fotokostic

Higher Natural Gas Prices Lead To More Expensive Fertilizers For Farmers But Also Cause Disruptions In The Fertilizer Industry

One of the industries most affected by the rapid rise in natural gas prices due to geopolitical tensions between Western countries and Russia is the fertilizer sector. This is because natural gas is the fossil fuel that powers the production process, but also the raw material that is needed to produce fertilizers for agriculture.

The rise in gas prices means that many operators in Europe had to drastically reduce or even temporarily halt the production of fertilizers as it became economically unsustainable, at the risk of being unable to reopen.

Due to the massive use of fertilizers in crops, insufficient European production is putting strong upward pressure on fertilizer prices, which have become more expensive as a result.

While this situation has put several small and underfunded operators at risk of exiting the market, it creates an incredible opportunity for the largest and most organized producers.

The Chance For Major Producers To Seize A Bright Future For Fertilizers

By leveraging a global presence, major manufacturers can import the products from their overseas operations. The higher price of fertilizers due to expensive gas has become an incredible opportunity for large fertilizer manufacturers in Europe, who can meet a significant local demand for fertilizers with products they can ship from abroad.

For the largest producers, this is an opportunity to further increase their profits, make more money to fund green projects and gain market share.

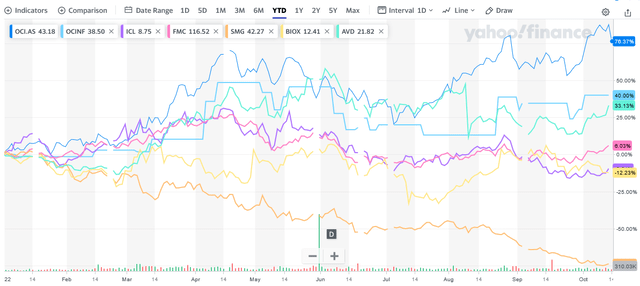

Higher profitability tends to translate into higher stock market valuations, which, as the chart below of Yahoo Finance shows, have recently sparked investor interest in publicly traded agricultural fertilizers and chemicals.

finance.yahoo.

Among the fertilizer and chemical stocks, OCI N.V. (OTC:OCINF) (OCI:AS) stock stands out by outperforming all its competitors with a year-to-date share price gain of 42% on the over-the-counter market and 76.4% on the Amsterdam stock market [as of this writing], while its continued operational development makes it well poised for long-term growth.

Based in Amsterdam, The Netherlands, OCI N.V. (OTC:OCINF) (OCI:AS) sells nitrogen products and chemical compounds for resin preparation, as well as bio-methanol and diesel exhaust fluid [DEF] to customers in various sectors, but mainly in the agricultural, transport and industrial sectors.

More than 95% of nitrogen product sales are sales of compounds used as a basis for fertilizers.

In-House Production Versus Imports

About 75% of the products sold are manufactured in-house, while 25% are purchased from various suppliers.

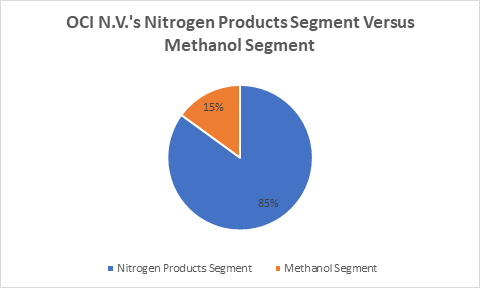

The Nitrogen Products Segment Versus The Methanol Segment

In terms of Adjusted EBITDA, the nitrogen products segment accounts for 85% of the total business, while the methanol segment accounts for 15%.

data from the company’s most recent earnings report

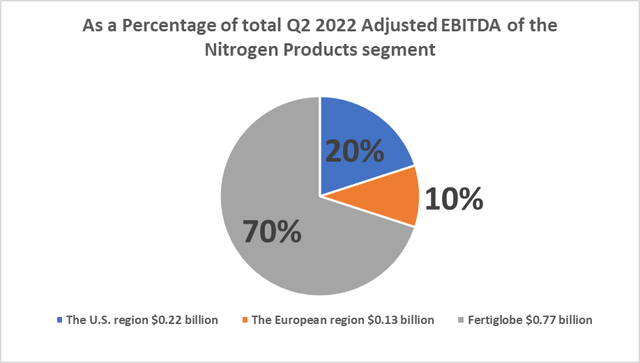

The Nitrogen Products Segment By Region

As for the Nitrogen Products segment, the U.S. region, which generated Adjusted EBITDA of $216 million in Q2 2022 [up 149% year over year], accounts for nearly 20% of its overall business segment.

Europe, which generated Adjusted EBITDA of $134 million in Q2 2022 [up 136% YoY], accounts for 10% of the total business segment.

While Fertiglobe posted adjusted EBITDA of $770 million [up 155.5% year over year], thus it accounts for about 70% of the entire segment.

data from the company’s most recent earnings report

The Fertiglobe segment offers a significant competitive advantage. OCI N.V. has inked low-cost gas supply contracts with fossil fuel traders in the United Arab Emirates and North Africa.

