Stock Market LIVE: Indices shed, Nifty drops 100 pts; all indices in red

Investors will keep an eye on earnings as they look for hints of an economic downturn. TCS management on Monday said the environment remains challenging amidst global recession fears. The firm’s second-quarter profit rose 8.4%, beating analysts’ estimates.

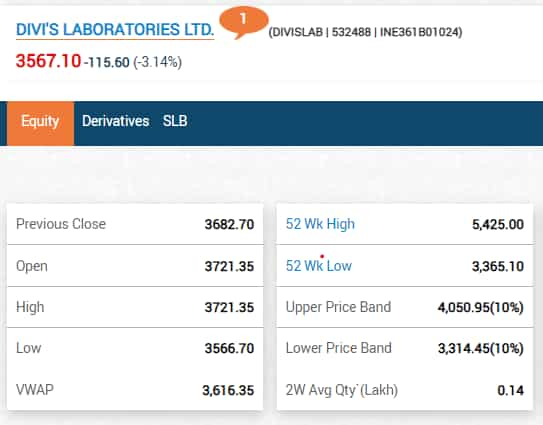

Divi’s Laboratories stock under pressure today, slips 3% in early trading

View Full Image

Rupee slips 1 paisa to 82.41 against US dollar in early trade

The rupee slipped 1 paisa to 82.41 against the US dollar in the morning trade on Tuesday amid the strengthening of the American currency and sustained foreign fund outflows.

Moreover, a weak trend in domestic equities and risk aversion sentiment among investors weighed on the local unit.

At the interbank foreign exchange, the domestic unit opened at 82.35 against the dollar, then pared the gains to 82.41, registering a loss of just 1 paisa over its previous close.

In a highly volatile session, the local unit also touched 82.33 against the American currency in initial deals. (PTI)

Japan’s Nikkei drops sharply, tech stocks lead losses

Japanese shares plunged on Tuesday, led by losses in tech stocks that tracked peers across global markets, though travel-related companies remained firm as Japan re-opens its borders to regular tourism this week.

The Nikkei share average fell 2.34% after returning to trade from a three-day weekend. It opened well below the 27,000 level and was at 26,480.97 at the midday break.

The broader Topix fell 1.6%.

The Philadelphia semiconductor index lost 3.5% overnight after U.S. President Joe Biden announced a new set of export controls last week that could stymie China’s chipmaking industry.

“Washington’s moved to further restrict China’s access to U.S. technology, which adds to signs of slowing global chip demand,” Saxo Bank market strategist Redmond Wong wrote in a note. (Reuters)

Angel One and Ashika Stock Broking on today’s market

Sameet Chavan, chief analyst-technical and derivatives, Angel One Ltd: The sacrosanct level of 17000 once again proved its mettle. In spite of the not so favorable global environment, our markets managed to recover a fair bit of ground; courtesy to the recently laggard IT space, which has shown some sign of revival ahead of the quarterly result of IT giant, TCS. We continue to remain sanguine as long as the key support zone of 17000 – 16800 remains intact and meanwhile, the buy on declines approach remains the key. For the coming session, intraday supports are now visible at 17140 – 17050; whereas a move above 17300 would trigger a short covering move towards 17400 and beyond.

Traders are advised to stay upbeat and it’s better to focus on thematic moves, which are likely to provide better trading opportunities. We, being the stronger market, are successfully managing to weather all storms and hence, once the global market supports, we may see the outperformance to continue.

Tirthankar Das, technical & derivative analyst, retail, Ashika Stock Broking Ltd: On the technical front, Nifty started on a negative note. However, supportive efforts from 200 days EMA has been adding strength at lower levels. Yesterday Nifty formed a long bull candle on the daily chart, revalidating that buying interest are developing at the lows. However, for the Index to end its prolonged correction, it needs to provide a decisive close above 17350. Presently a trader needs to show patience and need to avoid trading aggressively in the market as the risk of a bare minimum correction of 38.2% of the entire rally from 15,183 to 18,096 comes around 16990 followed by 50% correction at 16650 remains. During the day index is likely to open on a negative note due to weak global cues. Formation of lower high- lower low signifies corrective bias. Hence, until and unless Index provides a decisive close above 17350, it would be a sell-on-rise market.

Oil prices inch lower as dollar firms, China COVID worries dent demand

Oil prices slid on Tuesday, extending losses of nearly 2% in the previous session, as a stronger U.S. dollar and a flare-up in COVID-19 cases in China raised concerns of slowing global demand.

