Indian economy to recover faster than developed markets – Nifty50 may end 2023 at 19,500

- Volatility will continue to plague stocks in 2023 as well with focus shifting to a soft landing and subsequent economic recovery.

- Past recessions show that even as exports and India’s economic growth tend to slow down, recovery is expected to be faster.

- While concerns over recession and interest rates will continue, the second half of the year will factor in the general election outcome.

Equities have had a rough ride in 2022 and the new year is likely to be another volatile year. Volatility will continue to plague markets in 2023 too, but markets are still expected to generate positive returns next year. After swinging 20% in 2022, equities are going to end 2022 with 5% gains – despite high inflation, rising interest rates and the dollar’s persistent strength. Some of these concerns are likely to spill over into 2023 as well. But the debate is now centred around a soft landing by leading developed economies and a gradual economic recovery. It’s not surprising that many strategists believe that the benchmark Nifty50 could oscillate between 17,000 and 20,000 in 2023.

Even if the world slips into a recession, India is expected to see much lower contraction in economic growth compared to other economies. According to a Bank of America analysis of recessions across three decades, India’s growth contracts by 180 basis points in a recession, compared to 280 basis points seen in the USA.

Bank of America says that economic growth contraction for India is less protracted (1-3 quarters against 2-7 quarters for the USA) and India also recovers faster. This view is also echoed by Morgan Stanley, which says, “Emerging markets are likely to benefit from a relatively more benign world vs. 2022, and India’s trailing outperformance could take a breather in H1 2023, given relative valuations.”

Volatility expected to spill over into the new year too

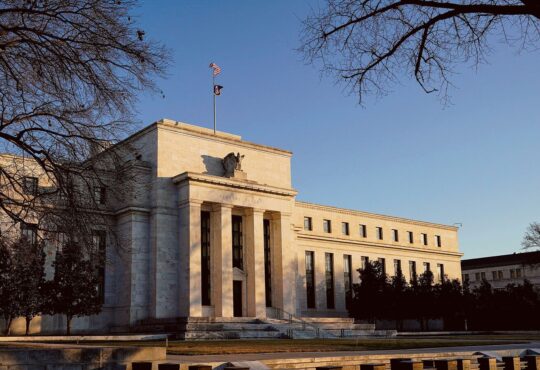

The volatility that hit markets in 2022 because of factors including the Russia-Ukraine war, inflation, and recession fears in the US is expected to spill over into the new year as well. This is because central banks across the world are still battling inflation and higher interest rates will impact growth.

In India, Reserve Bank of India Governor Shaktikanta Das has also voiced his opinions on handling inflation, having hiked rates five times this year. Das, in his recent monetary policy statement, said that due to the geopolitical uncertainty and financial market volatility, further calibrated monetary policy action is needed to keep inflation expectations “anchored”, saying that the RBI will keep an “Arjuna’s eye” on inflation and react as needed.

“The year 2022 has been volatile for markets – both India and global. 2023 is going to be no exception to that. With inflation still being one of the key factors to watch out for, it would be interesting to see how things unfold and how swiftly central banks adapt to it. Indian markets have outperformed global peers by a margin,” said Srikanth Subramanian, CEO of investment platform Kotak Cherry by Kotak Investment Advisors.

Besides, there is continuing fear around recession hitting major global economies in 2023. “Key point to note here is if recession hits hard, then India will also face the heat and it will be very difficult for Indian markets to stay decoupled for long,” said Subramanian.

The sharp fall in US markets indicate recession fears among investors as the benchmark index Dow Jones Industrial Average is down by over 10% in 2022 so far while the tech-heavy Nasdaq has tanked over 30% so far this year.

At the same time, Indian markets have been quite resilient but may not remain so for long if a US recession comes true. Benchmark indices Sensex and Nifty50 have gained about 4% in 2022 so far.

Morgan Stanley says, “If the global economy slips into recession, it would not be good news for India, which exports about 20% of its output.”

Second half of the 2023 will factor in the general election outcome

While concerns over recession and interest rates will continue, the second half of the year will factor in the general election outcome. “Going into H2 2023, the market should start factoring in its view on the general elections (slated for May 2024) with either outright repositioning or considerable hedging of portfolios,” said a report by Morgan Stanley.

Besides, analysts believe markets will improve in the second half of the year given that the inflation is likely to settle by then along with a loosening monetary policy. “Global growth outlook is likely to improve in H2 CY23 (especially US) due to sharp moderation in inflationary pressures in CY23, loosening monetary policy towards end CY23 and lower base,” said Antique Stock Broking in a report.

Further, analysts are overweight on financials, consumer discretionary, technology and infrastructure. Morgan Stanley says it is overweight on consumer discretionary, industrials, financials, and technology and underweight all other sectors. Electric vehicles, clean energy, digital transformation and air travel cycle are among the key themes for 2023.

“We continue to pursue ideas around clean energy spending, defence indigenisation, a new residential property, auto, and air travel cycle, a multiyear credit cycle for financials and life insurance, digital transformation, and market share concentration, plus horizontal growth for discretionary and staple consumption and electric vehicles as key themes for 2023,” said Morgan Stanley.

Stocks that Morgan Stanley is overweight on

| Company | YTD Change |

| Nykaa | -54% |

| Maruti Suzuki India | 12% |

| Titan Company | -1% |

| ICICI Bank | 17% |

| SBI Cards & Payment Services | -13% |

| Hindustan Aeronautics | 112% |

| L&T | 12% |

| Infosys | -20% |

| UltraTech Cement | -9% |

Note: Change as on 12:30 p.m December 21

“We believe that the private capex cycle is about to resume. With the Made in India and PLI programmes, the government has maintained its focus on infrastructure. The financial sector as a whole, banks, insurance, industrials, and cement will do well,” said Manoj Kumar Dalmia, founder and director, Proficient Equities.

Once the volatility settles by the second half of 2023, analysts expect markets to pick up pace. Bank of America expects Nifty to end 2023 at 19,500, implying muted but positive returns. Despite the volatility, India’s valuations are expected to remain elevated in the new year. Clearly, 2023 will see some of the older themes continue, even as the focus shifts to economic recovery and earnings growth.

SEE ALSO: Prime time TV & OTT now have competition from online shopping – Indians shop the most after 8 pm, says Meesho

Varanasi, Tirupati, Puri are the top travel destinations, as spiritual tourism gains favour reveals OYO