Stocks lost some steam in midday trading on Friday as the S&P 500 (^GSPC) reversed earlier gains while the Nasdaq Composite (^IXIC) held higher as earnings from Amazon (AMZN) and Intel (INTC) eased worries around Big Tech and investors weighed a fresh reading on US inflation.

The tech-heavy Nasdaq, which closed Thursday deep in the red, bounced back on Friday, up roughly 0.9% while the benchmark S&P 500 (^GSPC) erased gains to trade mostly flat.

The Dow Jones Industrial Average (^DJI) dropped roughly 0.6%, or more than 180 points.

The moves come amid a tough week for stocks, which has seen the S&P 500 threaten to join the Nasdaq in correction territory amid a sell-off fueled by mixed earnings from megacap techs.

On Friday, the Federal Reserve’s preferred inflation metric showed prices continued to cool in September — a critical data point that policymakers will consider for the next interest rate decision on Nov. 1.

Read more: What the Fed rate-hike pause means for bank accounts, CDs, loans, and credit cards

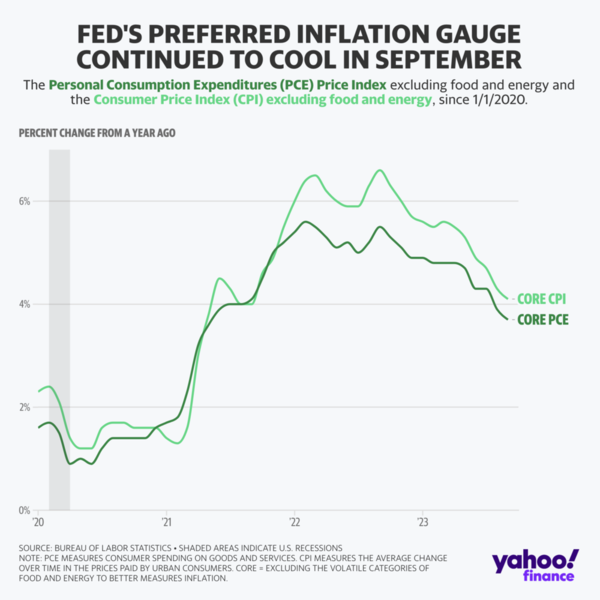

The Personal Consumption Expenditures (PCE) Index grew 3.4% year over year in September, in line with August’s revised increase and also in line with expectations. “Core” PCE, which excludes the volatile food and energy categories, grew 3.7%, down from the revised 3.8% from the month prior and in line with what economists surveyed by Bloomberg had expected.

Month-over-month, core PCE rose 0.3% in September, an uptick from the 0.1% rise seen in August, which was the lowest rate since November 2020.

The latest US GDP reading on Thursday came in hot, a sign that the Fed’s higher-for-longer stance isn’t holding back the American consumer. But some analysts are questioning how long that resilience can last, given recurring words of caution in companies’ outlooks alongside earnings.

-

Nasdaq pushes higher, S&P 500 loses steam

Stocks were mixed in midday trading on Friday as the tech-heavy Nasdaq Composite (^IXIC), which closed Thursday deep in the red, bounced back on Friday, up roughly 0.9% while the benchmark S&P 500 (^GSPC) erased earlier gains to trade mostly flat. The Dow Jones Industrial Average (^DJI) dropped roughly 0.6%, or more than 180 points.

The benchmark 10-year yield (^TNX) rose about 3 basis points to trade near 4.88% after monthly core PCE prices jumped the most in four months as spending accelerated.

-

JPM slumps on Dimon stock sale

JPMorgan Chase (JPM) shares fell as much as 3.2% on Friday, the highest intraday drop in more than two months, after the bank said CEO Jamie Dimon plans to sell 1 million shares of company stock currently valued at roughly $141 million. This would be Dimon’s first such sale since taking over as executive officer in 2005.

As Yahoo Finance’s David Hollerith reports:

The CEO and his family intend to do so starting in 2024, according to a regulatory filing from JPMorgan Friday that described the sale as being “for financial diversification and tax-planning purposes.”

A JPMorgan spokesman said Friday that the disclosure does not relate to any near-term succession planning. Dimon, 67 years old, is currently the longest-serving CEO of a major national bank. JPMorgan is the largest lender by assets in the US.

“Mr. Dimon continues to believe the company’s prospects are very strong and his stake in the company will remain very significant,” JPMorgan said in the filing.

The planned stock sale represents roughly 12% of the holdings belonging to the CEO and his family, excluding uninvested shares and stock appreciation rights. Dimon and his family currently own roughly 8.6 million shares of stock worth approximately $1.2 billion as of Thursday’s closing price.

-

Spending driven by ‘unsustainable’ fall in savings

The Federal Reserve’s preferred inflation metric showed prices continued to cool in September. But spending increased at a pace that may not be sustainable.