Brent crude futures fell 27 cents, or 0.3%, to $95.92 a barrel by 0342 GMT, after falling $1.73 in the previous session.

U.S. West Texas Intermediate crude was at $90.73 a barrel, down 40 cents, or 0.4%, after losing $1.51 in the previous session.

The dollar gained on Tuesday, with worries about rising interest rates and geopolitical tensions unsettling investors. (Reuters)

Yes Securities on Tata Consultancy Services Q2 FY23 recommendations: Broadly inline operating performance; signs of moderation in demand environment – ADD

Tata Consultancy Services (TCS IN) Result Report Q2 FY23

Recommendation: ADD

CMP: ₹3,119

Target Price: ₹3,536

Potential Return: +13%

Broadly inline operating performance; signs of moderation in demand environment

Tata Consultancy Services(TCS) reported broadly inline quarterly performance. The USD reported revenue was impacted due to cross currency headwinds. However, the depreciation of INR by around 3.4% QoQ supported the INR reported growth. The revenue growth was led by strong performance in Retail and CPG vertical(up 22.9% YoY). There was sequential improvement in EBIT margin(up 91bps QoQ) led by improving employee pyramid and other efficiency measures. Employee attrition remained high as LTM attrition increased by 180 bps QoQ to 21.5%. We change our rating on the stock from BUY to ADD with revised target price of ₹3,536/share at 27x on FY24E EPS.

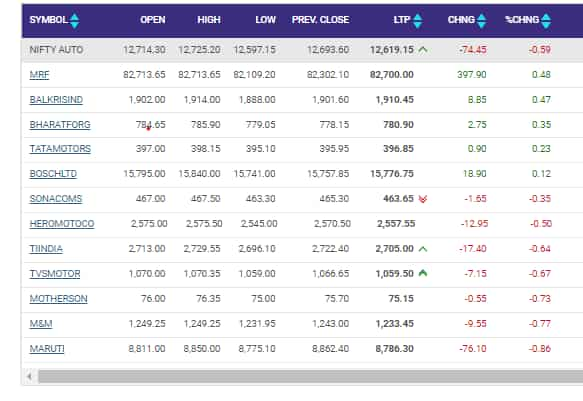

Auto index sheds in early trading; Eicher Motors among biggest laggards

View Full Image

Wales govt to discuss with Welsh companies on investing in Gift City in Kochi

Wales has told a ministerial delegation from Kerala that it will take the initiative to discuss with companies there on investing in the Gift City to be launched in Kochi area of the southern state, Chief Minister Pinarayi Vijayan’s office said. Apart from that, a decision was also taken to sign a Memorandum of Understanding (MoU) with the Wales government to send health professionals from Kerala to the European country, the Chief Minister’s Office (CMO) said in a statement issued on Monday. (PTI)

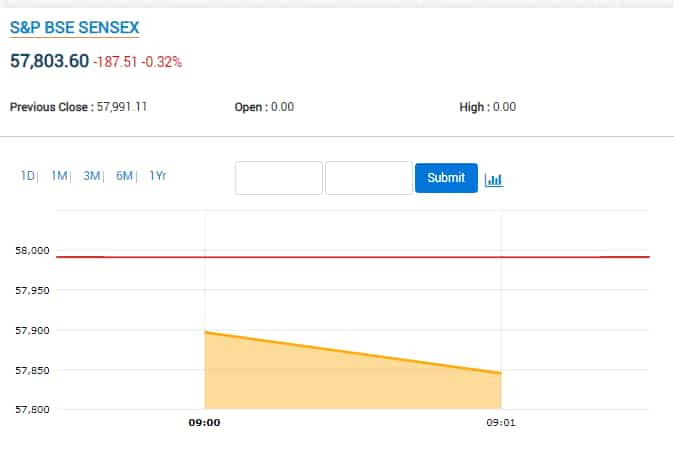

Indices open marginally lower with IT stocks leading the green side

View Full Image

INDIA BONDS-Bond yields seen marginally higher tracking U.S. peers

Indian government bond yields are expected to open marginally higher in early trading on Tuesday, as the 10-year U.S. yield inches closer to 4.00%.

The benchmark Indian 10-year government bond yield is seen in a 7.46%-7.50% band, a trader with a private bank said. The yield, which ended at 7.4758% on Monday and has risen an aggregate 12 basis points in the last three sessions.

