Image source: Getty Images

Lloyds (LSE: LLOY) shares weren’t always trading at penny stock levels. In fact, well before the global financial crisis decimated the banking sector this century, the mid-1990s was the last time I could have bought the shares for under £1.

Since 2008, the Lloyds share price has never recovered to its pre-crisis levels and it’s been anchored well below 100p. As I write, the FTSE 100 stock is changing hands for just short of 52p.

Let’s explore the return I’d have made from a £1,000 investment 15 years ago as well as my take on the outlook for the bank today.

15-year return

Back in January 2008, Lloyds Bank was trading for 278.18p per share. Over the next 12 months, the share price fell off a cliff in the fallout that engulfed banking stocks following the collapse of Lehman Brothers.

On this day 15 years ago, with a £1,000 lump sum to invest, I could have purchased 359 shares, leaving me £1.33 as spare change.

Today, my original £1k investment would be a fraction of the size. After waiting patiently for a recovery, my shareholding would be valued at £186.32. That’s a disastrous return, testament to just how destructive major economic crises can be to investors’ portfolios.

Over that period, I’d have received some dividends to soften the blow after the banking group restarted payouts in 2014. Assuming I didn’t reinvest any dividends, I could add £62.38 in passive income to my total return, giving me a figure of £248.70.

Today’s outlook

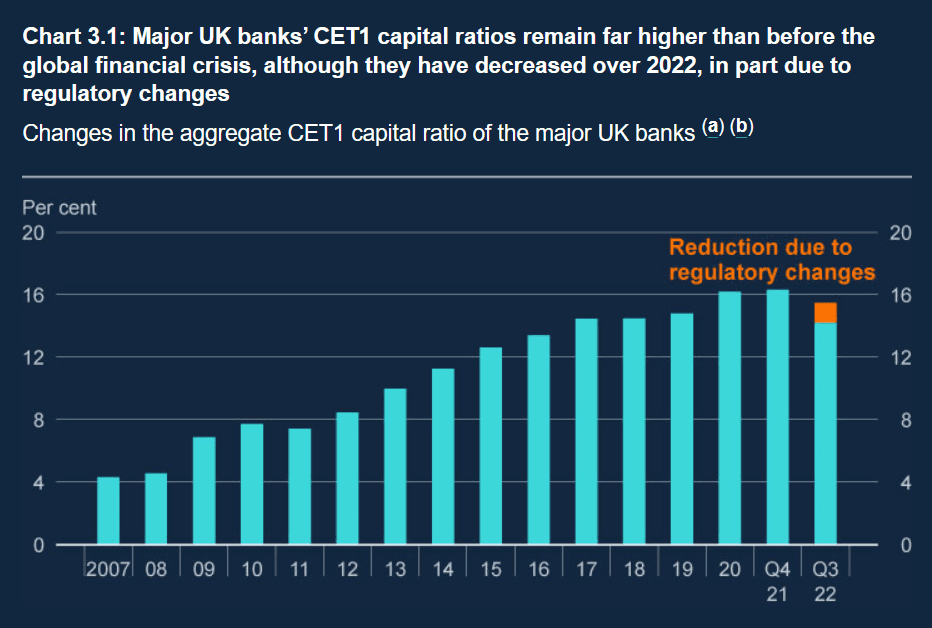

Today, the picture for Lloyds shares is rather different. Capital requirements on large banks are now 10 times higher than before the crisis. They’re also now disciplined by a leverage ratio, that protects the system from significant risks.

Common Equity Tier 1 (CET1) ratios are far higher than before the crisis. This measurement compares a bank’s capital against its risk-weighted assets to determine its ability to withstand financial distress. Lloyds had a 15% pro forma CET1 ratio as of 27 October 2022.

In addition, the Bank of England now has an bigger supervisory role. It conducts stress tests to ensure banks have the strength to deal with very severe recessions without cutting back on lending.

That’s not to say banking stocks are risk-free. As the UK’s largest mortgage lender, Lloyds is exposed to housing market fluctuations. This could be a headwind for the share price if there’s a property downturn this year. Nonetheless, I think the bank’s a much safer bet than it was 15 years ago.

Rising interest rates should help the group by benefiting its net interest margin. What’s more, the stock’s established itself as a handy passive income generator with a 4.1% annual dividend yield.

Should I buy Lloyds shares?

I already own Lloyds shares, and I’ll continue to hold. I believe the share price represents fair value today, and the dividends are certainly handy. But if there are any significant dips in 2023, I’d consider buying more.

With much stricter regulations in place today, I hope we won’t see a repeat of 2008. Nonetheless, it’s always useful to look at history for valuable investing lessons today.