Investors will eye a host of stock market triggers in the coming week including macroeconomic indicators such as retail inflation, wholesale inflation, trade deficit data, rupee’s movement to global cues, along with foreign capital inflow.

Investors will eye a host of stock market triggers in the coming week including macroeconomic indicators such as retail inflation, wholesale inflation, trade deficit data, rupee’s movement to global cues, along with foreign capital inflow.

Domestic equity benchmarks Sensex and Nifty settled lower for the second consecutive session on Friday, August 11 amid weak global cues and the dollar’s rise against its major global peers after the US inflation came in steady.

Domestic equity benchmarks Sensex and Nifty settled lower for the second consecutive session on Friday, August 11 amid weak global cues and the dollar’s rise against its major global peers after the US inflation came in steady.

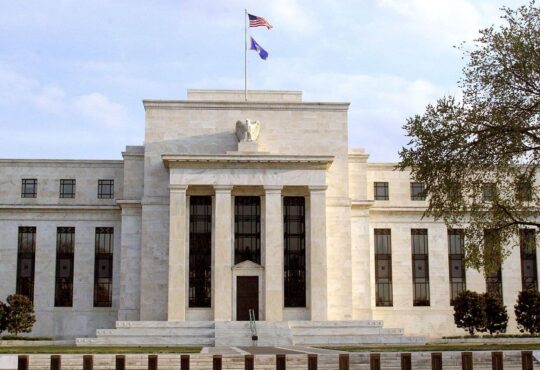

US consumer prices rose moderately last month which raised hopes that the US Federal Reserve will leave interest rates steady next month. Sensex closed 365.53 points, or 0.56 per cent, lower at 65,322.65 while the Nifty closed the day at 19,428.30, down 114.80 points, or 0.59 per cent.

US consumer prices rose moderately last month which raised hopes that the US Federal Reserve will leave interest rates steady next month. Sensex closed 365.53 points, or 0.56 per cent, lower at 65,322.65 while the Nifty closed the day at 19,428.30, down 114.80 points, or 0.59 per cent.

Shares of HDFC Bank ended as the top drag on the Sensex index, followed by those of ICICI Bank, Infosys and Hindustan Unilever. Mid and smallcaps also fell but they still outperformed the benchmark. The BSE Midcap index ended 0.13 per cent lower while the Smallcap index ended with a loss of 0.31 per cent.

Shares of HDFC Bank ended as the top drag on the Sensex index, followed by those of ICICI Bank, Infosys and Hindustan Unilever. Mid and smallcaps also fell but they still outperformed the benchmark. The BSE Midcap index ended 0.13 per cent lower while the Smallcap index ended with a loss of 0.31 per cent.

The overall market capitalisation of BSE-listed firms dropped to nearly ₹304.6 lakh crore from ₹305.4 lakh crore in the previous session and ₹306.2 lakh crore on Wednesday. Investors lost about ₹1.6 lakh crore in two days. Sensex lost 0.6 per cent for the week while the Nifty declined 0.45 per cent.

The overall market capitalisation of BSE-listed firms dropped to nearly ₹304.6 lakh crore from ₹305.4 lakh crore in the previous session and ₹306.2 lakh crore on Wednesday. Investors lost about ₹1.6 lakh crore in two days. Sensex lost 0.6 per cent for the week while the Nifty declined 0.45 per cent.

Last week, the Reserve Bank of India (RBI) conducted its third monetary policy committee (MPC) meeting for the current fiscal (FY24) and left the repo rate unchanged at 6.5 per cent, among other key decisions. However, the central bank raised concerns on the inflation front due to uneven monsoon in some parts of the country which has led to an increase of vegetable prices.

Last week, the Reserve Bank of India (RBI) conducted its third monetary policy committee (MPC) meeting for the current fiscal (FY24) and left the repo rate unchanged at 6.5 per cent, among other key decisions. However, the central bank raised concerns on the inflation front due to uneven monsoon in some parts of the country which has led to an increase of vegetable prices.

‘’Benchmark indices fell for the third week in a row following RBI’s decision to impose a 10 per cent incremental cash reserve ratio to absorb surplus liquidity from the banking system after the withdrawal of the ₹2,000 currency notes,” said Arvinder Singh Nanda, Senior Vice President, of Master Capital Services.

‘’Benchmark indices fell for the third week in a row following RBI’s decision to impose a 10 per cent incremental cash reserve ratio to absorb surplus liquidity from the banking system after the withdrawal of the ₹2,000 currency notes,” said Arvinder Singh Nanda, Senior Vice President, of Master Capital Services.

‘’With the increase in the cash reserve ratio, it is expected that it will not impact the majority of the banks in the longer tenure. The banking sector will continue to remain resilient on the back of strong asset quality, healthy credit growth and solid capitalisation,” added Nanda.

‘’With the increase in the cash reserve ratio, it is expected that it will not impact the majority of the banks in the longer tenure. The banking sector will continue to remain resilient on the back of strong asset quality, healthy credit growth and solid capitalisation,” added Nanda.

Macro Data

Several macroeconomic indicators will influence market dynamics in the upcoming holiday-shortened week –with the market closure on August 15. India’s wholesale price index (WPI) and July retail inflation data, exports and imports numbers, forex reserves will be in focus in the coming days.

Macro Data

Several macroeconomic indicators will influence market dynamics in the upcoming holiday-shortened week –with the market closure on August 15. India’s wholesale price index (WPI) and July retail inflation data, exports and imports numbers, forex reserves will be in focus in the coming days.

RBI’s rate-setting panel expects that the headline inflation will increase in the next couple of months which has led RBI to increase the CPI inflation targets to 5.4 per cent in FY24 compared to an earlier projection of 5.1 per cent.

RBI’s rate-setting panel expects that the headline inflation will increase in the next couple of months which has led RBI to increase the CPI inflation targets to 5.4 per cent in FY24 compared to an earlier projection of 5.1 per cent.

‘’The week began with moderate gains, led by strong performances in the pharma and IT sectors. However, uncertainties surrounding economic data releases and the RBI’s policy announcement hindered substantial moves. Inflation worries resurfaced as the RBI raised their CPI forecast by 30 bps to 5.4 per cent, increasing the potential for a prolonged rate-cut trajectory,” said Vinod Nair, Head of Research at Geojit Financial services.

‘’The week began with moderate gains, led by strong performances in the pharma and IT sectors. However, uncertainties surrounding economic data releases and the RBI’s policy announcement hindered substantial moves. Inflation worries resurfaced as the RBI raised their CPI forecast by 30 bps to 5.4 per cent, increasing the potential for a prolonged rate-cut trajectory,” said Vinod Nair, Head of Research at Geojit Financial services.

The last set of April-June quarter results will be released on Monday, August 14. Markets will begin the week by reacting to the June quarter results of ONGC, Nykaa, Aurobindo Pharma, Muthoot Finance, Glenmark Pharma, among few others as these companies declared their quarterly results during the weekend or during post-market hours on Friday.

The last set of April-June quarter results will be released on Monday, August 14. Markets will begin the week by reacting to the June quarter results of ONGC, Nykaa, Aurobindo Pharma, Muthoot Finance, Glenmark Pharma, among few others as these companies declared their quarterly results during the weekend or during post-market hours on Friday.

4 IPOs, 5 listings to hit D-Street

In the coming week, few initial public offerings (IPO) await the bourses in both main board and small- and medium-sized enterprise (SME) segments. These are as follows:

4 IPOs, 5 listings to hit D-Street

In the coming week, few initial public offerings (IPO) await the bourses in both main board and small- and medium-sized enterprise (SME) segments. These are as follows:

-Pyramid Technoplast IPO will open on August 18 and conclude on August 22. Shares will get listed on stock exchanges BSE and NSE.

-Pyramid Technoplast IPO will open on August 18 and conclude on August 22. Shares will get listed on stock exchanges BSE and NSE.

-Among the SME IPOs, Shoora Designs IPO will open on August 17 and close on August 21. Crop Life Science IPO and Bondada Engineering IPO will both open on August 18 and conclude on August 22.

-Among the SME IPOs, Shoora Designs IPO will open on August 17 and close on August 21. Crop Life Science IPO and Bondada Engineering IPO will both open on August 18 and conclude on August 22.

New listings: SBFC Finance will get listed on BSE and NSE on August 16. Concord Biotech will debut on stock exchanges on August 17.

New listings: SBFC Finance will get listed on BSE and NSE on August 16. Concord Biotech will debut on stock exchanges on August 17.

Sangani Hospitals and Yudiz Solutions are both SME IPOs whose shares will get listed on NSE SME and NSE Emerge respectively, on August 17, while Vinsys IT will debut on NSE Emerge on August 14.

Sangani Hospitals and Yudiz Solutions are both SME IPOs whose shares will get listed on NSE SME and NSE Emerge respectively, on August 17, while Vinsys IT will debut on NSE Emerge on August 14.

FII Inflow

Foreign institutional investors (FIIs) largely remained net sellers last week, except for a two-day gap in between which was driven by positive global cues. On Friday, FIIs cumulatively bought ₹9,508.14 crore of Indian equities, while they sold ₹12,581.42 crore — resulting in an outflow of ₹3,073.28 crore. The domestic institutional investors (DIIs) turned net buyers and invested ₹500.35 crore during the session.

FII Inflow

Foreign institutional investors (FIIs) largely remained net sellers last week, except for a two-day gap in between which was driven by positive global cues. On Friday, FIIs cumulatively bought ₹9,508.14 crore of Indian equities, while they sold ₹12,581.42 crore — resulting in an outflow of ₹3,073.28 crore. The domestic institutional investors (DIIs) turned net buyers and invested ₹500.35 crore during the session.

Foreign portfolio investors (FPIs) performance also remains muted on D-Street so far in August, far lower than the inflows sustained in the last three months. FPIs bought ₹3,272 crore worth of Indian equities and infused a total of ₹6,241 crore as of August 11, taking into account debt, hybrid, debt-VRR, and equities, according to National Securities Depository Ltd (NSDL ) data. Month till-date, FPIs have sold Indian stocks to the tune of ₹7,543 crore, according to analysts.

Foreign portfolio investors (FPIs) performance also remains muted on D-Street so far in August, far lower than the inflows sustained in the last three months. FPIs bought ₹3,272 crore worth of Indian equities and infused a total of ₹6,241 crore as of August 11, taking into account debt, hybrid, debt-VRR, and equities, according to National Securities Depository Ltd (NSDL ) data. Month till-date, FPIs have sold Indian stocks to the tune of ₹7,543 crore, according to analysts.

Analysts observed that the Indian markets have seen a third consecutive week of decline, attributed to profit booking by major private banks and selling by FIIs. Interestingly, the midcap and smallcap markets have remained bullish during this period.

Analysts observed that the Indian markets have seen a third consecutive week of decline, attributed to profit booking by major private banks and selling by FIIs. Interestingly, the midcap and smallcap markets have remained bullish during this period.

‘’Given the recent consistent selling by FIIs, their future actions will be closely tracked, as they hold the potential to dictate the overall trajectory of headline indices,” said Santosh Meena, Head of Research, Swastika Investmart Ltd.

‘’Given the recent consistent selling by FIIs, their future actions will be closely tracked, as they hold the potential to dictate the overall trajectory of headline indices,” said Santosh Meena, Head of Research, Swastika Investmart Ltd.

‘’Furthermore, insights from the derivative market indicate a decline in FIIs’ long exposure in index futures to 40 per cent, signifying a short-term bearish bias. Additionally, the put-call ratio stands at 0.91, approaching oversold territory,” added Meena.

‘’Furthermore, insights from the derivative market indicate a decline in FIIs’ long exposure in index futures to 40 per cent, signifying a short-term bearish bias. Additionally, the put-call ratio stands at 0.91, approaching oversold territory,” added Meena.

Global Cues

Last week, global markets faced volatility due to weak signals such as declining Chinese exports and the rating downgrade of US small and mid-sized banks. Geojit Financial Services’ Vinod Nair observed that despite lower-than-expected US CPI and better-than-anticipated UK GDP figures, global market sentiment remained subdued.

Global Cues

Last week, global markets faced volatility due to weak signals such as declining Chinese exports and the rating downgrade of US small and mid-sized banks. Geojit Financial Services’ Vinod Nair observed that despite lower-than-expected US CPI and better-than-anticipated UK GDP figures, global market sentiment remained subdued.

However, US dollar rose against its major global peers last week after the US inflation came in steady. US consumer prices rose moderately last month which raised hopes that the US Fed will leave interest rates steady next month.

However, US dollar rose against its major global peers last week after the US inflation came in steady. US consumer prices rose moderately last month which raised hopes that the US Fed will leave interest rates steady next month.

‘’A critical aspect to monitor is the exchange rate between the rupee and the dollar. Recent indications of rupee weakness, with the potential to breach the 83 level against the dollar, necessitate close observation,” said Swastika Investmarts’ Santosh Meena.

‘’A critical aspect to monitor is the exchange rate between the rupee and the dollar. Recent indications of rupee weakness, with the potential to breach the 83 level against the dollar, necessitate close observation,” said Swastika Investmarts’ Santosh Meena.

Moving on, the major key global events that will drive the market next week are China’s industrial production, China unemployment rate, Japan GDP, Japan trade data, US retail sales, crude oil inventories, US initial jobless claims, FOMC minutes of meeting, UK unemployment rates, UK CPI data, Euro inflation and GDP data.

Moving on, the major key global events that will drive the market next week are China’s industrial production, China unemployment rate, Japan GDP, Japan trade data, US retail sales, crude oil inventories, US initial jobless claims, FOMC minutes of meeting, UK unemployment rates, UK CPI data, Euro inflation and GDP data.

‘’We expect the Indian market will continue to remain rangebound and will take further cues from RBI decision, US job data and minutes of the FOMC meeting,” said Master Capital Services’ Arvinder Singh Nanda.

‘’We expect the Indian market will continue to remain rangebound and will take further cues from RBI decision, US job data and minutes of the FOMC meeting,” said Master Capital Services’ Arvinder Singh Nanda.

Oil Prices

Oil prices settled higher after the International Energy Agency (IEA) forecast record global demand and tightening supplies, propelling prices to the seventh straight week of gains, the longest such streak since 2022.

Oil Prices

Oil prices settled higher after the International Energy Agency (IEA) forecast record global demand and tightening supplies, propelling prices to the seventh straight week of gains, the longest such streak since 2022.

Brent crude futures rose 41 cents, or 0.5 per cent, to settle $86.81 a barrel, while U.S. West Texas Intermediate (WTI) crude futures gained 37 cents, or 0.5 per cent, to settle at $83.19. On a weekly basis, both benchmarks rose about 0.5 per cent, according to news agency Reuters.

Brent crude futures rose 41 cents, or 0.5 per cent, to settle $86.81 a barrel, while U.S. West Texas Intermediate (WTI) crude futures gained 37 cents, or 0.5 per cent, to settle at $83.19. On a weekly basis, both benchmarks rose about 0.5 per cent, according to news agency Reuters.

The IEA estimated that global oil demand hit a record 103 million barrels per day (bpd) in June and could scale another peak this month. The Organization of the Petroleum Exporting Countries (OPEC) said it expects global oil demand to rise by 2.44 million bpd this year, unchanged from its previous forecast.

The IEA estimated that global oil demand hit a record 103 million barrels per day (bpd) in June and could scale another peak this month. The Organization of the Petroleum Exporting Countries (OPEC) said it expects global oil demand to rise by 2.44 million bpd this year, unchanged from its previous forecast.

Meanwhile, output cuts from Saudi Arabia and Russia set the stage for a sharp decline in inventories over the rest of this year, which could drive oil prices even higher, said IEA.

Meanwhile, output cuts from Saudi Arabia and Russia set the stage for a sharp decline in inventories over the rest of this year, which could drive oil prices even higher, said IEA.

Also shares of Lancor Holdings will trade ex bonus on August 18, according to data on stock exchanges. Additionally, Avantel Ltd will declare a stock split on August 14 from ₹10 to ₹2. EFC Ltd will also declare a stock split on August 18 from ₹10 to ₹2. CL Educate will declare buyback of shares on August 14 and Control Prints will declare the same on August 18.