Personal spending jumped 0.7%, outweighing personal income, which rose 0.3% — the third consecutive month of declines.

“That is clearly unsustainable, and we expect spending growth will slow sharply in the quarters ahead,” Oxford Economics lead economist Michael Pearce wrote in reaction to the data.

“Disposable income growth has come under pressure as wage and job growth slows,” Pearce explained. “The weakness also reflects a slight fiscal tightening as transfer payments decline and as tax payments increase. With incomes falling, higher spending is being funded by lower saving, with the personal saving rate declining to 3.4% in September, its lowest since December 2022.”

“While we estimate there is still a considerable stock of excess saving left over from the pandemic, that is now mostly concentrated among higher income households and appears to be increasingly treated as wealth, so we expect the boost to spending from lower saving to wane from here. We also expect some increase in precautionary saving as the job market slows.”

Friday’s inflation data comes as the US economy grew at its fastest pace in nearly two years during the past three months, largely driven by consumers stepping up their spending despite a high interest rate environment.

The Federal Reserve will carefully consider all of these data points ahead of its next interest rate decision on November 1.

-

Amazon, Chevron, and Intel: Stocks trending in early trading

Here are some of the stocks leading Yahoo Finance’s trending tickers page in morning trading on Friday:

Amazon.com, Inc. (AMZN): Shares of the tech giant surged more than 7% after the company reported earnings that beat estimates, and touted bullish commentary around artificial intelligence. CEO Andy Jassy told analysts on the earnings call that AI represents an opportunity worth “tens of billions” for Amazon’s cloud business, Amazon Web Services (AWS). Check out the full earnings breakdown here, from Yahoo Finance’s Allie Garfinkle.

Chevron Corporation (CVX), Exxon Mobil (XOM): Shares fell more than 5% and 1%, respectively, after the oil giants reported disappointing earnings for the third quarter. Both companies saw quarterly profits decline more than 40%, hampered by the oil price spikes in 2022. Chevron and Exxon also reported weak results for their oil-refining and chemical businesses.

Intel Corporation (INTC): Shares surged more than 10% after the tech giant beat analysts’ expectations on the top and bottom lines and reported better-than-expected guidance for the fourth quarter, implying revenue growth for the first time since 2020. Yahoo Finance’s Dan Howley has the breakdown.

Enphase Energy, Inc. (ENPH): Energy tech company Enphase saw shares slump about 15% in early trading after its third-quarter revenue target fell short of analyst estimates due to weak demand. Oppenheimer analyst Colin Rusch downgraded the stock to Perform from Outperform following the results, citing “industry uncertainty”

With contributing reporting from Jenny McCall

-

S&P 500, Nasdaq open higher

Stocks opened mostly higher on Friday with the tech-heavy Nasdaq Composite (^IXIC), which closed Thursday deep in the red, bouncing back, up about 1%. The benchmark S&P 500 (^GSPC) also moved higher, up around 0.4%. The Dow Jones Industrial Average (^DJI) hugged the flatline.

-

More signs of cooling inflation

The Federal Reserve’s preferred inflation metric showed prices continued to cool in September — a critical data point the Federal Reserve will consider as it weighs its next interest rate decision on Nov. 1.

The Personal Consumption Expenditures (PCE) Index grew 3.4% year over year in September, in line with August’s revised increase and also in line with expectations. “Core” PCE, which excludes the volatile food and energy categories, grew 3.7%, down from the revised 3.8% from the month prior and in line with what economists surveyed by Bloomberg had expected.

Month-over-month, core PCE rose 0.3% in September, an uptick from the 0.1% rise seen in August, which was the lowest rate since November 2020.

Inflation has remained significantly above the Federal Reserve’s 2% target. A labor market that, while softening in certain areas, is still tight, suggests the Federal Reserve could continue to raise interest rates. The Federal Reserve’s latest meeting minutes showed policymakers support a more restrictive rate environment.

Cleveland Fed president Loretta Mester said last week she still sees the possibility of one more rate hike this year.

But markets still expect the central bank to pause its hikes at its meeting next month. Following the release of the data, markets were pricing in a roughly 99% chance the Federal Reserve keeps rates unchanged at its upcoming policy meeting, according to data from the CME Group.

-

Stock futures pop as Amazon, Intel earnings boost hopes

US stocks were poised for a comeback Friday after two days of losses, as earnings from Amazon and Intel lifted spirits ahead of the key PCE inflation release.

Futures on the Dow Jones Industrial Average (^DJI) were up 0.12%, or 40 points, while S&P 500 (^GSPC) futures were up 0.51%. Contracts on the tech-heavy Nasdaq 100 (^NDX) jumped 0.96%.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance