Image source: Getty Images

Rolls-Royce (LSE:RR) and its share price have been the FTSE 100’s biggest winners in 2023.

At 204.5p per share, the enginebuilder is up 116% since 1 January. Even as market volatility has erupted in recent weeks, Rolls shares have remained resolute.

What’s remarkable is that the FTSE firm still looks cheap despite its rapid share price ascent. City analysts predict annual earnings will soar almost 300% in 2023. This results in a price-to-earnings growth (PEG) ratio of just 0.1.

Any reading below one suggests that a stock is undervalued. The company trades on PEG multiples below this benchmark through to 2025, too, as brokers predict strong and sustained earnings growth.

Strong momentum

Market confidence in Rolls-Royce and its shares has been transformed since the dark days of the pandemic.

Back then the company seemed on the verge of bankruptcy as Covid-19 grounded the airline industry. This meant it wasn’t able to make money from servicing commercial planes, a key part of the business. Meanwhile, net debt accumulated and soared to £5.2bn by the end of 2021.

Yet an enduring travel sector recovery following the end of lockdowns has driven revenues and profits sharply higher again.

Rolls’ turnaround isn’t just thanks to external factors, though they have been critical. Epic streamlining and cost-cutting has given the balance sheet a big boost. New chief executive Tufan Erginbilgiç is making all the right noises, too, on future improvements at the firm.

Back in business?

It’s easy to see why investor appetite for Rolls shares has boomed. Travel demand could slow in the months ahead as the global economy splutters, but the firm is now in much better shape to withstand any bumps.

The long-term outlook for key end markets also remains highly encouraging. Defence spending is rising strongly as the geopolitical backdrop fractures. The transition from fossil fuels also means demand for its nuclear reactor technology could rise strongly.

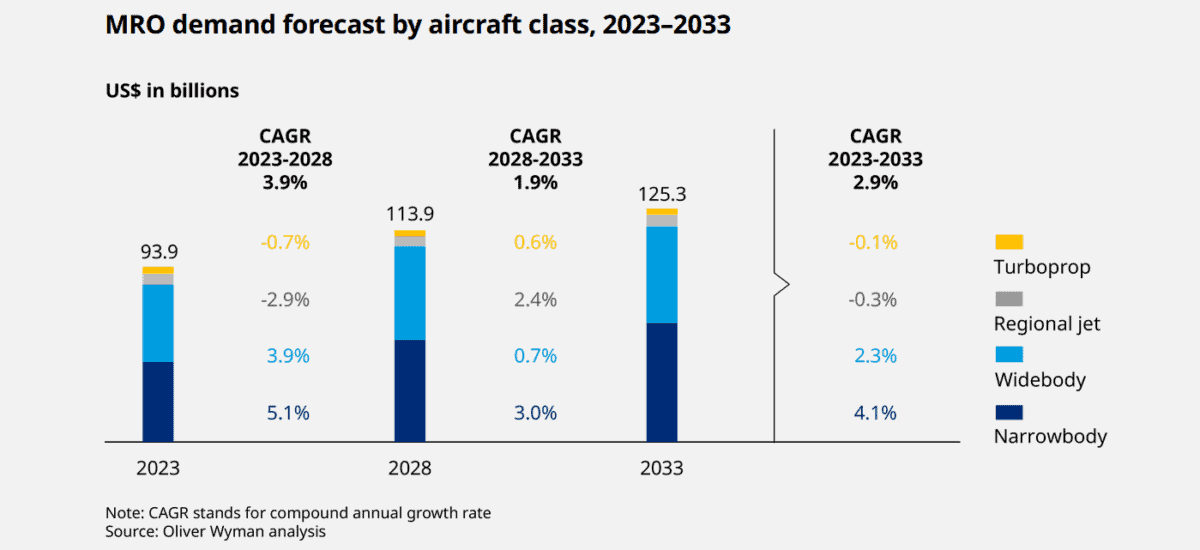

Importantly the world’s aircraft fleet is also predicted to soar, giving Rolls an opportunity to increase its servicing revenues. Consulting firm Oliver Wyman thinks the maintenance, repair, and overhaul (MRO) services sector will rise to be worth more than $125bn by 2033, as the graphic above shows.

Not so fast

Yet despite the recent fanfare around Rolls shares, I’m yet to be convinced by the firm’s long-term investment case.

It was only eight months ago that chief exec Erginbilgiç described the company as “a burning platform” that “underperform[s] every key competitor out there“. Sure, the firm’s self-help measures have been impressive since the pandemic. But I want to see much more progress being made that could pull Rolls’ share price out of its long-term slump.

I’m also concerned that, while net debt has fallen sharply, Rolls still has an uncomfortable £2.8bn worth on the balance sheet. And a large portion of this needs to be repaid in the next couple of years.

Then there are other external threats to the firm’s fortunes. These include high levels of competition, strict aerospace regulation, technological disruption, and escalating R&D costs.

While Rolls is moving in the right direction, I’d still much rather buy other FTSE 100 shares for my portfolio.