) crude futures fell 65 cents, or 0.8%, to $84.94 a barrel.

Brent dropped by 1.1% and WTI declined by 1.5% on Wednesday after Russian oil shipments via the Druzhba pipeline to Hungary restarted.

“Crude oil fell after NATO cleared Russia’s missile attack on Poland, while demand concerns (are) back to trader’s focus amid ongoing China’s COVID curbs and gloomy global economic outlooks,” said Tina Teng, an analyst at CMC Markets. (Reuters)

Bitcoin, ether, dogecoin, other crypto prices continue to remain under pressure

In cryptocurrencies, the world’s largest and most popular digital token Bitcoin’s price today was trading nearly 2% lower at $16,588. The global crypto market cap today remained below the $1 trillion mark, as it was almost down over a per cent in the last 24 hours to $870 billion, as per CoinGecko.

On the other hand, Ether, the coin linked to the ethereum blockchain and the second-largest cryptocurrency, also plunged by more than 4% to $1,208. (Read More)

Sensex preopens flat on Thursday; SBI, Paytm, Tata Motors stocks are in focus today

View Full Image

UK Paints(India) acquires 50.092% stake in Berger Paints

U.K Paints (India) Ltd on Wednesday announced that it has acquired 50.09 per cent stake in Berger Paints. UK Paints (India) acquired the shares through open market operations.

Berger Paints India reported a consolidated net profit of ₹219.51 crore for the second quarter, up marginally from ₹219.21 crore in the year-ago period. (Read More)

“Remain watchful,” RBI Governor’s advice to heads of banks amid global headwinds

Reserve Bank of India Governor Shaktikanta Das chaired meetings with Managing Directors and Chief Executive Officers of public sector banks and certain private sector banks on Wednesday.

The meetings were also attended by Deputy Governor M. K. Jain along with a few senior officials of the RBI, the central bank said in a statement.

Governor Das acknowledged the crucial role played by the commercial banks in supporting economic growth throughout the turbulent times since the outbreak of the pandemic and the ongoing financial market turmoil.

Das further stated that despite challenges, the Indian banking sector has remained resilient and continued to improve in various performance parameters. (ANI)

IMF: calibrating China’s COVID strategy critical to sustaining recovery

Calibrating China’s zero-COVID strategy to mitigate the country’s economic impact will be critical to sustain and balance the recovery, Gita Gopinath, the first deputy managing director of the IMF, told the Caixin Summit on Thursday.

“For China, inflation and weakening growth allow for greater support for vulnerable households, which together with strengthening social safety nets would promote consumption,” she said via video. (Reuters)

Reliance Securities Stock in Focus for today: ENGINEERS INDIA

STOCK IN FOCUS

ENGINEERS INDIA (CMP 73)

Considering its asset-light business model, strong clientele base, foray into newer segments and healthy execution track record, we have our BUY rating on ENGR, with a SOTP-based Target Price of Rs100.

Intraday Picks

CONCOR (PREVIOUS CLOSE: 762) BUY

For today’s trade, long position can be initiated in the range of Rs758- 754 for the target of Rs779 with a strict stop loss of Rs743.

SIEMENS (PREVIOUS CLOSE: 2,880) BUY

For today’s trade, long position can be initiated in the range of Rs2,860- 2,840 for the target of Rs2,940 with a strict stop loss of Rs2,799.

DALBHARAT (PREVIOUS CLOSE: 1,708) BUY

For today’s trade, long position can be initiated in the range of Rs1,692- 1,684 for the target of Rs1,765 with a strict stop loss of Rs1,665.

Multibagger fashion stock hits 5% upper circuit on six days in a row

Filatex Fashions shares are one of the multibagger stocks that Dalal Street has produced in recent years. This stock has delivered over 400 per cent in the last four years and the stock is still maintaining its uptrend. This small-cap stock with a market cap of ₹236 crore has been climbing to its 52-high for the last six straight sessions. In fact, this multibagger small-cap stock has been hitting 5% upper the last six days in a row and climbing to new 2-week highs. (Read More)

Indian refiners becoming wary of buying Russian oil as EU sanctions loom – sources

Indian refiners are wary of buying Russia crude oil loading after Dec. 5 when European Union sanctions take effect, pending clarity on the proposed G7 price cap mechanism, according to sources familiar with the refiners’ crude purchase plans.

Chinese refiners have already begun slowing down Russian oil imports from next month.

The Asian giants, who are two of the world’s top three importers, had become Russia’s biggest customers after the West shunned Russian oil after the outbreak of war in Ukraine.

Reduced buying by both of them would leave Russia chasing alternative customers, potentially depressing prices even if those new buyers are unlikely to join a plan by rich nations in the Group of Seven (G7) to cap Russian oil prices.

Reliance Industries Ltd, operator of the world’s biggest refining complex and a major customer for Russia, has not placed orders yet for Russian cargoes loading after Dec. 5, two sources familiar the refiner’s purchase plans told Reuters.

Neither has state-run Bharat Petroleum Corp, they said. (Reuters)

Keystone Realtors IPO subscribed 2 times. Check share allotment, listing date details

The initial public offering (IPO) of Keystone Realtors, which sells properties under the brand ‘Rustomjee’, received 2 times subscriptions on the last day of the offer on Wednesday, November 16, 2022. The issue got bids for 1,73,72,367 shares against 86,47,858 shares on offer.

Keystone Realtors IPO had a fresh issue of up to ₹560 crore and an offer for sale of up to ₹75 crore. The price range for the initial share sale was fixed at ₹514-541 a share. On Friday, Keystone Realtors said it has collected a little over ₹190 crore from anchor investors. (Read More)

Stocks to Watch: SBI, Paytm, Tata Motors, Coal India, Hindustan Zinc, Aurobindo Pharma, Ircon International, Spandana Sphoorty Financial, ONGC and Berger Paints

NSE has put Balrampur Chini, Bhel, Delta Corp, Gujarat Narmada Valley Fertilizers and Chemicals, Indiabulls Housing Finance, and Sun TV stocks on the list of banned securities under the F&O segment for Wednesday trading as they have crossed 95% of the market-wide position limit. (Read More)

INDIA BONDS-Bond yields seen easing tracking fall in oil, U.S. peers

Indian government bond yields are expected to open lower on Thursday, tracking a decline in U.S. yields as well as oil prices.

The benchmark 10-year yield is likely to be in a 7.25%-7.30% band for the session, a trader with a private bank said.

The yield ended a tad higher at 7.2736% on Wednesday, having declined 22 basis points (bps) in the previous seven sessions.

After some consolidation on Wednesday, yields are likely to track and react to moves in U.S. yields and oil prices, and there could be marginal downward bias today, the trader said. (Reuters)

Trai to roll out caller ID system to rival Truecaller in 3 weeks

The telecom regulator is set to roll out its mobile phone caller identity system—verified by KYC or know your customer details—within the next three weeks.

The caller ID system will be pitched as the government’s replacement for the popular Truecaller app. “Trai has conducted several stakeholder consultations to iron out the issues,” Vaghela told HT. “The new feature should be rolled out in the next two to three weeks.” (Read More)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today

Vaishali Parekh of Prabhudas Lilladher has recommended two stocks to buy today, here we list out full details in regard to those buy or sell stocks:

1] Pidilite Industries: Buy at ₹2682 , target ₹2755, stop loss ₹2640; and

2] Castrol India: Buy at ₹129, target ₹135, stop loss ₹127. (Read More)

Rupee falls 35 paise to close at 81.26 against US dollar on forex outflows

The rupee depreciated by 35 paise to close at 81.26 against the US dollar on Wednesday on disappointing trade data and foreign fund outflows.

Forex traders said a negative bias on risk aversion in global markets weighed on the local unit.

At the interbank foreign exchange market, the local unit opened at 81.41 and later witnessed an intraday high of 81.23 and a low of 81.58 during the session.

The domestic unit finally settled at 81.26 against the American currency, registering a fall of 35 paise over its last close.

On Tuesday, the rupee appreciated 37 paise to close at 80.91 against the US dollar. (PTI)

Spandana Sphoorty Fin to raise ₹300 crore via bonds

Microfinance lender Spandana Sphoorty Financial will raise up to ₹300 crore by issuing bonds next week, the company said on Wednesday.

The board of directors in a meeting held on November 16, 2022, has approved to issue market-linked rated non-convertible debentures (NCDs) with a base issue size of ₹200 crore and green shoe option of ₹100 crore, the company said in a regulatory filing.

The tenure of bonds, to be allotted on November 22, 2022, have a tenure of 18 months.

The company said the bonds will carry interest at 11.15 per cent per annum. (PTI)

Pricing challenges likely to persist for steelmakers in Q3

Indian steelmakers posted weak numbers in the September quarter as high inventory costs and declining steel prices led to significant pressure on profits, according to data compiled by Mint.

Earnings before interest, taxes, depreciation and amortization (Ebitda) of leading steelmakers such as Tata Steel, JSW Steel, Jindal Steel and Power, and Steel Authority of India (SAIL) fell 49-68%, sequentially, and 58-90% from the year earlier.

According to analysts, domestic steel prices are close to import-parity prices and may not go up significantly. The natural hedge against cheap exports was being provided to some extent by a weak rupee and a stronger dollar. However, with the rupee appreciating in the past few days, the risk of cheap imports increases, and the industry must be cautious about it, analysts said. (Read More)

USB-C will be mandatory for all smart devices sold in India

India will be adopting USB-C type as a common charging port for smart devices, with stakeholders reaching a consensus at a meeting of an inter-ministerial task force, consumer affairs secretary Rohit Kumar Singh said on Wednesday.

