Key Takeaways

- U.S. exchange-traded funds pulled in an estimated $35 billion in May, a slight increase from their April and May hauls

- Strong flows into U.S. large-blend strategies helped stock ETFs collect nearly $21 billion.

- Investors pulled a record $7 billion from large-value funds in their fifth straight month of outflows.

- Technology ETFs absorbed more than $9 billion behind enormous flows into Vanguard Information Technology ETF VGT.

- Commodities ETFs collected $1 billion in May, their most lucrative month since April 2022.

- The Morningstar US Market Index scraped out a 0.45% gain as the market’s largest firms papered over weak mid- and small-cap performance.

- The Morningstar US Core Bond Index lost 1.07% as default concerns on U.S. Treasuries and hotter-than-expected labor and inflation data resurfaced.

Bonds Face Familiar Concerns

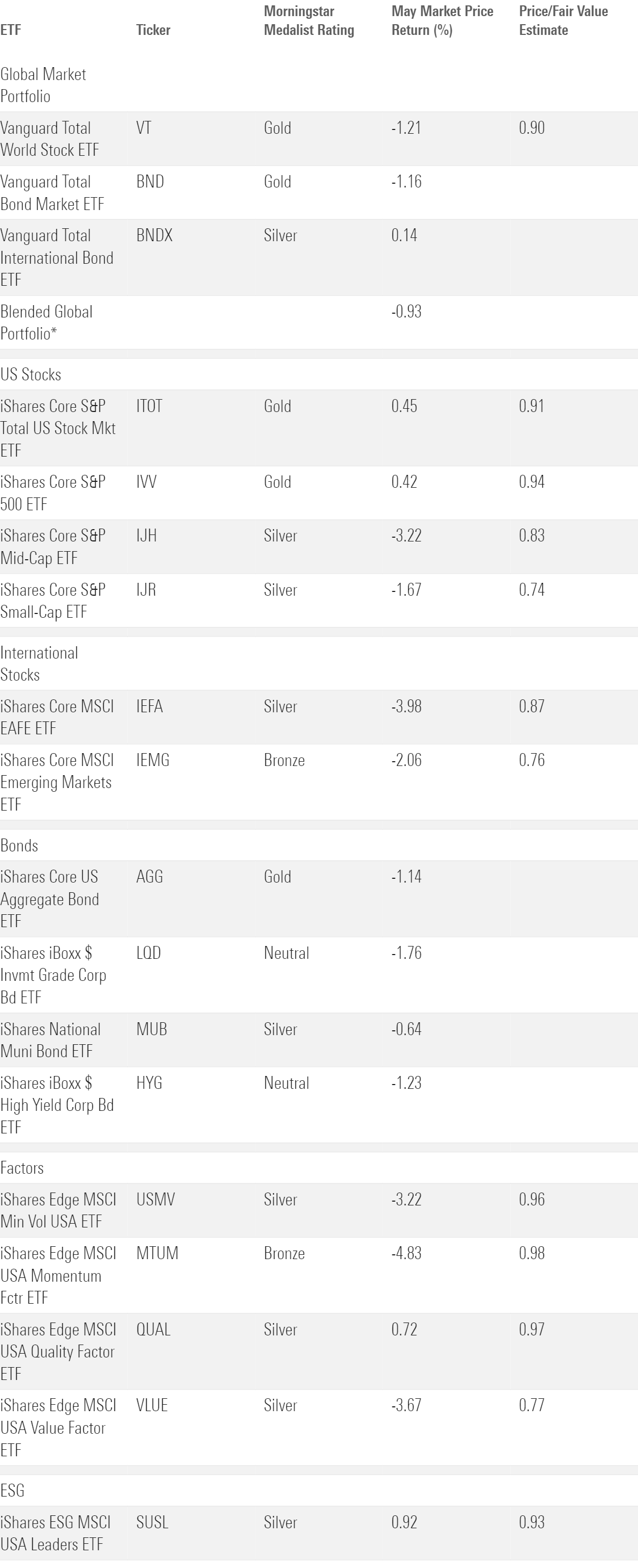

The exhibit below shows May returns for a sample of Morningstar analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended portfolio lost 0.93% last month, as U.S. bonds and foreign stocks weighed on returns.

Vanguard Total Bond Market ETF BND hampered the blended portfolio’s bond sleeve with a 1.16% loss in May. Against the backdrop of a then-unresolved U.S. debt ceiling, investors digested many of the same economic concerns that punished bonds in 2022. Initially, most market participants believed the interest-rate hike that the Federal Reserve greenlit in its May 3 meeting would mark the last for a while. But hotter-than-expected inflation and labor data emerged throughout the month, casting doubt on whether the Fed would pause rate hikes like it hinted it would.