“We should see some selling today, tracking U.S. yields, but any major move could be safely ruled out until the inflation data,” the trader said. “Also, some pullback in oil prices could help.”

The yield on 10-year U.S. Treasury note hit 3.99% earlier in the day, on bets that the Federal Reserve would opt for another 75 basis points hike in early November in its bid to combat inflation, after a strong jobs report. (Reuters)

Cryptocurrency prices today: Bitcoin, ether fall over 2%, Shiba Inu plunges 8%

Bitcoin price today plunged as the world’s largest and most popular cryptocurrency was trading more than 2% lower at $19,061. The global crypto market cap today was below the $1 trillion mark, even as it was up slightly in the last 24 hours at $983 billion, as per CoinGecko. (Read More)

Sensex preopens in flat-to-negative territory; TCS, Infosys, Adani Green stocks in focus

View Full Image

Geojit Financial Services views on today’s market: FII selling is getting completely absorbed by DII and retail buying

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services: “The global environment continues to be weak for markets with concerns of a US recession and possible hard landing rising. Clarity is yet to emerge on this. India’s market outperformance continues with Nifty declining less than 0.5 % yesterday in response to near 4% cut in Nasdaq on Friday. A significant factor contributing to this outperformance is that FII selling is getting completely absorbed by DII and retail buying. So even if FIIs continue to sell on rising dollar and US bond yields, that is unlikely to have a significant impact on markets. More important, the fundamentals of the Indian economy and corporates continue to be sound.

The Q2 results season has started off well with decent numbers from TCS which have beaten street estimates on most parameters. This and the news of buy back from Infosys will impart resilience to the IT segment. Financials too will come out with good numbers imparting strength to the market in the near-term.”

Stocks to Watch: TCS, Adani Energy, Infosys, India Cements, Bajaj Auto, Inox Wind, Adani Ports, GVK Power, Panacea Biotech, NMDC, JSW Steel

Delta Corp, GM Breweries, and Supreme Infrastructure India will be in focus as they declare the September quarter earnings today. (Read More)

Finance Minister Nirmala Sitharaman to arrive in US to participate in IMF-WB meeting; to meet Treasury Secretary

Union Finance Minister Nirmala Sitharaman will arrive here on Tuesday to attend an important meeting of the International Monetary Fund and the World Bank.

The finance minister during her visit will also hold a bilateral meeting with US Treasury Secretary Janet Yellen.

Sitharaman upon her arrival will participate in a fireside chat on “India’s Economic Prospects and Role in the World Economy” at the prestigious Brookings Institute think-tank and soon after hold a bilateral meeting with Yellen at the Department of Treasury.

At an official dinner hosted by India’s Ambassador to the US Taranjit Singh Sandhu, nearly 30 senior representatives of the US Administration, World Bank, IMF, and CEOs of the private sector are expected to participate. (PTI)

Axis Securities – BFSI – Q2FY23 – Earnings Preview: Yet another strong quarter

“The systemic credit growth continues to remain robust and at a multi-year high, supported by continued growth in the Retail and SME segment. Corporate loans show gradual signs of revival. With the festive season beginning slightly early, a small part of the credit growth from festive demand (which is expected to be healthy) will be reflected in Q2FY23. Even as credit growth continues to gather pace, deposit growth continues to lag on a systemic level and discussion around deposit accretion to support the robust credit growth will remain in focus. The competitive intensity amongst banks to shore up deposits continues to intensify with banks looking to garner deposits to support their accelerating credit growth. We believe, a sequential NIM improvement would be seen primarily amongst banks with a higher share of EBLR/MCLR linked loans. The hit on treasury income is expected to be lower QoQ and should lend some support to PPOP growth. Opex ratios are likely to remain elevated with investments towards franchise-building and investments in technology. Earnings growth is likely to remain strong driven by moderating credit costs which continue to gravitate to normalized levels. The slippages, and ex-restructured pool, are expected to remain muted and hence asset quality improvement will be aided by improving traction in recoveries and upgrades.

