Geode Capital Management LLC lowered its holdings in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) by 2.0% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 425,208 shares of the specialty retailer’s stock after selling 8,482 shares during the quarter. Geode Capital Management LLC owned approximately 1.88% of Murphy USA worth $118,874,000 at the end of the most recent reporting period.

Geode Capital Management LLC lowered its holdings in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) by 2.0% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 425,208 shares of the specialty retailer’s stock after selling 8,482 shares during the quarter. Geode Capital Management LLC owned approximately 1.88% of Murphy USA worth $118,874,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in the business. Quadrant Capital Group LLC grew its holdings in Murphy USA by 28.1% during the 3rd quarter. Quadrant Capital Group LLC now owns 155 shares of the specialty retailer’s stock valued at $43,000 after buying an additional 34 shares in the last quarter. PNC Financial Services Group Inc. lifted its stake in shares of Murphy USA by 0.5% during the 4th quarter. PNC Financial Services Group Inc. now owns 8,269 shares of the specialty retailer’s stock worth $2,312,000 after acquiring an additional 38 shares during the last quarter. Zacks Investment Management lifted its stake in shares of Murphy USA by 0.6% during the 3rd quarter. Zacks Investment Management now owns 6,953 shares of the specialty retailer’s stock worth $1,912,000 after acquiring an additional 39 shares during the last quarter. First Republic Investment Management Inc. raised its position in Murphy USA by 0.7% during the 1st quarter. First Republic Investment Management Inc. now owns 6,221 shares of the specialty retailer’s stock valued at $1,244,000 after purchasing an additional 42 shares in the last quarter. Finally, Paragon Wealth Strategies LLC raised its position in Murphy USA by 25.0% during the 4th quarter. Paragon Wealth Strategies LLC now owns 250 shares of the specialty retailer’s stock valued at $70,000 after purchasing an additional 50 shares in the last quarter. Hedge funds and other institutional investors own 85.30% of the company’s stock.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on MUSA shares. Wells Fargo & Company lifted their target price on Murphy USA from $325.00 to $330.00 in a research report on Thursday, May 4th. StockNews.com raised Murphy USA from a “hold” rating to a “buy” rating in a research report on Friday, May 12th. One equities research analyst has rated the stock with a sell rating, one has given a hold rating and four have assigned a buy rating to the company’s stock. According to MarketBeat, the stock presently has a consensus rating of “Moderate Buy” and an average price target of $315.60.

Murphy USA Trading Down 1.0 %

Shares of NYSE:MUSA opened at $282.02 on Thursday. Murphy USA Inc. has a 12-month low of $217.39 and a 12-month high of $323.00. The business’s fifty day simple moving average is $274.50 and its 200-day simple moving average is $271.48. The company has a market capitalization of $6.14 billion, a PE ratio of 10.52 and a beta of 0.80. The company has a current ratio of 0.92, a quick ratio of 0.53 and a debt-to-equity ratio of 2.50.

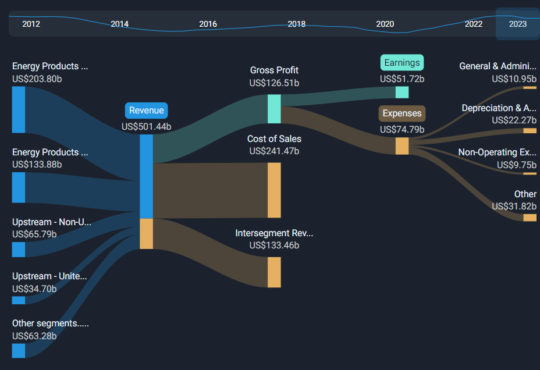

Murphy USA (NYSE:MUSA – Get Rating) last announced its quarterly earnings results on Tuesday, May 2nd. The specialty retailer reported $4.80 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $4.18 by $0.62. Murphy USA had a return on equity of 86.87% and a net margin of 2.68%. The business had revenue of $5.08 billion for the quarter, compared to the consensus estimate of $4.95 billion. During the same period last year, the business posted $6.08 EPS. The business’s revenue was down .8% compared to the same quarter last year. As a group, equities research analysts predict that Murphy USA Inc. will post 19.38 earnings per share for the current fiscal year.

Murphy USA Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, June 1st. Investors of record on Monday, May 15th were paid a dividend of $0.38 per share. This represents a $1.52 annualized dividend and a yield of 0.54%. This is an increase from Murphy USA’s previous quarterly dividend of $0.37. The ex-dividend date was Friday, May 12th. Murphy USA’s payout ratio is 5.67%.

Insider Buying and Selling

In related news, SVP Robert J. Chumley sold 1,075 shares of the business’s stock in a transaction on Friday, May 19th. The stock was sold at an average price of $277.72, for a total transaction of $298,549.00. Following the transaction, the senior vice president now directly owns 6,661 shares in the company, valued at approximately $1,849,892.92. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. In other Murphy USA news, Director Jeanne Linder Phillips sold 550 shares of the business’s stock in a transaction dated Wednesday, May 10th. The stock was sold at an average price of $283.97, for a total transaction of $156,183.50. Following the sale, the director now owns 2,874 shares in the company, valued at approximately $816,129.78. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, SVP Robert J. Chumley sold 1,075 shares of the business’s stock in a transaction dated Friday, May 19th. The shares were sold at an average price of $277.72, for a total value of $298,549.00. Following the sale, the senior vice president now owns 6,661 shares in the company, valued at approximately $1,849,892.92. The disclosure for this sale can be found here. Insiders have sold a total of 1,628 shares of company stock worth $455,611 in the last ninety days. 9.04% of the stock is owned by insiders.

Murphy USA Profile

Murphy USA, Inc engages in marketing motor fuel products and convenience merchandise through retail stores, namely Murphy USA and Murphy Express. It collaborates with Walmart to offer customers discounted and free items based on purchases of qualifying fuel and merchandise. The company was founded in 1996 and is headquartered in El Dorado, AR.

See Also

Want to see what other hedge funds are holding MUSA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Murphy USA Inc. (NYSE:MUSA – Get Rating).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you consider Murphy USA, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Murphy USA wasn’t on the list.

While Murphy USA currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.