tadamichi

When it comes to their equity portfolios, US investors have historically exhibited a high degree of home country bias. But in today’s fast-changing global market landscape, they may find that there are good reasons to rethink regional allocations to stocks.

International equities accounted for just 15% of total US investor assets through April, according to Morningstar, a fund tracking firm. There are reasons for this.

US equities trade in a deep single market with a single currency and ample exposure to growth, value and income. And for the last decade and a half, US stocks have comfortably outperformed.

US Stocks Don’t Always Outperform

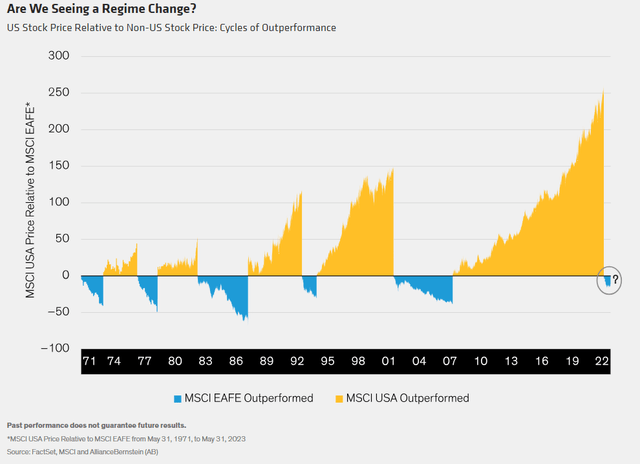

But widen the lens and it becomes clear that US and non-US stocks have traded periods of outperformance over the last 50 years at irregular intervals (Display).

The most recent run of US dominance ended in 2021. Between October 2022 and May 2023 – a particularly strong stretch for non-US stocks – the MSCI EAFE Index of developed-market stocks outside the US and Canada delivered a net return of 26.2%, outpacing both that of the MSCI USA (13%) and the S&P 500 (13.3%).

Here are three reasons why we think it’s time for US investors to start looking further afield for equity return potential.

First, US dollar depreciation – partly the result of easing US inflation pressure – should support select companies and stocks outside US borders. A weaker dollar has in the past correlated with non-US stock outperformance. It also boosts returns for US investors who own non-US stocks, which are worth more when converted back to dollars.

Second, China’s reopening should provide a boost to consumer spending throughout the world, including in emerging markets and developed non-US markets such as the European Union, which counts China as its largest trading partner.

Third, adding emerging market equities to the mix can give investors exposure to dynamic companies in some of the fastest-growing countries in the world. India, for example, is pressing ahead with investment and efficiency efforts to support growth, which is expected to outpace that in China and the world over the next five years.

Pay Attention to Market Concentration

Finally, market concentration risk in the US is high. The technology-heavy top 10 components in the S&P 500 have accounted for more than 90% of index returns in 2023 so far. Non-US indices offer diversification through access to companies underrepresented in the US, such as European luxury goods makers, and important trends, including industrial automation in Asia.

US stocks still offer solid long-term return potential, in our view. But we think investors may have much to gain from venturing beyond the border to build a more globally diversified equity allocation.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.