For the stock market, earnings represent the sum of all fears. But if they don’t play out the way bearish investors think they will, shares’ next move could be higher.

At any given moment, earnings expectations reflect everything that’s happening in the world, from the economy and the Federal Reserve to interest rates and geopolitics. Right now, most of the fear stems from expectations about the economy. The Fed has lifted interest rates to tamp down inflation by reducing economic demand, and so far, that seems to be working. The rate of inflation has been cut almost in half from its post-Covid peak, but growth is slowing with it: First-quarter gross-domestic-product expansion is set to fall to 1% from 2.1% last year when it’s reported on April 27. And since higher rates operate with a lag, the full effects of the rate hikes probably haven’t been felt yet, raising the possibility of a recession.

A recession would clobber corporate earnings far more than analysts currently expect. The aggregate earnings-per-share result for

companies this year is expected to come in at $218, up a touch from last year’s $216, but a recession could cause it to decline year over year—and stocks to tumble.

“We don’t know how bad that downturn will be,” says Chris Harvey, chief U.S. equity strategist at Wells Fargo. “We think you need to have a pretty aggressive repricing” of risk assets.

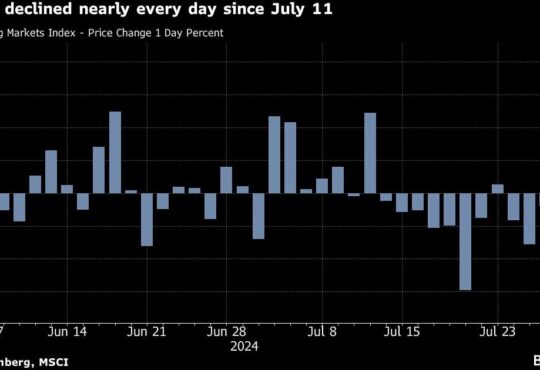

And yet the stock market seems to be just fine. The S&P 500 index fell 0.1% this past week, while the

dropped 0.2% and the

lost 0.4%. Still, all three are in positive territory for the year, with the S&P 500 up 7.7%.

Advertisement – Scroll to Continue

The rally has made stocks far more expensive than they were at the start of the year, with the S&P now trading at 18.3 times forward earnings, up from 16.7. While that could be a sign that investors are paying too much for future profits, it could also indicate that the market is confident that they’ll be better than analysts are predicting.

And for the moment, first-quarter reporting season appears to be going swimmingly. Earnings from S&P 500 companies that have reported have come in almost 5% above analysts’ estimates as of Friday, according to Evercore. While those that have topped their numbers are getting rewarded, those that miss aren’t being punished all that much. Companies that have announced earnings and sales that beat expectations have gained 2.3%, versus an average advance of 1% over the past five years. A double miss has resulted in a mere 1.8% drop, versus an average 2.9% decline.

That could be a sign that the worst for the economy is actually over. And that possibility—for the moment, at least—is showing up in analysts’ forecasts. About 76% of companies in the

have seen upwardly revised earnings estimates for the next year, according to Ned Davis Research. That’s the highest level in 10 months and up from a recent low of just under 60%, and it could be a sign that estimates have bottomed and are ready to rebound.

Advertisement – Scroll to Continue

“The increasingly positive revisions rate makes it more likely that, after close to two years of increasingly pessimistic earnings sentiment, investors will buy on expectations of better earnings ahead,” writes Tim Hayes, chief global investment strategist at Ned Davis Research.

Call it complacent, call it shortsighted, call it just plain stupid, but sometimes the stock market is right to shrug off what feels like a pressing concern. This might be one of those times.

Write to Jacob Sonenshine at jacob.sonenshine@barrons.com