Also shares of Lancor Holdings will trade ex bonus on August 18, according to data on stock exchanges. Additionally, Avantel Ltd will declare a stock split on August 14 from ₹10 to ₹2. EFC Ltd will also declare a stock split on August 18 from ₹10 to ₹2. CL Educate will declare buyback of shares on August 14 and Control Prints will declare the same on August 18.

Technical View:

From a technical standpoint, the Nifty index is exhibiting signs of weakness or a bearish trend, characterized by a lower top formation. The challenge lies in surpassing the 20-day moving average (20-DMA), positioned around the 19,650 mark, according to analysts.

Technical View:

From a technical standpoint, the Nifty index is exhibiting signs of weakness or a bearish trend, characterized by a lower top formation. The challenge lies in surpassing the 20-day moving average (20-DMA), positioned around the 19,650 mark, according to analysts.

‘’On the downside, immediate support rests at 19,300. A breach below this level could expose Nifty to further declines, possibly targeting the 19191 and 18888 levels. The re-establishment of bullish momentum hinges on a rebound above the 20-DMA,” said Swastika Investmarts’ Santosh Meena.

‘’On the downside, immediate support rests at 19,300. A breach below this level could expose Nifty to further declines, possibly targeting the 19191 and 18888 levels. The re-establishment of bullish momentum hinges on a rebound above the 20-DMA,” said Swastika Investmarts’ Santosh Meena.

Religare Brokings’ Ajit Mishra observes that the continued pressure in the banking pack is fading the recovery attempts however stability in select heavyweights is capping the pace of decline. Besides, resilience in the global markets is also helping in restricting the downside so far.

Religare Brokings’ Ajit Mishra observes that the continued pressure in the banking pack is fading the recovery attempts however stability in select heavyweights is capping the pace of decline. Besides, resilience in the global markets is also helping in restricting the downside so far.

‘’The recent price action indicates the corrective tone to continue in Nifty, after the failed attempt to surpass the hurdle at 19,650. And, a decisive break of the recent swing low i.e. 19,300 may push the index to 19,100. Besides, we are eyeing 43,850 in the banking index as the next key support, which could prompt some recovery. Meanwhile, traders should focus more on risk management citing mixed signals and staying stock-specific,” said Ajit Mishra, SVP – Technical Research, Religare Broking.

‘’The recent price action indicates the corrective tone to continue in Nifty, after the failed attempt to surpass the hurdle at 19,650. And, a decisive break of the recent swing low i.e. 19,300 may push the index to 19,100. Besides, we are eyeing 43,850 in the banking index as the next key support, which could prompt some recovery. Meanwhile, traders should focus more on risk management citing mixed signals and staying stock-specific,” said Ajit Mishra, SVP – Technical Research, Religare Broking.

Conversely, Bank Nifty is displaying underperformance and currently dominated by bears, experiencing a breakdown below the crucial support level of 44,400-44,444 on a closing basis, as per analysts.

Conversely, Bank Nifty is displaying underperformance and currently dominated by bears, experiencing a breakdown below the crucial support level of 44,400-44,444 on a closing basis, as per analysts.

This breach opens the door to a potential support zone ranging from 43,500 to 43,300. A bullish resurgence would necessitate a successful breach of the 50-day moving average (50-DMA) at 44,700,” said Swastika’s Santosh Meena.

This breach opens the door to a potential support zone ranging from 43,500 to 43,300. A bullish resurgence would necessitate a successful breach of the 50-day moving average (50-DMA) at 44,700,” said Swastika’s Santosh Meena.

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said that the prevailing sentiment seems to lean towards selling on rallies, with an immediate resistance level observed around 44,500. Looking ahead, the index’s next significant support is positioned at 43,700, which might serve as a buying zone for the bulls, potentially triggering a bounce back.”

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said that the prevailing sentiment seems to lean towards selling on rallies, with an immediate resistance level observed around 44,500. Looking ahead, the index’s next significant support is positioned at 43,700, which might serve as a buying zone for the bulls, potentially triggering a bounce back.”

Disclaimer: The views and recommendations above are those of individual analysts and broking companies, not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Disclaimer: The views and recommendations above are those of individual analysts and broking companies, not of Mint. We advise investors to check with certified experts before taking any investment decisions.