The Fertiglobe segment is the world’s largest overseas exporter and producer of nitrogen fertilizers in the MENA region [the Middle East and North Africa] and a pioneer in clean ammonia.

The above statistics show that Fertiglobe is critical to the success of OCI N.V. and the MENA segment is now benefiting greatly from higher selling prices.

If favorable gas supply contracts from Fertiglobe are combined with the hedging strategy of OCI N.V. in the United States, the company has dramatically reduced its exposure to natural gas spot market volatility.

As a result of these strategies, the company can have an upfront view of approximately 90% of the future price of the raw material needed for 7 years of production through 2030, while only 10% is fully subject to future uncertainties.

This allows the company to program with more confidence. From a cost perspective, the company now looks more resilient, which will have a positive effect on the company’s financial health.

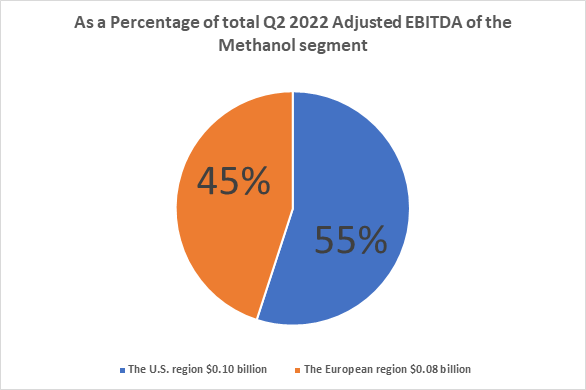

The Methanol Segment By Region

As for the Methanol segment, the U.S. region, which generated Adjusted EBITDA of $105 million in Q2 2022 [up 11.2% year over year], accounts for nearly 55% of its overall business segment.

Europe, which generated Adjusted EBITDA of $76 million in Q2 2022 [up 467.2% YoY], accounts for 45% of the total business segment.

data from the company’s most recent earnings report

Competitive Advantage

The unusually high price for gas together with the well-known volatility of this raw material market is currently making business very difficult for European fertilizer manufacturers.

The sharp increase in production costs due to speculation on the price of gas on the futures market is one of the greatest challenges for the European fertilizer industry.

However, OCI N.V.’s Nitrogen Europe segment is developing well as the Dutch global supplier has made its business model much more flexible than before with the following operational change.

By expanding the receiving capacity of the import terminal in the cargo port of Rotterdam, the largest and most important trade sea harbor in Europe, OCI N.V. welcomes larger volumes of fertilizer products from its overseas production activities in North Africa and the US. This step makes it possible to significantly reduce the European production of ammonia [the basis for fertilizers has almost halved in a few months] and other fertilizers, as running the facility has become expensive due to the high price of gas. The European facility currently consumes less than 10% of all the natural gas the company needs to operate the facilities and that it needs as the basis for manufacturing the ingredients for its nitrogen products.

Thanks to the positive feedback in recent months, the Dutch fertilizer manufacturer wants to further increase the capacity of the terminal in the port of Rotterdam. In this way, OCI N.V. can continue to exploit its position as a global market leader.

The Outlook For The Company’s Operations

For The Nitrogen Products Segment:

The company’s supply is well positioned to meet the expected growth in the global demand for fertilizers in the coming years, which Vantage Market Research analysts say will increase primarily as a result of two long-term factors of increasing food needs coupled with the growing population. These analysts expect global fertilizer market revenue to grow more than 14% from $191.5 billion in 2019 to at least $219 billion in 2028.

The food crisis in underdeveloped economies and many Third World regions – especially in the Horn of Africa – will also greatly contribute to the demand for fertilizers.

Many other companies in the industry, whose activities do not have a global reach, will not be able to benefit from the projected higher demand for fertilizers as production costs, which are expected to be well above current levels, will lead to a suspension of business operations.

The current geopolitical tensions between the countries, mainly due to the war in Ukraine, are the reason to expect higher operating costs. These factors are so severe that the inflationary pressures they generate are deeply entrenched and require aggressive action by monetary authorities. Thus, these factors define the expected higher operating cost event as probable at this point.

A supply that will become quite scarce compared to a growing demand will drive up fertilizer prices and OCI N.V. should benefit a lot from this.

For The Methanol Segment:

As for the global methanol market, analysts from Data Bridge market research predict that it will grow significantly in the coming years from $29.2 billion in 2021 to $41.43 billion before the end of 2029.

An expected strong increase in demand for petrochemicals will be a key factor in the growth of the global market for methanol as the commodity is widely used in petrochemical production activities worldwide. In addition, there is a notable demand for methanol for the manufacture of plastic materials and various chemical products such as engine antifreeze, solvents and denaturants. It is also suggested as a fuel blended with gasoline.

In the future, the global market for methanol will be driven by global concerns about climate change, as the product can be used to produce cleaner fuels, i.e., fuels with low CO2 and greenhouse gas emissions.

The latter is on track to become a very thriving market in the future, but its exploitation will require a huge allocation of resources for the realization of green fuel manufacturing technologies.

The Balance Sheet Looks Strong

From a financial point of view, OCI N.V. seems strong enough to support the company’s growth projects, such as the continued expansion of the Rotterdam hub and clean technologies for the automotive industry.

As of June 29, 2022, the total debt of $3.1 billion far exceeds the total available cash of $2.1 billion, but the company can afford the burden, as evidenced by its interest coverage ratio of 7.44.

The ratio is calculated as a 12-month profit from current operations of $2.3 billion divided by a 12-month interest expense of $0.309 billion.

The remarkable profitability of the operation [OCI N.V. outperforms most of its peers on every financial indicator] allows the company to deleverage its balance sheet fairly consistently, as shown in the table below.

|

Items |

As of June 2021 |

As of September 2021 |

As of December 2021 |

As of March 2022 |

As of June 2022 |

|

TTM Cash from Operations [in USD million] |

1,199.8 |

1,543.2 |

2,264.1 |

2,617.4 |

3,399.5 |

|

Net Debt [in USD million] |

3,314.5 |

3,320.0 |

2,497.7 |

1,542.3 |

979.5 |

A strong increase in operating cash flow was accompanied by a significant reduction in net debt. As this trend continues, the company will be more and more efficient in pursuing value-added growth opportunities. This is of no small importance amid a future characterized by higher borrowing costs due to hawkish central bank stances.

Given the above, this stock could outperform the market in the coming years. So it seems like a long-term investment.

The Stock Isn’t At Its Lowest, But It’s Cheap Though

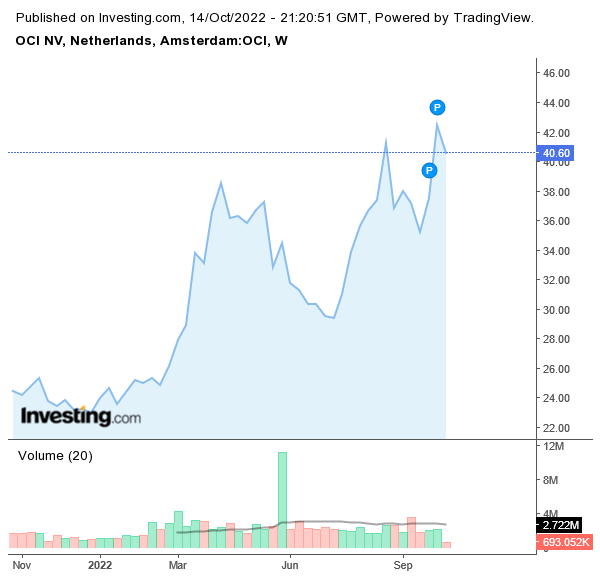

The primary listing of the stock in OCI N.V. (OCI:AS) is on the Amsterdam Stock exchange and shares were exchanging hands at €40.60 per unit for a market cap of €8.392 billion and a 52-week range of €22.54 to €44.40 as of this writing, the chart below by Investing illustrates.

investing/equities/oci-nv-chart

The stock is not trading low as it is significantly above the middle point of €33.47 of the 52-week range and above the 200-Day Moving Average of €32.58.

The company paid a semi-annual dividend of EUR 3,550 per common share on October 31, 2022, and EUR 1,450 per common share on June 22, 2022. The payment leads to a dividend yield [forward] of 16.84% at the time of writing.

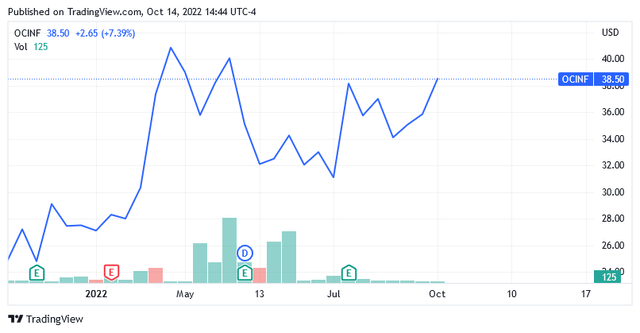

The stock is also traded on the over-the-counter market under the symbol (OTC:OCINF).

As of this writing, shares were trading at $38.50 for a market cap of $8.16 billion and a 52-week range of $24.80 to $40.85.

The stock is not trading low as it is significantly above the middle point of $32.83 of the 52-week range and above the 200-Day Moving Average of $33.36.

seeking alpha OCINF stock symbol summary chart

Valuations aren’t low, but they’re not particularly high either, as evidenced by the EV/EBITDA [TTM] of 3.08 compared to the industry median of 5.84.

However, given strong upside catalysts, the stock is a very interesting investment idea at this price.

Conclusion – OCI N.V. Will Benefit From Higher Profit Margins

The rise in the price of gas, the raw material for fertilizers, could put many European producers out of business because production would no longer be viable unless they could import the goods from foreign subsidiaries. This causes the supply of fertilizers to fall while the demand for these commodities remains robust as food needs are in line with the global population that grows.

OCI N.V. will benefit from higher profit margins in the coming years as a more flexible business model and ad hoc hedging strategies allow for improved cost control while fertilizers are on track to become increasingly expensive.