[1/3]Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., July 26, 2023. REUTERS/Brendan McDermid/File Photo Acquire Licensing Rights

NEW YORK/LONDON, Sept 19 (Reuters) – Global stocks eased and the benchmark Treasury yield rose close to levels last seen in 2007 as a plunge in U.S. homebuilding in August underscored the balancing act the Federal Reserve faces in signaling its outlook on interest rates this week.

Traders and investors avoided big bets ahead of rate decisions by the Fed on Wednesday, the Bank of England on Thursday and the Bank of Japan on Friday, in a week with policy decisions also expected from other central banks.

Oil prices rose for a fourth straight session, with futures for global benchmark Brent crude climbing past $95 a barrel, to further exacerbate inflation concerns and question whether rates need to go higher to quash inflation.

The U.S. central bank will likely pause its aggressive hiking of interest rates and also indicate its outlook on rates and economic growth in the months ahead when Fed Chairman Jerome Powell speaks on Wednesday.

“The story is a function of how dovish versus how hawkish he is going to be,” said Steven Ricchiuto, U.S. chief economist at Mizuho Securities USA LLC in New York, referring to Powell.

“The more dovish he is leads to an environment where yields are likely to move higher,” he said. “The less willing they are to assure being restrictive, the more likely inflation is to come back and bother them.”

The impact of rising interest rates crimped demand in U.S. housing as a resurgence in mortgage rates led homebuilding last month to plunge to more than a three year-low.

The yield on benchmark 10-year Treasury notes rose 2 basis points at 4.339%, just below the 4.366% level reached on Aug. 22, which was the highest since late 2007.

Stocks slid as expectations interest rates will stay higher for longer put a damper on the market. Futures show the Fed will keep its overnight lending rates above the 5% mark until late July 2024.

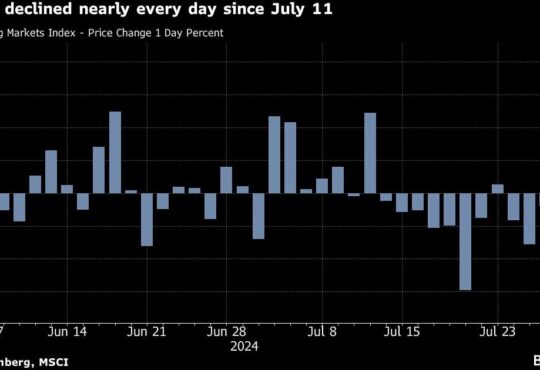

MSCI’s gauge of stocks across the globe (.MIWD00000PUS) shed 0.46%, while the pan-regional STOXX 600 index (.STOXX) in Europe lost 0.18%.

On Wall Street, the Dow Jones Industrial Average (.DJI) fell 0.69%, the S&P 500 (.SPX) lost 0.65% and the Nasdaq Composite (.IXIC) dropped 0.84%.

The dollar index , which gauges the currency against six major peers, was 0.08% at 105.00, not far from Thursday’s six-month high of 105.43.

Investors and central bankers are contending with a sharp rise in oil prices as demand has picked up while Saudi Arabia and Russia have limited supply, and weak U.S. shale output has increased concerns.

U.S. crude futures rose 1.55% to $92.90 a barrel, while Brent was at $95.49, up 1.12%.

Samuel Zief, head of global FX strategy at JPMorgan Private Bank, said central banks should not be overly concerned by the run-up in oil prices, which he said should fade as economies slow.

“What the central banks are really, really focused on, it’s not really the supply-side energy shocks anymore, it’s really the sticky services part of the inflation basket,” he said.

The Bank of England sets policy on Thursday and is expected to hike rates by 25 basis points to 5.5%, in what many investors believe will be the last increase of the cycle.

The Bank of Japan is expected to leave rates on hold in negative territory on Friday, although it too will be scrutinized for clues about the outlook after Governor Kazuo Ueda hinted at a move away from ultra-loose policy.

In Asia, Japan’s Nikkei (.N225) fell 0.87% under the weight of big losses for chip-related stocks including Tokyo Electron (8035.T).

Japanese markets were closed Monday, when Asian tech stocks were sold off following a Reuters report that TSMC (2330.TW) had asked its major vendors to delay deliveries.

Reporting by Herbert Lash, additional reporting by Harry Robertson in London, Kevin Buckland in Tokyo and Lewis Jackson in Sydney; Editing by Marguerita Choy and Chizu Nomiyama

Our Standards: The Thomson Reuters Trust Principles.