Global market today: On account of strong US job data for the month of September 2023, US stock market witnessed sharp upside movement on Friday. Dow Jones Index shot up 0.87 per cent, S&P 500 index surged 1.18 per cent whereas tech heavy weight Nasdaq skyrocketed 1.60 per cent. MSCI’s gauge of stocks across the globe closed up 1.0 per cent, while the pan-European STOXX 600 index rose 0.82 per cent.

According to stock market experts, US stock market surged after the US job data as it eased the tension of US Fed rate hike in upcoming US Fed meeting shceduled in November 2023.

“Exciting news! Mint is now on WhatsApp Channels

Marvin Loh, senior global macro strategist at State Street in Boston said, “Maybe the economy has structurally changed to the point where real yields need to be higher than what they were in the five years before the pandemic,” adding, “We are in a period where it’s unclear how much slowing of the economy 500 basis points have actually generated,” he said, referring to the amount the Fed has raised interest rates since March 2022.”

The yield on the benchmark 10-year Treasury note jumped more than 13 basis points within a half hour after the report’s release to a fresh 16-year high of 4.8874%, adding to this month’s steep sell-off. Bond yields move inversely to price.

Bond yield posts biggest single-day jump in 17 months; What’s fuelling the rise?

Bond yields later eased a bit from early highs and the three major US stock indexes rallied as stock investors saw moderating wage growth as decelerating inflation further.

Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York said, “We’ve raised rates, inflation is coming down and the economy is booming,” adding, “It’s the best of all worlds as long as inflation keeps coming down and that’s the risk – if inflation doesn’t keep coming down.”

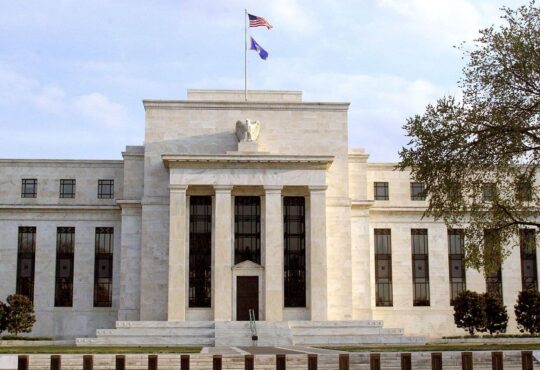

US Fed rate hike in focus

Futures traders raised the probability of the Fed hiking rates in November to 29.2%, up from 23.7% before the data’s release, according to CME Group’s FedWatch Tool. The Fed’s overnight rate was priced above 5% through next July.

Gold price jumps after ease in US dollar, bond yield and crude oil rate

Everyone who has looked at the September employment data is stunned, said Matt Miskin, co-investment strategist at John Hancock Investment Management in Boston. “The jobs report was a stunner and the market reaction is stunning.”

The US dollar index, a measure of the greenback against six other currencies, initially rose then fell, down 0.24%, as it snapped an 11-week winning streak after hitting its best level in about 11 months earlier in the week.

(With inputs from Reuters)

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

“Exciting news! Mint is now on WhatsApp Channels