Positive result plays: ICICI Bank, SBI, Federal Bank, IDFC First Bank, Ujjivan Small Finance Bank, Bajaj Finance”

Electronics Mart India IPO: Latest GMP ahead of share allotment

The initial public offering (IPO) of consumer durables retail chain Electronics Mart India received 71.93 times subscription on the final day of offer last week on Friday. The IPO received bids for 449.53 crore shares against 6.25 crore shares on offer. Electronics Mart India IPO consisted of a fresh issue of equity shares aggregating to ₹500 crore. (Read More)

Tracxn Technologies IPO: GMP, subscription status on day 2 of the issue

The three-day initial public offering (IPO) of Tracxn Technologies received 23% subscription on the first day of offer on Monday. The price band has been fixed at ₹75-80 per share for its ₹309-crore public issue that will close on Wednesday, October 12, 2022.

Tracxn Technologies’ IPO is entirely an offer-for-sale (OFS) of 38,672,208 equity shares by promoters and investors. The OFS will see sale of up to 76.62 lakh shares each by promoters Neha Singh and Abhishek Goyal, up to 12.63 lakh shares each by Flipkart founders Binny Bansal and Sachin Bansal. (Read More)

Axis Securities – Metals – Q2FY23 – Earnings Preview: Monetary tightening and strong USD continues to weigh on Steel and Base Metal

“We expect Steel companies under our coverage to deliver weak Q2FY23 numbers. Revenue is likely to decline YoY mainly due to 1) Lower sales realisation on account of lower steel prices (domestic Steel HRC prices have corrected by 25% from the peak in Apr’22), 2) Weak exports due to the 15% export duty imposed from May’22, the lower sales realisation will be only partially offset by 3) QoQ increase in sales volumes led by re-stocking by traders as Q1FY23 sales volumes were impacted by sharp de-stocking by traders. We expect EBITDA to show a steeper fall in Q2FY23, a de-growth of ~40% QoQ and ~65% YoY, primarily on account of a fall in the topline and higher coking coal consumption costs in the quarter. The high coking coal cost inventory will flow through in Q2FY23 and would impact the margins. The benefit from the drop in coking coal and iron ore prices will be realised only partially in Q2FY23. The majority gain will be realised in Q3FY23. Steel HRC prices ex-Mumbai continue to correct with the spot prices currently at ₹56,500/tonne, down 25% from the peak of the 1st week of Apr’22. The fall in revenue in Q2FY23 will be led by lower average price realisations as average Q2FY23 HRC prices have declined by 17% QoQ and 14% YoY to ₹57,027/tonne. In Q1FY23, the sales volumes were impacted due to destocking by traders as they expected the steel prices to fall as well as in light of the onset of the monsoon. However, in Q2FY23, we foresee steel sales volumes reviving as traders are restocking to serve the demand from the pick-up in construction activities post-monsoon as well as the upcoming festive season demand. With the restocking on the cards, we expect the steel prices to bottom out at the current spot price levels and as a result we foresee some support to the steel prices in Q3FY23.”

Bajaj Auto buys back shares worth ₹2,499.97 cr

Bajaj Auto Ltd on Monday said it has bought back over 64 lakh shares from public shareholders for ₹2,499.97 crore under its share buyback exercise.

The company, which had commenced the share buyback on July 4, 2022, said its Buyback Committee at its meeting held on Monday approved the completion and closure of the exercise from October 10, 2022.

In a regulatory filing, Bajaj Auto said it has bought back 64,09,662 equity shares, utilising an aggregate amount of ₹2,499.97 crore.

The total amount earmarked for the purpose was up to ₹2,500 crore.

The company’s board at its meeting held on June 27, 2022 had approved the proposal for buyback of the fully paid up equity shares of face value of ₹10 each from existing shareholders except promoters, promoter group and persons in control of the company from open market at a price not exceeding ₹4,600 per share. (PTI)

This multibagger penny stock fixes record date for 102:100 bonus shares

With a market valuation of ₹13 Cr, SMVD Poly Pack is a small-cap company that operates in the packaging industry. One of the leading Indian manufacturers and exporters of bulk bags, PP/HDPE woven bags, and FIBC Jumbo bags is SMVD Polypack. The firm owns cutting-edge equipment with a 4000 MT installed capacity per year. Fertilizer plants, cement plants, chemical industries, flour mills, ceramic industries, steel industries, plastic compounds, rice plants, poultry farms, and many more are among the company’s clientele. The record date for 102:100 bonus shares has been made public by the company’s board of directors. (Read More)

Rupee drops 10 paise to close at all-time low of 82.40 per USD

The rupee slipped 10 paise to finish at a fresh lifetime low of 82.40 against the US dollar on Monday, weighed down by risk-averse sentiment among investors.

