Stocks on the move: Ocado soars 39%, delivery companies make big gains

Ocado shares soared more than 39% on Tuesday after agreeing a partnership deal with South Korean retailer Lotte that will see the

German food delivery companies Delivery Hero and Hellofresh jumped 12% and 11% respectively on the back of the surge for their British peer.

At the bottom of the Stoxx 600, Danish pharmaceutical company ALK-Abelló fell 6%.

– Elliot Smith

Ocado shares up 31% after partnership with Lotte Shopping

Online grocery store Ocado topped the Stoxx 600 in early trade with shares up 31%. The gains come after the company partnered with South Korean retail company Lotte Shopping.

Ocado and Lotte are set to develop a network of robotic warehouses, coined “Customer Fulfilment Centres” by Ocado, across South Korea in a move to expand the online shopping business.

— Hannah Ward-Glenton

BP quarterly profits soar to $8.2 billion amid renewed calls for windfall taxes

Bernard Looney, chief executive officer of BP Plc, gestures while speaking during a news conference in London, U.K., on Wednesday, Feb. 12, 2020.

Bloomberg | Getty Images

Oil and gas giant BP on Tuesday reported stronger-than-expected third-quarter profits.

The British energy major posted underlying replacement cost profit, used as a proxy for net profit, of $8.2 billion for the three months through to the end of September. That compared with $8.5 billion in the previous quarter and a net profit of $3.3 billion over the same period a year earlier.

The world’s largest oil and gas majors have reported bumper earnings in recent months, benefitting from surging commodity prices following Russia’s invasion of Ukraine.

– Sam Meredith

CNBC Pro: This Chinese electric carmaker’s stock could rally by more than 260%, Citi says

Citi has picked a large electric car maker as one of its “top” buy ideas among Chinese stocks.

It expects shares in the automaker to rise by more than 260% over the next 12 months as EV sales soar.

CNBC Pro subscribers can read more here.

— Ganesh Rao

China’s factory activity shrank for a third consecutive month in October, private survey says

The Caixin manufacturing Purchasing Managers’ Index for October showed that factory activity contracted for the third month in a row.

The reading came in at 49.2, compared with expectations for a print of 49. In September, the manufacturing PMI was at 48.1, below the 50-point mark that separates growth from contraction.

PMI readings compare activity from month to month.

Official data from the National Bureau of Statistics came in at 49.2 on Monday, missing expectations for a print of 50.

— Abigail Ng

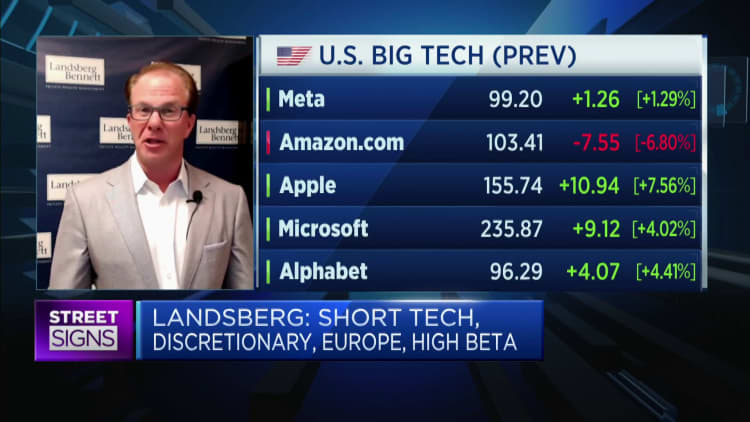

CNBC Pro: What investors should buy in this ‘short lived’ rally, according to one analyst

After October’s stock market rally, investors are debating whether stocks have hit the bottom or if it’s another short-lived bounce.

Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management, is in the latter camp, arguing the rally, once again, looks temporary.

He told CNBC what he thinks investors should buy — and short.

CNBC Pro subscribers can read more here.

— Weizhen Tan

Hong Kong’s economy shrank by 4.5% in the third quarter

Hong Kong’s gross domestic product fell by 4.5% in the third quarter of the year compared with the same period a year ago, advance estimates from the Census and Statistics Department showed Monday.

That’s the worst contraction since the second quarter of 2020. Analysts polled by Reuters expected 0.7% growth, while GDP decreased 1.3% in the second quarter.

“The worsened external environment and continued disruptions to cross-boundary land cargo flows dealt a serious blow to Hong Kong’s exports,” the statement said, adding the drop in GDP was “mainly attributable to the weak performance in external demand during the quarter.”

Fixed capital formation, or investment, decreased by 14.3%, while exports and imports also fell.

— Abigail Ng

CNBC Pro: Forget Tesla? Citi and HSBC name 2 alternatives to play the EV boom

Tesla may be an investor favorite for exposure to the EV industry, but Citi and HSBC name two alternatives to play the growing demand for electric vehicles.

Pro subscribers can read more here.

— Zavier Ong

European markets: Here are the opening calls

European markets are heading for a positive start to the trading session on Tuesday with global investors focusing on the U.S. Federal Reserve’s policy meeting, which begins today. The central bank is expected to hike interest rates by 75 basis points on Wednesday when its meeting concludes.

As for Europe’s opening calls, here they are:

London’s FTSE index is expected to open 31 points higher at 7,135, Germany’s DAX up 80 points at 13,348, France’s CAC up 31 points at 6,304 and Italy’s FTSE MIB up 178 points at 22,696, according to data from IG.

European markets closed higher Monday despite euro zone GDP and inflation data pointing to further pain ahead for the 19-member bloc, with consumer price inflation soaring to a record high in October and growth slowing markedly in the third quarter.

Earnings come from BP, Fresenius and DSM on Tuesday. Data releases include manufacturing purchasing managers’ index figures from the Netherlands, Ireland and Sweden for October.

— Holly Ellyatt