Livforsakringsbolaget Skandia Omsesidigt cut its position in shares of Murphy USA Inc. (NYSE:MUSA – Free Report) by 10.2% during the 2nd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 3,510 shares of the specialty retailer’s stock after selling 400 shares during the quarter. Livforsakringsbolaget Skandia Omsesidigt’s holdings in Murphy USA were worth $1,092,000 as of its most recent SEC filing.

Livforsakringsbolaget Skandia Omsesidigt cut its position in shares of Murphy USA Inc. (NYSE:MUSA – Free Report) by 10.2% during the 2nd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 3,510 shares of the specialty retailer’s stock after selling 400 shares during the quarter. Livforsakringsbolaget Skandia Omsesidigt’s holdings in Murphy USA were worth $1,092,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Dark Forest Capital Management LP purchased a new position in Murphy USA in the fourth quarter valued at about $29,000. Mendota Financial Group LLC purchased a new position in Murphy USA in the first quarter valued at about $50,000. GPS Wealth Strategies Group LLC purchased a new position in Murphy USA in the first quarter valued at about $52,000. Harbor Investment Advisory LLC boosted its stake in Murphy USA by 522.9% in the first quarter. Harbor Investment Advisory LLC now owns 218 shares of the specialty retailer’s stock valued at $56,000 after acquiring an additional 183 shares during the last quarter. Finally, Covington Capital Management purchased a new position in Murphy USA in the third quarter valued at about $61,000. 83.95% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research firms have weighed in on MUSA. StockNews.com upgraded shares of Murphy USA from a “hold” rating to a “buy” rating in a research note on Wednesday, September 6th. Stephens reissued an “overweight” rating and issued a $370.00 price target on shares of Murphy USA in a research report on Thursday, August 3rd. Finally, Royal Bank of Canada lowered their price target on shares of Murphy USA from $362.00 to $360.00 and set a “sector perform” rating on the stock in a research report on Thursday, August 3rd. One analyst has rated the stock with a sell rating, one has issued a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat, the stock has an average rating of “Moderate Buy” and an average price target of $318.60.

Read Our Latest Research Report on MUSA

Insider Buying and Selling

In related news, CEO R Andrew Clyde sold 32,173 shares of the company’s stock in a transaction that occurred on Wednesday, August 23rd. The shares were sold at an average price of $311.23, for a total transaction of $10,013,202.79. Following the sale, the chief executive officer now owns 172,729 shares of the company’s stock, valued at approximately $53,758,446.67. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other news, SVP Christopher A. Click sold 700 shares of the stock in a transaction on Monday, August 7th. The shares were sold at an average price of $302.31, for a total value of $211,617.00. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO R Andrew Clyde sold 32,173 shares of the stock in a transaction on Wednesday, August 23rd. The stock was sold at an average price of $311.23, for a total transaction of $10,013,202.79. Following the completion of the transaction, the chief executive officer now directly owns 172,729 shares in the company, valued at approximately $53,758,446.67. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 70,815 shares of company stock valued at $22,153,785. Company insiders own 9.04% of the company’s stock.

Murphy USA Stock Performance

NYSE MUSA opened at $336.84 on Friday. The company’s 50 day moving average is $313.04 and its 200-day moving average is $287.35. Murphy USA Inc. has a 12-month low of $231.65 and a 12-month high of $337.07. The company has a quick ratio of 0.51, a current ratio of 0.94 and a debt-to-equity ratio of 2.38. The firm has a market cap of $7.23 billion, a P/E ratio of 13.31 and a beta of 0.80.

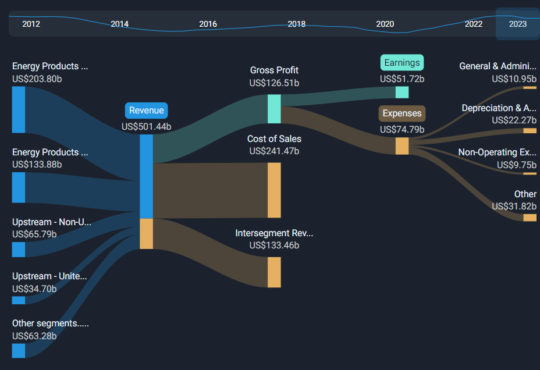

Murphy USA (NYSE:MUSA – Get Free Report) last posted its earnings results on Wednesday, August 2nd. The specialty retailer reported $6.02 earnings per share for the quarter, missing analysts’ consensus estimates of $6.09 by ($0.07). The firm had revenue of $5.59 billion for the quarter, compared to the consensus estimate of $5.61 billion. Murphy USA had a return on equity of 80.20% and a net margin of 2.59%. Sell-side analysts predict that Murphy USA Inc. will post 21.44 earnings per share for the current year.

Murphy USA Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, September 7th. Investors of record on Monday, August 28th were issued a dividend of $0.39 per share. This represents a $1.56 dividend on an annualized basis and a yield of 0.46%. The ex-dividend date of this dividend was Friday, August 25th. This is a positive change from Murphy USA’s previous quarterly dividend of $0.38. Murphy USA’s dividend payout ratio is 6.16%.

Murphy USA Profile

Murphy USA Inc engages in marketing of retail motor fuel products and convenience merchandise. The company operates retail stores under the Murphy USA, Murphy Express, and QuickChek brands. It operates retail gasoline stores principally in the Southeast, Southwest, and Midwest United States. The company was founded in 1996 and is headquartered in El Dorado, Arkansas.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Murphy USA, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Murphy USA wasn’t on the list.

While Murphy USA currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of seven stocks and why their long-term outlooks are very promising.