Companies backed by Stagecoach founder Sir Brian Souter have outperformed the stock market by 270% over the 15 years since he set up the family office.

Over the period, Souter Investments has seen an 8% annual increase in value, after tax and costs, and adjusted for charitable donations. This compares with a 5% annual return on UK quoted equities including dividends over the same period.

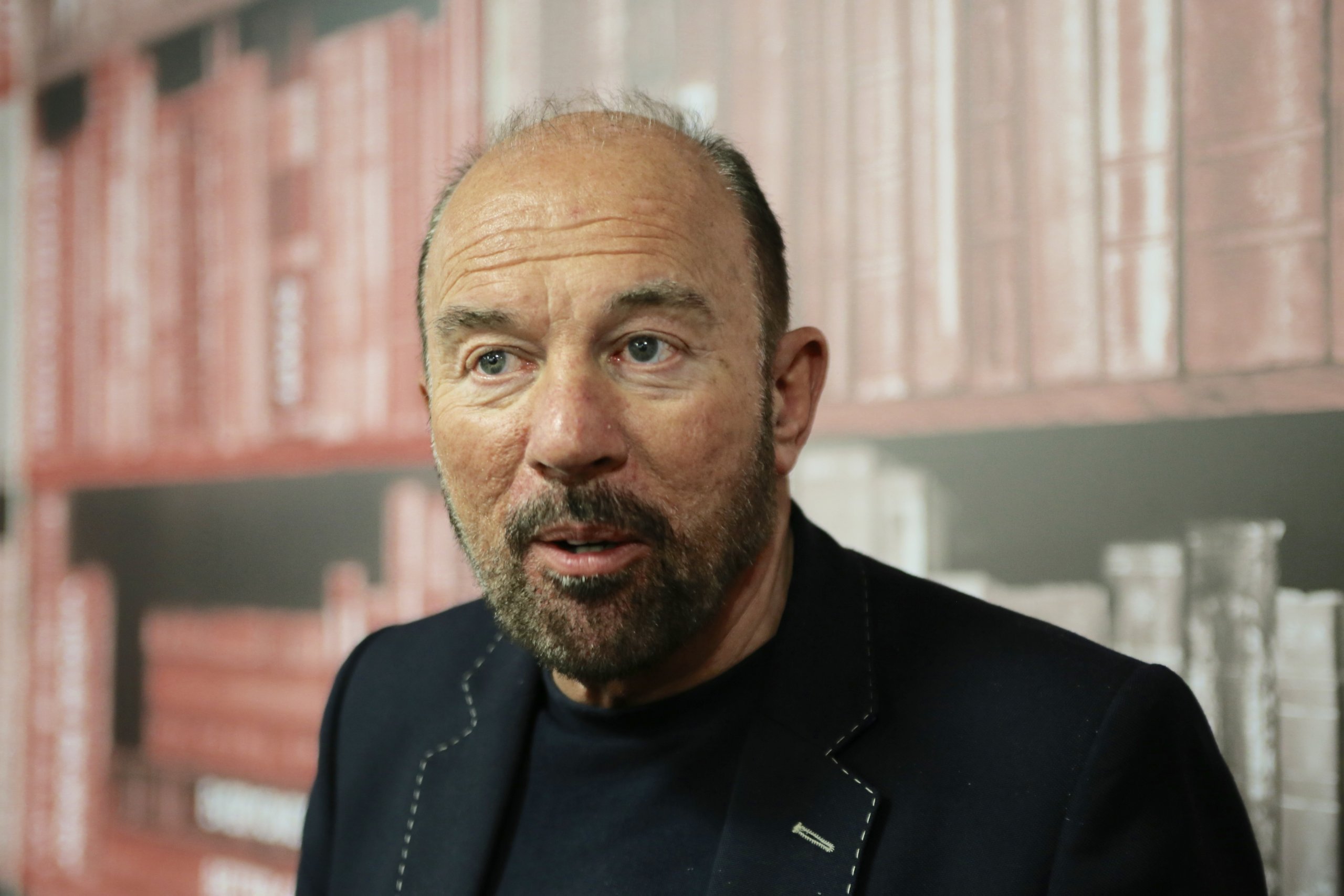

Sir Brian said: “Although this may not sound like much of a difference, the compounding effect of our performance means that our portfolio is now 270% higher in value than it would have been if we had invested solely in the UK stock market.”

The review highlights continued strong performance from Souter’s core private equity portfolio, which generated a 26% annualised return across nearly 30 realised deals.

The current private equity portfolio includes companies spanning sectors including industrials, financial services, business services, telecoms media and technology, consumer, healthcare, energy, and education. Two-thirds sell business-to-business.

Souter Investments’ co-managing director Calum Cusiter said: “Sir Brian’s vision for Souter Investments was to create an entrepreneurial family investment office, which would be resilient to economic downturns, generate healthy returns over the long-term and fund charitable donations.

“Since 2006 we have pursued those objectives by building a diversified portfolio and retaining an opportunistic and flexible investment approach.

“Our overall strategy of focussing on private equity investments remains the same today as it did over 15 years ago.”

The office has been particularly active over the last three years, adding nearly 20 new private companies to its portfolio.

Among them, LIKEZERO is a software business providing next generation data capture and contract analysis solutions to the financial services sector; and Climate Impact Partners, a voluntary carbon markets specialist working with leading corporates, NGOs, and governments.

Others include sustainable clothing and homeware brands Celtic and Co and Turtle Doves, which specialise in ethically sourced fashion; and Amber River, a consolidator of the independent financial advice market.

The office has sold several companies, including Stone Technologies Group; Duke Street backed Voyage Care; Global Risk Partners in a deal led by Penta Capital; and The Rohatyn Group’s Pet Network International. Acquirers have been a mix of strategic corporate buyers and financial investors.

Co-managing director John Berthinussen commented: “We are particularly pleased that the returns from our private equity portfolio, where the weight of our capital and efforts are focussed, remain so strong.

“While holding high levels of cash and liquidity over the last three years during a period of low yields has inevitably held back our returns in the short-term, and the social and economic backdrop has been challenging, we are pleased with the progress of the portfolio and confident that the new investments we have made will mature to generate continued robust returns.”

A major beneficiary of Souter Investments’ performance is The Souter Charitable Trust, which aims to assist projects engaged in the relief of human suffering. It has awarded nearly 20,000 charitable grants totalling almost £130m in funding since 2006.

By number, most grants awarded are one-off payments of £5,000 or less, often to smaller local charities working in the communities in which they are based. Larger one-off and multi-year grants are also awarded.

Sir Brian added: “As we traverse today’s set of challenges and seek to identify new opportunities, we are fortunate to benefit from a diversified portfolio of strong businesses and significant liquidity to invest in new deals.

“Following the sale of Stagecoach Group in May 2022, I am excited to continue with our work at both Souter Investments and The Souter Charitable Trust.”