Moreover, a negative trend in domestic equities and a firm greenback overseas sapped investor appetite, forex traders said.

At the interbank foreign exchange market, the local currency opened at 82.68, then fell further to an all-time intra-day low of 82.69.

According to forex traders, the local unit pared initial losses on possible central bank intervention and finally settled for the day at an all-time low of 82.40 against the American currency, down 10 paise over its previous close. (PTI)

India Cements divests entire stake in SMPL to JSW Cement for ₹477 cr

India Cements Ltd on Monday said it has entered into a pact to sell its entire stake in Springway Mining Private Limited (SMPL) to JSW Cement for a total consideration of ₹476.87 crore.

SMPL owns limestone-bearing land at Panna district and is in the process of setting up a cement plant at Damoh district in Madhya Pradesh.

The company has “entered into a Share Purchase Agreement on October 10, 2022, with JSW Cement Limited (Buyer) and divested the entire shareholdings held by it in SMPL, for a total consideration of ₹476.87 crore,” India Cements Ltd (ICL) said in a regulatory filing.

Consequently, SMPL has ceased to be a wholly-owned subsidiary of ICL, it added.

The deal is expected to be completed by the end of this year. (PTI)

Inox Wind sells entire stake in 3 SPVs to Adani Green

Inox Wind through its subsidiary arm, Inox Green Energy Services Limited (IGESL) has sold the entire equity shareholding held in three special purpose vehicles (SPV) — Wind One Renergy Ltd, Wind Three Renergy Ltd and Wind Five Renergy Ltd to Adani Green Energy Limited, a part of the Adani Group.

In a regulatory filing, Inox Wind said that the SPVs had commissioned 50 MW each, out of the total 250 MW which it had successfully won under the tranche 1 of Solar Energy Corporation of India Limited’s (SECI) bids for wind power projects at Dayapar, Gujarat connected on the central grid connected on the central grid at affixed tariff of ₹3.461 per unit for 25 years for sale to PTC India. (Read More)

Infosys to consider a proposal for buyback of shares

India’s second-largest IT services provider Infosys Ltd will consider a buyback proposal when its board will meet on 13 October, the company informed the stock exchanges.

“Pursuant to Regulation 29(1)(b) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI LODR Regulations”), the Board of the Company will consider a proposal for buyback of fully paid-up equity shares of the Company at its meeting to be held on October 13, 2022, in accordance with the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018, as amended,” Infosys said in a filing.

The outcome of the board meeting will be disseminated to the stock exchanges after the conclusion of the board meeting on 13 October 2022, the company said. (Read More)

TCS Q2 net up 8.4% to ₹10,431 crore; flags challenging environment

Largest IT services exporter TCS on Monday reported an 8.4 per cent growth in its September quarter net profit at ₹10,431 crore, crimped by a dent on margins.

The Tata group company, however, said the operating environment is “challenging” and warrants “vigilance”, even though the headwinds posed by factors like recession in its biggest market US, rising inflation around the world and currency volatilities are yet to materialise into its order pipeline.

Its Chief Executive Officer and Managing Director Rajesh Gopinathan said it is difficult to say if the company will be completely insulated from the events as they unfold, and made it clear that it will try to minimise the risks as much as possible.

The reporting quarter saw an 18 per cent jump in revenues to ₹55,309 crore as against ₹46,867 crore in the year-ago period, but it was a 1.60 percentage points narrowing in the operating margin to 24 per cent which crimped the profit growth. (PTI)

US stocks fall as markets await bank earnings

Wall Street stocks were modestly lower Monday after a quiet session to open a news-jammed week filled with major economic reports and corporate earnings.

This week’s calendar includes the latest US consumer price index data, which will give an updated reading on inflation that has prompted significant Federal Reserve interest rate hikes.

Investors will also take in new retail sales figures and earnings from Delta Air Lines, JPMorgan and others.

Monday’s calendar saw no major economic reports. The bond market was closed for Columbus Day.

The Dow Jones Industrial Average shed 0.3% to 29,202.94.

The broad-based S&P 500 fell 0.8% to 3,612.43, while the tech-rich Nasdaq Composite Index dropped 1.0% to 10,542.10.

Investors are cautious ahead of the earnings period, with rising costs expected to cut into corporate profits. (AFP)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!