The government held wide-ranging consultations to standardize charging ports for all compatible smart devices, but it is yet to reach a decision on chargers for low-cost feature phones. (Read More)

Indian Appliances & Consumer Electronic industry to double to ₹1.48 cr by 2025

The Indian Appliances and Consumer Electronics (ACE) market is expected to almost double in the next three years to around ₹1.48 lakh crore by 2023, led by increasing domestic demand, said the industry body CEAMA.

India has become one of the fastest growing ACE markets in the world and is also emerging as an alternative manufacturing destination of China and other South East Asian countries, the president of the Consumer Electronics and Appliances Manufacturers Association (CEAMA), Eric Braganza, said.

The foreign direct investment in the ACE industry has also almost doubled to USD 481 million till June in 2022 as against USD 198 million in 2021, he added.

“Now several global OEMs are setting up their base in India,” said Braganza while addressing the annual function of CEAMA here. (PTI)

Windfall profit tax on crude oil hiked, levy on export of diesel cut

The government on Wednesday hiked the windfall tax on domestically produced crude oil while reducing the rate on the export of diesel.

The tax on crude oil produced by firms such as state-owned Oil and Natural Gas Corporation (ONGC), was hiked to ₹10,200 per tonne, from ₹9,500 per tonne, with effect from November 17, a government notification said.

In the fortnightly revision of the windfall tax, the government cut the rate on the export of diesel to ₹10.5 per litre, from ₹13 per litre. The levy on diesel includes ₹1.50 per litre road infrastructure cess.

The export tax on jet fuel or ATF, which was set at ₹5 a litre in the last review on November 1, has not been altered. (PTI)

Kaynes Technology IPO: Share allotment likely today. GMP, how to check status

After the closure of the subscription, bidders are eagerly waiting for the finalisation of share allocation of the initial public offering (IPO) worth ₹857.82 crore. As per the tentative schedule of Kaynes Technology IPO, the announcement of share allocation can be announced anytime today as the probable Kaynes Technology allotment date is 17th November 2022. After the announcement of share allotment, bidders will be able to check their IPO application status online by logging in at the BSE website on the website of its official registrar. Link Intime India Private Ltd has been appointed as the official registrar of the public issue.

Meanwhile, grey market sentiments have gone choppy after the range-bound sentiments on Dalal Street. According to market observers, shares of Kaynes Technology Ltd are available at a premium of ₹95 in the grey market today that means Kaynes Technology IPO GMP (grey market premium) today is ₹95. (Read More)

Jaguar Land Rover’s Bolloré exits citing personal reasons

Jaguar Land Rover (JLR) chief executive Thierry Bolloré said on Wednesday that he would leave the company on 31 December due to personal reasons after two years at the helm of the iconic British luxury brands.

Bolloré, a former chief executive of French carmaker Renault, took over the top job at JLR from Ralf Speth in September 2020. He will also resign as a non-executive, non-independent director of parent Tata Motors Ltd with effect from 31 December. (Read More)

Softbank to sell Paytm stake worth $200 mn via block deal

Japan’s SoftBank will sell a third of its stake in One97 Communications Ltd, the owner of the Paytm payments app, through a $200 million block deal, according to deal terms reviewed by Mint.

SoftBank, which owns 12.9% of Paytm, plans to sell 29 million shares or 4.5% of the fintech company on Thursday.

The shares are being offered to institutional investors at ₹555-601.45. At the lower end of the band, it is a 7.7% discount to the closing price of ₹601.3 on Wednesday. If completed, the sale will fetch SoftBank at least ₹1,628.9 crore or $200 million. (Read More)

US STOCKS-Wall Street falls after Target outlook, Micron supply cut

Wall Street’s main indexes fell on Wednesday as a grim outlook from Target spurred fresh concerns for retailers heading into the crucial holiday season, while semiconductor shares slumped broadly after Micron’s supply cut.

The Dow Jones Industrial Average fell 46.76 points, or 0.14%, to 33,546.16, the S&P 500 lost 29.2 points, or 0.73%, to 3,962.53 and the Nasdaq Composite dropped 146.85 points, or 1.29%, to 11,211.56.

Shares of Target Corp tumbled 12% after the big-box retailer forecast a surprise drop in holiday-quarter sales.

Micron Technology shares dropped over 7% after the company said it would reduce memory chip supply and make more cuts to its capital spending plan. The S&P 500 information technology sector dropped 1.3%, while the Philadelphia SE Semiconductor index sank over 4%. (Reuters)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!